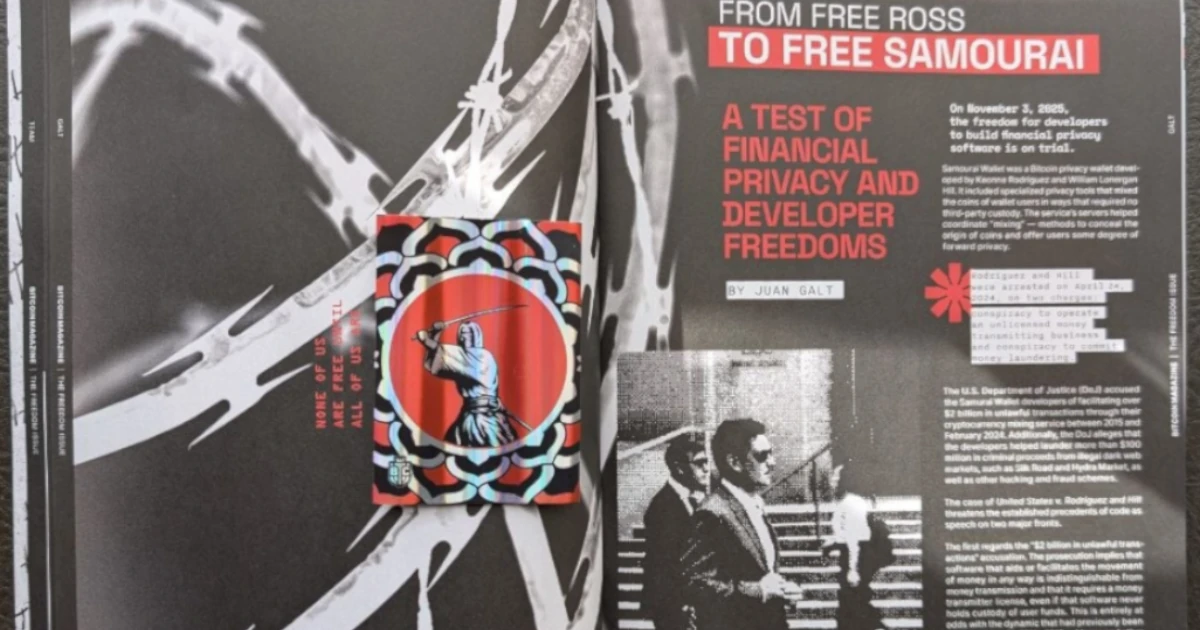

On November 3, 2025, the rights of developers to create software focused on financial privacy are under scrutiny.

Samourai Wallet, a Bitcoin privacy wallet conceived by Keonne Rodriguez and William Lonergan Hill, incorporated sophisticated privacy tools designed to mix the cryptocurrencies of users without necessitating third-party custody. The wallet utilized servers to facilitate the “mixing” process—methods aimed at obscuring the original sources of coins and providing users with a degree of forward privacy.

Rodriguez and Hill were apprehended on April 24, 2024, facing two charges: conspiracy to operate an unlicensed money transmission business and conspiracy to commit money laundering.

The U.S. Department of Justice (DoJ) accused the developers of facilitating transactions amounting to over $2 billion through their cryptocurrency mixing service from 2015 to February 2024. Furthermore, the DoJ claims the developers aided in laundering more than $100 million derived from illegal dark web markets, including Silk Road and Hydra Market, as well as other hacking and fraud ventures.

The case of United States v. Rodriguez and Hill poses significant threats to the established legal notion of “code as speech” on two critical fronts.

The first pertains to the assertion of “$2 billion in unlawful transactions.” The prosecution suggests that software facilitating any form of monetary movement is indistinguishable from money transmission and therefore mandates a money transmitter license, irrespective of whether the software ever holds custody of user funds. This position starkly contrasts with earlier delineations established by FinCEN’s 2019 guidance and other historical financial regulations.

The second implication challenges the protection of software that safeguards the privacy of communications or value transfers as protected speech under the First Amendment of the United States Constitution.

Code is Speech

The United States has a rich and distinctive tradition of protecting freedom of speech.

Numerous court rulings over the years have fortified these principles, establishing precedents that empower developers to create superior software and disseminate it online. Such innovations have positioned the United States as a global technological leader, spanning areas from artificial intelligence to cryptographic finance; the liberty to develop software is now essential to the nation’s economic prosperity.

A landmark case, Texas v. Johnson (1989), affirmed that the act of burning a U.S. flag in protest qualified as protected speech, even though the expression manifested through the functional destruction of the flag.

In the 1990s, as the internet burgeoned, pivotal legal decisions like Bernstein v. United States (1996-1999) underscored that discussions surrounding cryptography—specifically, the sharing of source code involving cryptographic algorithms—did not classify as a “munition” governed by the Arms Export Control Act and the International Traffic in Arms Regulations. Rather, the publication of source code elucidating cryptographic functions was deemed expressive speech, thus fully protected under the First Amendment.

This victory marked a pivotal moment for the Cypherpunks of the ’90s, whose contributions to open-source software laid the groundwork for Bitcoin. Many of the foundational technologies utilized by Satoshi Nakamoto were forged within the discussions on internet forums, where the Cypherpunks deliberated on the application of cryptography to uphold freedom of speech, digital privacy, and civil rights.

However, in the case of Universal City Studios v. Corley (2001), a notable shift occurred. Jon Lech Johansen, a Norwegian teenager, developed software to circumvent copyright protections on DVDs, permitting playback on Linux systems. Eric Corley, an American journalist, published this software online, which instigated significant litigation led by Universal Studios.

This case hinged on the classification of software as either speech or conduct. It established that when software manifests functionality—such as decrypting DVD content—it transitions into a tool and may become subject to regulation.

While Corley’s free speech protections were ultimately upheld by the Second Circuit Court of Appeals, the differentiation between source code as a form of expression and functional software as a potentially regulated tool was firmly established.

Despite the legal rulings—Corley even opted to remove the DeCSS piracy software from his website—the damage was already inflicted. Civil disobedience online proliferated, and piracy conflicts endured for years, revealing both the limitations of free speech protections and the challenges posed by efforts to enforce digital censorship.

Information inherently seeks to be free.

The Samourai case may confront analogous hurdles, raising questions about whether “code is speech” can serve as a robust defense for Rodriguez and Hill.

Chink in the Armor

A project that engendered both devotion and criticism is now at the forefront of legal conflicts under the Biden administration, calling into question the principle of code as speech once more.

This situation has compelled critics—among them the author—to defend a wallet that, while experiencing notable user adoption, was subject to several design decisions that may be scrutinized harshly in the upcoming months.

A potential vulnerability in their defense arises from allegations of enabling sanctioned individuals to “launder money” via their coin-mixing service. The U.S. Attorney’s Office for the Southern District of New York (SDNY) even showcased a screenshot of a Samourai wallet account that appeared to cater to sanctioned oligarchs:

Coin mixers serve a purpose akin to virtual private networks (VPNs), utilized by both law-abiding citizens and criminals. For privacy to exist, individuals must be capable of blending in with the crowd, their choices and personal information shielded from scrutiny and revealed only following due process.

Consequently, the founders of Samourai Wallet may not have positioned themselves as formidable targets. Should the prosecution’s claims hold merit, suggesting they knowingly facilitated illicit activities, they may face severe consequences for violating sanctions regulations. An unsettling legal precedent could be established, with lasting implications for digital finance and the advancement of such technologies in the United States.

Nonetheless, a shift to a more crypto-friendly administration under President Trump may offer some hope.

“I Will Defend Your Right to Self Custody” – Trump

During his keynote speech at the Bitcoin Conference in Nashville in 2024, Trump made a commitment that he still has time to uphold.

He pledged to “defend the right to self custody.”

Without financial privacy, self-custody becomes significantly undermined, which is evident in the increasing instances of physical assaults on Bitcoin users in recent years. The freedoms previously enjoyed by software developers to construct self-custodial Bitcoin tools like Samourai Wallet are presently on trial.

The Chilling Effect

Historically, the U.S. government has refrained from confronting entrenched legal precedents such as freedom of expression. However, by pursuing the developers and maintainers of Samourai Wallet directly, the DoJ has negatively impacted financial privacy within the United States, inducing a chilling effect among Bitcoin software developers.

Following the arrests of Rodriguez and Hill, Phoenix Wallet—renowned as a leading self-custodial Lightning wallet—removed its application from U.S. app stores. This decision was made to safeguard its operations from a government perceived as hostile towards Bitcoin self-custody software. (As of April 2025, Phoenix has resumed its availability in the U.S.) Additionally, Wasabi Wallet ceased offering its non-custodial mixing services to the public, and applications like Blink from El Salvador geofenced American users, excluding them entirely from accessing their services.

If Trump intends to genuinely protect the right to self-custody and prevent the anticipated implementation of a central bank digital currency (CBDC) in the United States—another electoral commitment—he must address the critical need for financial privacy in the digital age and redress the injustices introduced by the Biden administration.

These cases are poised to leave a significant mark on his presidential legacy.

Foundations of a CBDC

The Biden administration has continued its legal pursuits, scrutiny, and debanking of the cryptocurrency industry—an initiative that originated under Obama with Operation Choke Point, culminating in Silicon Valley CEOs facing account closures.

A particularly striking example of the abuse of sanctioned financial systems was seen in Canada in 2022, when the bank accounts of truckers and donors were frozen during the Freedom Convoy protests in Ottawa, following the invocation of the Emergencies Act by then-Prime Minister Justin Trudeau.

Moreover, key U.S. Treasury officials have asserted that central bank digital currencies (CBDCs) would necessitate stringent identity tracking, all while “balancing consumer privacy”—a precarious trade-off that ultimately sacrifices user privacy:

“The Report notes that ‘a CBDC system could increase the amount of data generated on users and transactions,’ which would pose ‘privacy and cybersecurity risks, but … afford opportunities for proper … supervision and law enforcement efforts.’”

Among the ideals of justice and fairness articulated in the Constitution is one where individual privacy is a given, where a presumption of innocence prevails, and where the burden of proof rests with the prosecution to establish guilt beyond a reasonable doubt.

The Fourth Amendment rights of innocent Americans utilizing Samourai Wallet are already endangered due to the kind of lawfare demonstrated in this case:

“The right of the people to be secure in their persons, houses, papers, and effects, against unreasonable searches and seizures, shall not be violated, and no Warrants shall issue, but upon probable cause, supported by Oath or affirmation, and particularly describing the place to be searched, and the persons or things to be seized.”

Today, homes extend beyond mere physical structures, and communications often traverse digital channels. The movement of value has similarly transitioned online. Much like cash enclosed in a sealed envelope, the utilization of financial privacy software aligns seamlessly with the protections afforded by the Fourth Amendment, particularly when no custody of funds is ever undertaken by the facilitating infrastructure.

Yet, the instruments designed to safeguard this intrinsic right to privacy have faced concerted attacks and erosion in the digital era, akin to the government prosecuting envelope manufacturers as money launderers for concealing the contents of individual financial exchanges.

The situation is even graver: While developers of privacy-centric software like Samourai Wallet face harassment, traditional financial institutions—complying with KYC and AML regulations, the same regulations levied against Samourai Wallet—are compelled to gather excessive private data from their customers to report any “suspicious” activities to authorities.

This KYC data is frequently compromised. In fact, maintaining security on such growing troves of personal information is nearly impossible, rendering them attractive targets for cybercriminals and exposing ordinary individuals to identity theft and fraud. By 2012, identity fraud in the U.S. had eclipsed all other types of theft, with losses exceeding $21 billion, a figure that soared to $52 billion by the 2020s.

This infrastructure of surveillance inflicts significant and irreversible damage on U.S. citizens and the broader legacy financial system.

Yet, it is portrayed as a necessary measure to combat money laundering by cartels and to curtail terrorist financing through sanctions, such as those enacted through the OFAC list. Ironically, these banks themselves are often implicated in laundering vast sums for cartels—such as TD Bank, which recently incurred a record $3 billion fine from U.S. regulators for neglecting to monitor $18 trillion in transactions, of which nearly $700 million was allegedly funneled by drug cartels. Despite extensive regulations, it appears that it is often the banks that are responsible for the majority of money laundering activities.

On the topic of sanctions, the harshest measures imposed by the U.S. on Russia in recent memory have included the freezing of foreign treasury reserves. Despite these measures, Russia has made significant territorial advances in Ukraine during the ongoing invasion, ultimately emerging in a robust negotiating position, suggesting a potential decline in the efficacy of sanctions-based foreign policy.

It is noteworthy that the Trump administration has emphasized tariffs, focusing on the movement of goods across borders rather than the flow of money.

Furthermore, it is crucial to recall that, when discussing terrorist financing, the CIA historically supported and trained the Afghan Mujaheddin in the 1980s, fostering guerrilla operatives such as Osama bin Laden, who went on to contribute to the formation of Al Qaeda and the events of 9/11.

None of these actions can be attributed to Bitcoin or its proponents. Yet, the ramifications of such legislation weigh heavily on civilian populations. The growth of identity theft, the ironic failures embedded in the fight against cash, the overregulation of individuals’ financial activities, and the resulting impact on privacy-focused software developers are direct consequences of the ever-expanding KYC framework surrounding us.

All of these policies represent critical flashpoints in the ongoing conflict against cash, part of a broader strategy to lay the groundwork for the implementation of CBDCs—an initiative that Trump has pledged to protect citizens from.

Lesson Learned

The most pressing concern regarding the Samourai Wallet was its backend design. While the ambition to bring advanced, self-custodial coin mixing to the public was commendable, the decisions made often sparked skepticism among competitors and critics regarding their practicality and security—judgments that may arise during the trial. A primary concern was the method by which the mobile client purported to manage users’ xpubs.

Xpubs are pivotal cryptographic components in Bitcoin and cryptocurrency wallets. Similar to IP addresses in the realm of VPNs, xpubs serve as core identifying information for Bitcoin users. Possession of an individual’s xpub enables one to deterministically recreate all public addresses associated with that wallet, allowing for complete visibility into which Bitcoin addresses are under a user’s control and the transactional history linked to those addresses.

In discussions around VPNs, the handling of IP addresses—particularly the commitment to avoid retaining IP logs—plays a crucial role in establishing trust among discerning users. Services highlight their practices and policies regarding the safeguarding of users’ IP addresses. Should an operation shut down, as was the case with Samourai Wallet, any retained data may become accessible to prosecutors, implicating users’ browsing history.

Applying a similar principle to Samourai Wallet and xpubs seems prudent. Over decades, users have recognized that vigilance concerning the reliability of tools and implementations yields beneficial outcomes in the long run. This lesson has been learned through numerous instances where VPN services and privacy-focused email providers faced hacks or seizures enforced by government authorities. Accumulated user data presents a compelling target during legal investigations.

The specifics of what data the U.S. government confiscated from the 17 terabytes obtained from Samourai Wallet remain unknown. Much of this data is likely linked to on-chain analyses conducted by their research division, OXT. However, should user data have been retained, significant privacy risks could ensue for affected users.

The Trump Legacy?

A profound shift is occurring as the future of software developers and their capacity to create private self-custody solutions will be evaluated in an era where Michael Saylor contends that cryptocurrency is not a form of currency, and Trump, branding himself as the “crypto president,” promises to safeguard self-custody rights.

As Rodriguez and Hill face their trial, those advocating for financial privacy and the political landscape surrounding it will also be subject to analysis in the court of public opinion, where history shall serve as the ultimate adjudicator.

For individuals unable to directly influence public policy and who must assess the tools they utilize based on their merits, the tale serves a moral lesson. Compromising on privacy for convenience—to bypass the learning curve—carries inherent risks.

Ultimately, those who embrace caution and embrace the principles of crypto-anarchism are likely to endure.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.