This article posits that Global Liquidity has emerged as one of the most reliable indicators for forecasting Bitcoin’s price movements throughout the current market cycle. The well-established correlation between the expansion of the money supply and the growth of risk assets, including Bitcoin, has been closely observed. Recently, however, attention has been drawn to additional data points that have demonstrated even greater statistical accuracy in predicting Bitcoin’s future trajectory. Collectively, these metrics provide valuable insights into whether Bitcoin’s recent stagnation signifies merely a short-term hiatus or the onset of a more prolonged consolidation phase.

Bitcoin Price Trends Driven by Global Liquidity Shifts

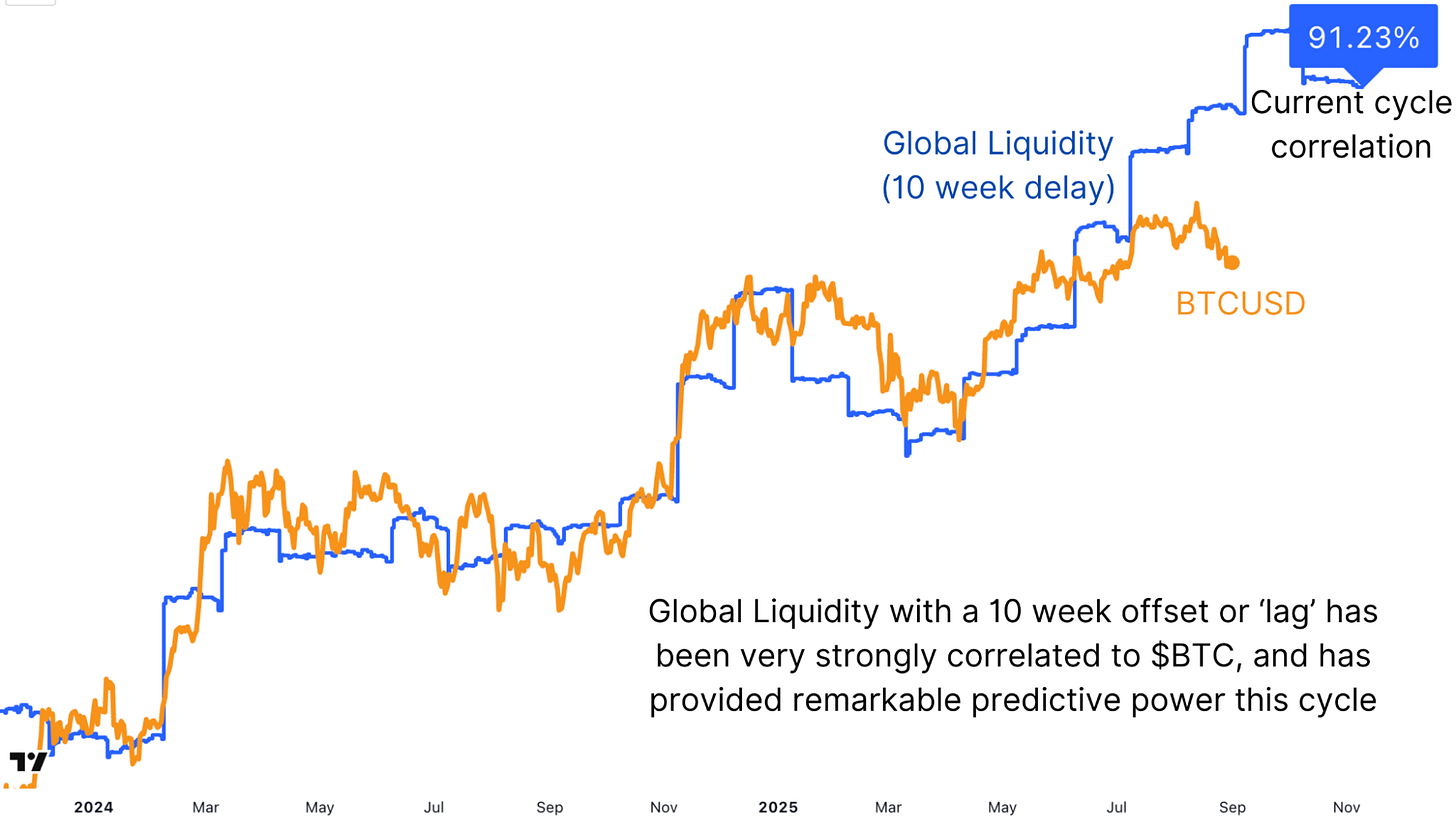

The relationship between Global Liquidity, particularly the M2 money supply, and Bitcoin’s price is compelling. Historically, when liquidity expands, Bitcoin experiences upward price movements; conversely, when liquidity contracts, Bitcoin tends to struggle.

The correlation between these variables in the current cycle stands at an impressive 88.44%. Incorporating a 70-day offset further enhances this correlation to 91.23%, indicating that changes in liquidity frequently precede movements in Bitcoin’s price by just over two months. This framework has reliably captured the broader market trend, with declines in Bitcoin’s price aligning with periods of tightened Global Liquidity and subsequent recoveries reflecting renewed liquidity expansion.

Nonetheless, a notable divergence has recently emerged. While liquidity continues to rise, suggesting support for higher Bitcoin prices, Bitcoin itself has stalled following the establishment of new all-time highs. This divergence merits monitoring; however, it does not negate the broader relationship. It could be indicative of Bitcoin lagging behind prevailing liquidity conditions, as has been observed in previous cycles.

Stablecoin Supply Signaling Bitcoin Market Surges

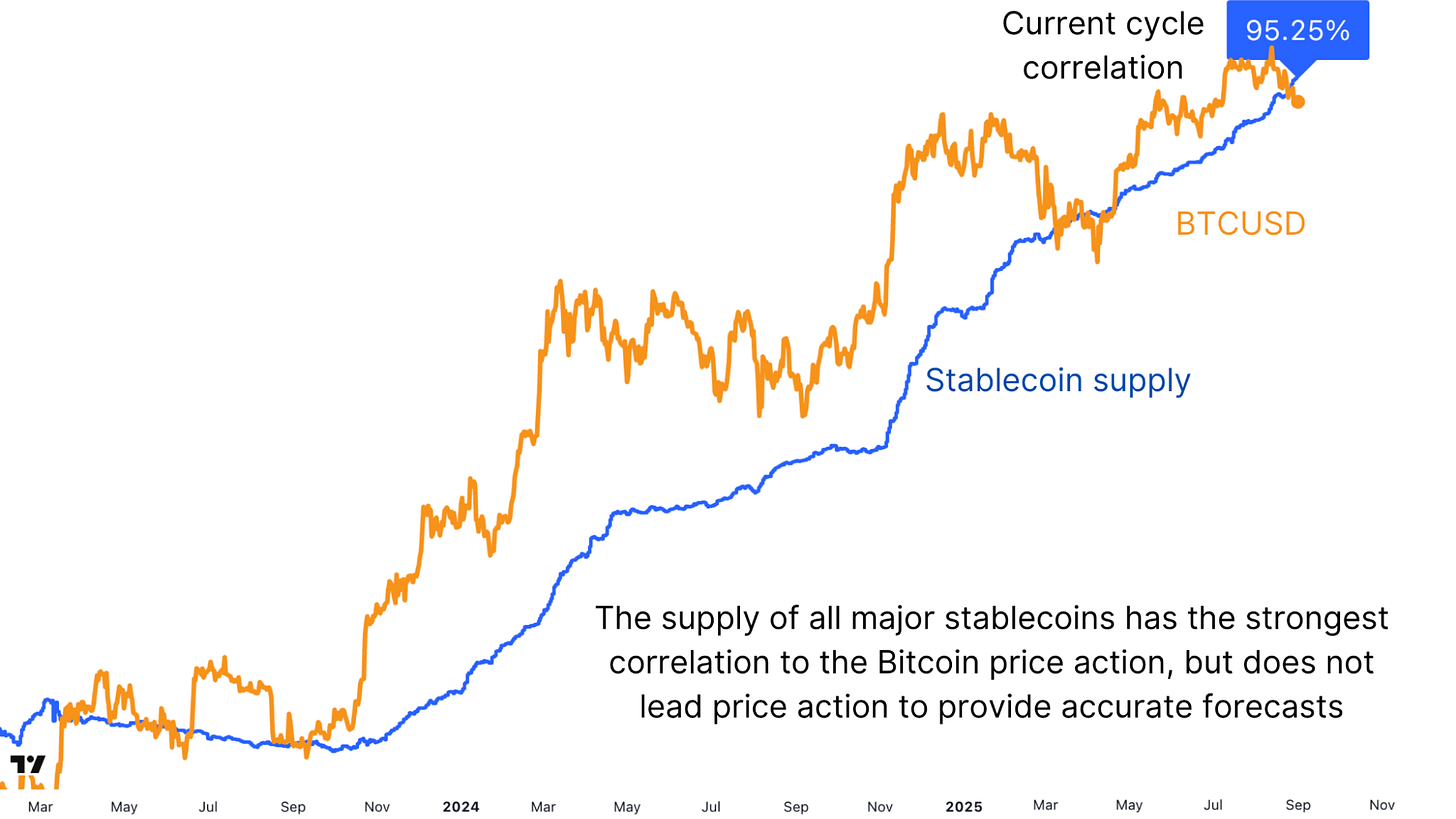

While Global Liquidity captures the broader macroeconomic environment, stablecoin supply offers a more immediate perspective on capital poised to enter the digital asset space. A significant increase in the minting of stablecoins such as USDT and USDC represents “dry powder” poised to be allocated into Bitcoin and subsequently into more speculative altcoins. Interestingly, the correlation with stablecoin supply is even more robust than that of M2, sitting at 95.24% without any offset. Each substantial inflow of stablecoin liquidity has consistently preceded or coincided with a surge in Bitcoin’s price.

This metric’s efficacy is attributed to its specificity; unlike Global Liquidity—which encompasses the entire financial system—stablecoin growth is directly tied to potential demand within the cryptocurrency market. Nevertheless, a divergence is also apparent here, as stablecoin supply has seen aggressive expansion while Bitcoin has undergone consolidation. Historically, such divergences are transient, as this capital typically seeks returns by flowing into risk assets. Whether this will lead to an imminent price increase or a slower capital rotation remains uncertain, but the strength of the correlation underscores its importance in the short to medium term.

Bitcoin Predictive Power of Gold’s High-Correlation Lag

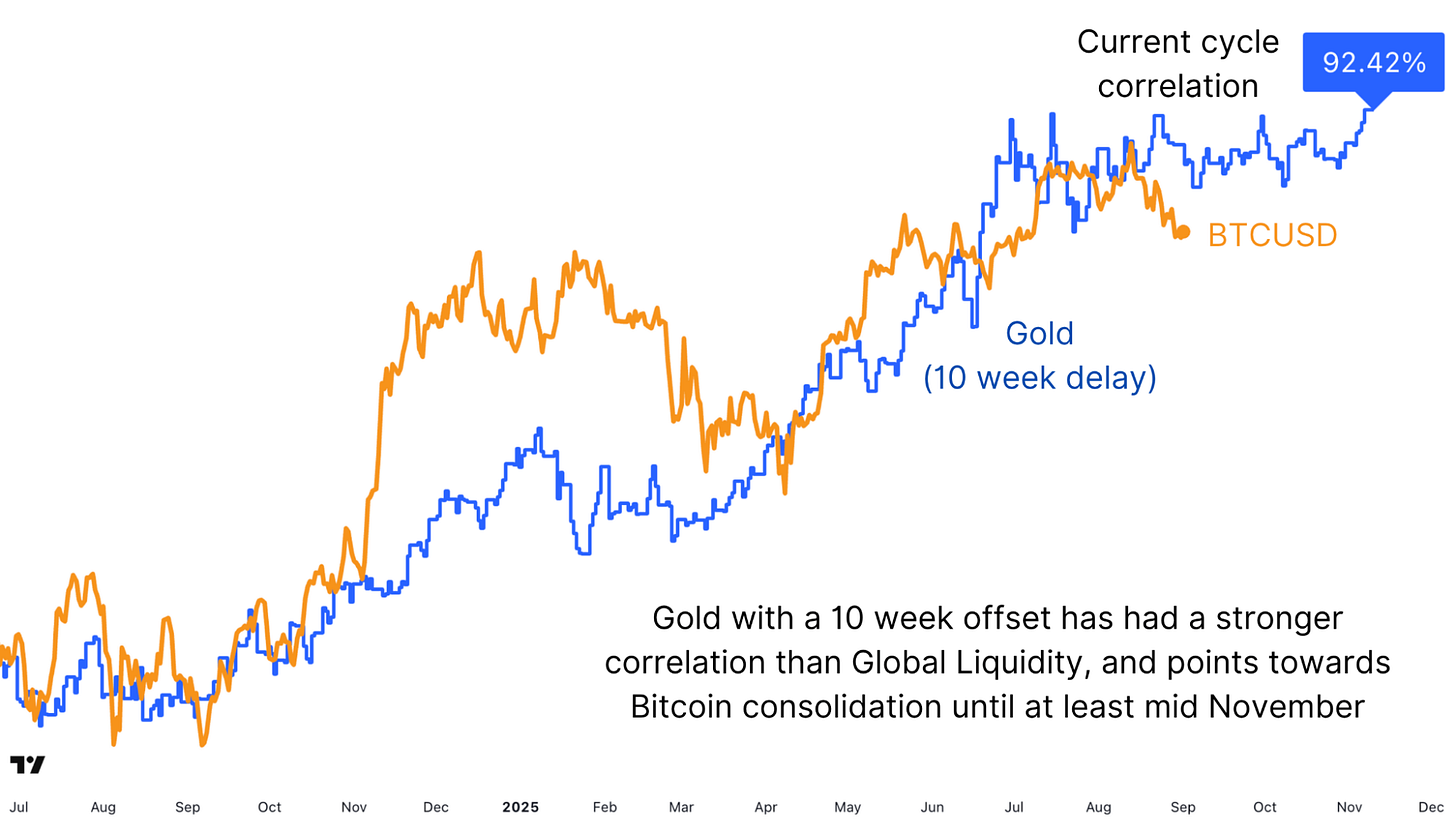

At first glance, the correlation between Bitcoin and Gold may appear inconsistent. Their relationship exhibits volatility, with instances of both alignment and divergence. However, applying a 10-week delay to Gold’s market data reveals a more coherent relationship: across this cycle, Gold shows a 92.42% correlation with Bitcoin, surpassing the correlation observed with Global M2.

The alignment observed is striking, as both assets have reached their respective lows at nearly the same time. Since that point, their major rallies and subsequent consolidations have followed comparable trajectories. Presently, Gold has entered a prolonged consolidation phase, and Bitcoin exhibits similar volatile sideways action. Should this correlation persist, Bitcoin may continue to experience range-bound movement until at least mid-November, echoing Gold’s stagnant patterns. Nevertheless, as Gold displays signs of technical strength and readiness for new all-time highs, Bitcoin may soon follow suit if the “Digital Gold” narrative once again gains traction.

Bitcoin’s Next Move Forecasted by Key Market Metrics

In summary, the interplay among these three metrics—Global Liquidity, stablecoin supply, and Gold—forms a robust framework for anticipating Bitcoin’s subsequent movements. The stability of Global M2 remains a reliable macroeconomic anchor, particularly with a 10-week lag. Meanwhile, the growth in stablecoin supply serves as a clear and direct signal of incoming demand for cryptocurrencies, with its acceleration indicating increasing pressure for higher prices. Lastly, Gold’s delayed correlation offers valuable predictive insights, suggesting a consolidation phase may precede a potential breakout in the coming weeks.

In the short term, this confluence of indicators suggests that Bitcoin may continue to move sideways, mirroring Gold’s stagnation despite the backdrop of expanding liquidity. However, should Gold achieve new highs and stablecoin issuance persist at its current rate, Bitcoin may be gearing up for a significant end-of-year rally. While patience remains essential, the prevailing data suggests that the underlying conditions are favorable for Bitcoin’s long-term trajectory.

Watch Latest Bitcoin Price Analysis

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.