Recent developments suggest that the U.S. Marshals Service (USMS) has sold approximately $6.3 million worth of bitcoin that Samourai Wallet developers Keonne Rodriguez and William Lonergan Hill forfeited as part of their guilty plea to the U.S. Department of Justice (DOJ).

This action raises questions about a potential violation of Executive Order (EO) 14233, which stipulates that bitcoin acquired through criminal or civil asset forfeiture must be retained within the United States’ Strategy Bitcoin Reserve (SBR).

If the Southern District of New York (SDNY) indeed contravened EO 14233, it would not mark the first instance of personnel within the SDNY acting contrary to directives from the federal government.

What Happened to the Bitcoin?

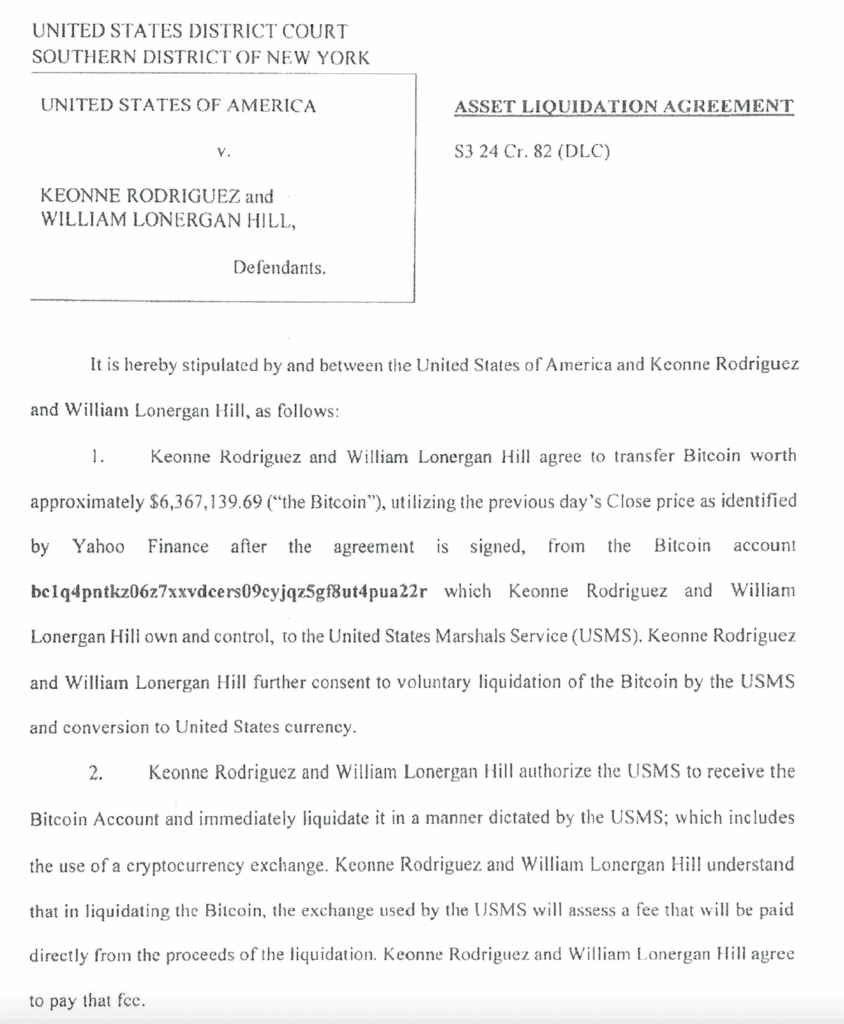

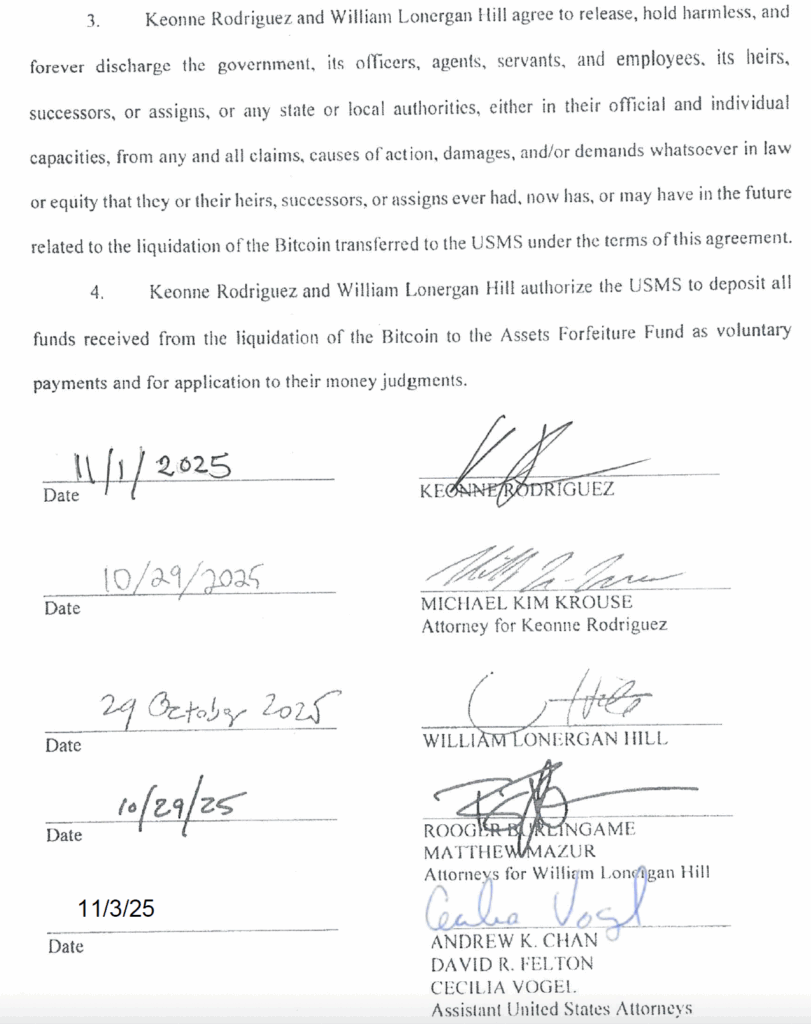

The document reveals that the defendants agreed to transfer 57.55353033 bitcoin, valued at $6,367,139.69 at the time of the final agreement, to the USMS on November 3, 2025, with Assistant United States Attorney Cecilia Vogel signing the agreement.

The transferred bitcoin appears to have bypassed direct custody by the USMS, being directed instead to a Coinbase Prime address (3Lz5ULL7nG7vv6nwc8kNnbjDmSnawKS3n8) which is attributed to the brokerage, presumably for sale. This address currently shows a zero balance, implying that the bitcoin may have already been sold.

Violating Executive Order 14233

If the USMS has, indeed, sold the forfeited bitcoin, this would likely constitute a violation of EO 14233, which mandates that bitcoin acquired by the U.S. government through criminal forfeiture—referred to as “Government BTC”—must not be sold, but rather must be contributed to the U.S. SBR.

This sale, executed at the discretion of the USMS rather than legally mandated, suggests a lingering interpretation among some DOJ personnel that bitcoin is still viewed as a deprecated asset to be liquidated rather than a strategic one, as directed by President Trump’s administration.

The prosecution of Samourai Wallet under the previous administration—a regime known for its adversarial posture toward noncustodial crypto tools—parallels a broader trend in which bitcoin is either disregarded or deemed expendable by certain legal entities.

Legal Details Regarding Forfeiture and Liquidation

Legal insights indicate that the forfeiture of the bitcoin by the Samourai developers was conducted under 18 U.S. Code § 982(a)(1), which mandates forfeiture of any property involved in an offense violating the regulations on unlicensed money transmitting businesses.

According to § 982 and its connection to 21 U.S.C. § 853(c), it is stipulated that forfeited property can be subject to a special verdict of forfeiture and subsequent orders of forfeiture to the United States. The bitcoin forfeited by Rodriguez and Hill thus falls within the EO’s definition of “Government BTC.”

Neither § 982 nor § 853 necessitate the liquidation of forfeited property. Additionally, the fund forfeiture statutes referenced in the EO—31 U.S.C. § 9705 and 28 U.S.C. § 524(c)—govern the handling of forfeiture proceeds without stipulating that forfeited bitcoin must be liquidated rather than retained.

The EO categorically asserts that “Government BTC” is encompassed within “Government Digital Assets” and expressly states that “the head of each agency shall not sell or otherwise dispose of any Government Digital Assets,” except in circumstances that do not apply to Rodriguez and Hill, wherein the Attorney General would determine the fate of such forfeited assets.

The Sovereign District of New York

When considering EO 14233 alongside the statutes mentioned herein, it appears that the SDNY has acted in opposition to the directive to transfer bitcoin obtained through criminal forfeiture to the U.S. SBR.

This incident is not an isolated occurrence for the SDNY, sometimes informally dubbed the “Sovereign District of New York,” which is known for its independent operational style within the federal system.

The continuation of prosecutions against Rodriguez and Hill, as well as Tornado Cash developer Roman Storm, illustrates this trend.

On April 7, 2025, Deputy Attorney General Todd Blanche issued a memo entitled “Ending Regulation By Prosecution,” stating, “the Department [of Justice] will no longer target virtual currency exchanges, mixing and tumbling services, and offline wallets for the acts of their end users…”.

However, the SDNY appears to have overlooked the implications of this memo, proceeding with the cases against Samourai Wallet and Tornado Cash regardless.

Furthermore, when defense counsels for Rodriguez and Hill submitted a Brady request and learned that senior members of the Financial Crimes Enforcement Network (FinCEN) had “strongly suggested” that Samourai Wallet was not functioning as a money transmitter due to its noncustodial nature, the prosecution continued unabated.

In the context of the federal court system, statistics reveal that over 90% of defendants face conviction, with acquittal rates as low as 0.4% in certain years. The SDNY has established a reputation for an even higher rate of successful prosecutions.

Aware of these statistics and the formidable reputation of Judge Denise Cote, who presided over their case, Rodriguez expressed apprehension prior to pleading guilty to charges related to operating an unlicensed money transmitter.

Is the War on Crypto Really Over?

There is growing concern among Bitcoin and cryptocurrency advocates, particularly those who supported President Trump in 2024, regarding the true intent behind the rhetoric promising an end to the hostility toward crypto.

For a substantive shift to occur, the DOJ must comply with EO 14233 and heed Deputy Attorney General Blanche’s guidance to halt prosecutions of developers involved in noncustodial crypto technology.

President Trump has recently indicated that he is contemplating a pardon for Rodriguez, which would not only underscore a commitment to his pro-Bitcoin and pro-crypto stance but also prompt an investigation into the rationale behind the sale of the forfeited bitcoin from the Samourai developers.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.