Contrary to widespread conversations, it is presumed that improvements to Bitcoin—such as BitVM, OP_CAT, or OP_CTV—will serve to support Bitcoin agreement. By assisting in brand-new miner charges and alleviating reliance on extractive pooling designs, these improvements guarantee to cultivate network sustainability, guide miners far from possibly damaging kinds of expressivity, and make it possible for Bitcoin to keep its stability without turning to rivalrous or centralizing profits systems.

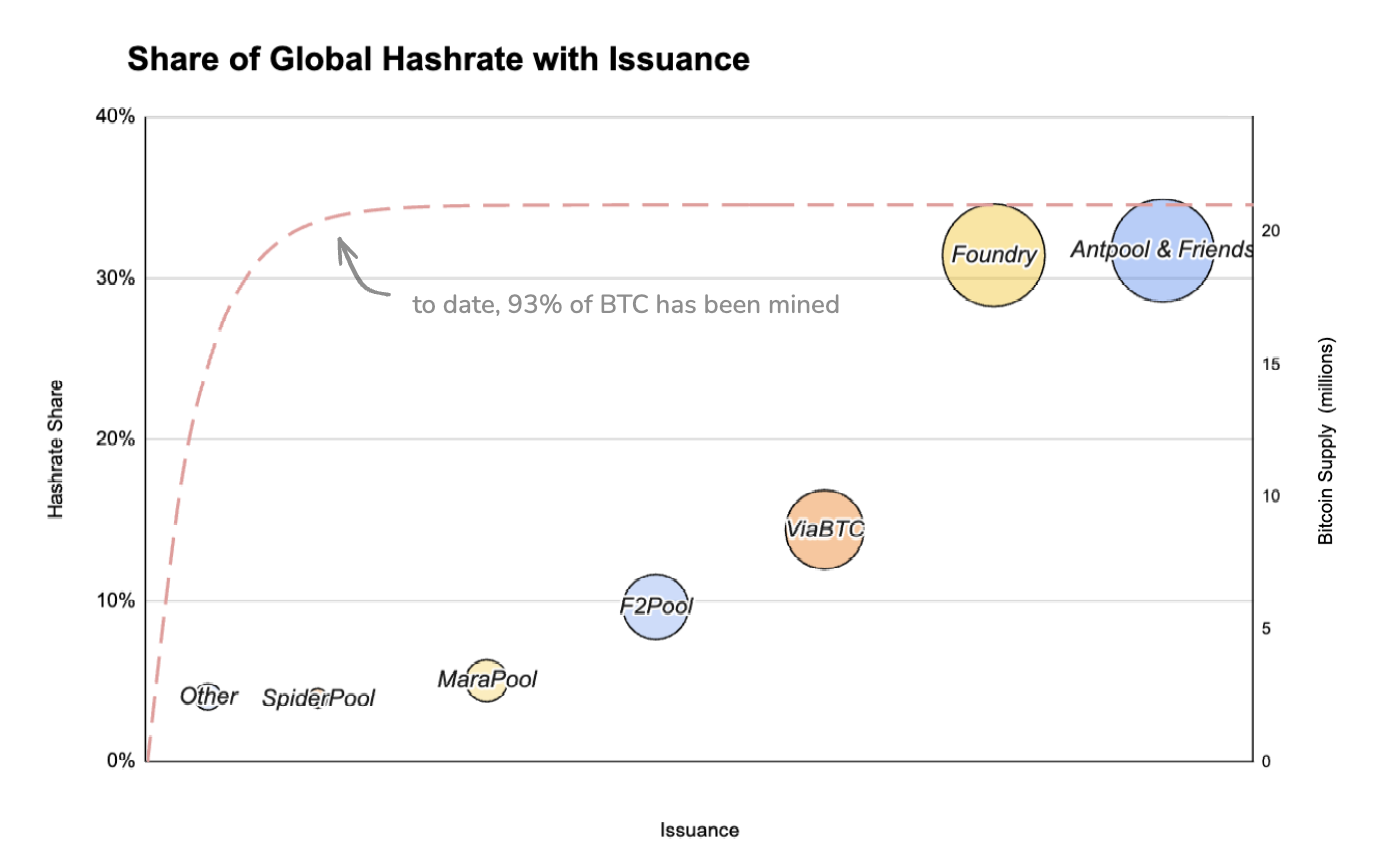

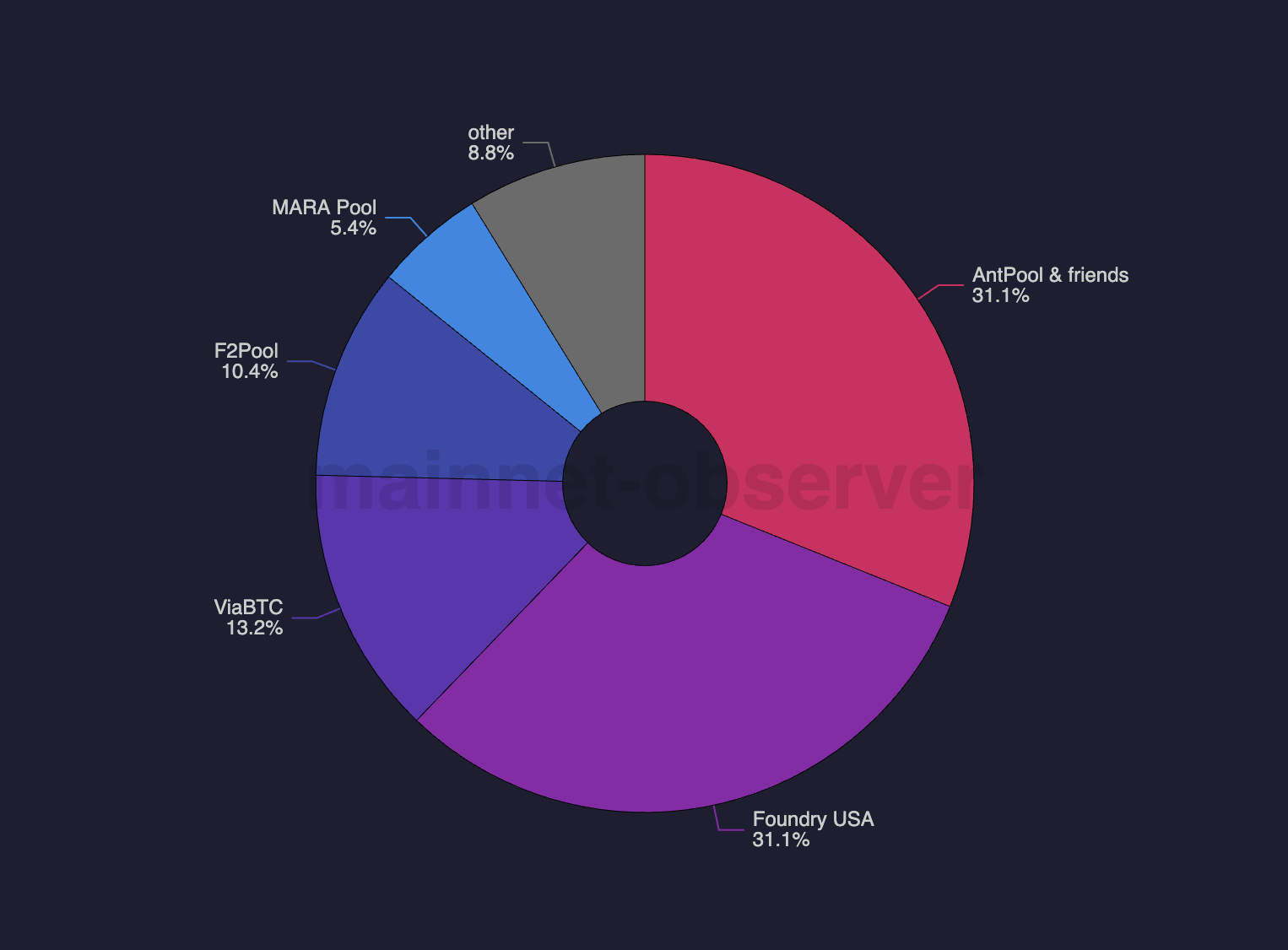

A robust mining market is vital for Bitcoin’s durability. In the previous year, amidst a background of decreased blockspace need, Bitcoin’s leading miners started engaging in combine mining to produce extra charges. This pattern, while possibly helpful in specific contexts, raises issues that, in the lack of issuance, miners looking for profits might turn to destabilizing practices including damaging kinds of expressivity. This raises a crucial concern: How would variations in expressivity effect Bitcoin’s stability? Specifically, how might expressivity and charges affect a mining market presently controlled by a simple 5 big swimming pools?

One substantial argument versus increasing expressivity within Bitcoin is the intrinsic threats connected with presenting extra opcodes, which might result in an “Ethereum-ization” of Bitcoin. However, the authors compete that, when correctly comprehended, the characteristics of nonlinear and ephemeral charges, together with Bitcoin agreement and evidence-of-work (PoW) race conditions, might insulate the network from the most damaging kinds of entrenchment.

Looking ahead, specific opcodes might level the competitive landscape for miners, maintaining the core characteristics of Bitcoin and shutting the door on unhealthy kinds of expressivity. This conversation will define essential requirements of miners and users, briefly examining lessons drawn from Ethereum’s experiences with expressivity, before analyzing the economics of mining swimming pools and checking out the future of mining with OP_CAT as a referral point.

What Do Bitcoin Miners and Bitcoin Users Need?

Miners Require Fees

All miners depend upon charges to sustain hashing operations. While low charges and undifferentiated hardware recommend that mining runs as a product service, bigger miners hold substantial impact over smaller sized ones. Major miners typically support operations through market cycles utilizing different service endeavors. Examples consist of Matrixport as an exchange and Bitdeer as a miner, along with ASIC producer Bitmain and mining swimming pool Antpool.

This vibrant outcomes in smaller sized miners counting on bigger equivalents to reduce their generally unstable profits streams. Smaller miners presently do not have the utilize to affect bigger miners and swimming pool operators and are not able to endure individually.

Users Require a Satisfactory User Experience

While miners are directed by monetary factors to consider, users look for a reliable experience, including both deal quality and guarantees versus censorship and settlement dependability for Bitcoin.

Users incorporate different classifications, consisting of loan providers making use of Discreet Log Contracts (DLCs), stakechains, Metaprotocols, and merge-mined chains (drivechains). All users demand robust guarantees for addition and settlement from miners. Designs that are carefully connected to hashrate—consisting of drivechains—develop economies of scale in mining.

Hash-based expressivity develops a mutual relationship in which users wanting addition focus their deals solely on miners running meaningful, albeit typically undependable and unverifiable, facilities. In this hash-based yet programmatic landscape, contending miners might try to incorporate their own expressivity; nevertheless, phenomena such as plume forks, reorganizations, and attacks typically combine power amongst the biggest miners.

In essence, hash-based expressivity substantially weakens Bitcoin’s specifying particular of sovereignty by focusing control over mining.

What Is the Alternative?

Without embracing safe and secure, egalitarian approaches for miners to produce profits, Bitcoin runs the risk of a steady shift towards PoW-based expressivity. At best, this would manifest in combine mining and Metaprotocols; at worst, it would result in a collapse of stability and censorship resistance as reorganizations drive centralization.

Certainly, some proposed services (such as tail issuance) are not practical. The authors preserve—drawing from Ethereum’s past—that the intro of opcodes can enhance Bitcoin by instilling safe and secure cost irregularity and promoting responsibility at the swimming pool level. The rest of this conversation makes use of lessons gained from Ethereum prior to articulating a vision for Bitcoin’s stability through expressivity.

Vectors for Censorship on Ethereum

Proposer-Builder Separation (PBS): How and Why We Arrived Here

While Ethereum desires cultivate an “egalitarian” structure, significant chances for excess charges stay due to Maximal Extractable Value (MEV). Enhanced effectiveness in capital circulation, information management, and facilities have actually permitted astute individuals to collect power at several levels. Concerns concerning this concentration of power triggered the advancement of Proposer-Builder Separation (PBS).

Under this structure, resource-intensive jobs—such as deal harvesting and buying—are segregated into a competitive market, permitting both easy and intricate nodes to efficiently mine the most rewarding block. PBS looks for to optimize competitiveness in block structure.

Current State of Ethereum MEV

Atomic MEV deals—such as liquidations and sandwiching—are carried out completely on-chain, rendering them extremely competitive. Such deals demand an all-or-nothing method, relying exclusively on on-chain capital. This lessens threats and decreases barriers to entry, making involvement reasonably available.

In contrast, asynchronous MEV is identified by increased competitors. As detailed in “Flash Boys 2.0,” a distinguished 2019 term paper, asynchronous MEV mainly occurs within decentralized exchanges, which “pose significant security risks to the blockchain systems on which they operate.” MEV from decentralized exchanges is specified by its exclusivity and entrenchment.

Presently, the Ethereum block-building landscape is controlled by 2 classifications: arbitrageurs (taking on capital effectiveness, latency, exclusive designs, and lower charges) and individuals engaging in tit-for-tat special order circulation (EOF) plans. Ongoing efforts intend to reform this system, consisting of causing regional structure through adjustments to default staker settings. However, services alleviating centralization through arbitrage or EOF strategies stay minimal.

Importance of the Issue

Centralization at any layer weakens the whole network’s censorship resistance and assists in verticalization. In environments such as Solana, the coupling of liquid staking with an MEV customer enables entities like Jito to monopolize MEV.

Integrated searcher-builders sustain expenses and other aspects, while the incorporation of liquid staking tokens (LST) into the MEV market increases success and cultivates a cycle of special order circulation. Without staking systems, the intrinsic dangers presented by ASICs and swimming pools continue to tower above Bitcoin.

Lessons from Ethereum’s Proof-of-Work Era

Prior to Ethereum’s shift, the network ran based upon PoW concepts. As network charges went beyond block benefits, deal front-running and personal mining swimming pools with fortunate gain access to ended up being prevalent.

The issues concerning PoW Ethereum then parallel those dealt with by Bitcoin now: reward structures threaten decentralized agreement. Initial scientists looked for to level the playing field in PoW Ethereum through the mevgeth customer, permitting any miner to auction blockspace to advanced individuals for fair profits circulation.

While Bitcoin’s minimal expressivity decreases the direct applicability of numerous difficulties dealt with in PoW Ethereum, the continuous arguments surrounding expressivity and brand-new opcodes emphasize Ethereum’s vital insight: keeping openness in mining while restricting rivalrous financial activities is necessary for Bitcoin.

Relevance for Bitcoin Pools: A Closer Look

The Bitcoin pooling market stays underexamined. As future halvings take place, the dependence on issuance will move towards charges, demanding competitiveness and openness in mining to make sure Bitcoin’s stability.

Factors Sustaining Bitcoin’s Stability

Ethereum’s agreement system designates proposers for each date, producing a set management structure for blockspace, assisting in high levels of extraction. Conversely, Bitcoin miners preserve control over blocks without an established slot, presenting randomness. Race conditions due to nonces drive speedy deal addition and effective block proliferation amongst mining peers. This multiplicity of individuals makes it possible for the network to constantly advance, guaranteeing stability and openness.

Thus, just with substantial hashrate debt consolidation or the intro of centralizing expressivity will Bitcoin’s censorship resistance—and, by extension, its worth—weaken. In essence, while miners keep monopoly power over deal addition, the competitive characteristics intrinsic to PoW make sure strong pressures for addition as long as mining stays open. Consequently, the authors argue that the primary obstacle dealing with Bitcoin belongs to mining sustainability, with all supplementary issues—including worth accrual, reorganizations, and systemic stability—resting upon miner stability and economics.

Overview of Mining Pool Exploitation

Currently, significant miners and swimming pools extract profits, keeping nontransparent templating approaches and even carrying out attacks to subordinate smaller sized miners. Smaller operations typically depend exclusively on swimming pools to reduce the intrinsic randomness connected with PoW. Within a swimming pool, a central server governs the obstruct design template, sharing it to specific miners, who then hash the design template for a legitimate nonce.

Most swimming pools utilize closed-source mining firmware, distributing benefits based upon issuance instead of charges within an offered block. The following prevail swimming pool payment structures:

- Pay-Per-Share (PPS): Miners get a constant earning of the swimming pool’s anticipated issuance benefits, which restricts difference. While swimming pools can sustain losses under this design, they might at the same time broaden through supplementary endeavors (e.g., ASIC production).

- Full Pay-Per-Share (FPPS): Miners make both PPS benefits and their share of deal charges in advance—regardless of whether the swimming pool discovers a block. Fee earnings stays unverifiable, computed as an average, demanding trust in the swimming pool operator.

- Pay Per Last N Shares (PPLNS): Miners are compensated based upon their hashing contributions over a defined number of rounds and just get payments upon effectively mining a block.

While alternative mining designs exist, such as Marathon’s Slipstream—offering a personal channel to bypass mempool requirements—and Ocean’s offering of open templating to users, a lot of swimming pools have actually defaulted to an FPPS design. Engagements with alternative plans have actually traditionally failed due to negative impacts on profits per hash, eventually worsening centralization within Bitcoin. Moving forward, miners will need improved exposure into templating as charges gain significance in their profits designs, demanding a competitive yet auditable swimming pool structure to sustain Bitcoin’s decentralized nature.

Current State of Bitcoin Fees

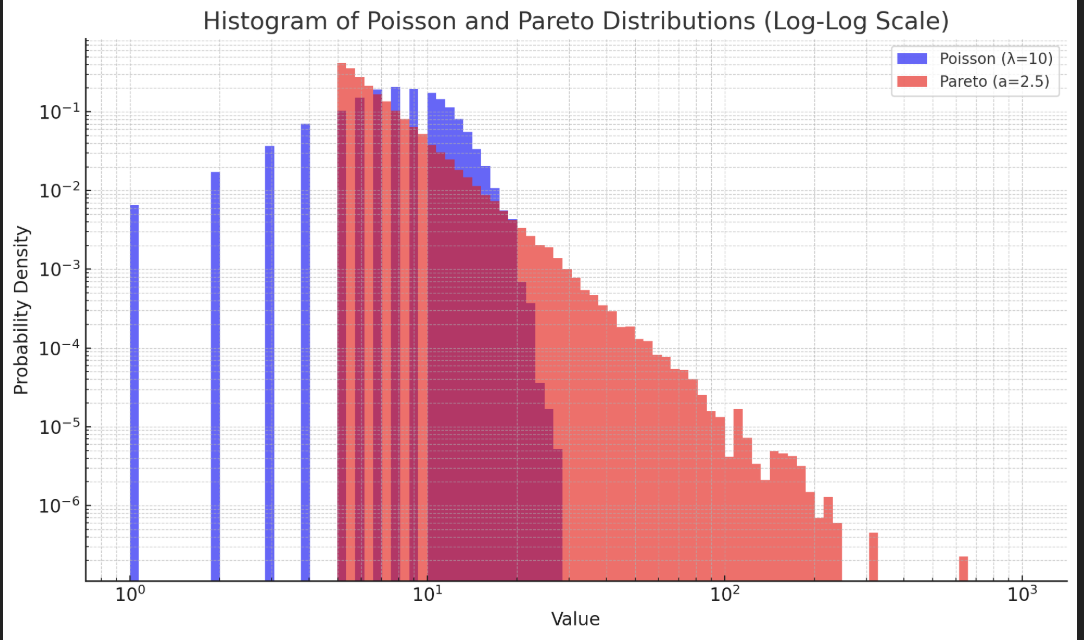

At present, Bitcoin experiences reasonably low charges, with numerous blocks staying uninhabited or solely consisting of basic UTXO deals or engravings. When charges manifest, they show a “spiky” pattern.

In an environment identified by constant need for charges, there is little reward to carry out reorganizations, as subsequent blocks likewise present cost chances. However, the intro of brand-new agreements, ordinal mints, or basic market volatility (e.g., an exchange collapse) can activate significant cost spikes, which might prompt miners to carry out reorganizations.

While Nakamoto agreement will eventually result in finality, there exists a substantial possibility that miners may independently mine high-fee blocks and consequently goal to rearrange the Bitcoin network to record these blocks from other miners.

Regardless of whether charges are regularly low or show substantial spikes, variations in need will undoubtedly result in hashrate debt consolidation, as users significantly depend on bigger miners and swimming pools, thus engaging little miners to work under the aegis of bigger entities.

However, the authors presume that, under beneficial payment structures and responsibility procedures, smaller sized miners might possibly record spiky charges, eventually lowering entrenchment. This area illuminates this thesis and supporters for Bitcoin’s accept of variable charges.

Will Mining Pools Distribute Spiky Fees?

As formerly kept in mind, smaller sized miners presently depend greatly on bigger miners and/or swimming pools for cost profits. Designing a transparent or fair swimming pool that makes sure a reasonable circulation of charges is especially tough in the lack of auditability. Although competitive pressure from competitors may trigger fee-sharing, useful truths—consisting of undependable information, changing expenses, and verticalization—force smaller sized miners to position their trust in bigger ones.

Furthermore, block reordering threats increase as charges increase. While Nakamoto agreement makes sure ultimate finality, miners may make use of high cost chances by keeping deals, making complex the audit procedure for smaller sized miners.

Potential Stabilization Mechanisms for Bitcoin Consensus Beyond Fees

One proposed option includes setting up responsibility systems within a federated swimming pool. Such responsibility can bring financial finality, thus lowering reorganization threats and improving verification warranties. Importantly, miners can still run individually of this swimming pool through Bitcoin Core, guaranteeing network connection and enabling broad involvement in recognition procedures.

Under this design, miners might collectively share charges while offering users with sped up yet liable access to Bitcoin. Users would choose this swimming pool over personal entities like SlipStream due to its resistance to reorganizations and its prolonged access to a higher number of miners, guaranteeing exceptional verification warranties. While independent channels for non-standard or vulnerable deals might continue, supporting race conditions through responsibility systems would use users a competitively decentralized option.

Given that finality is vital for monetary applications and demands partnership amongst miners, this liable swimming pool might deal with a considerable volume of deals. The shared responsibility amongst its individuals would cultivate fairer profits circulation, possibly engaging competitor swimming pools to embrace comparable fee-sharing practices. Ultimately, the authors assert that properly structured expressivity can support Bitcoin through financial finality, resolving issues about network stability and advancing mining towards a more fair design.

Pooling in OP_CAT’s World

Numerous Bitcoin soft forks have actually been proposed; making use of OP_CAT as a referral point, the authors analyze how brand-new opcodes may improve mining and the more comprehensive network.

Note to reader: In the list below analysis, a situation is thought where Bitcoin incorporates a native automatic market maker (AMM)—a mathematical function encoded on blockchains that makes it possible for decentralized trading. AMMs are acknowledged as a main source of MEV (or “MEVil”) within blockchain environments, sustaining both rivalrous arbitrage and repeating EOF arrangements.

Much of the discourse in this area builds on works entitled “Unity is Strength” and “Balrogs and OP_CAT.”

Scenario 1 (No AMM Unleashed by means of Soft Fork)

In this circumstance, the network would prevent the mistakes connected with arbitrage and EOF arrangements. In the lack of an AMM, a lot of MEV would take place as atomic or particular occasions (e.g., the publishing of rollup information or Ordinals). Despite the capacity for verticalization amongst miners, transactors would mainly concentrate on broadcasting deals to enhance addition rates.

Lower issuance would interfere with bigger mining swimming pools, while newbies would require to use higher openness to bring in little miners’ involvement. Although mining might end up being a functional cost for verticalized business, as kept in mind by Matt Corallo in “Stop Calling it MEV,” without an AMM, MEV would stay restricted to supplementary layers.

Scenario 2 (Soft Fork Powers an AMM with Minimal Leakage)

In this circumstance, the combination of an AMM happens at Bitcoin’s base layer. Due to the intrinsic time difference in Bitcoin block production, the possibility of undesirable rates rises, resulting in regular reorganization and stagnant orders. Moreover, different intricate attacks and exceptional options might render the AMM primarily inactive.

Traders might still engage in deals on the L1 for ideological or memantic inspirations, however without significant improvements in Bitcoin’s structure, the possibility of an effective and resilient Bitcoin AMM stays not likely.

Scenario 3 (AMM on L1; Significant Leakage)

While a situation where Bitcoin hosts a commonly used DEX appears unlikely, it benefits factor to consider.

In this theoretical scenario, arbitrage chances and EOF plans would result in verticalization and a concentration of hashpower within a dominant “superpool.” The dependability supplied by a bigger swimming pool and the special nature of both extraction types would cultivate a cooperative relationship in between miners and extractors, basically producing a unified entity. Most miners would likely line up with this swimming pool however would have restricted control over its financial structure.

There would naturally exist restraints on the miner’s size, nevertheless; Bitcoin’s worth originates from its decentralization, and going beyond a specific limit would be damaging to its own interests. Additionally, PoW mechanics permit contending miners to individually offer more effective procedures, while geographical barriers recommend the capacity for several exchanges or EOFs to grow. Nonetheless, needs to an AMM accomplish any degree of energy, it would substantially hamstring network health.

The authors discover this circumstance not likely:

I have a thesis (yet to be "proven" real however I also sanctuary't yet discovered any information to *negate* it) that there is "no such thing as a 'long block time & high mevil' blockchain". Inspired by the "no such thing as a low-energy rich country" chart. pic.twitter.com/Qq5Vn9vLkk

— light (@lightcoin) January 2, 2025

Even if a decentralized exchange ends up being a practical truth, it would be substantially constrained; reorganization threats, variations in obstruct times, and the capacity for negative rates would likely result in decreased engagement (for more insights, see “The Spectre of MEV on Bitcoin”).

Potential Attacks Related to AMMs and Other Threats

In addition to an AMM, different opcode-related vulnerabilities benefit attention, that include:

- Selfish Mining: Miners might keep legitimate blocks to make extra profits. Recent analyses extend this “mining cartel” or “timing game” principle beyond issuance to incorporate charges, exposing that self-centered mining ends up being more rewarding at lower hashrates. This technique can be worsened by sluggish block verifications and nonuniform network proliferation times.

- 51% Attack on Optimistic Rollups: Asserting control over 51% of the hashrate can help with attacks on positive rollups and BitVM bridges. A well-financed opponent may lease hash power and brief Bitcoin futures to profit from censorship and bridge invasions. Such an attack would demand collecting a considerable number of ASICs, foregoing future profits, and rendering their devices unusable. Notably, a zk-verification opcode—or possibly simply OP_CAT—might render this type of attack impractical.

- Oracle Attacks: Currently, Bitcoin loan providers handle their own oracles. Although presigned deals reduce the threat of fund extraction by the oracle, market individuals might serve as loan providers, enabling unreasonable liquidation of security. Additionally, censorship of liquidations stays an issue.

Of course, other kinds of attacks (consisting of mass exit or robbery situations) exist, and mapping all possible vulnerabilities a priori is naturally tough. While couple of are most likely to intensify the wide range of approaches by which Bitcoin can be jeopardized today, extra opcodes (such as one for zk-verification) might really reduce possible attacks.

Considerations for Additional Opcodes

Beyond OP_CAT, numerous opportunities exist for updating Bitcoin. Options that incorporate Lightning, Ark, covenants, discrete log agreements, and more can serve to improve expressivity through opcodes like OP_CTV and OP_VAULT. Bitcoin might efficiently include opcodes supplied they help with cost generation without stimulating economies of scale or exclusivity, thus omitting the most destructive kinds of expressivity.

It is the authors’ viewpoint that a lot of kinds of expressivity—be it through a BitVM attestation chain or a Bitcoin rollup—are most likely to reinforce security over the long term without triggering established structures. No fork is perfect, yet by constraining rivalrous cost irregularity and developing brand-new paths for the network to self-finance its security (accessing open kinds of MEV or setting up profits smoothing), Bitcoin stands to reduce possible security decreases over coming halvings while supporting, and even improving, its sovereignty.

Numerous styles can open profits streams for miners:

- Decentralized Exchange: The development of a SNARK confirmation opcode might make it possible for miners to collaboratively run a fast-finality BTC-denominated exchange, obtaining earnings from settlement and trading charges.

- Rollup: A general-purpose, trustless, and proven sidechain based upon Bitcoin might help with financing for information schedule and finality. Miners would have the choice to build their own rollups or team up on such efforts. While there exists the threat of verticalization by specific miners, geographical barriers recommend several miners might complete along with one another. Additionally, enhanced opcode performance might result in completely noncustodial rollups, providing a more suitable option to centralized platforms (e.g., Celsius, FTX). Furthermore, miners might balance out PoW-related expenditures through rollup-generated charges.

- Payments Chains: Statechains or comparable styles such as Ark might sustain on-chain expenses payable to miners and might also serve to focus on finality by means of a responsible swimming pool.

Critically, any efforts connected with Bitcoin will require improved finality arrangements as issuance decreases. By welcoming responsibility in pooling systems, chances for egalitarian miner profits broaden. Ultimately, the alternative to embracing proven and collective profits designs is the development of bigger miners gravitating towards hash-based kinds of expressivity (or cumbersome workarounds). Therefore, focusing on styles that deter miners from damaging expressivity appears cautious.

Future Perspectives on Mining

The compartmentalized nature of personal channels and the failure of miners to individually inspect or confirm big swimming pools recommend that pooling structures will end up being more fragmented as issuance decreases to no. Concurrently, in the lack of inflation (and declining tail issuance as a practical option) and reasonable fee-sharing systems, the hashrate is poised to diminish and combine.

The authors assert that minimal, safe and secure expressivity along with fair cost structures becomes an essential top priority. Should expressivity multiply, vertically incorporated miners throughout varied locations will be finest placed to endure the contraction in issuance. Furthermore, improvements in liable pooling, applications, rollups, and other ingenious services can bid for quick finality, producing profits for miners while guaranteeing Bitcoin’s stability in exchange for offering users with safe and secure and prioritized access to a premium possession.

Moving forward, the development of a market comparable to the mevgeth design is expected. Within this structure, deal packages representing “spiky revenue” (such as those connected with Ordinals mints or information created from rollups) might be provided to miners through a swimming pool. The level to which this swimming pool stays available to normal miners, in addition to its responsibility procedures, will substantially affect Bitcoin’s long-lasting practicality.

It need to be kept in mind that this technique does not include nullifying nonstandard deals (charges) or personal channels, which have actually traditionally added to significant hashrate centralization. Instead, Bitcoin need to embrace a course towards practicality that assists in energy and permits fair circulation of profits amongst miners. As long as the charges opened by a soft fork yield atomic deals, separated off-chain arrangements, and self-referential MEV from miner-supported applications—while notably declining exclusivity and entrenchment—profits will be fairly dispersed and smooth for miners. This shift will make it possible for Bitcoin’s intrinsic shortage to develop into a practical medium of exchange through its own applications and trust-minimized sidechains.

Crucially, the failure to adjust towards much safer kinds of expressivity naturally welcomes the expansion of less preferable options. Without trustworthy miner charges, the threat is that less safe and secure, less sustainable, and less democratic kinds of expressivity will control the landscape, relegating smaller sized miners to termination.

BM Big Reads are weekly, in-depth posts resolving present subjects appropriate to Bitcoin and the neighborhood. Contributions that line up with this format are motivated at editor[at]bitcoinmagazine.com.

Walt Smith works as a visitor author and is a partner at Standard Crypto. Having been active in the Bitcoin area given that 2019, Walt formerly led U.S. endeavors at Cyberfund and held a position at Galaxy in New York City. Based in Colorado, he is an alumnus of Grove City College in Pennsylvania, where he studied Austrian Economics.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.