It has been reported that U.S. Senate Democrats are poised to resume discussions with representatives from the cryptocurrency sector on Friday, as indicated by sources familiar with the matter speaking to CoinDesk.

This development follows a last-minute postponement of a crucial Senate Banking Committee hearing concerning comprehensive legislation on digital assets.

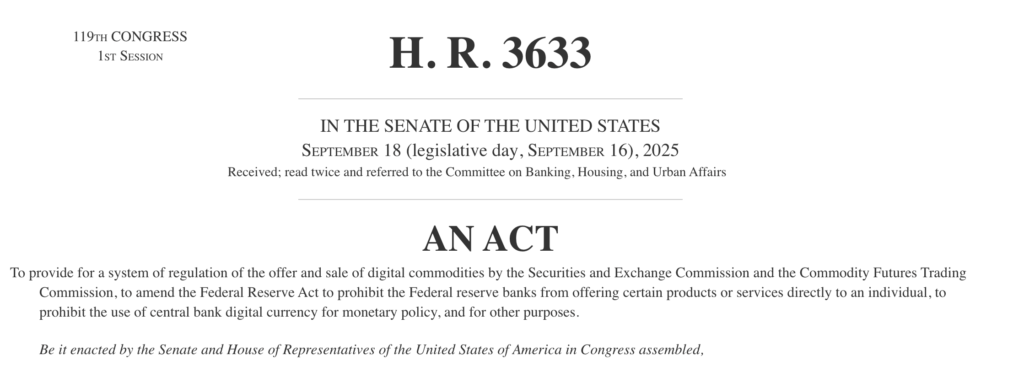

The decision to resume talks comes after the committee’s planned markup of the long-negotiated crypto market structure bill was abruptly canceled on Wednesday evening. This bill was anticipated to delineate regulatory oversight of digital assets between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

This setback was precipitated by Coinbase, the largest cryptocurrency exchange based in the U.S., which rescinded its support for the draft legislation. The company articulated its concerns regarding stablecoin reward programs and the perceived excessive authority allocated to the SEC.

In comments made by Coinbase CEO Brian Armstrong, he expressed apprehension that banks are attempting to undermine competition through the proposed crypto market structure legislation. Armstrong contended that “crypto companies should be allowed to compete and offer loans just like banks.”

Following the cancellation, public activity significantly decreased on Thursday; nevertheless, lawmakers and industry stakeholders assert that negotiations are ongoing.

It is expected that Democrats from both the Senate Banking Committee and the Senate Agriculture Committee, which provides oversight for the CFTC, will participate in Friday’s discussions, along with representatives from cryptocurrency policy advocacy groups in Washington, as per reports.

Originally, the Banking Committee was scheduled to convene for an all-day session on Thursday to debate amendments and vote on the advancement of the bill.

However, plans unraveled quickly after CEO Brian Armstrong’s announcement that Coinbase could not support the current iteration of the legislation, leading Senate Banking Committee Chair Tim Scott, R-S.C., to postpone the hearing shortly thereafter.

Senator Lummis: Progress Towards Consensus

Despite this setback, several lawmakers involved in the discussions have indicated that negotiations will persist. Senator Cynthia Lummis, R-Wyo., a vocal proponent of cryptocurrency within the Senate, remarked on social media that legislators were “closer than ever” to achieving a consensus.

“Everyone is still at the negotiating table, and I look forward to collaborating with [Chairman Scott] to deliver a bipartisan bill that both the industry and the public can take pride in,” Lummis stated on Thursday.

Senator Bill Hagerty, R-Tenn., echoed this sentiment of optimism, expressing confidence that lawmakers could reach a resolution “in short order.”

“I am fully committed to continuing this important work with my colleagues on market structure and look forward to enacting legislation that ensures this innovative technology thrives in the United States for decades,” Hagerty asserted.

The industry’s reaction to Coinbase’s withdrawal has been mixed. While Armstrong’s comments have intensified scrutiny surrounding the bill, other cryptocurrency executives and advocacy groups have urged lawmakers to persist in advancing the discussions.

Arjun Sethi, co-CEO of Kraken, warned that abandoning negotiations now would exacerbate regulatory uncertainty for U.S. cryptocurrency firms. “Walking away now would not preserve the status quo in practice. It would solidify uncertainty while the rest of the world progresses,” Sethi noted on social media.

A principal contentious issue in recent negotiations has been whether stablecoin issuers should be permitted to provide rewards or yield programs—an aspect that has faced opposition from bank lobbyists and certain Democrats concerned about consumer protection and competition with conventional deposit accounts.

Although the Banking Committee’s markup has been postponed, the Senate Agriculture Committee is still anticipated to conduct a hearing on the legislation on January 27, after rescheduling its previous session. Ultimately, the work of both committees would need to be integrated before the bill could advance to the full Senate.

Some analysts have interpreted the delay as a strategic pause, with Mark Palmer of Benchmark suggesting that it could provide lawmakers an opportunity to garner broader bipartisan support, ultimately strengthening what he describes as a potentially historic overhaul of U.S. financial regulation.

Conversely, others remain skeptical; TD Cowen has cautioned that reconciling Democratic demands with Coinbase’s objections could prove challenging, particularly as some contentious provisions were already concessions made to appease Democrats. The constraints of election-year timing and the Senate’s requirement for a 60-vote threshold further complicate matters.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.