Originally released on Unchained.com.

Unchained is the main United States Collaborative Custody partner of Bitcoin Magazine and an essential sponsor of associated material released through Bitcoin Magazine. For more info on services provided, custody items, and the relationship in between Unchained and Bitcoin Magazine, please visit our site.

For beginners, specifically those around retirement age, the concept of buying or owning bitcoin can stimulate responses from uncertainty to shock. If you look beyond the popular stories, nevertheless, you may discover there is more to the story than impressions recommend. Here are 6 reasons to think about owning a minimum of some bitcoin throughout retirement.

1. Bitcoin assists expand your possession allotment base

Traditionally, financiers utilize a method called possession allotment to disperse and protect funds from financial investment threat gradually. A sound possession allotment method is the remedy to putting all of your eggs in one basket. There are a number of kinds of possession “classes” or classifications over which to disperse threat. Customarily, consultants look for to develop a vibrant mix in between financial obligation instruments (i.e., bonds), equities (i.e., stocks), property, money, and products.

The more classifications you use to disperse your properties and the less associated those classifications are, the much better your opportunities of stabilizing your threat, a minimum of in theory. Recently, due to unintentional effects triggered by the aggressive growth of social financial obligation and the cash supply, properties that were formerly less associated now tend to act more in kind with one another. When one sector gets hammered today, a number of sectors frequently suffer together.

Regardless of these contemporary conditions, possession allotment stays a well-conceived method for moderating threat. While still in its relative infancy, bitcoin represents a totally brand-new possession class. Because of this, owning a minimum of some bitcoin, specifically due to its unique residential or commercial properties when compared to other “cryptocurrencies,” offers a chance to expand your possession base and better disperse your total threat.

2. Bitcoin uses a hedge versus inflation and currency debasement

As a senior citizen, safeguarding yourself from inflation is essential to maintaining your long-lasting buying power. In the possession allotment conversation above, we referenced the current and aggressive cash supply growth. Everyone who has actually lived enough time to method retirement age understands that a dollar no longer purchases what it utilized to. When the federal government problems big quantities of brand-new cash, it debases the worth of the dollars currently in blood circulation. This typically presses costs higher as freshly produced dollars start to chase after the existing restricted supply of items and services.

Our own Parker Lewis discussed this thoroughly in his Gradually, Then Suddenly series:

In summary, when attempting to comprehend bitcoin as cash, begin with gold, the dollar, the Fed, quantitative easing and why bitcoin’s supply is repaired. Money is not merely a cumulative hallucination or a belief system; there is rhyme and factor. Bitcoin exists as a service to the cash issue that is worldwide QE and if you think the degeneration of regional currencies in Turkey, Argentina or Venezuela might never ever take place to the U.S. dollar or to an established economy, we are simply at a various point on the exact same curve.

In contrast to fiat currencies, nobody can increase the supply and arbitrarily lower bitcoin’s worth. There are no central authorities that govern its financial policy. Despite arguments to the contrary, bitcoin resembles gold—however not precisely, due to the fact that gold miners continue to pump up the supply of gold each year at a rate of 1-2%.

As bitcoin is gradually presented to the flowing supply (i.e., mined), its inflation rate reductions and will ultimately stop. This truth makes bitcoin distinctively limited amongst worldwide financial properties. Ultimately, this deficiency, in addition to bitcoin’s other financial residential or commercial properties, need to secure its buying power. As such, owning bitcoin throughout retirement uses you a hedge versus inflation.

3. Bitcoin uses a chance for uneven returns

Bitcoin’s capability to reduce a lot of the difficulties we go over here rests on its capability to accomplish uneven returns. Its supply is repaired (there will just ever be 21,000,000 bitcoin), and need for the possession is growing progressively. As this restricted supply hits increased store-of-value adoption from people, organizations, and federal governments, bitcoin has the prospective to overshadow the returns of almost every completing possession class.

It’s worth keeping in mind that individuals typically enhance their returns with bitcoin when they hold it for the long term. In the contemporary age, retirements lasting years or more are significantly typical. Over such period, even a minimal allotment to bitcoin uses sufficient chance to take advantage of its upside capacity. You simply require time to hold through the short-term volatility, which contrary to common belief, is not proof of it being a bad shop of worth.

Sequestering a part of funds exclusively for gratitude throughout retirement runs rather counter to traditional knowledge. Modern retirement preparation typically enhances for the liquidation of portfolio funds to supply earnings. However, reserving a percentage of bitcoin—kept steadfastly gated from funds allocated for earnings—unlocks to take advantage of the money making of bitcoin’s restricted supply.

4. Bitcoin uses security from the threat of long-lasting bonds

Conventionally, top-quality bonds—held straight or as fund shares—comprise a substantial part of many retirement portfolios due to their low threat levels and propensity towards capital conservation. However, things have actually altered.

Monetary growth and increases in social financial obligation have actually required bond yields—or the quantity of interest paid (i.e., discount coupon)—to traditionally low levels. The yields on many bonds today fall well below the rate of inflation. This “negative real yield” suggests that owning a bond can cost you cash. But the problem doesn’t end there.

Because retired people require funds from their portfolios to pay expenses, they typically should offer properties at present market rates to obtain earnings throughout retirement. In the case of bonds, at present, this can be really troublesome. Consider the following formulas.

- How much cash does it consider a bond paying a 2% rate to yield $20? Answer: $1,000. ($1,000 x 2% = $20)

- How much cash does it consider a bond paying a 4% rate to yield $20? Answer: $500. ($500 x 4% = $20)

These 2 formulas expose that to yield the exact same $20 return, the marketplace worth of the underlying bond modifications based upon the rates of interest assured.

- When rate of interest increase, the marketplace worth of bonds decreases.

- When rate of interest decrease, the marketplace worth of bonds increases.

The market price of bonds has an inverted relationship to rate of interest. Consider that rate of interest today hover near historical lows. Over the next twenty to thirty years, what will take place to the marketplace worth of bonds held by retired people if rate of interest increase considerably? The response: the marketplace worth of their bonds will collapse.

This alters the whole threat paradigm for bonds in retirement portfolios and possibly makes them far less safe than normally thought of. Bitcoin exists in a different possession class from bonds; it is a bearer instrument that is not exposed to the exact same cash market threats. As such, owning bitcoin might assist you balance out a minimum of a few of the prospective threat sustained from owning bonds in retirement.

5. Bitcoin uses a possible option for long-lasting health care threat

Another location of issue for retired people is the expense of health care. Here, I am not referring a lot to regular medical expenses however rather to the prospective to sustain long-lasting care expenditures in later age. Insurance is readily available for long-lasting care, however it has some special and significantly challenging difficulties to conquer.

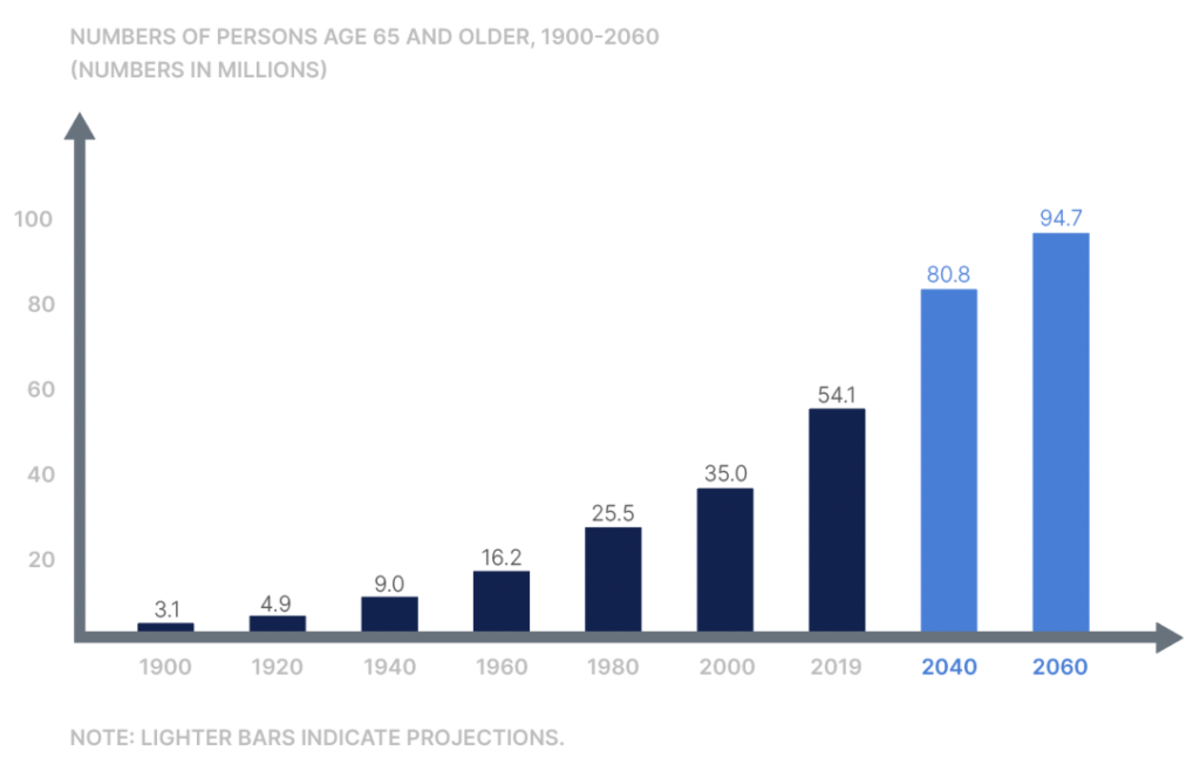

Healthcare, in basic, takes a double-hit when it concerns price inflation. Not just do health care expenses increase due to financial debasement, however health care deals with extra headwinds from need stimulated by development in the aging population.

States manage insurance coverage for long-lasting care. To keep policyowners safe, insurance providers deal with examination over where and how they invest policy premiums. To maintain capital needed for future claims, insurance providers typically count on low-risk, intermediate and long-lasting bonds. However, as our conversation above on bonds exposes, low yields and the capacity for increasing rates complicate this practice. One instant fallout is that premiums for long-lasting care insurance plan have actually increased considerably.

We kept in mind earlier bitcoin’s effectiveness as an inflation hedge and its capacity for long-lasting rate gratitude. As it associates with long-lasting health care, it might make good sense to reserve some bitcoin clearly committed as a hedge for this quickly increasing cost.

6. Bitcoin uses you private sovereignty

The last factor we’ll think about for owning bitcoin in retirement is that it uses you increased private sovereignty. Bitcoin offers you a level of ownership that is not attainable with other properties. It can quickly be brought throughout borders with a hardware wallet or seed expression, for instance, or moved peer-to-peer throughout the world at low expense.

If you hold bitcoin safely in a wallet you manage, no reserve bank can take the worth of your bitcoin by printing it into oblivion. No CEO can dilute its worth by releasing more of its “shares.” Nor can a bank arbitrarily obstruct access to or take your funds. Unlike centralized monetary custodians, which can be purchased to freeze or keep funds on the impulses of federal government or other third-party authorities, bitcoin with secrets effectively held is resistant to these type of overreach.

Specifically for retirement functions, you can also hold your own secrets for bitcoin in an individual retirement account. Products like the Unchained individual retirement account are a robust tool for structure and conserving your wealth on a tax-advantaged basis. And holding your bitcoin type in the type of a multisig collective custody vault permits you to remove all single points of failure while you do so.

Sound monetary concepts and owning bitcoin

Benefitting from bitcoin does not need devoting to wild speculation or senseless desertion of sound monetary concepts. In contrast, the more you take a look at bitcoin through noise monetary concepts and use them to your thinking, the higher the chances it offers. One unfaltering monetary concept that accompanies bitcoin ownership is vigilance.

Macro-financial financial investment strategist Lyn Alden frequently mentions developing a “non-zero position” in bitcoin (i.e., owning a minimum of some). The threat of losing a couple of portfolio portion points in a worst-case situation is, in my evaluation, worth the prospective benefit. But to be clear, everyone’s circumstance is special. You should do your own research study and make the very best choices you can about what operate in your specific situation.

Originally released on Unchained.com.

Unchained is the main United States Collaborative Custody partner of Bitcoin Magazine and an essential sponsor of associated material released through Bitcoin Magazine. For more info on services provided, custody items, and the relationship in between Unchained and Bitcoin Magazine, please visit our site.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.