Bitcoin Magazine

Is 8% of Bitcoin Owned by Institutions a Threat to Its Future?

Institutional ownership of Bitcoin has actually risen over the previous year, with around 8% of the overall supply currently in the hands of significant entities, which number is still climbing up. ETFs, openly noted business, and even nation-states have actually started protecting significant positions. This raises essential concerns for financiers. Is this growing institutional existence a good idea for Bitcoin? And as more BTC ends up being secured in cold wallets, treasury holdings, and ETFs, is our on-chain information losing its dependability? In this analysis, we go into the numbers, trace the capital streams, and check out whether Bitcoin’s decentralized values is genuinely at danger or merely developing.

The New Whales

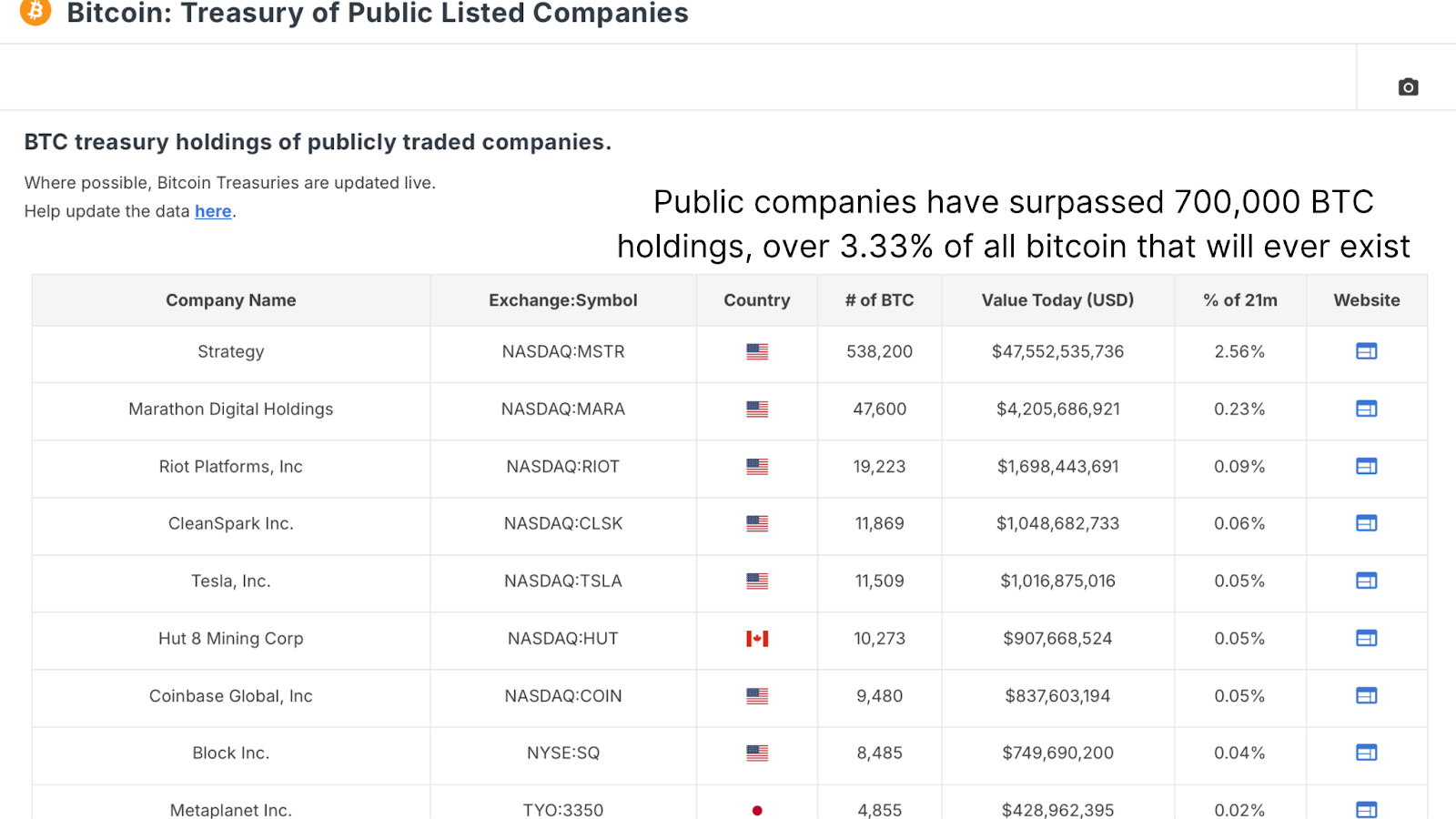

Let’s start with the Treasury of Public Listed Companies table. Major business, consisting of Strategy, MetaPlanet, and others, have actually jointly built up more than 700,000 BTC. Considering that Bitcoin’s overall hard-capped supply is 21 million, this represents approximately 3.33% of all BTC that will ever exist. While that provide ceiling won’t be reached in our life times, the ramifications are clear: the institutions are making long-lasting bets.

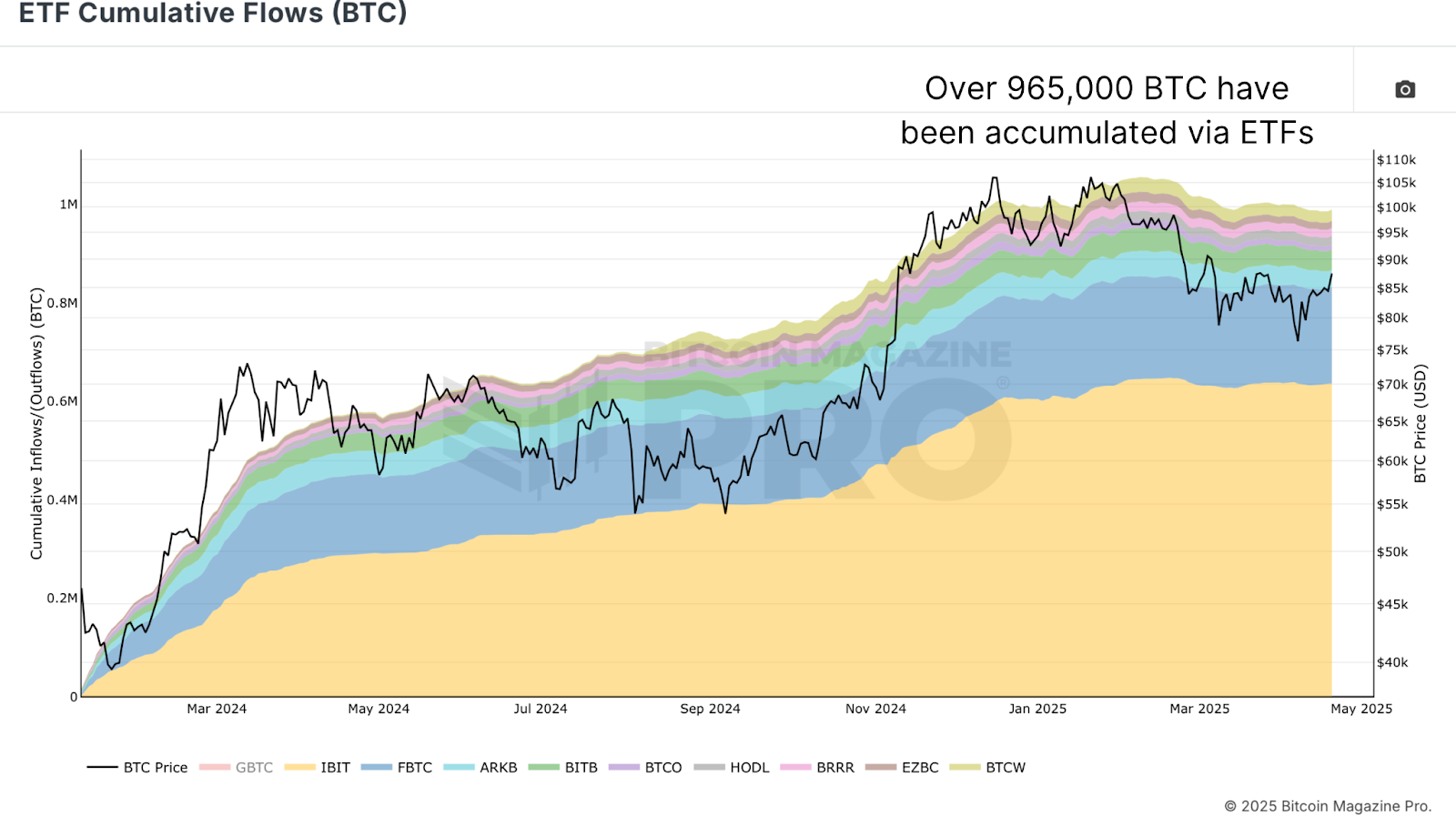

In addition to direct business holdings, we can see from the EFT Cumulative Flows (BTC) chart that ETFs now manage a substantial piece of the marketplace too. At the time of writing, area Bitcoin ETFs hold roughly 965,000 BTC, simply under 5% of the overall supply. That figure changes a little however stays a significant force in everyday market characteristics. When we integrate business treasuries and ETF holdings, the number climbs up to over 1.67 million BTC, or approximately 8% of the overall theoretical supply. But the story doesn’t stop there.

Beyond Wall Street and Silicon Valley, some federal governments are now active gamers in the Bitcoin area. Through sovereign purchases and reserves under efforts like the Strategic Bitcoin Reserve, nation-states jointly hold roughly 542,000 BTC. Add that to the previous institutional holdings, and we come to over 2.2 million BTC in the hands of institutions, ETFs, and federal governments. On the surface area, that’s about 10.14% of the overall 21 million BTC supply.

Forgotten Satoshis and Lost Supply

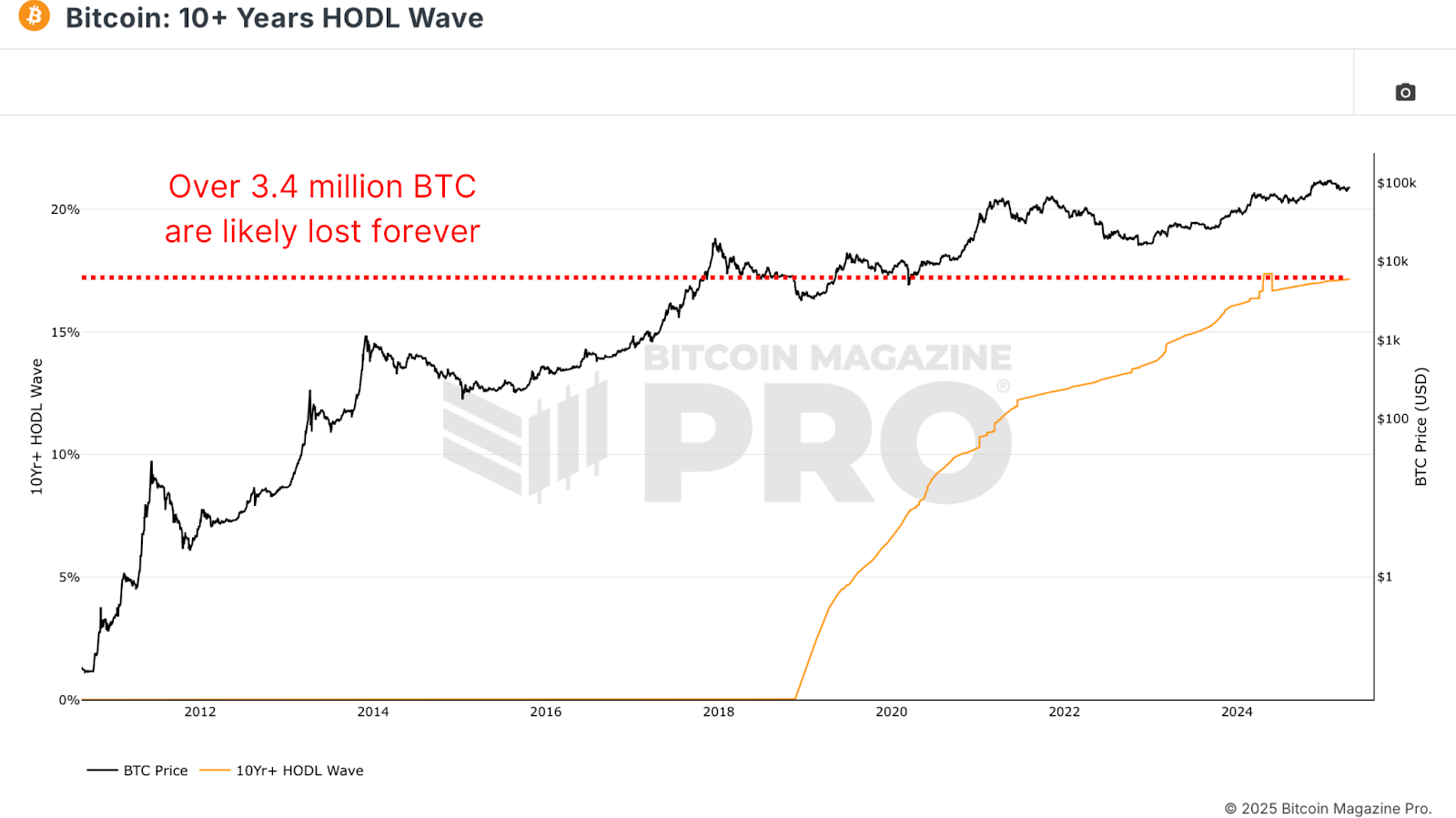

Not all 21 million BTC are in fact available. Estimates based upon 10+ Years HODL Wave information, a measurement of coins that haven’t relocated a years, recommend that over 3.4 million BTC are most likely lost permanently. This consists of Satoshi’s wallets, early mining-era coins, forgotten expressions, and yes, even USBs in land fills.

With roughly 19.8 million BTC presently in flow and approximately 17.15% presumed to be lost, the efficient supply is better to 16.45 million BTC. That significantly alters the formula. When determined versus this more reasonable supply, the portion of BTC held by institutions increases to approximately 13.44%. This suggests that roughly one in every 7.4 BTC readily available to the marketplace is currently secured by institutions, ETFs, or sovereigns.

Are Institutions Controlling Bitcoin?

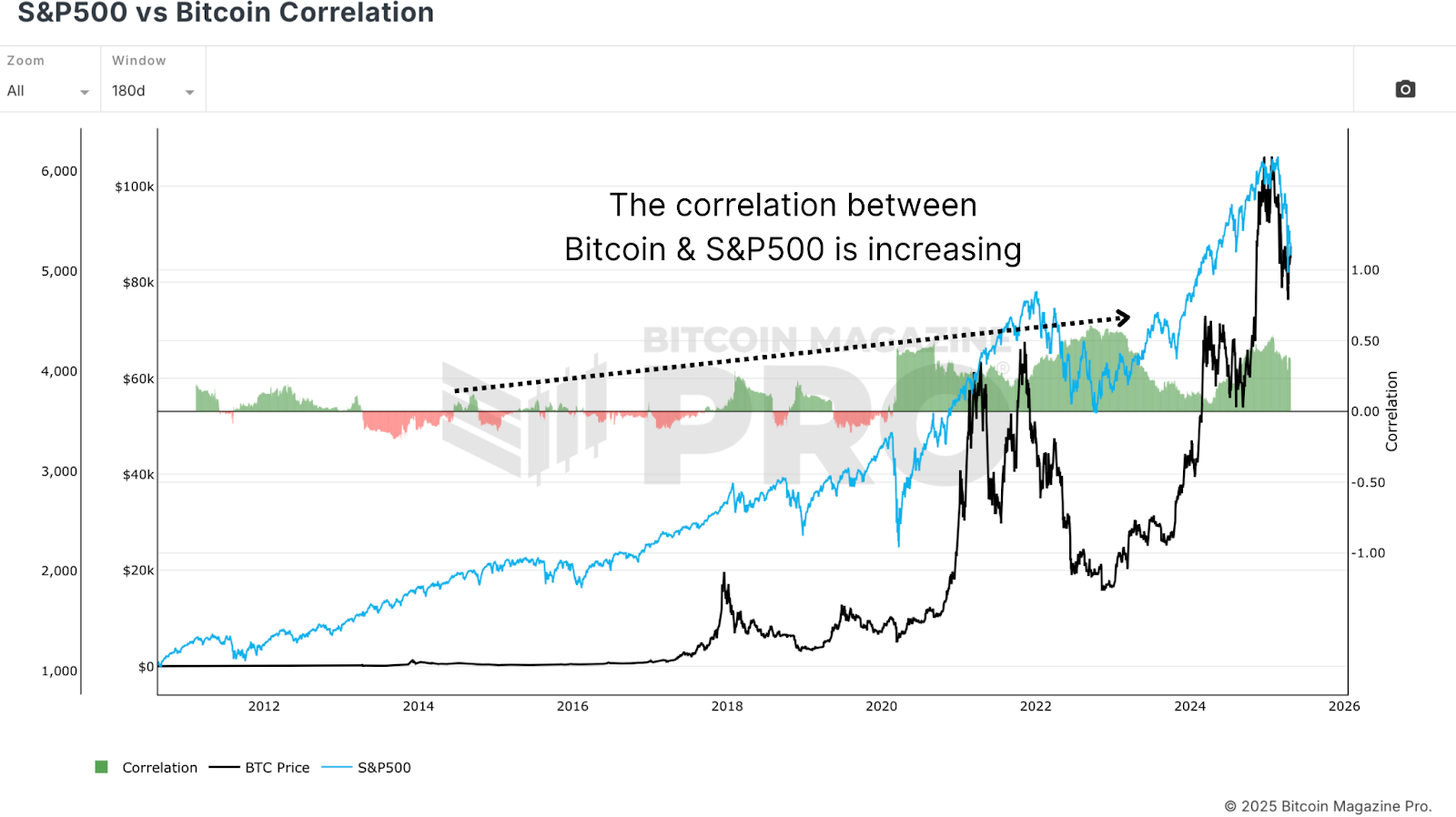

Does this mean Bitcoin is being managed by corporations? Not yet. But it does signal a growing impact, particularly in cost habits. From the S&P 500 vs Bitcoin Correlation chart, it appears that the connection in between Bitcoin and conventional equity indexes like the S&P 500 or Nasdaq has actually tightened up substantially. As these big entities get in the marketplace, BTC is progressively considered as a “risk-on” property, indicating its cost tends to fluctuate with wider financier belief in conventional markets.

This can be helpful in booming market. When international liquidity expands and run the risk of possessions carry out well, Bitcoin now stands to bring in bigger inflows than ever in the past, particularly as pensions, hedge funds, and sovereign wealth funds start designating even a little portion of their portfolios. But there’s a compromise. As institutional adoption deepens, Bitcoin ends up being more delicate to macroeconomic conditions. Central bank policy, bond yields, and equity volatility all start to matter more than they as soon as did.

Despite these shifts, more than 85% of Bitcoin stays outdoors institutional hands. Retail financiers still hold the frustrating bulk of the supply. And while ETFs and business treasuries might hoard big quantities in freezer, the marketplace stays broadly decentralized. Critics argue that on-chain information is ending up being less beneficial. After all, if a lot BTC is secured in ETFs or inactive wallets, can we still draw precise conclusions from wallet activity? This issue stands, however not brand-new.

Need to Adapt

Historically, much of Bitcoin’s trading activity has actually taken place off-chain, especially on central exchanges like Coinbase, Binance, and (as soon as upon a time) FTX. These trades seldom appeared on-chain in significant methods however still affected cost and market structure. Today, we deal with a comparable circumstance, just with much better tools. ETF streams, business filings, and even nation-state purchases are subject to disclosure guidelines. Unlike nontransparent exchanges, these institutional gamers typically should divulge their holdings, supplying experts with a wealth of information to track.

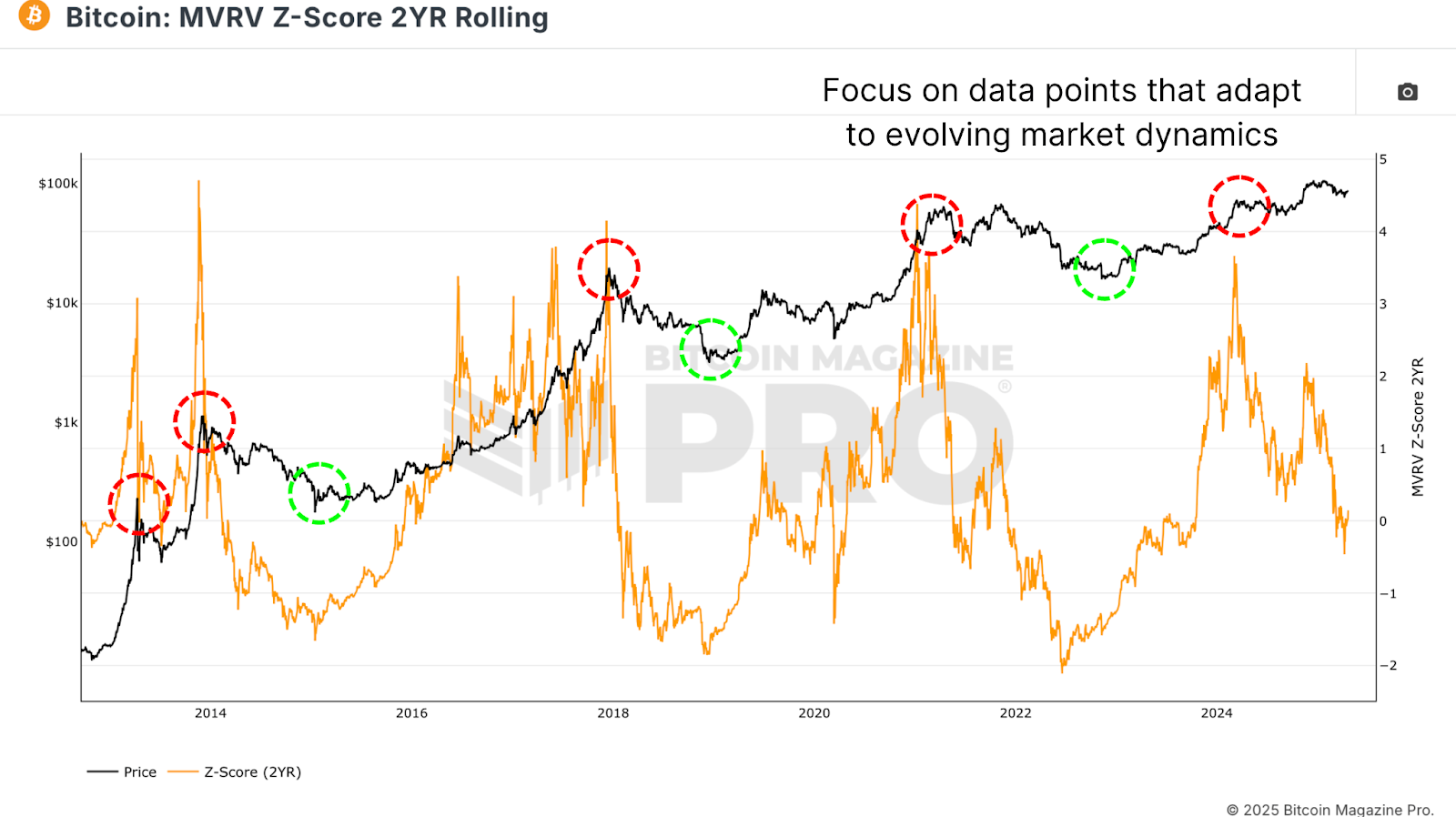

Moreover, on-chain analytics isn’t fixed. Tools like the MVRV-Z rating are developing. By narrowing the focus, state, to an MVRV Z-Score 2YR Rolling typical rather of complete historic information, we can much better catch present market characteristics without the distortion of long-lost coins or non-active supply.

Conclusion

To cover it up, institutional interest in Bitcoin has actually never ever been greater. Between ETFs, business treasuries, and sovereign entities, over 2.2 million BTC are currently promoted, which number is growing. This flood of capital has actually unquestionably had a supporting result on cost throughout durations of market weak point. However, with that stability comes entanglement. Bitcoin is ending up being more connected to conventional monetary systems, increasing its connection to equities and wider financial belief.

Yet this does not spell doom for Bitcoin’s decentralization or the significance of on-chain analytics. In truth, as more BTC is held by recognizable institutions, the capability to track streams ends up being much more accurate. The retail footprint stays dominant, and our tools are ending up being smarter and more responsive to market development. Bitcoin’s values of decentralization isn’t at danger; it’s simply growing. And as long as our analytical structures progress together with the property, we’ll be fully equipped to browse whatever follows.

For more deep-dive research study, technical indications, real-time market informs, and gain access to to a growing neighborhood of experts, see BitcoinMagazinePro.com.

This post Is 8% of Bitcoin Owned by Institutions a Threat to Its Future? initially appeared on Bitcoin Magazine and is composed by Matt Crosby.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.