From Trey Walsh, Executive Director of The Progressive Bitcoiner

The author reveals substantial bookings relating to the pursuit of a Strategic Bitcoin Reserve (SBR) by the United States. Notably, the significant propositions that have actually pertained to the author’s attention consist of legislation recommended by Senator Lummis and a draft Executive order from the Bitcoin Policy Institute. It is very important to keep in mind that this conversation does not incorporate state-level propositions, which tend to have a more simple focus as they intend to diversify state possession portfolios that currently consist of Bitcoin. The author raises issues relating to the timing of such efforts, the politically polarizing results they might have, the systems and expenses linked in getting Bitcoin, and the reasoning for the U.S. embracing this technique specifically as a country that currently holds a dominant position as the world’s reserve currency. There is also apprehension that increased federal government participation in Bitcoin might jeopardize its fundamental concepts and impact its energy as a legal tender, advantage personal privacy, and lead to higher threats to self-custody for American people. The author mentions an informative review by Nic Carter, who opposes the pursuit of an SBR, and highly suggests that readers engage with Carter’s arguments.

While some assistance for the SBR has actually emerged amongst Bitcoin supporters, especially amongst Republican political leaders and previous President Trump, it is noteworthy that there has actually been very little interest for such a reserve from progressive circles. Criticism has actually mainly defined the progressive reaction so far. Despite the revealed bookings and criticisms discussed, the author proposes to check out prospective advantages of a U.S. Strategic Bitcoin Reserve through the lens of progressive worths, especially in relation to social safeguard costs. This line of thinking has actually not been thoroughly gone over, and the author looks for to brighten methods which an SBR might serve the requirements of daily Americans in concrete terms, instead of simply improving nationwide power or bolstering the dollar.

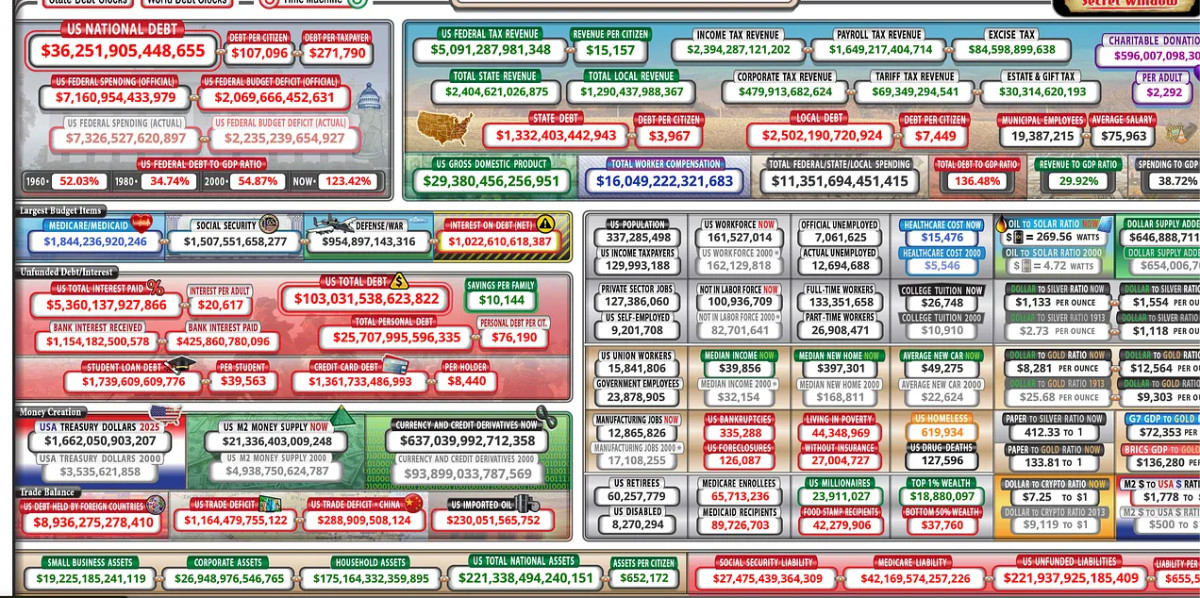

The monetary landscape presently dealing with the U.S. provides pushing difficulties, specifically as suggested by information from US Debt Clock. The vital concern stays relating to how the country will fund the important services that people have actually pertained to anticipate, especially amidst a looming financial obligation crisis. Varied financial theories propose unique methods for resolving this pushing issue; nevertheless, the truth continues that the U.S. is postponing action on financial obligation management, costs, and enforcing tax boosts or substantial cuts to expenses. This introduction sets the structure for talking about strategic usage cases of a Strategic Bitcoin Reserve in relation to social safeguard funding, deficit spending, and strengthening the concept of federal government serving the interests of the population.

1. Hedge Against Inflation to Protect Public Programs

- Stability for Social Spending: Inflation and currency devaluation reduce the acquiring power of federal government budget plans, weakening the efficiency of social safeguard efforts. A Bitcoin reserve, acknowledged for its deflationary nature, might provide a secure versus these financial difficulties, guaranteeing constant financing for important programs such as Medicare, Medicaid, and Social Security. In an environment of increasing expenses in fiat currencies, the worth of items and services in Bitcoin terms might end up being more available.

- Future-Proofing Benefits: The restricted supply of Bitcoin might provide defense versus the long-lasting decline of fiat currencies, guaranteeing that privilege programs keep their worth and continue to benefit receivers in the future.

2. Revenue Generation for Safety Nets

- Asset Appreciation: Bitcoin has actually shown considerable rate development gradually. A government-held Bitcoin reserve might be tactically utilized throughout monetary exigencies to create extra financing for social programs, highlighting a long-lasting financial investment viewpoint instead of short-term trading.

- Controlled Liquidation: Implementing a progressive structure, the federal government might develop strict procedures for liquidating parts of the reserve throughout financial declines, therefore protecting the long-lasting worth of the reserve while still resolving public well-being requirements.

3. Alternative to Taxpayer Burden

- Reducing Taxpayer Reliance: Conventional financing for social safeguard originates from tax, which can disproportionately impact middle- and lower-income homes. A Bitcoin reserve might provide a extra financing stream, easing the requirement for direct tax to support safeguard programs.

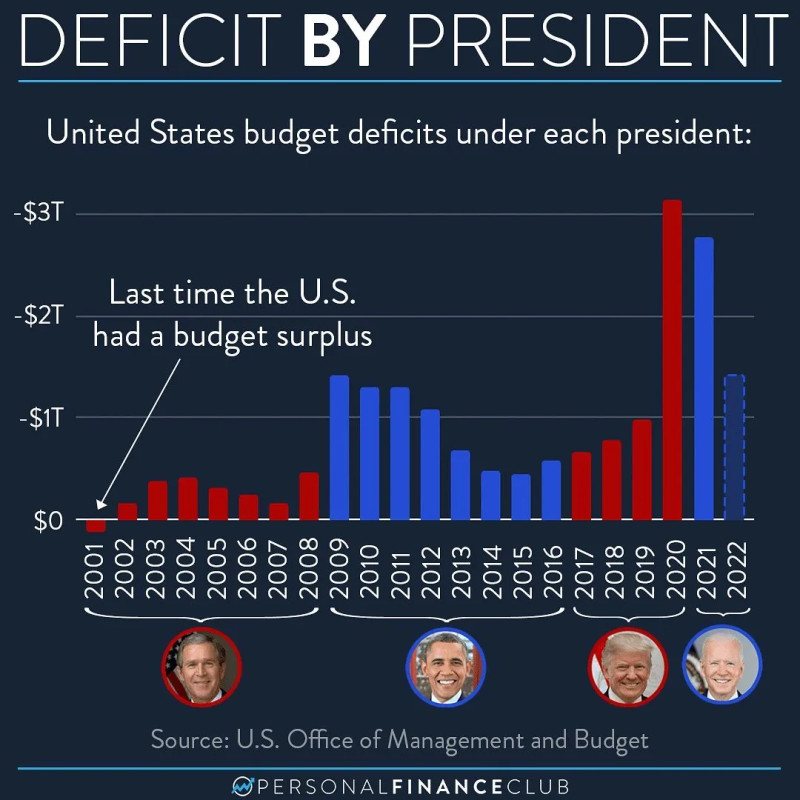

- Reducing Deficit Spending: Deficit costs is a leading reason for inflation, frequently worsened by financial policy from the Federal Reserve and legal activities that surpass offered possession and tax earnings. The SBR might supply a implies to minimize dependence on cash printing systems that drive inflation, especially impacting lower- and middle-income households. Integrating Bitcoin into the reserve technique together with conventional reserves, such as gold, might improve the federal government’s capability to sustain well-being programs without turning to budget deficit.

4. Emergency Financial Assistance

- Crisis Mitigation Fund: In times of monetary crises, federal governments regularly deal with difficulties activating resources rapidly to broaden safeguard programs. Given Bitcoin’s high liquidity and worldwide ease of access, it might work as an emergency situation reserve for direct money transfers or welfare throughout durations of financial distress.

- Global Remittance Efficiency: Bitcoin’s borderless character might assist in the effective shipment of global help and remittances to support diasporic neighborhoods or susceptible populations, lining up with progressive concepts of worldwide equity.

5. Promoting Financial Inclusion for Vulnerable Populations

- Bridging the Wealth Gap: A Strategic Bitcoin Reserve might support policies targeted at promoting public ownership of Bitcoin, making it possible for people and neighborhoods to participate in a monetary system less dependent on traditional banking structures. This idea is similar to the Alaska Permanent Fund, which disperses dividends based upon the area’s oil reserves.

- Direct Redistribution Mechanisms: The federal government may use revenues from Bitcoin reserves to fund Universal Basic Income (UBI) efforts or targeted help programs for low-income homes, as gone over in a podcast episode including Scott Santens, a popular UBI supporter.

Although not straight connected to the SBR, the present approval of Bitcoin might produce opportunities for advancing Bitcoin mining and neighborhood participation.

6. Incentivizing Green Bitcoin Mining for Job Creation

- Jobs for At-Risk Communities: By incentivizing Bitcoin mining operations to use renewable resource sources, task chances can be produced in underserved locations, yielding both financial revitalization and ecological advantages.

- Revenue for Local Governments: Tax incomes originated from sustainable Bitcoin mining efforts might be assigned to improve regional safeguard programs, such as budget friendly real estate or neighborhood health efforts.

7. Economic Resilience to Fund Long-Term Programs

- Buffer Against Economic Crises: In times of financial declines or geopolitical instability, Bitcoin’s autonomy from fiat systems might supply a monetary buffer, guaranteeing the ongoing operation of essential safeguard programs.

- Strengthening the Social Contract: By keeping a reserve that protects nationwide financial interests, the federal government strengthens its dedication to safeguard susceptible populations—an important tenet of progressive ideology.

8. Enhancing Public Trust in Social Programs

- Transparent Funding Mechanism: Bitcoin’s blockchain innovation offers a transparent journal, which might improve public self-confidence when the possession is utilized to partly money social programs, promoting higher rely on resource allotment and management while resolving issues relating to governmental inadequacy or corruption. Public SBR Bitcoin addresses might be made available, comparable to practices in El Salvador.

- Public Ownership: Progressive structures might promote for assigning a part of Bitcoin gains straight to people, possibly through refunds or credits associated with social programs, therefore developing a concrete link in between nationwide reserves and public advantage. Such a technique would echo dividend or Universal Basic Income designs.

This expedition deals a initial structure for how progressives may think the application of a Strategic Bitcoin Reserve. While presently more of a conceptual workout, amidst continuous conversations around grassroots adoption of Bitcoin and its transformative capacity for people and neighborhoods, it raises a vital query: what social advantages might Bitcoin supply in a dynamically developing and economically tough environment? Beyond the simply speculative elements of rate gratitude, crypto trading, and Wall Street earnings, the vital concern is how Bitcoin can add to improving the lifestyle for daily people at a basic, structural level. The Progressive Bitcoiner stays dedicated to examining these pushing concerns.

This is a visitor post by Trey Walsh. Opinions revealed are totally their own and do not always show those of BTC Inc or Bitcoin Magazine.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.