Investing in Bitcoin provides differing degrees of intricacy, and by using a number of complimentary and efficient metrics, investors can achieve a substantial benefit over the average market individual. These tools help with on-chain analysis, successfully lessening psychological decision-making.

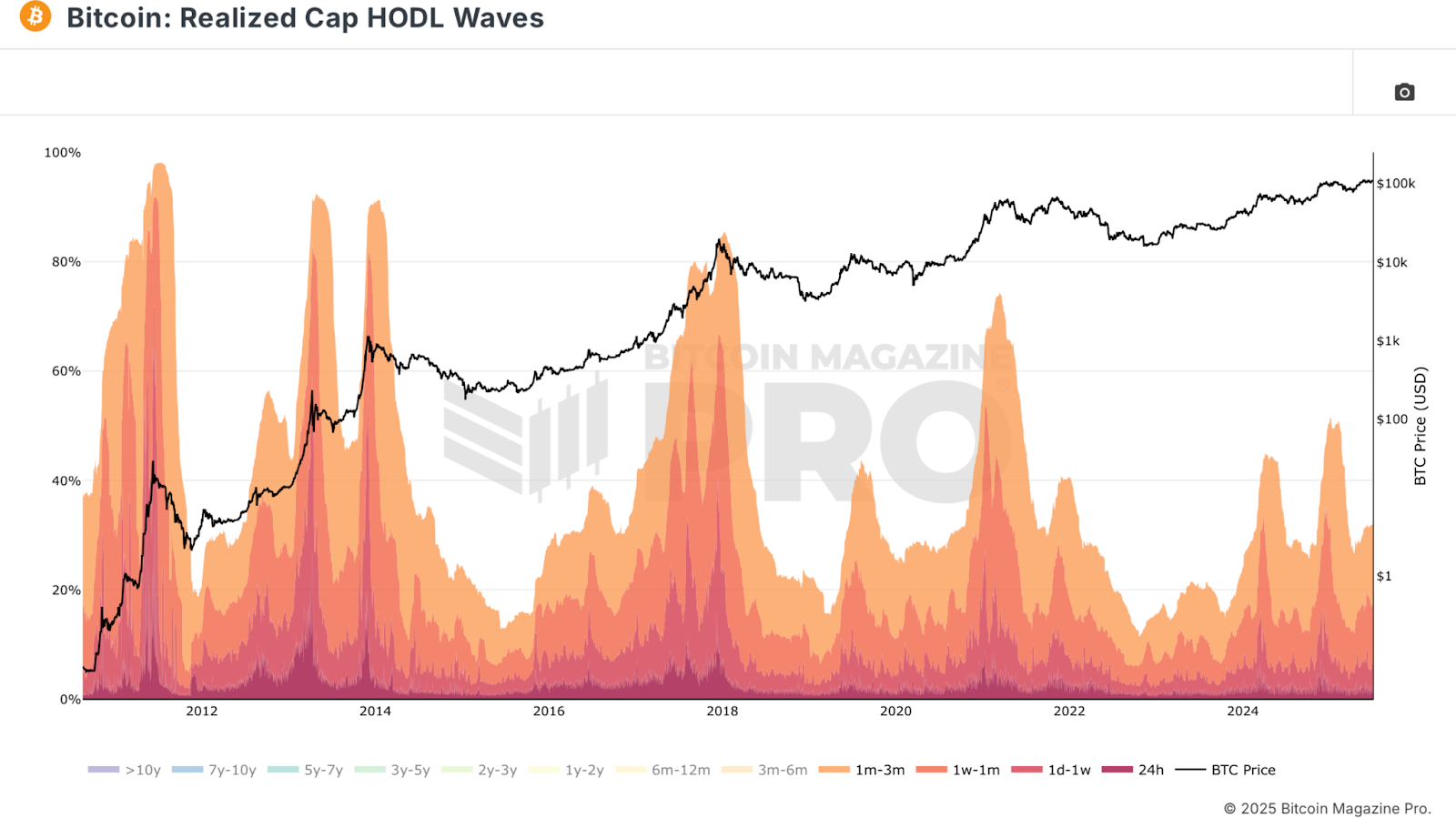

Realized Cap HODL Waves

The Realized Cap HODL Waves metric works as a advanced analytical tool within the on-chain structure. It examines the understood price—representing the typical expense basis of all Bitcoin held throughout the network—segmented by numerous age bands. Notably, the sector consisting of coins held for 3 months or less can be a sign of a rise in brand-new capital, often triggered by retail worry of losing out (FOMO). Historical information exposes that peaks in these more youthful holdings, regularly showed in warm colors on charts, have actually referred significant market tops observed in late 2017 and 2021.

Conversely, a reduction in the impact of short-term holders typically lines up with bear market bottoms; these stages are defined by very little brand-new purchaser engagement, depressing sentiment, and considerably marked down costs. This metric aesthetically supports contrarian techniques, promoting for acquisitions throughout durations of prevalent worry and personalities when avarice dominates.

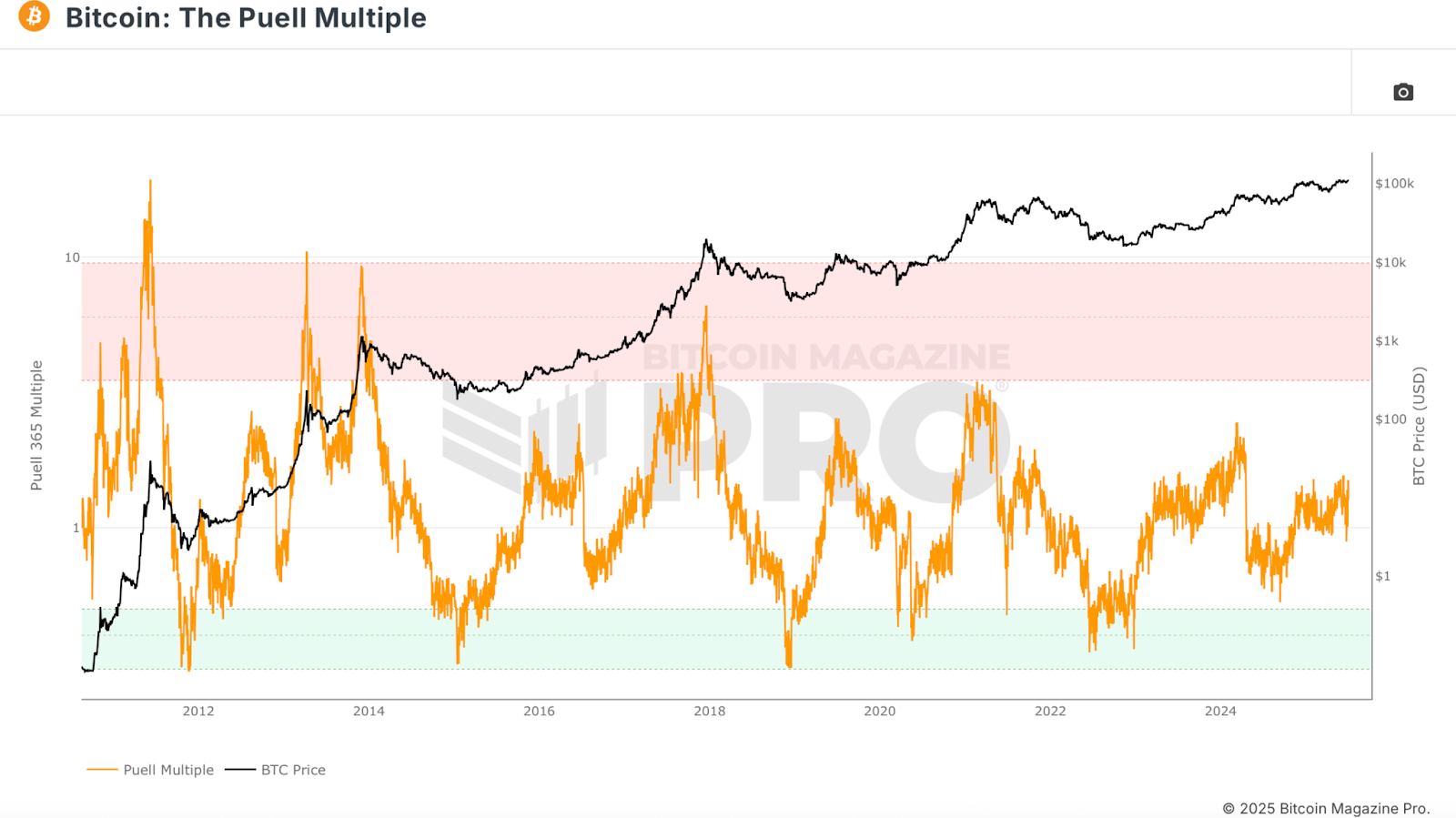

Puell Multiple

The Puell Multiple works as a barometer for miners’ sentiment by comparing their existing day-to-day profits (in USD) from block benefits and transaction charges to a year-long average. Elevated worths recommend substantial success for miners, while low worths may indicate monetary distress, meaning potential undervaluation.

Historically, lows in the Puell Multiple have actually been suitable minutes for build-up, often accompanying durations where miners deal with functional obstacles and high expenses, developing an financial flooring and a trustworthy entry signal.

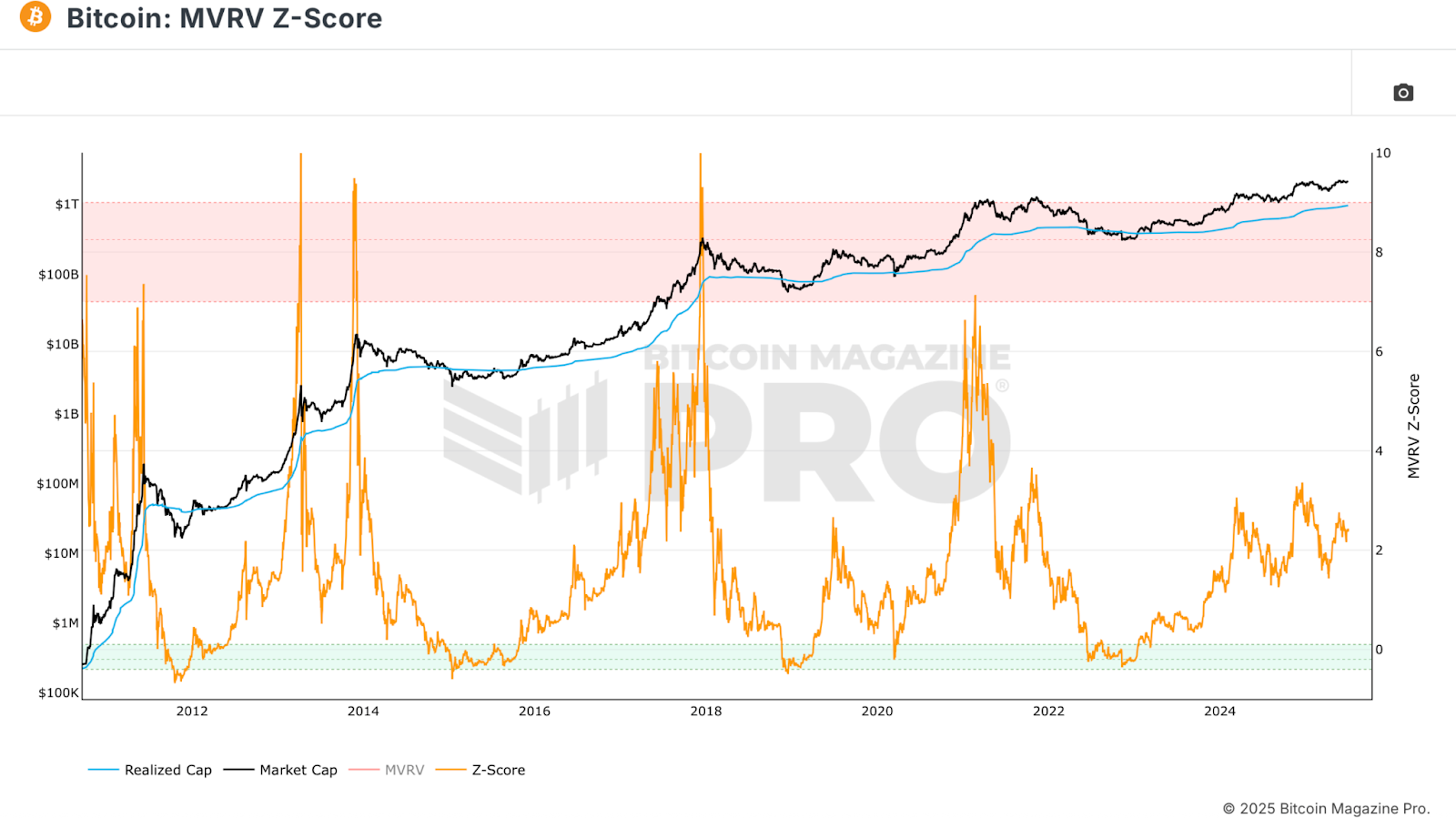

MVRV Z-Score

The MVRV Z-Score is amongst the most acknowledged metrics in on-chain analysis. It standardizes the ratio of market value (existing price increased by distributing supply) to understood value (typical expense basis), stabilizing it throughout Bitcoin’s unpredictable history. This z-score successfully indicates severe market conditions, offering clear signals for potential market tops and bottoms.

Historically, a z-score surpassing 7 represents blissful market conditions, recommending a regional top is impending. Conversely, a z-score below no typically lines up with beneficial build-up durations. Like any metric, this tool should not be used in seclusion; it is most efficient when integrated with other gone over metrics to boost analytical precision.

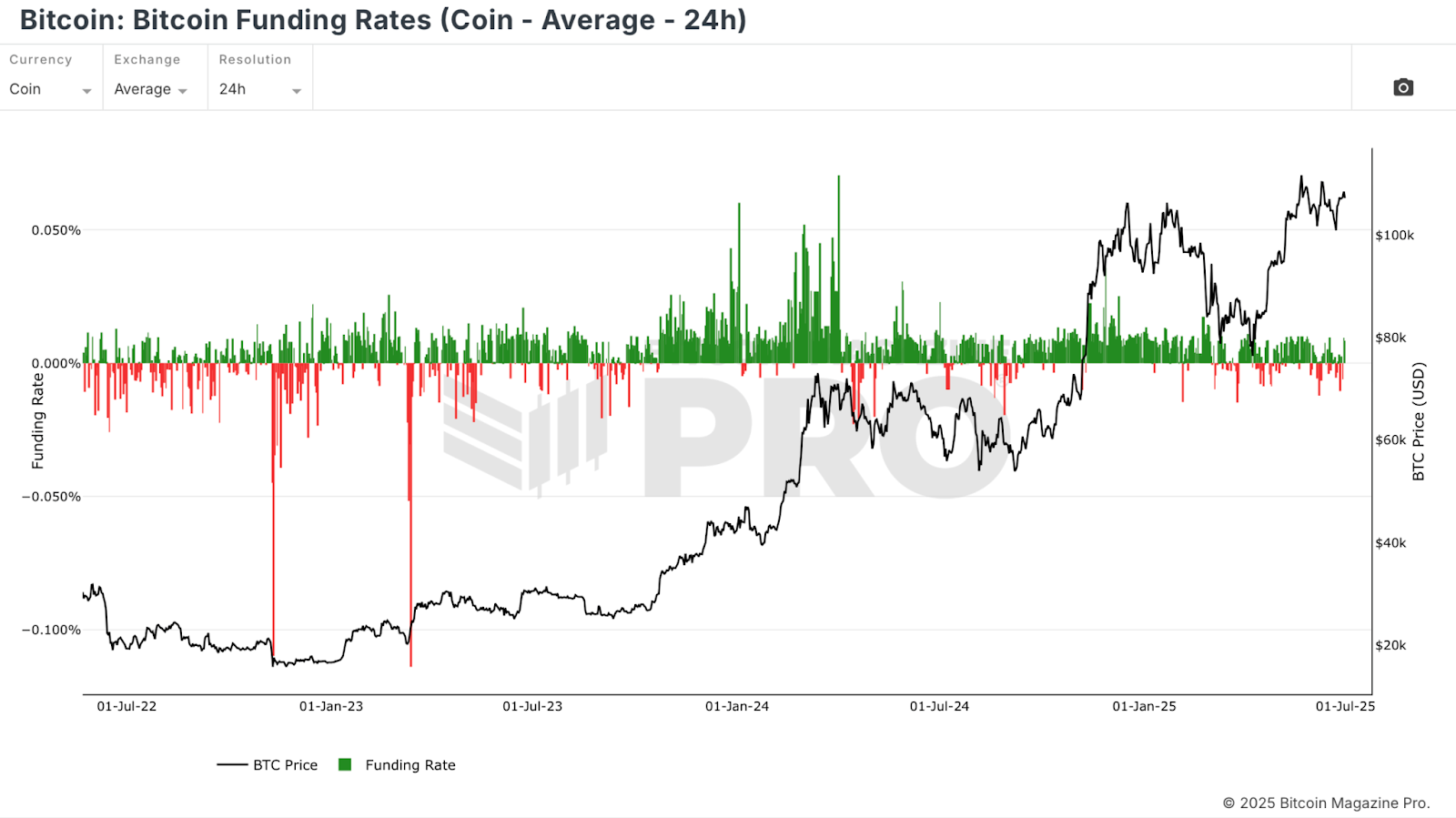

Funding Rates

Bitcoin Funding Rates provide insight into the sentiment of leveraged futures traders. An boost in favorable financing indicates that long positions are compensating brief positions, recommending a bullish outlook. Conversely, incredibly high financing rates often accompany ecstasy, possibly signifying upcoming corrections. Negative financing rates, on the other hand, show worry and may precede sharp market rallies.

Funding rates denominated in Bitcoin provide a clearer signal than those denominated in USD, as traders have direct exposure to Bitcoin. Sudden spikes in either instructions often highlight contrarian chances, with high rates indicating potential overextension and low or unfavorable rates recommending market bottoms.

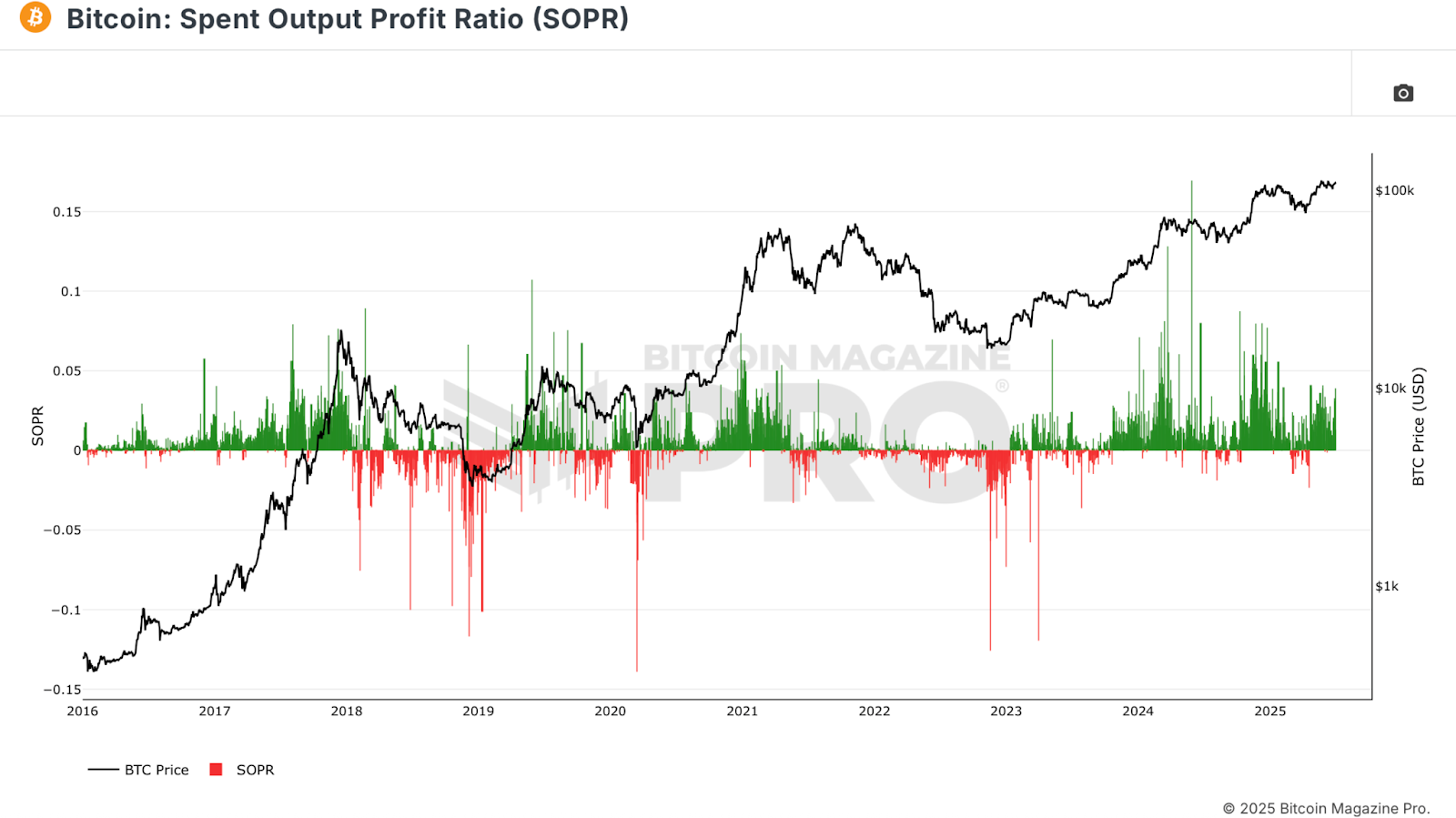

SOPR

The Spent Output Profit Ratio (SOPR) measures whether coins moved on-chain were negotiated at a earnings or loss. A reading above no indicates that the typical coin was cost a earnings, while a reading below no represents understood losses.

Significant down spikes in the SOPR metric are a sign of capitulation and investors securing losses, often marking fear-driven sell-offs and providing significant purchasing chances. Sustained SOPR readings above no may signal uptrends; nevertheless, extreme profit-taking may recommend an overheated market.

Conclusion

By incorporating these metrics—Realized Cap HODL Waves, Puell Multiple, MVRV Z-Score, Funding Rates, and SOPR—investors can accomplish a multidimensional understanding of Bitcoin market conditions. While no single indication can provide thorough insights, the confluence of several metrics raises the probability of effective investment results. Whether getting possessions in a bear market or considering circulation near a potential market leading, these complimentary tools can help in decreasing psychological impacts, directing data-driven decisions, and boosting one’s tactical edge in the Bitcoin market.

Those thinking about this analysis of Bitcoin price characteristics are urged to subscribe to Bitcoin Magazine Pro on YouTube for even more skilled insights and analysis!

Those thinking about this analysis of Bitcoin price characteristics are urged to subscribe to Bitcoin Magazine Pro on YouTube for even more skilled insights and analysis!

For extra extensive research study, technical signs, real-time market signals, and gain access to to professional analyses, please check out BitcoinMagazinePro.com.

This short article, entitled “5 Free Metrics Every Bitcoin Investor Needs,” was initially released in Bitcoin Magazine and authored by Matt Crosby.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.