The overall worth locked (TVL) in decentralized financing applications has actually exceeded $1 billion, triggering events from the Ethereum neighborhood. Not everybody has actually been quick to toast the turning point, nevertheless, with tips that the real worth locked into defi procedures is materially lower. Meanwhile, sneaking competitors from central loan providers reveals that defi will need to innovate if it is to keep its worth proposal.

A Big Day for Defi

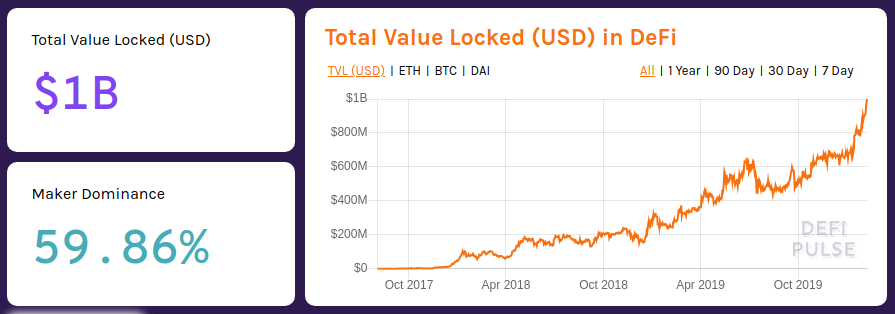

The minute decentralized financing supporters had actually been awaiting for weeks shown up on February 6, when the TVL of all possessions in defi procedures went beyond $1 billion. At press time, that figure has actually declined a little and is sitting at $997M. Defipulse.com, which tracks environment development, records Maker’s supremacy to be 60%. The crypto collateralized stablecoin network is to defi what bitcoin is to the crypto market, its shadow looming big over procedures.

Many of the decentralized financing, derivatives, and trading procedures draw their liquidity from Maker’s sai and dai stablecoins, which in turn draw theirs from ethereum. In a brief blog site post toasting the accomplishment, Defi Pulse announced “$1 billion marks a crucial turning point for Defi to be commemorated. It shows the development we’ve made towards our neighborhood’s vision of decentralized financing and the future of the world at big.” One year earlier, the defi market was valued at less than $280M. Today, financing alone represents $766.5M.

Centralized Lenders Eye Defi’s Market Share

Just as central exchanges have actually advertised staking, ejecting devoted masternode and staking services, there is a threat of crypto financing doing the same. Lending is at the heart of decentralized financing, representing 5 of the top 10 dapps (Maker, Compound, Instadapp, Dydx, and Bzx). Centralized financing (cefi) loan providers are making inroads into this profitable vertical, nevertheless.

This week, Binance presented the 13th stage of its financing items, providing rates of 6% on USDT, 8% on BUSD, and 15% on ERD. Then there are cefi loan providers like Cred and Squilla Loans to consider, whose organisation design needs absolutely no understanding of decentralized financing procedures, and boasts a remarkable UX. In the case of Squilla, for example, debtors and loan providers can merely go into the quantity they are looking for and the preferred loan duration to get an immediate quote. Decentralized financing applications are enhancing, but they will have a hard time to match the user experience and rates used by central crypto business.

Is defi’s $1 billion TLV the very first turning point of numerous, or will observers reflect on this minute as its apotheosis, the high water point prior to worth streamed into central crypto rivals? Speaking of the $1 billion figure, not everybody is persuaded that the numbers accumulate…

Picking Apart the $1 Billion Valuation

“Defi Pulse keeps track of each procedure’s underlying clever agreements on the Ethereum blockchain,” describes the site whose defi assessment is referenced by the whole market. “Every hour, we revitalize our charts by pulling the overall balance of Ether (ETH) and ERC20 tokens held by these clever agreements. TVL(USD) is determined by taking these balances and increasing them by their cost in USD.”

It’s a method which imitates the method which the marketplace cap of cryptocurrencies is determined. However, market cap has actually long been considered an imperfect reckoner, and the very same allegation has actually been imposed versus defi. “What percent of the “$1 billion dollars” that’s “secured” … is: 1) comprised of ICO tokens (illiquid?) 2) not fluffed by Consensys or Ethereum structure/Ethereum creators?” protested one bitcoiner.

“$1B isn’t secured in Defi,” weighed in crypto legal commenter Preston Byrne. “At least $300mm of that remains in ether that early financiers wear’t wish to offer and thus sustain the tax hit, if Dai advocates are to be thought. It’s the distinction in between stating “Jeff Bezos deserves $100bn” and stating “Jeff Bezos has $100bn in money.” Defi doesn’t have $100BN secured it, it has ether that early holders didn’t wish to offer, the worth of which is valuing in the middle of a nascent booming market.”

Others demurred, nevertheless, with Ethereum supporter Nathaniel Whittemore calling the accomplishment “one hell of a turning point.”

Do you believe the defi market can keep growing? Let us understand in the comments area below.

Did you understand you can validate any unofficial Bitcoin deal with our Bitcoin Block Explorer tool? Simply total a Bitcoin address search to see it on the blockchain. Plus, check out our Bitcoin Charts to see what’s occurring in the market.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.