Bitcoin Magazine

Bitcoin Covenants: CHECKTEMPLATEVERIFY (BIP 119)

This post marks the start of a series that explores particular covenant propositions that have actually reached a level of maturity calling for a thorough assessment.

CHECKTEMPLATEVERIFY (CTV), provided by Jeremy Rubin as BIP 119, is acknowledged as the most industrialized and completely articulated covenant proposition to date, not just amongst those included in this series however also within the whole landscape of covenant propositions. As highlighted in the initial post of this series, numerous issues exist within the environment relating to covenants showing extreme versatility, which might eventually cause destructive effects for Bitcoin.

CTV is clearly developed to enforce stringent restrictions on its abilities, consequently relieving such issues. To totally understood the performance of CTV, it is important to initially comprehend the specific parts of a Bitcoin deal.

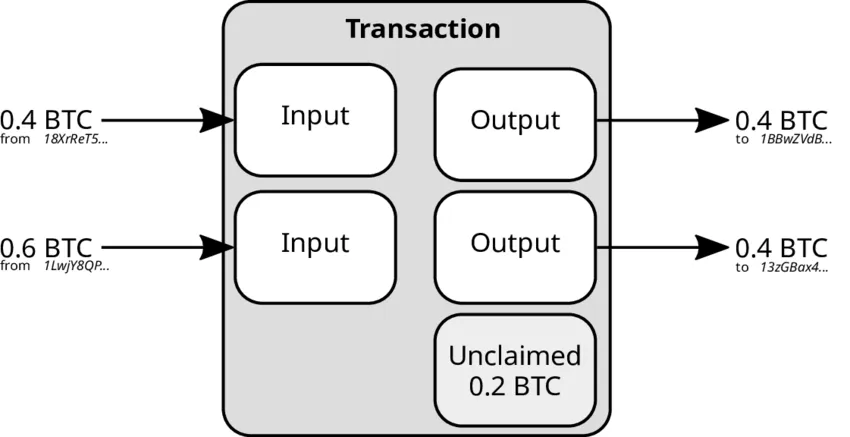

The illustration above supplies a top-level introduction of a Bitcoin deal, which includes inputs, called unspent deal outputs (UTXOs), and outputs, which represent brand-new unspent coins produced as soon as the deal is verified within a block. Although there are various extra parts to check out, this acts as a fundamental understanding of the deal’s structure.

Each deal includes a variation number field that represents its applicability worrying brand-new guidelines or functions. Furthermore, it integrates a marker and a flag set to particular worths to show that the deal utilizes Segregated Witness (SegWit). Following this is the input count, which defines the variety of inputs consisted of in the deal, been successful by the real inputs.

Each input incorporates the deal ID (TXID) of the deal that developed the unspent coin being made use of, a VOUT that determines the particular output from that deal being invested, the size of the ScriptSig, and the ScriptSig itself, which acts as the opening script verifying the permission of the input being invested according to its locking script guidelines. Lastly, a series number is included to make sure that the input sticks to relative time-lock policies, suggesting that the input has actually existed for a defined variety of blocks or period because its development.

The subsequent part refer to the output count, which information the variety of outputs within the deal. This part is followed by the outputs, which make up a quantity of satoshis connected with each output, the size of the ScriptPubKey, and the matching ScriptPubKey, which is accountable for locking that specific output. Finally, the nLocktime field enforces a time-lock worth in either timestamp or block height that uses to the whole deal.

Each SegWit deal also consists of a Witness area, where each input has an involved witness consisting of a Stack Items count, detailing the variety of aspects to be put on the script stack, a Size field for each product, and the real information products for the stack.

Understanding CTV

CTV acts as an opcode allowing an essential type of self-questioning and forward information transfer amongst the different covenant propositions. It allows a script to compare a pre-defined 32-byte hash versus a hash originated from many fields within the costs deal. If the hash produced from the real costs deal does not represent the pre-defined hash, the deal is considered void.

The fields to which CTV devotes consist of:

- nVersion

- nLocktime

- Input count

- A hash of all nSequence fields

- Output count

- A hash of all outputs

- Input index (the position of the input in the deal)

These fields are adequately dedicated by the CTV hash, guaranteeing no selective addition is allowed. The self-questioning offered by CTV is restricted to confirming whether the hash of these fields in the costs deal lines up with the hash in the locking script of the input being invested. Remarkably, this hash incorporates basically the whole deal aside from the real inputs. The reasoning for leaving out inputs depends on the requirement to lock an output to a 32-byte hash with CTV; the hash of the deal need to be understood before the total deal can be developed, which is not practical.

Moreover, CTV scripts can be embedded, permitting a preliminary CTV script to dedicate to a deal that consists of outputs consisting of extra CTV scripts. This function makes it possible for CTV to “carry forward” information, helping with a theoretical limitless depth of nesting, though useful restrictions occur due to the requirement of creating nesting in reverse order from completion. Each level needs to consist of the hash of the deal causing the next; subsequently, the previous deal cannot be developed without understanding of the subsequent deal.

Applications of CTV

CTV makes it possible for constraint of an output so that, in accordance with agreement guidelines, it can just be invested by means of a particularly pre-defined deal. This might raise concerns concerning its significance, as pre-signed deals are currently a feasible alternative. If the reflective capability is so restricted that it simply reproduces performances obtainable through pre-signing, what extra worth does CTV supply?

Firstly, the fundamental nature of pre-signed deals leaves space for keyholders to sign alternative deals or invest coins in varying good manners. Relying on keyholders to avoid such actions or to ruin the finalizing essential presents a component of trust. In contrast, CTV removes this commitment for trust completely. Once the costs deal is specified and an output locked to the CTV hash is developed, it ends up being difficult to invest it any other method, as implemented by agreement.

Currently, the only option to bypassing this trust includes taking part in pre-signing deals through multisignature plans. While this warranties that unless a specific selects to sign a deal themselves, no other legitimate costs deal can be produced, the intricacy and unreliability of collaborating several individuals to pre-sign deals all at once increases substantially after a particular point. This coordination difficulty ends up being not practical for bigger groups.

CTV streamlines the procedure by permitting deals to be dedicated without demanding synchronised online involvement from all celebrations included. It improves coordination by allowing people to share needed info at their benefit, which then makes it possible for a designated person to develop a chain of CTV deals without more participation from others, permitting confirmation and guarantee that the right result is the only practical one.

The intrinsic worth of CTV extends beyond this assistance; when integrated with other opcodes, it can make it possible for a lot more ingenious services, which will be checked out in future posts.

Conclusion

CTV provides a securely managed covenant that provides a restricted degree of self-questioning and forward information bring ability, which does not go beyond the performances obtainable through pre-signed deals. Its worth proposal does not depend on providing brand-new abilities by itself, however rather in significantly improving the effectiveness, scalability, and security warranties of present pre-signed deal structures. This enhancement provides a considerable advantage to almost every active procedure using pre-signed deals.

The list below tasks exhibit the substantial advancement and expedition surrounding this specific covenant compared to others:

- A standard payment swimming pool example by stutxo.

- A CTV vault application by James O’Beirne, who consequently proposed OP_VAULT (which continues to use CTV).

- A proof-of-concept adjustment of the pre-signed transaction-based Ark application from Second by Steven Roose utilizing CTV.

- The Sapio Language by Jeremy Rubin, a higher-level language for building agreements with CTV (also supporting pre-signed deals).

- Timeout Trees, a proposition for an essential coin swimming pool style by John Law.

- Numerous other possible procedures, consisting of enhanced Discreet Log Contracts (DLCs), non-interactive Lightning channels that a person celebration might start without the equivalent, and decentralized techniques for miners to team up.

In conclusion, CTV stands as an extremely fully grown proposition with substantial included worth, lacking any threat of conjuring up the issues connected with covenants. This proposal warrants severe factor to consider; the author thinks it must have been executed years earlier.

This post, entitled Bitcoin Covenants: CHECKTEMPLATEVERIFY (BIP 119), very first appeared on Bitcoin Magazine and was composed by Shinobi.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.