The institutional demand for Bitcoin has reached unprecedented heights in 2025.

As of October 8, the cumulative acquisitions of Bitcoin by global exchange-traded products (ETPs) and publicly traded companies have totaled 944,330 BTC, a figure that exceeds the total amount acquired throughout the entirety of 2024.

For context, these institutions have purchased approximately 7.4 times the new supply of Bitcoin mined this year.

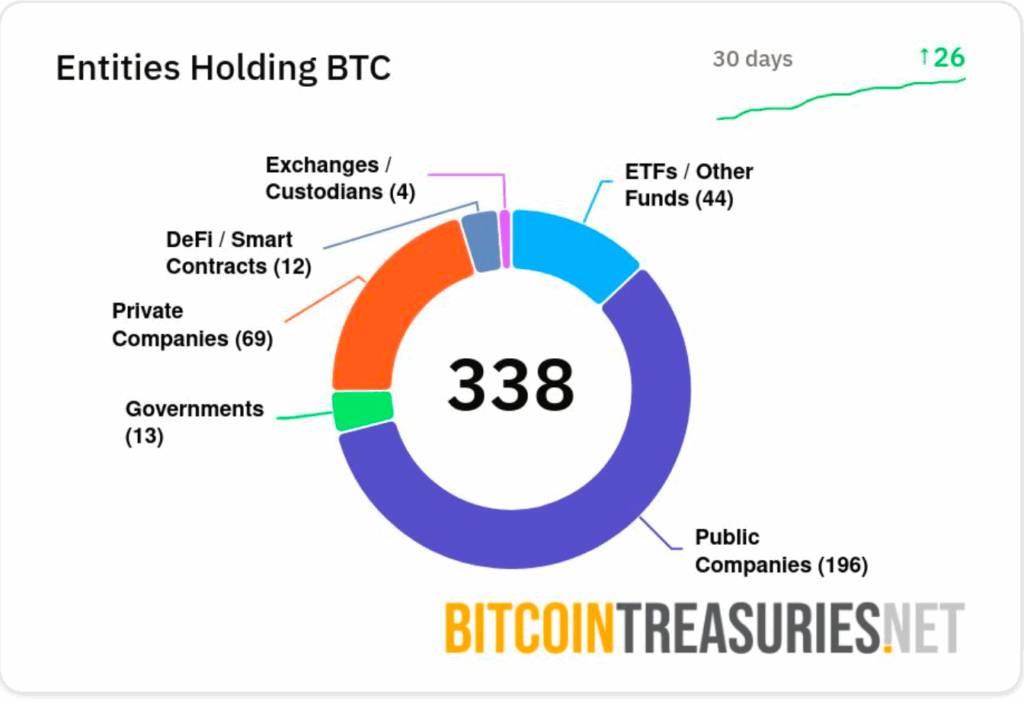

By the end of September, tracked entities together held over 3.8 million BTC, valued at approximately $435 billion. This aggregate includes holdings from public companies, private enterprises, governments, exchange-traded funds (ETFs), and decentralized finance (DeFi) platforms.

Additionally, around 130 non-U.S. companies were reported to hold 96,997 BTC, indicating a continued global adoption of Bitcoin.

As of September 30, 2025, a total of 338 entities were documented to hold Bitcoin, including 265 public and private companies. The number of listed entities has more than doubled since January, signifying a notable increase in institutional adoption.

In September alone, 26 new entities were recorded—18 public companies and 8 private firms. Publicly traded Bitcoin treasury companies are expected to continue their dominance, and analysts from bitcointreasuries.net speculate they will remain the primary drivers of new listings and Bitcoin acquisitions in the future.

Some of the prominent Bitcoin holders include MicroStrategy Inc. (MSTR) from the U.S. with 640,031 BTC; Marathon Digital Holdings, Inc. (MARA), also from the U.S. with 52,850 BTC; 21Shares/XXI (CEP) from the U.S. with 43,514 BTC; Metaplanet Inc. (MTPLF) from Japan with 30,823 BTC; and Bitcoin Standard Treasury Company (CEPO) from the U.S. with 30,021 BTC.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.