There are lots of criteria for determining IEO success. Token rate, neighborhood size, code delivered, and turning points satisfied are all yardsticks for determining the development of a tokenized job. For jobs looking for to develop the greatest possible splash, nevertheless, liquidity is the important aspect. The more exchanges an IEO reaches, the higher its potential customers of survival.

Multiple Exchanges Multiply Projects’ Prospects

Initial exchange offerings are huge service: according to Inwara, IEO jobs raised a cool $1.625 billion in the very first half of 2019. H2 has actually continued that pattern, with the leading exchange launchpads keeping their aggressive IEO schedule – one a month when it comes to Binance; 24/7 when it comes to smaller sized platforms such as Latoken. Investor need for initial exchange offerings also stays robust: the leading crypto Telegram channels, preserved by the similarity Coinidol, vouch for this, as financiers shout to capture wind of pre-sale and seed rounds for jobs that will ultimately IEO on Binance or Huobi.

While the initial exchange offering brings advantages to financiers and job groups, compared to the ICO, it is hamstrung by a defect that is intrinsic to this fundraising design: typically, there is little reward for other exchanges to note the token. As an outcome, many IEOs will live and pass away on the exchange that hosted their token sale. For the handful of IEOs that have actually prospered post-sale, both in regards to token rate and other criteria, it’s no coincidence that they’ve transcended their releasing platform, and got deep liquidity at the same time.

Bittorrent Remains the Liquid Leader

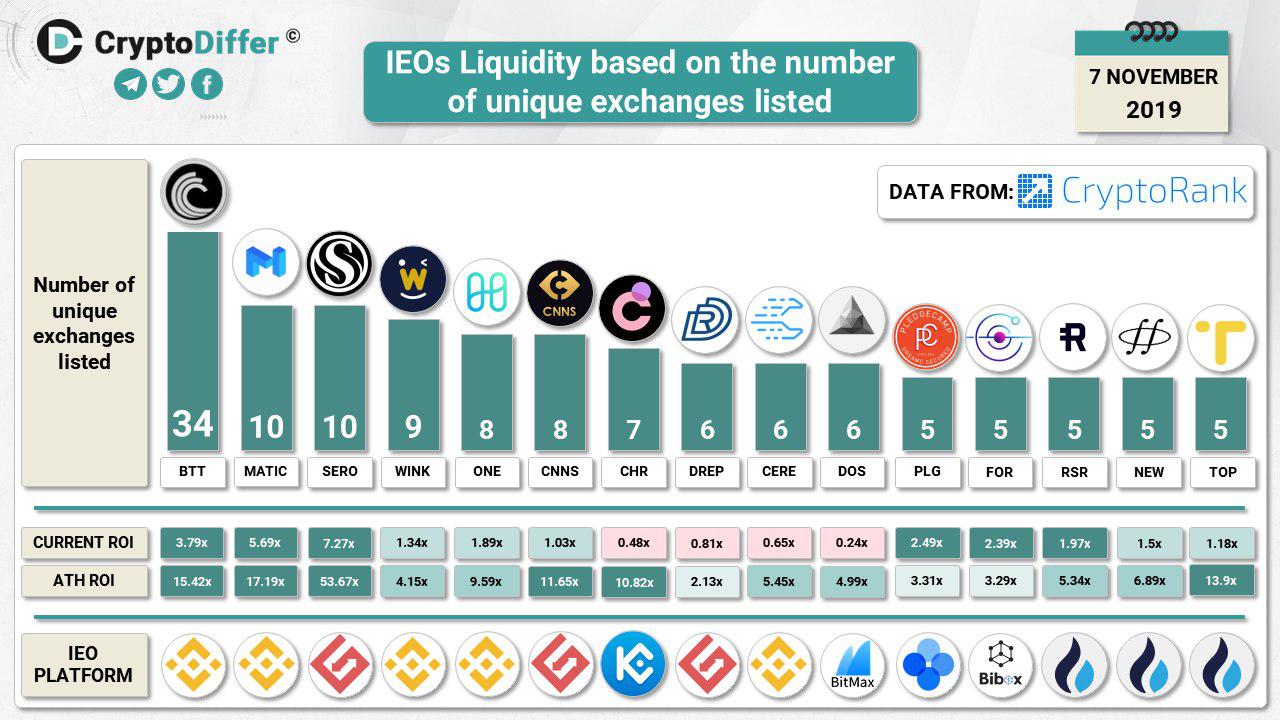

The most liquid token IEO to date, based upon the variety of exchanges where it’s noted, is also among the earliest: Bittorrent (BTT), which introduced on Binance in 2015. Today it appears on 34 exchanges – 24 more than the next most-noted tokens. It’s no coincidence that tokens listed on the most exchanges – particularly BTT (34), MATIC (10) and SERO (10) – exceed all others as far as ROI and ATH ROI are worried. The connection in between variety of exchanges and job efficiency is inarguable.

For much better or even worse, IEOs have actually taken the crypto world by storm, however many jobs will never ever see the sort of liquidity taken pleasure in by Bittorrent and Matic. In truth, of the 65 IEOs introduced in the previous 6 months, the huge bulk have actually stopped working to even make it onto a 2nd exchange. The repercussion of this has actually been restricted liquidity, low accessibility/visibility and, in a lot of cases, a job which has actually successfully passed away prior to it has actually even gotten the chance to establish any major momentum.

A last note on IEO liquidity: when it concerns protecting numerous exchange listings, quality beats amount each time. According to Cryptorank.io, Binance blazes a trail, with a much greater typical ROI for its noted tokens (94.53%). Bittorrent’s runaway success played a part in this: it was the very first IEO on Binance Launchpad, conference its financing objective of $7.2 million in simple minutes. Every job because has actually had a hard time fruitless to replicate that success.

Do you believe IEOs have peaked, or are they simply getting going? Let us understand in the comments area below.

Did you understand you can confirm any unofficial Bitcoin deal with our Bitcoin Block Explorer tool? Simply total a Bitcoin address search to see it on the blockchain. Plus, go to our Bitcoin Charts to see what’s occurring in the market.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.