Bitcoin Magazine

Where Could Bitcoin Peak This Cycle?

With Bitcoin looking as bullish as ever, the inescapable concern emerges of how high could BTC reasonably enter this market cycle? Here we’ll check out a vast array of on-chain evaluation designs and cycle timing tools to recognize possible cost targets for a Bitcoin peak. Although forecast is never ever an alternative to disciplined information response, this analysis provides us structures to much better comprehend where we are and where we may be heading.

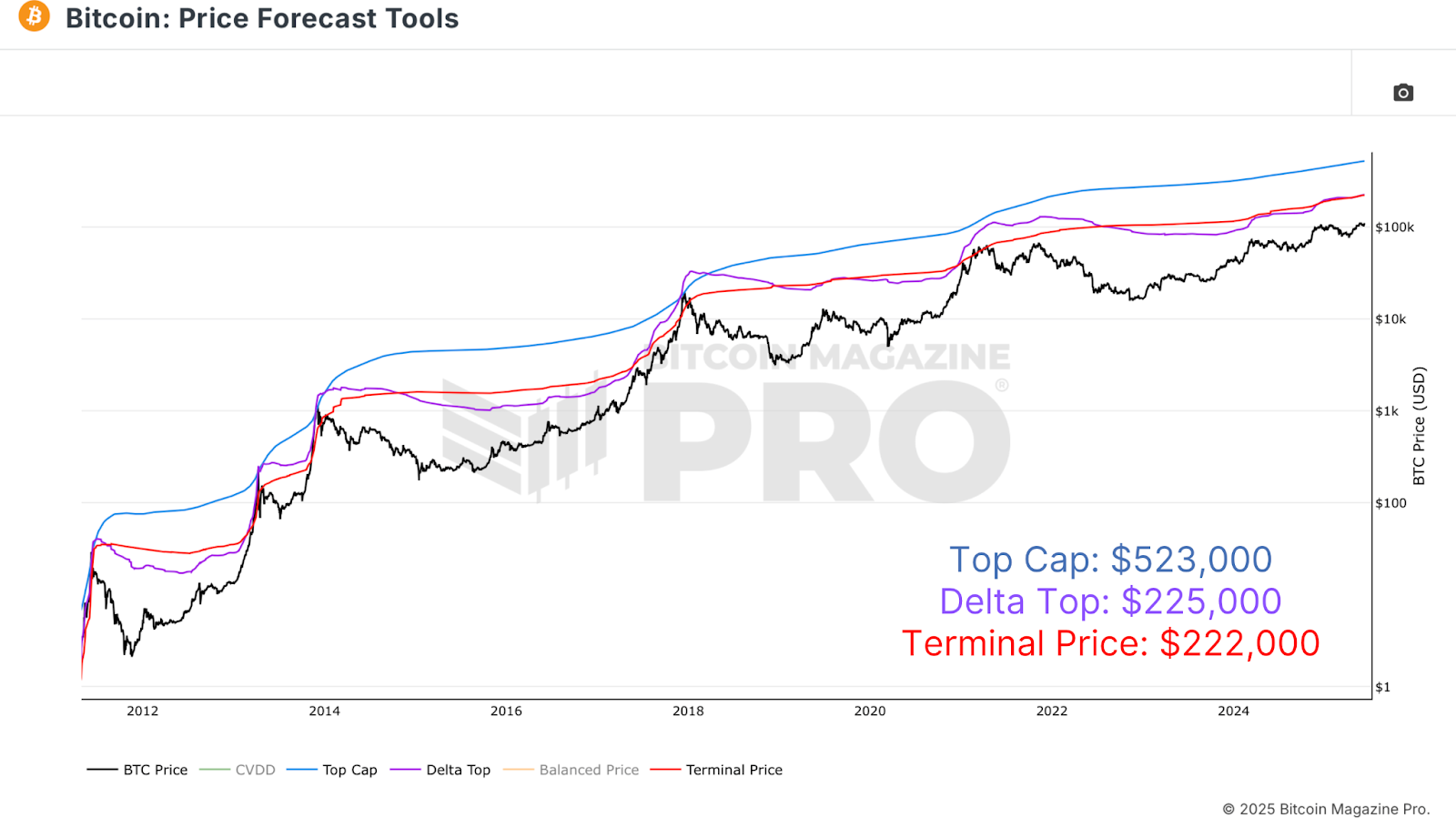

Price Forecast Tools

The journey starts with Bitcoin Magazine Pro’s complimentary Price Forecast Tools, which put together numerous traditionally precise evaluation designs. While it’s constantly more reliable to respond to information instead of blindly anticipate costs, studying these metrics can still supply effective context for market habits. If macro, derivative, and on-chain information all begin flashing cautions, it’s typically a strong time to take earnings, no matter whether a particular cost target has actually been struck. Still, checking out these evaluation tools is helpful and can direct tactical decision-making when utilized along with more comprehensive market analysis.

Among the crucial designs, the Top Cap increases the typical cap with time by 35 to predict peak appraisals. It properly anticipated 2017’s leading, however missed out on the 2020–2021 cycle, approximating over $200k while Bitcoin peaked around $69k. It now targets over $500k, which feels significantly impractical. An action even more is the Delta Top, deducting the typical cap from the recognized cap, based upon the expense basis of all flowing BTC, to produce a more grounded forecast. This design recommended an $80k–$100k top last cycle. The most regularly precise, nevertheless, is the Terminal Price, based upon Supply Adjusted Coin Days Destroyed, which has actually carefully lined up with each previous peak, consisting of the $64k top in 2021. Currently predicting around $221k, it could increase to $250k or more, and stays probably the most reputable design for forecasting macro Bitcoin tops. Of course, more info relating to all of these metrics and their estimation reasoning can be discovered below the charts on the website.

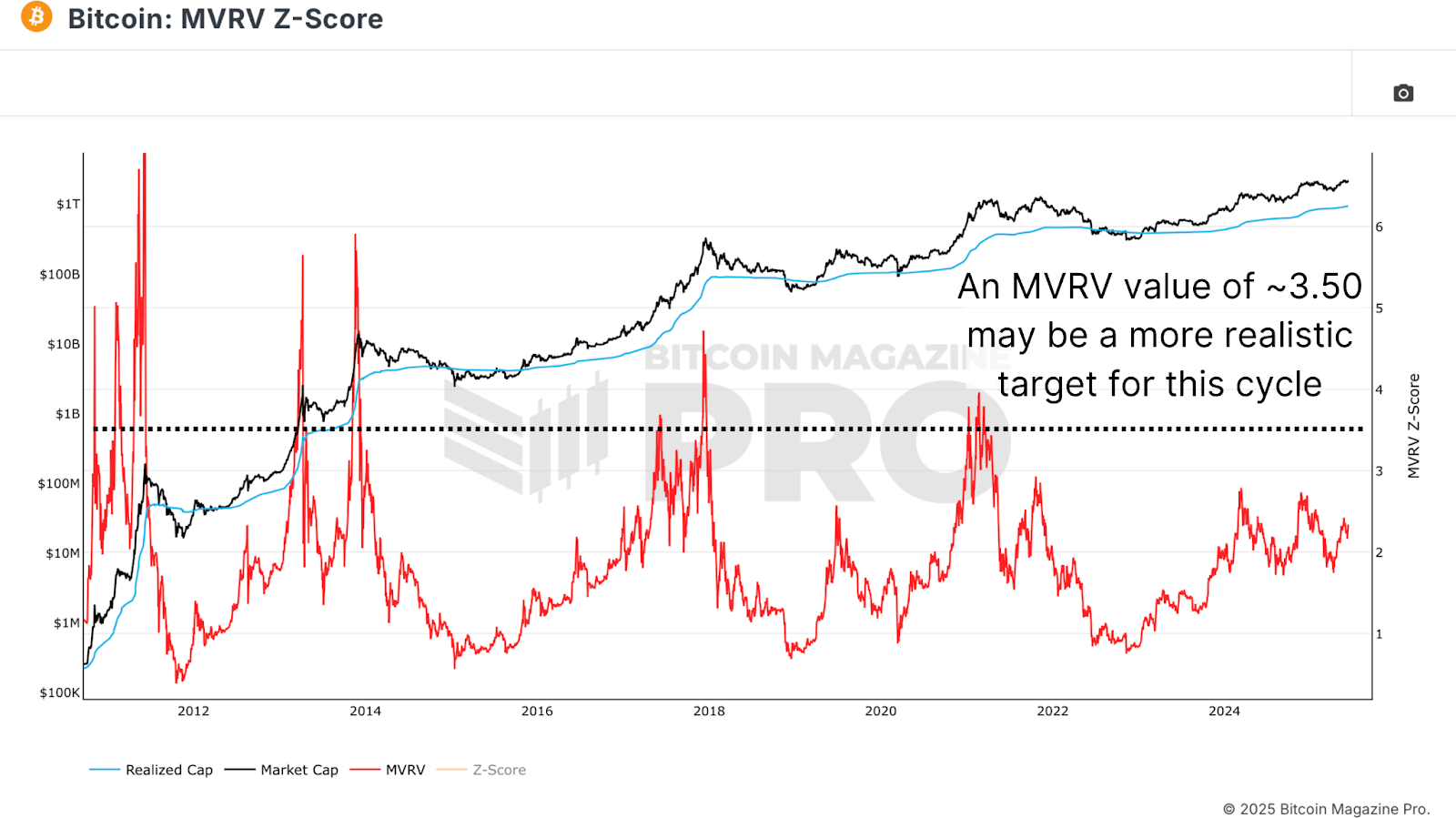

Peak Forecasting

Another effective metric is the MVRV ratio, which compares market cap to recognized cap. It uses a mental window into financier belief, generally peaking near a worth of 4 in significant cycles. The ratio presently sits at 2.34, recommending there might still be space for considerable advantage. Historically, as MVRV nears 3.5 to 4, long-lasting holders start to understand considerable gains, frequently indicating cycle maturity. However, with decreasing returns, we may not reach a complete 4 this time around. Instead, utilizing a more conservative quote of 3.5, we can start predicting more grounded peak worths.

Calculating A Target

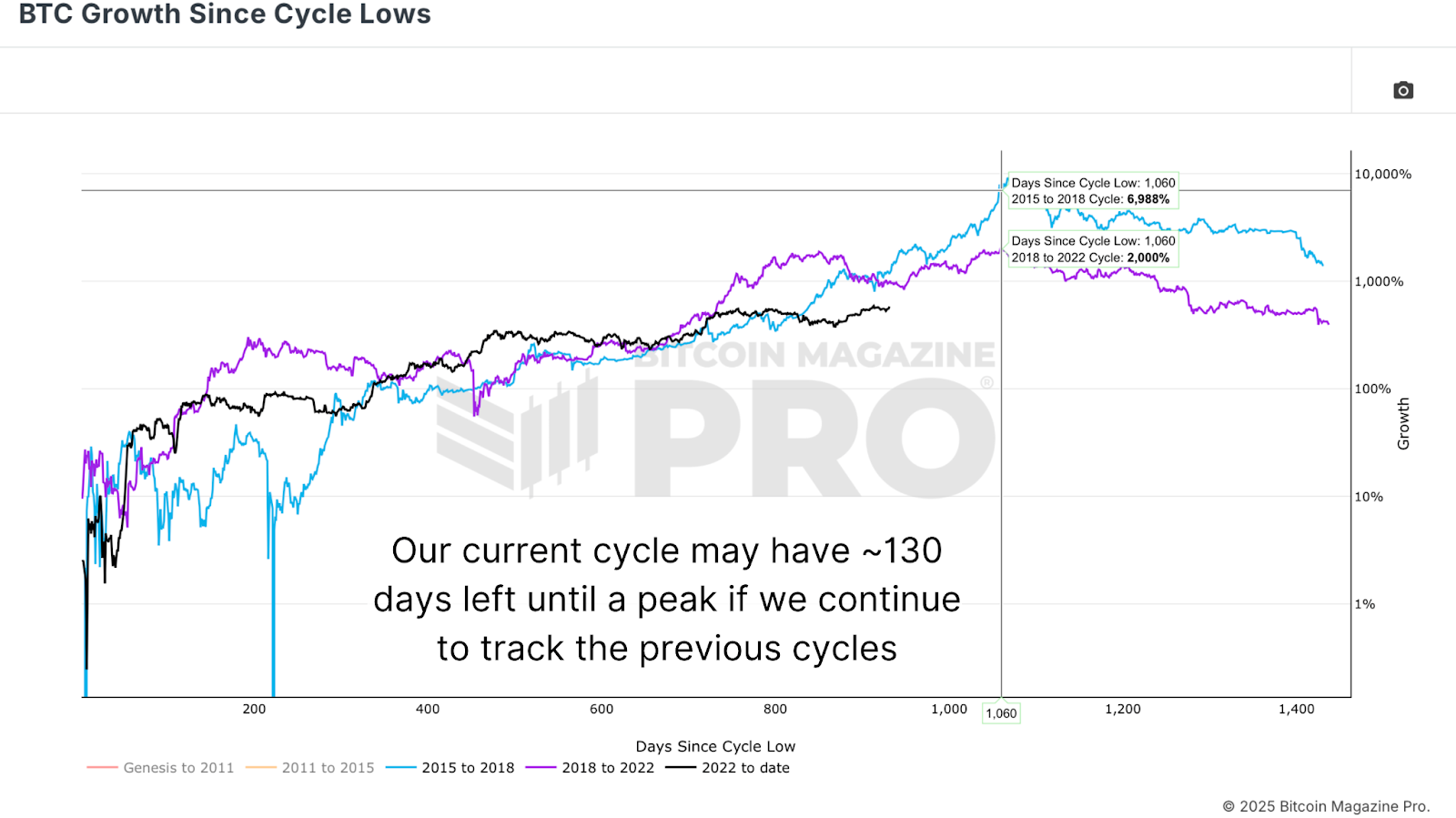

Timing is as crucial as evaluation. Analysis of BTC Growth Since Cycle Lows shows that previous Bitcoin cycles peaked nearly precisely 1,060 days from their particular lows. Currently, we have to do with 930 days into this cycle. If the pattern holds, we can approximate the peak might get here in approximately 130 days. Historical FOMO-driven cost boosts frequently occur late in the cycle, triggering Realized Price, a proxy for typical financier expense basis, to increase quickly. For circumstances, in the last 130 days of the 2017 cycle, recognized cost grew 260%. In 2021, it increased by 130%. If we presume an additional halving of development due to decreasing returns, a 65% increase from the present $47k recognized cost brings us to around $78k by October 18.

With a predicted $78k recognized cost and a conservative MVRV target of 3.5, we get to a possible Bitcoin cost peak of $273,000. While that might feel enthusiastic, historic parabolic blowoff tops have actually revealed that such relocations can occur in weeks, not months. While it might appear more practical to anticipate a peak closer to $150k to $200k, the mathematics and on-chain proof recommend that a greater evaluation is at least within the world of possibility. It’s also worth keeping in mind that these designs dynamically change, and if late-cycle bliss starts, forecasts could rapidly speed up even more.

Conclusion

Forecasting Bitcoin’s specific peak is naturally unsure, with a lot of variables to represent. What we can do is place ourselves with probabilistic structures grounded in historic precedent and on-chain information. Tools like the MVRV ratio, Terminal Price, and Delta Top have actually consistently shown their worth in preparing for market fatigue. While a $273,000 target may appear positive, it is rooted in previous patterns, present network habits, and cycle-timing reasoning. Ultimately, the very best technique is to respond to information, not stiff cost levels. Use these tools to notify your thesis, however remain active sufficient to take revenues when the more comprehensive environment begins indicating the top.

For more deep-dive research study, technical indications, real-time market notifies, and access to a growing neighborhood of experts, go to BitcoinMagazinePro.com.

This post Where Could Bitcoin Peak This Cycle? initially appeared on Bitcoin Magazine and is composed by Matt Crosby.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.