Grupo Murano, a popular $1 billion real estate company situated in Mexico, is starting an ingenious technique to include bitcoin into its operations. CEO Elías Sacal competes that bitcoin is “demonetizing” the realty market. The openly traded company intends to shift from conventional asset-heavy designs to a bitcoin-focused treasury, enhancing its monetary structure while profiting from the cryptocurrency’s possible gratitude. This pioneering technique might function as an important design for companies browsing changing rate of interest and unstable currencies.

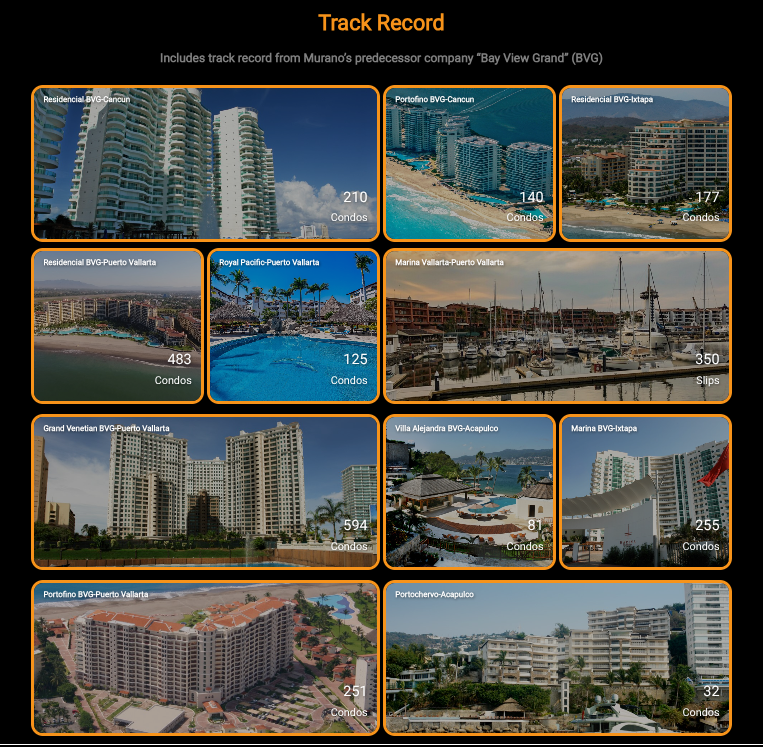

In a special interview on the Bitcoin for Corporations program, Sacal, an experienced expert with thirty years of experience in realty advancement, articulated Grupo Murano’s tactical vision. The company, which runs hotels under popular brand names such as Hyatt and Mondrian and handles numerous property and industrial homes in cities consisting of Cancun and Mexico City, prepares to transform existing possessions into bitcoin through refinancing and sale-leaseback plans. This technique is created to lower financial obligation and equity liabilities on its balance sheet while maintaining functional control. According to Sacal, “Instead of buildings waiting for small appreciation, we believe bitcoin will appreciate more,” forecasting a prospective 300% cost boost over the next 5 years.

Sacal’s tactical technique addresses the fundamental reliance of the realty sector on financial obligation funding, a circumstance that has actually been considerably interrupted by increasing rate of interest—intensifying from 4% to 9% in particular circumstances. He said, “Real estate needs to be independent of the rate of tomatoes or Walmart inflation,” highlighting bitcoin’s function as a steady medium for deals, consisting of worldwide product sourcing and hotel payments. By preventing intermediaries such as hedge funds and portfolio supervisors, bitcoin can reduce expenses connected with commissions and currency currency exchange rate. As Sacal showed, a deal of $100 typically lowers to $85 after costs, whereas bitcoin boosts deal effectiveness.

In addition, Grupo Murano is devoted to informing its stakeholders—staff members, financiers, and visitors—about the benefits of bitcoin. The company prepares to set up Bitcoin ATMs at its homes and is nearing a collaboration with a prominent payment platform to assist in smooth deals, especially for its customers in Cancun and Mexico City. This effort lines up with Murano’s enthusiastic objective to establish a $10 billion bitcoin treasury within 5 years, influenced by the effective technique of accomplishing a $100 billion assessment primarily by means of bitcoin combination. The business is also checking out choices to accept bitcoin payments throughout its portfolio and possibly host Bitcoin conferences at its areas.

Grupo Murano’s tactical focus stays on high-margin advancement jobs, committing 20-30% of its operations to realty holdings and 70-80% to bitcoin financial investments. Sacal has actually revealed a clear choice for bitcoin over other cryptocurrencies, comparing it to “the champion, like Formula One or the NFL.” He views Latin America, especially led by trendsetters such as El Salvador, as an appealing landscape for bitcoin adoption, in spite of existing political dangers. With the possible to combine local economies, bitcoin might reduce dependence on tourist and remittances.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.