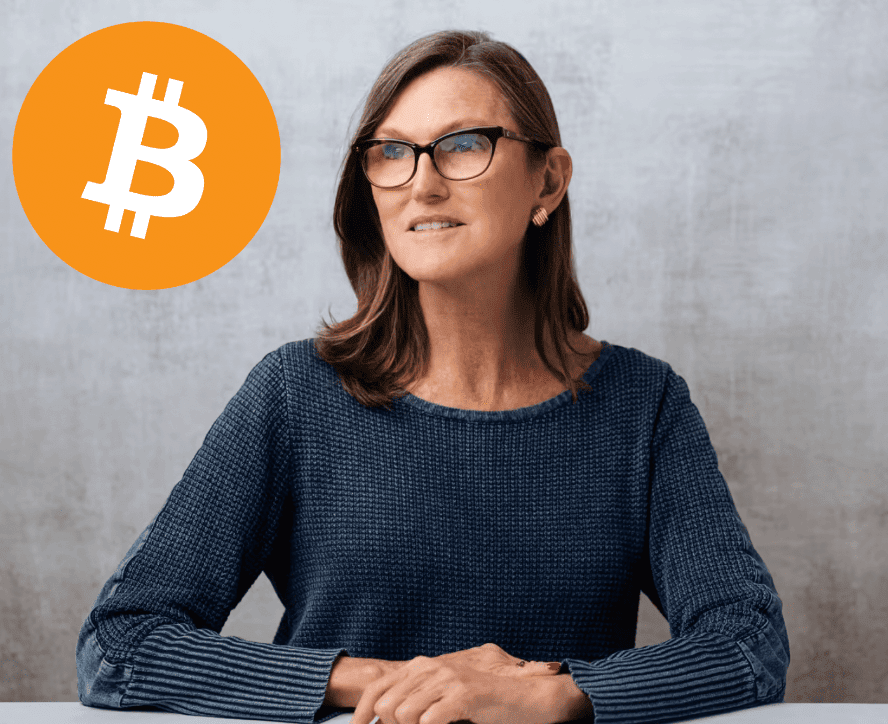

Noted Bitcoin evangelist Cathie Wood is marking a turning point today.

As kept in mind by Bitcoin Historian Pete Rizzo on X, today marks the 8th anniversary of Cathie Wood’s choice to make Ark Invest the first U.S. exchange-traded fund (ETF) to purchase Bitcoin when its price was a simple $200 to $300 per coin.

At that time, Bitcoin was still a fairly uncharted area for standard financial investment cars like ETFs. However, Wood’s choice to consist of Bitcoin in ARKW’s portfolio was groundbreaking and showed her belief in the capacity of the digital currency.

Wood said at the time:

“We believe the bitcoin platform could be as big as the Internet platform, which, in its early days, also faced tests associated with illicit activities. We would prefer to invest after, rather than before, such tests. We have been impressed that the bitcoin price has stabilized in the $200-300 range. It could have imploded but has survived.”

Though the specific figure can’t be understood, Bitcoin has actually experienced a huge boost in worth since that time, rising by approximately 12,000%. This exceptional development has actually strengthened Bitcoin’s position as a considerable possession class, recording the attention of institutional and retail financiers alike.

Cathie Wood and Ark Invest have actually stayed at the leading edge of cryptocurrency adoption and development. Their continuous dedication to Bitcoin consists of academic efforts like white documents, financial investment in Bitscoins.netpanies like Coinbase, and public appeals for regulative clearness around the sector, especially around Bitcoin ETFs.

For example, Ark is among approximately 10 candidates for a Bitcoin Spot ETF along with BlackRock, Fidelity, and the car it utilized to acquire its cryptocurrency, the Grayscale Bitcoin Investment Trust (GBTC). Already Bitcoin Futures ETFs are openly trading and have actually been so since 2021.

Still, while Wood is called a Bitcoin bull, she was especially on the sidelines for a long time, first publishing on X that Bitcoin might “go viral” in 2013 when it was combating to rebound from its $1,000 high that year.

As Bitcoin continues to develop and improve the monetary landscape, Wood’s early acknowledgment of its possible and her contributions to the market have actually left an enduring mark on the world of financing.

Time will inform if her Wall Street peers will follow.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.