Recently, Oklahoma lawmakers introduced legislation that would facilitate the negotiation and receipt of payments in bitcoin by state employees, vendors, private enterprises, and residents.

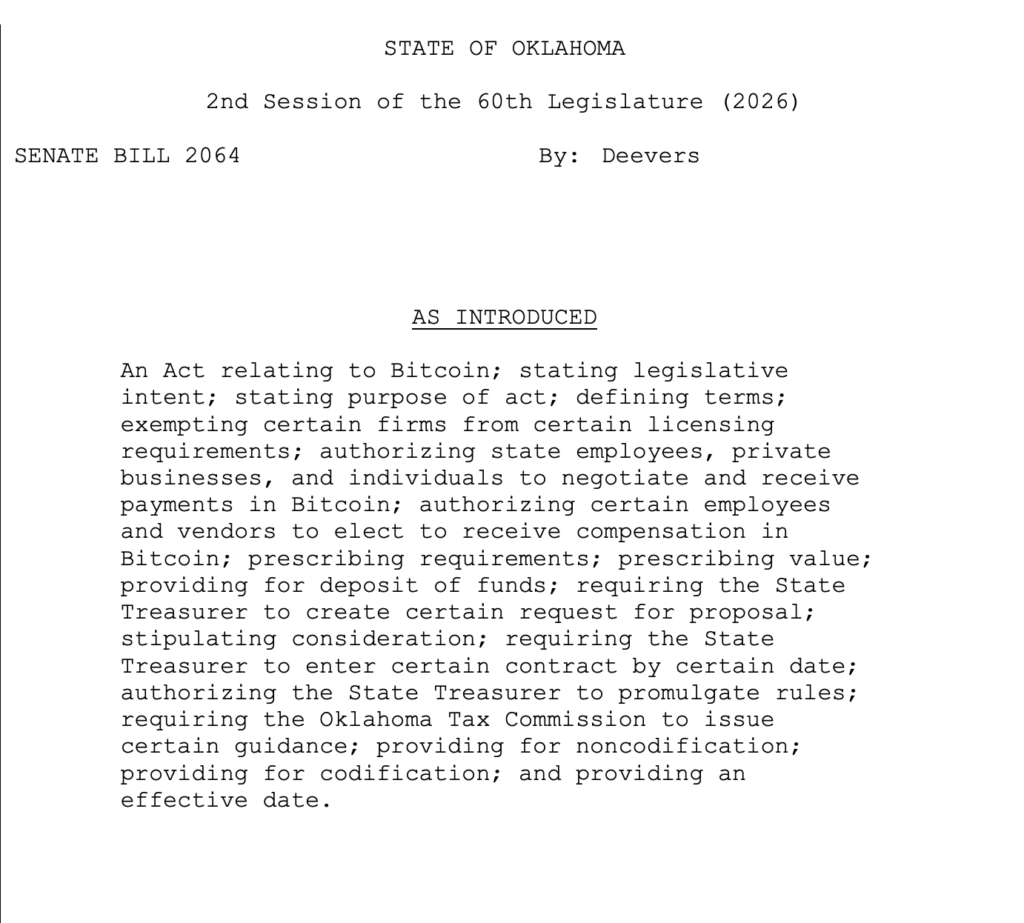

Senate Bill 2064, brought forward by Senator Dusty Deevers during the 2026 legislative session, aims to establish a legal framework that recognizes bitcoin as a medium of exchange and compensation without designating it as legal tender.

The bill clearly delineates that it does not contravene the U.S. Constitution’s prohibition against states coining money or declaring any legal tender apart from gold and silver. Instead, it acknowledges bitcoin as a financial instrument operating within existing legal structures.

Should the bill be enacted, it would allow Oklahoma state employees the option to receive their salaries or wages in bitcoin, calculated based on the asset’s market value either at the commencement of a pay period or at the time of payment.

Employees would have the flexibility to adjust their payment preferences at the beginning of each pay cycle, choosing from bitcoin, U.S. dollars, or a combination of both.

Payments would be directed either to a self-hosted wallet controlled by the employee or to a designated third-party custodial account.

The proposed legislation further allows vendors contracting with the state to elect to receive payment in bitcoin for individual transactions. The bitcoin value of these payments would be determined according to the market price at the time of transaction unless an alternative agreement is reached in writing.

The bill mandates that the Oklahoma State Treasurer issue a request for proposals to select a digital asset firm to manage bitcoin payments for state employees and vendors.

In selecting a provider, the Treasurer is required to consider various factors, including fees, transaction speed, cybersecurity measures, custody options, and relevant state licenses. The Treasurer is tasked with finalizing a contract with a chosen provider by January 1, 2027, and is authorized to create rules necessary for the implementation of the program.

A previous initiative, the Bitcoin Freedom Act (SB 325), introduced by Senator Dusty Deevers in January 2025, sought to allow employees, vendors, and businesses the option to voluntarily engage in bitcoin transactions while laying down a legal framework for its integration into the state’s economy.

Oklahoma’s Bitcoin Adoption Mirrors Actions by Other U.S. States

This legislative action aligns with similar initiatives in states such as New Hampshire and Texas, both of which are exploring the integration of bitcoin into their public financial systems.

New Hampshire has already passed the nation’s first Strategic Bitcoin Reserve law, enabling the state to hold up to 5% of its funds in high-market-cap digital assets and sanctioning the issuance of a bitcoin-backed municipal bond.

In a parallel effort, Texas has not only introduced legislation but has also taken actionable steps to create a Strategic Bitcoin Reserve and has made the first purchase of a Bitcoin ETF by a U.S. state, valued at approximately $5 million, positioning it as a strategy against economic volatility and a modernization of state finances.

Should SB 2064 pass, it would take effect on November 1, 2026, thereby placing Oklahoma among a select group of U.S. states that are actively pursuing the direct integration of bitcoin into government payment systems.

The Oklahoma Tax Commission would also be mandated to provide guidance on the tax implications of digital assets received as payment by January 1, 2027, addressing a significant area of uncertainty for both employees and employers.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.