Arizona State Senator Wendy Rogers has introduced a comprehensive legislative package aimed at revising the treatment of digital assets within the framework of state and local tax laws. This initiative reflects a broader effort by certain lawmakers to position Arizona as a jurisdiction with more defined and favorable regulations for cryptocurrencies and blockchain infrastructure.

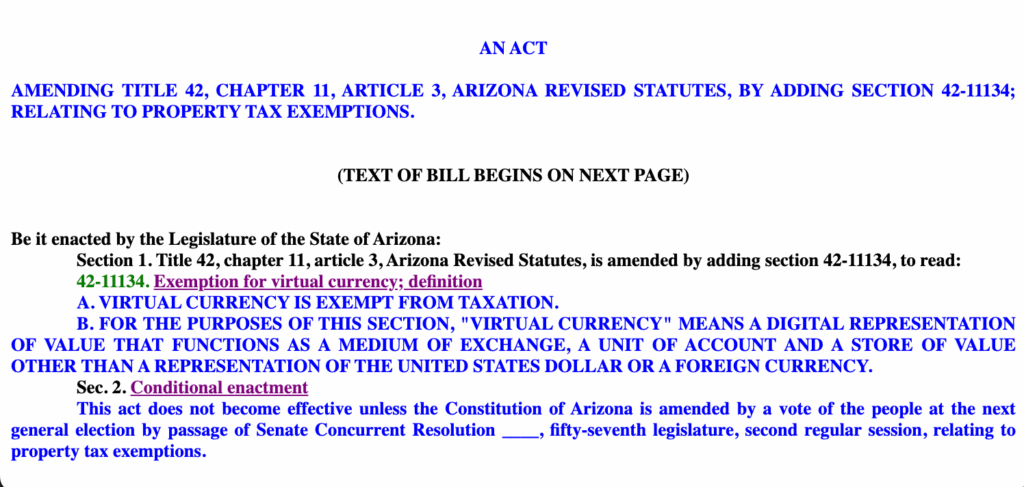

In the prefiled bills presented to the Arizona Senate, Senator Rogers proposes amendments to state statutes designed to exempt virtual currency from taxation (SB 1044), prohibit counties, cities, and towns from taxing or imposing fines on entities operating blockchain nodes (SB 1045), and advance a constitutional amendment to clarify the classification of digital assets within Arizona’s property tax framework (SCR 1003).

The proposed measures follow distinct procedural trajectories. SB 1045, which focuses on the protections for blockchain node operators, has the potential to progress through the legislature and be enacted, contingent upon approval by lawmakers and the governor’s signature.

In contrast, SB 1044 and SCR 1003 are interlinked and would ultimately necessitate voter approval during the upcoming general election in November 2026.

SCR 1003 seeks to amend Arizona’s constitution to explicitly exclude virtual currency from property taxation, while SB 1044 aims to align state statutes with this change, specifying that digital assets are not liable for property tax. Given Arizona law, any modifications to constitutional tax definitions must receive voter endorsement, representing a significant hurdle for the overall tax exemption initiative.

SB 1045 tackles a more focused and increasingly relevant issue: the regulation of blockchain nodes at the local level. This bill would prevent municipalities from imposing “a tax or fee on a person that runs a node on blockchain technology,” thus shielding local governments from levying taxes or penalties specifically targeting node operators.

Arizona’s Engagement with Bitcoin and Cryptocurrency

The legislative activity surrounding digital assets in Arizona builds upon previous initiatives that have established the state as one of the few jurisdictions with legal frameworks specific to cryptocurrency. Notably, Arizona permits the government to assume custody of digital assets classified as abandoned after three years.

This regulatory framework stems from prior efforts by cryptocurrency advocates to create a state-level digital asset reserve and has since become part of a larger discourse regarding the extent of state authority to manage or invest in cryptocurrencies such as Bitcoin.

Senator Rogers had previously co-sponsored a bitcoin reserve bill that was vetoed by Arizona Governor Katie Hobbs in May. Following this veto, Senator Rogers expressed her discontent and indicated her intention to reintroduce similar legislation in future sessions.

Arizona’s proposals come at a time when various states across the country are exploring diverse approaches to digital asset policy. New Hampshire and Texas have enacted laws pertaining to digital asset reserves, while other states have concentrated on more specific tax-related issues.

In Ohio, lawmakers have advanced a bill aimed at exempting cryptocurrency transactions under $200 from capital gains taxes, although it has been stalled since June.

Similarly, in New York, a proposal to impose a 0.2% excise tax on digital asset transactions was referred to committee earlier this year but has yet to progress.

At the federal level, Senator Cynthia Lummis from Wyoming introduced draft legislation proposing a de minimis exemption for digital asset transactions and capital gains of $300 or less.

Senator Lummis recently announced her intention to retire from the U.S. Senate in January 2027.

As of current trading data, Bitcoin is valued at $87,341, reflecting a decrease of 3% within the last 24 hours. The 24-hour trading volume stands at $46 billion. This price is 3% lower than its 7-day high of $90,031 and 1% above its 7-day low of $86,806.

With a circulating supply of 19,966,021 BTC (out of a maximum of 21 million), Bitcoin’s market capitalization is approximately $1.74 trillion, also indicating a 3% decline over the past 24 hours.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.