Bitcoin Magazine

‘Ancient’ Bitcoin Supply Now Outpacing Newly Mined BTC: Fidelity Report

Fidelity Digital Assets launched a brand-new report that exposes that for the very first time in history, more bitcoin is going into “ancient supply,” which describes coins that have actually stayed unmoved for ten years or more, than are being mined.

As of June 8, 17% of all bitcoin falls under the classification of “ancient supply”—implying these coins have actually stagnated in a years or more. What could this suggest for shortage, market characteristics, and financiers’ conviction? Find our group’s ideas: https://t.co/EALzrfS92c pic.twitter.com/Ckm3MylTLY

— Fidelity Digital Assets (@DigitalAssets) June 18, 2025

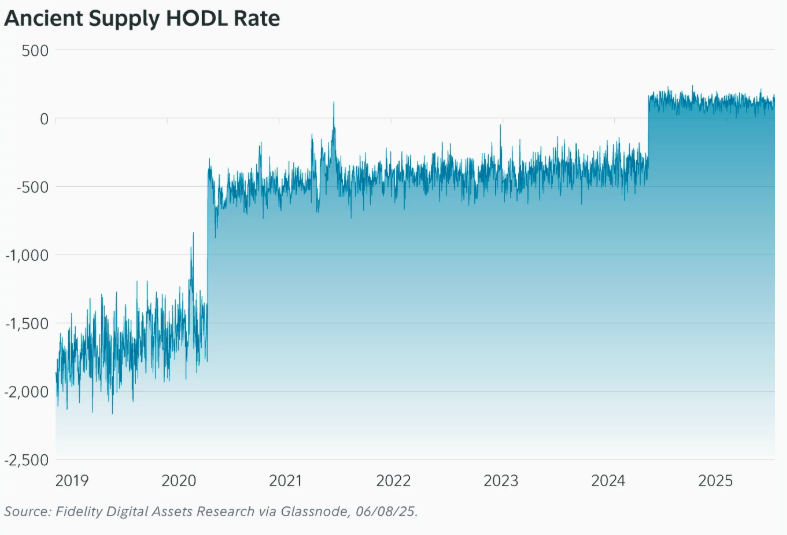

As of June 8, approximately 566 BTC daily is crossing the ten years limit, while just 450 BTC is being provided daily following the 2024 halving. 3

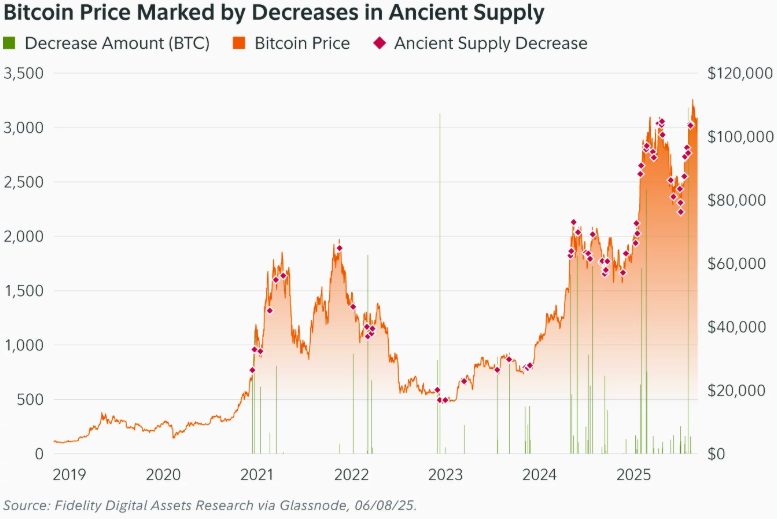

“The share of ancient supply also tends to increase each day, with daily decreases observed less than 3% of the time,” the report states. “In contrast, that number increases to 13% when the threshold is lowered to bitcoin holders of five years or more.”

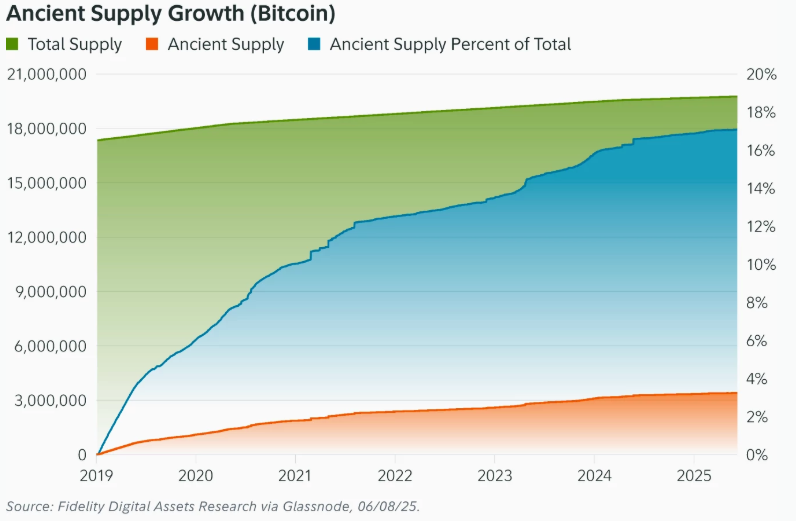

Bitcoin’s ancient supply has actually grown because January 1, 2019, when Satoshi Nakamoto ended up being the very first ten years holder. Today, over 3.4 million BTC fall under this classification, worth more than $360 billion. Around 1/3 is thought to come from Nakamoto.

Despite their increasing worth, long-lasting holders are not squandering. Ancient supply comprises over 17 percent of all bitcoin, which share continues to grow.

Since the 2024 halving, the variety of coins going into ancient supply has actually regularly outmatched the variety of brand-new coins being mined, according to the report. This shift highlights growing long-lasting conviction amongst holders and shows a more comprehensive tightening up of bitcoin’s liquid supply.

Following the 2024 U.S. election, ancient supply decreased on 10% of days, which is almost 4 times greater than the historic average. Movement amongst the holders was a lot more noticable, with day-to-day decreases taking place 39% of the time.

To much better track this pattern, Fidelity utilizes a metric called the ancient supply HODL rate. It determines the number of coins are going into the ten years classification every day, changed for brand-new issuance. This rate turned favorable in April 2024 and has actually stayed that method, enhancing the long-lasting supply shift.

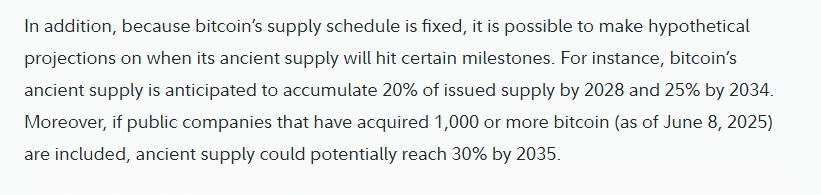

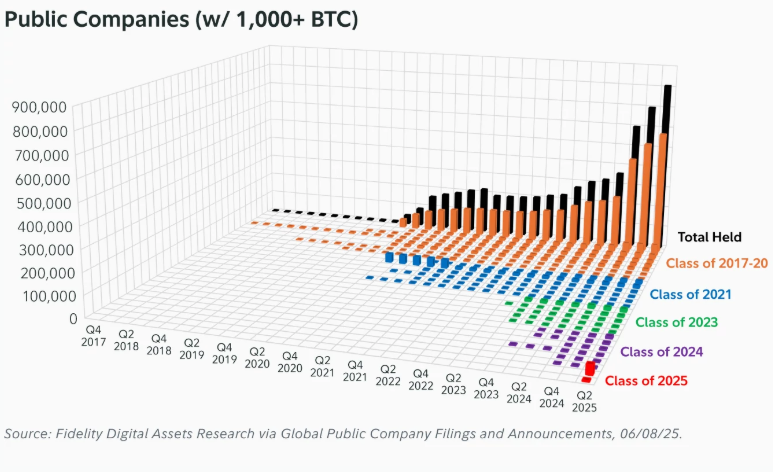

Looking ahead, Fidelity Digital Assets forecasts that ancient supply might reach 20 percent of overall bitcoin by 2028 and 25 percent by 2034. If public business holding a minimum of 1,000 BTC are consisted of, it might reach 30 percent by 2035.

As of June 8, 27 public business hold more than 800,000 BTC integrated, according to the report. This growing institutional existence might even more tighten up supply and increase the impact of long-lasting holders gradually.

This post ‘Ancient’ Bitcoin Supply Now Outpacing Newly Mined BTC: Fidelity Report initially appeared on Bitcoin Magazine and is composed by Oscar Zarraga Perez.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.