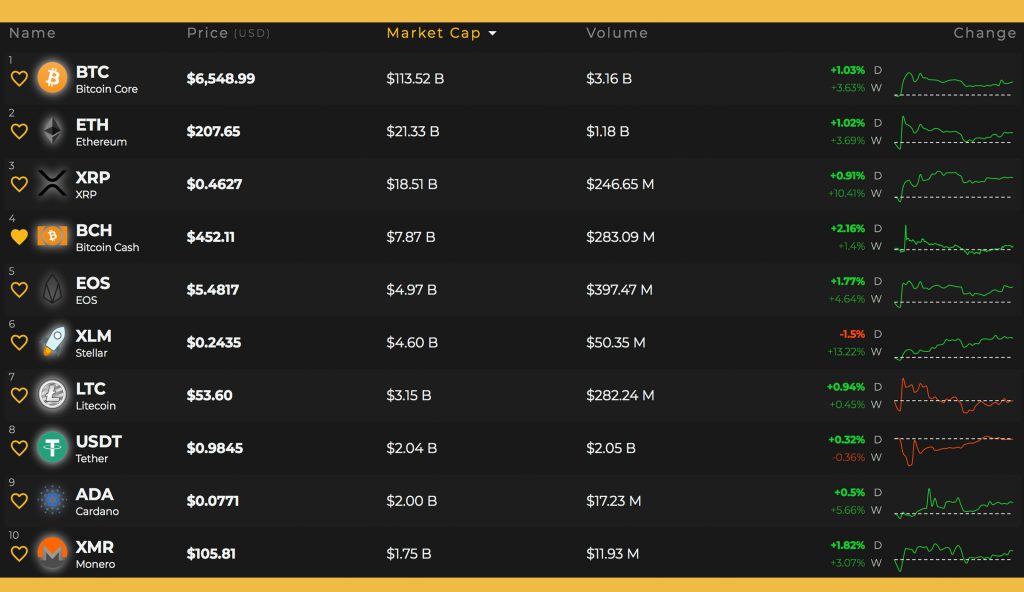

Not loads has modified since our final markets replace 4 days in the past as cryptocurrency markets proceed transferring sideways in a consolidated sample. The high 5 digital belongings have seen modest northbound positive aspects this week, with will increase between 1-5% during the last seven days. This Sunday, Oct. 21, your complete cryptocurrency economic system of over 2,000 digital tokens is valued at $214.four billion.

Boring Market Action Often Leads to Something Unexpected

It’s been a lackluster week for cryptocurrency merchants as not a lot has been taking place, aside from a number of stablecoins having some attention-grabbing breakouts a number of days in the past. Since then most of the stablecoins, funnily sufficient, have seen much less volatility and truly remained ‘stable.’ Top performing digital belongings like bitcoin money (BCH), ethereum (ETH), and bitcoin core (BTC) dropped a hair in worth final week as conventional finance investments plummeted. However, these digital belongings have regained the very small losses that occurred on Oct. 19, and most of the high cash are up during the last seven days. This weekend, bulls appear to be strengthening their positions for an additional try to accentuate a bearish-to-bullish pattern change.

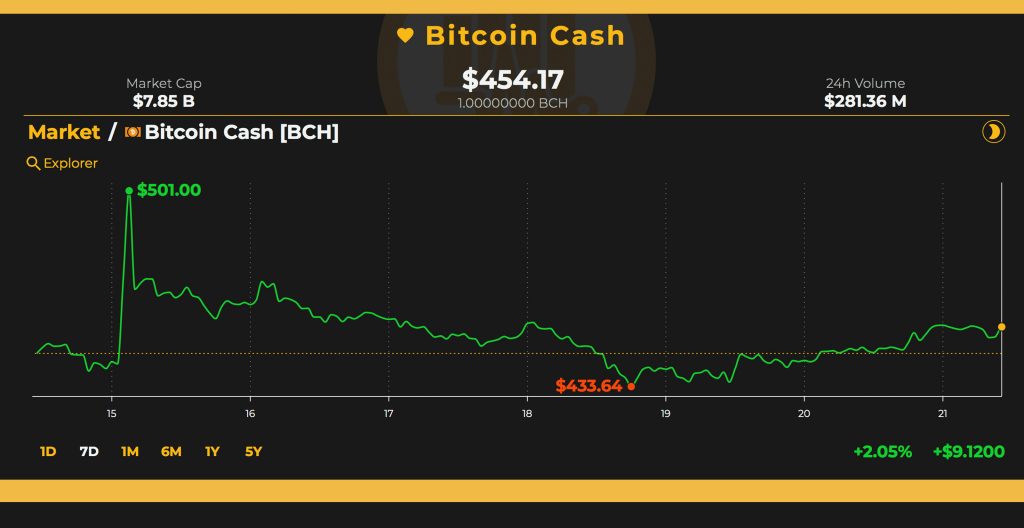

Bitcoin Cash (BCH) Market Action

Bitcoin money (BCH) is presently buying and selling at $452 per coin this Sunday, with a market valuation of about $7.85 billion. Much like BTC and the remainder of the highest cryptocurrency markets, bitcoin money commerce volumes have been waning. Four days in the past, BCH every day commerce volumes have been above $300 million, however have since dropped to $281.Three million. The high exchanges buying and selling essentially the most BCH right now embody Lbank, Hitbtc, Binance, Okex, and Bithumb. The dominant 5 buying and selling pairs swapped for bitcoin money this weekend are BTC (43%), USDT (29%), ETH (10.9%), KRW (8.6%), and USD (3.1%). The US greenback pair has dropped significantly towards BCH, and the Korean gained has jumped a superb proportion upwards relating to international fiat volumes. Bitcoin money this weekend is the sixth most traded cryptocurrency among the many whole crypto-economy.

BCH/USD Technical Indicators

Looking at charts over the previous few days is much like trying on the ocean’s horizon or a straight line. The four-hour and every day charts for BCH/USD present bulls look as if they’re trying to breakout upwards once more within the close to time period. However, the 2 easy transferring averages (SMA) have crossed hairs, indicating a pattern change might be imminent. The 200 SMA is now simply above the 100 SMA, exhibiting the trail in direction of the least resistance is probably going the draw back in the intervening time.

Relative energy index (RSI) ranges are meandering within the center (-54.47), exhibiting merchants could also be indecisive. The MACd exhibits an identical readout, indicating there might be room for enchancment or a break towards the draw back. Order books present bears will probably be stopped quick within the $420 area and see one other pitstop round $385 as nicely. BCH bulls have to press previous the present vantage level and surpass a big sum of orders between the $460 by $500 vary. After that, BCH bulls nonetheless have to defeat huge partitions above the $520 vary and larger to maintain momentum going robust.

The Verdict: Positive News Hasn’t Erased Market Skepticism

Overall there’s been loads of information regarding institutional funding coming into the house and many crypto proponents are happy to see these new entries. For occasion, Fidelity Investments lately introduced launching a buying and selling desk, and Caspian’s multi-exchange buying and selling platform got here out of beta. Bitgo raised $57.5 million and Genesis Global Trading stories that institutional merchants have borrowed $553 million price of digital belongings since March 2018. Meanwhile, Bitcoin Cash followers have seen an exponential enhance in adoption and growth during the last seven days. The outlook is definitely constructive for the long run of cryptocurrencies, however markets don’t appear to be reflecting the optimism. The verdict this week continues to be skeptical so far as short-term market costs are involved. This is because of weak cryptocurrency market volumes, a narrowing vary of consolidation, and the earlier and very attention-grabbing stablecoin fluctuations that occurred earlier this week.

Where do you see the value of bitcoin money and different cash headed from right here? Let us know within the remark part below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.