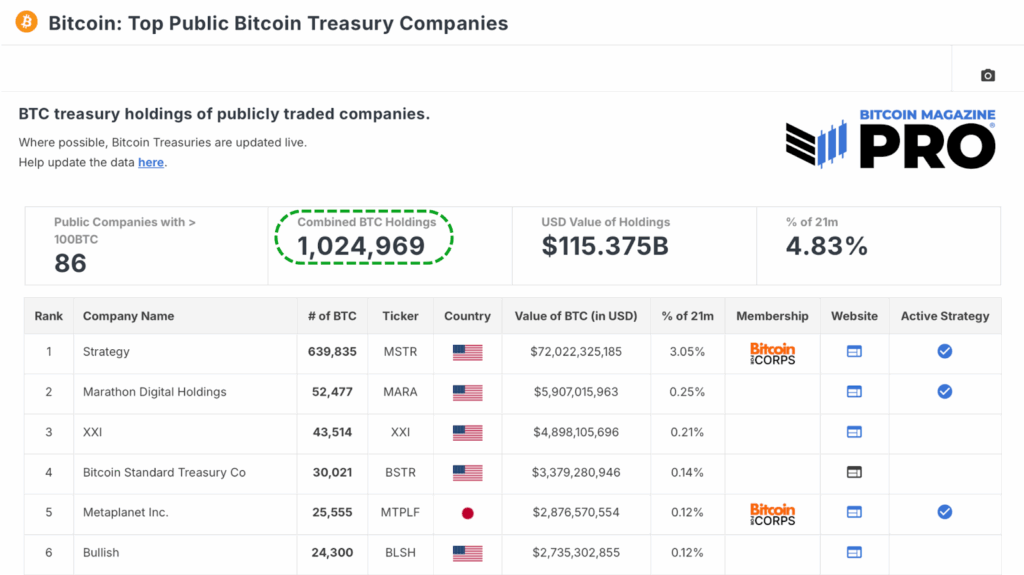

The emergence of Bitcoin treasury companies has significantly influenced demand in the current market cycle. Collectively, 86 publicly traded firms currently possess over 1 million BTC on their balance sheets. The trend initiated by MSTR (Strategy) in 2020 has since proliferated across various corporate entities, with new participants consistently entering the arena. However, a detailed analysis of their purchasing behaviors reveals an intriguing observation: many of these companies might be holding a substantially larger quantity of Bitcoin today if they had adhered to a straightforward, rules-based strategy for accumulation.

MSTR Maintains Leadership in Bitcoin Treasury Holdings

MSTR (Strategy) continues to assert its dominance among corporate Bitcoin holders, boasting nearly 640,000 BTC. Altogether, the top public Bitcoin treasury companies collectively hold more than 1 million BTC, a situation that effectively diminishes liquid supply and bolsters Bitcoin’s monetary premium—assuming these entities do not liquidate their holdings. While this scenario has proven beneficial for Bitcoin’s supply-demand dynamics, the data indicates that a substantial portion of these acquisitions took place during periods of market exuberance, particularly at local peaks.

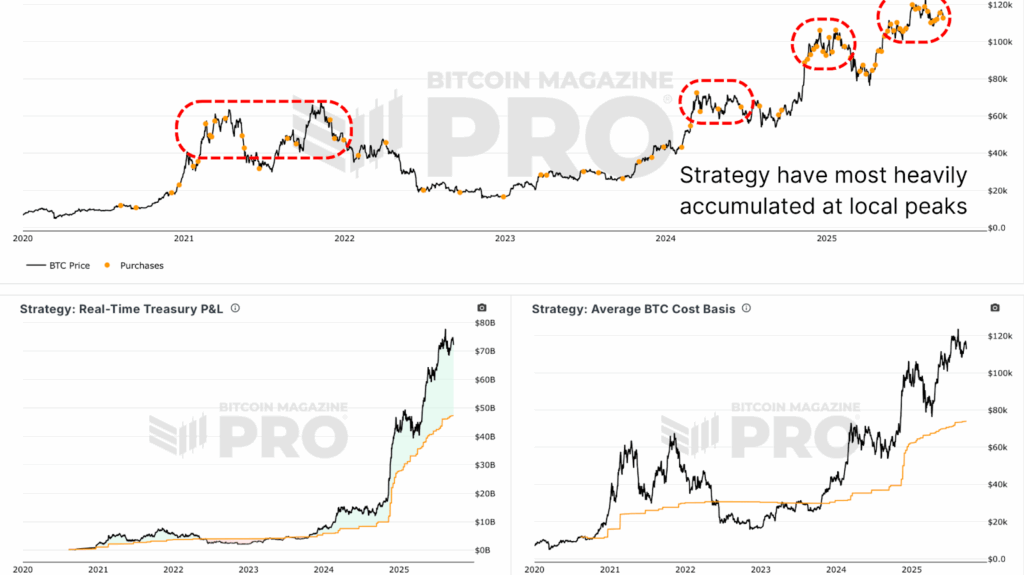

MSTR’s Example: Acquiring Bitcoin at Market Peaks

MSTR’s (Strategy) acquisition patterns serve as a pertinent illustration. The company engaged in substantial purchases in late 2024, coinciding with Bitcoin’s ascendance beyond $70,000 following the approval of ETFs. This trend is reflective of broader market behaviors, where treasury firms similarly front-loaded acquisitions during peak euphoric phases.

While such behavior is understandable, given that capital procurement is simpler during rising prices and robust sentiment, the consequence is that treasury companies often overpay for their acquisitions. Historical analysis indicates that waiting for even modest price pullbacks could have enabled these firms to save between 10% and 30% on average compared to their actual entry prices. Although it is impossible to predict price movements with certainty, a more judicious approach—such as refraining from purchases right after substantial gains—would likely yield more favorable outcomes.

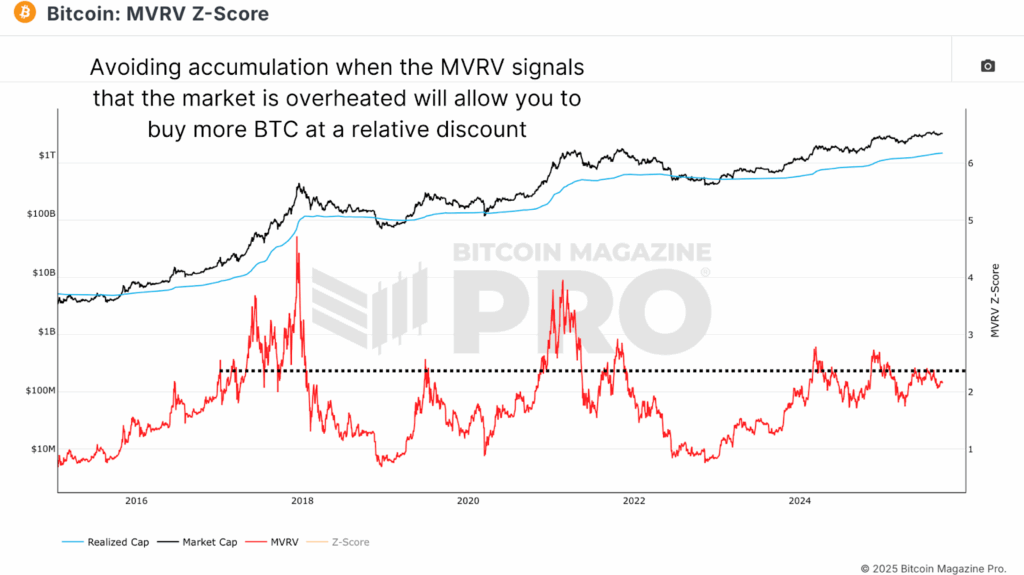

A Simple MVRV Data-Driven Solution for MSTR and Other Treasuries

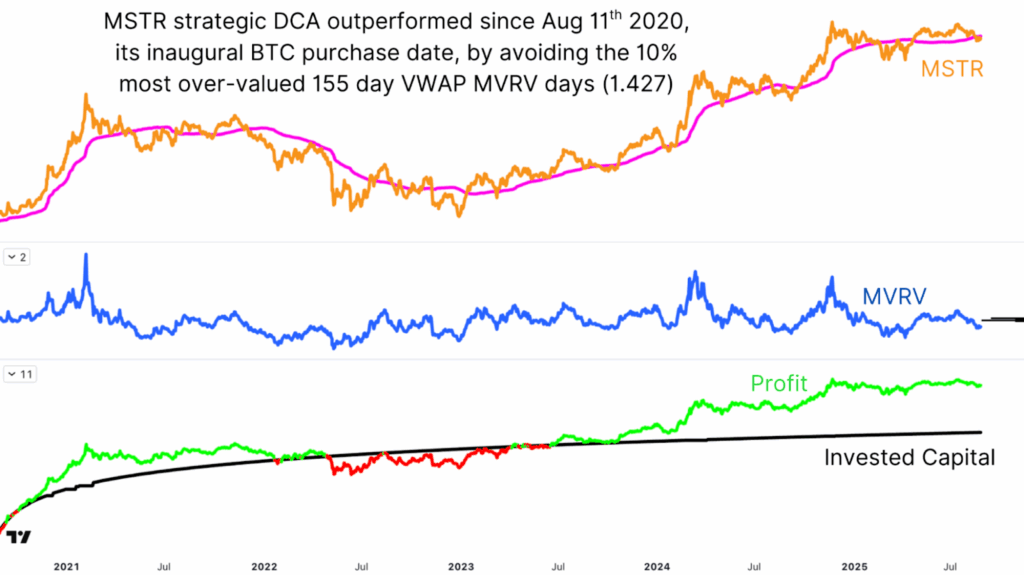

An uncomplicated adjustment could have yielded substantial benefits: employing the MVRV Ratio as a guiding metric. This strategy is not complex; it does not aim to determine precise market bottoms or rely on subjective interpretations. Instead, it utilizes a rolling MVRV percentile threshold to sidestep buying during the most heated periods of bull markets.

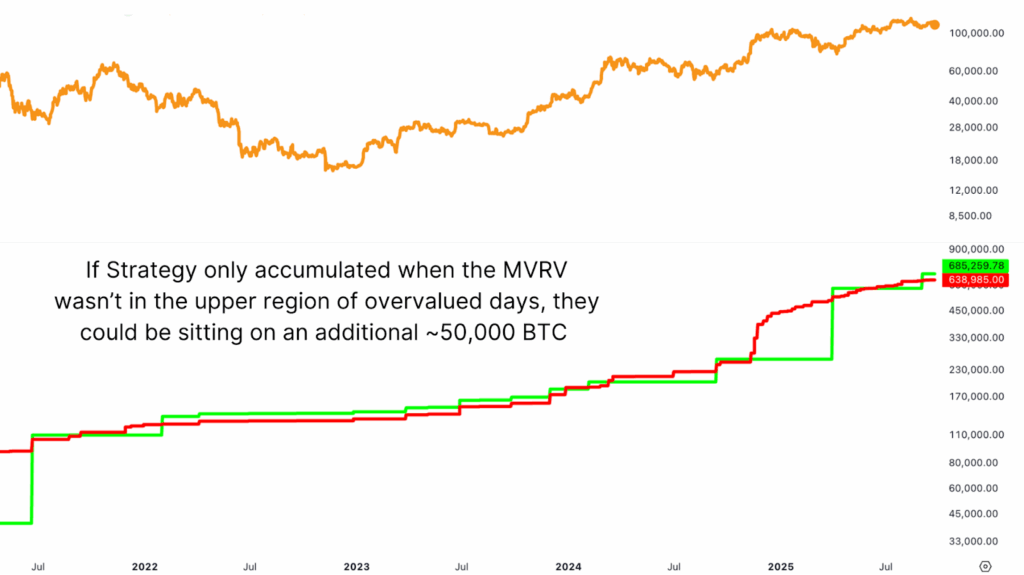

By refraining from purchases when the MVRV ratio was within the top 20% of historical values—indicative of overvaluation—and allocating capital during periods of relative calm, MSTR (Strategy) could potentially increase its holdings to approximately 685,000 BTC today, representing an additional 50,000 BTC compared to its current assets.

At present valuations, this ‘missed’ Bitcoin equates to over $5 billion. In context, this additional Bitcoin is roughly equivalent to the total lifetime holdings of all other active Bitcoin treasury companies, excluding Marathon Digital.

Similar methodologies have been evaluated across other markets, including altcoins, equities, and the S&P 500, demonstrating consistent outperformance over blind dollar-cost averaging strategies. Strategic dollar-cost averaging tends to yield superior results compared to emotional dollar-cost averaging under various market circumstances.

Implications for MSTR, Treasuries, and Individual Investors

For treasury companies, the adoption of this model could translate into billions of dollars in added value over time. This principle also applies to individual investors, highlighting the importance of avoiding the temptation to chase rallies during euphoric market periods and instead allowing the market’s fluctuations to present opportunities.

It is essential to recognize the complexities involved. Corporations encounter challenges such as capital raising constraints, executing large block trades without incurring slippage, and managing shareholder expectations. Nevertheless, even within these limitations, the implementation of a data-driven filter could enhance financial outcomes significantly.

Conclusion: MSTR’s Path to Enhanced Bitcoin Accumulation

Bitcoin treasury companies have proven to be a considerable asset to the network. Their combined holdings of 1 million BTC serve to decrease supply, augment the money multiplier effect, and illustrate the increasing institutional acceptance of Bitcoin. However, the data suggests that a majority of these firms could significantly improve their positions. A strategic approach that avoids acquisitions during overheated market conditions could have afforded MSTR (Strategy) an additional 50,000 BTC, valued at over $5 billion today.

For both corporations and individual investors, the takeaway is consistent: disciplined strategies outperform impulse-driven decisions. While treasury accumulation has transformed Bitcoin’s supply dynamics, the next phase may involve adopting more intelligent accumulation strategies to maximize returns and mitigate downside volatility without adding risk.

For a more comprehensive examination of this topic, individuals are encouraged to view our latest YouTube video here:

This Simple Bitcoin Strategy Would Have Made Them Billions

For additional data, charts, and expert analysis on Bitcoin price trends, please visit BitcoinMagazinePro.com.

WATCH BITCOIN PRICE VIDEO ANALYSIS

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.