The below is an excerpt from a current edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be amongst the very first to get these insights and other on-chain bitcoin market analysis directly to your inbox, subscribe now.

With Bitcoin’s next halving set to happen this month, miners are utilizing record profits to adjust their service designs for disorderly chances.

The halving is nearly upon us. As the entire world of Bitcoin waits with bated breath for mining benefits to be halved, the capacity for new income streams has actually left us questioning how the area will respond to new market conditions. Halvings in the past have actually normally been related to success for Bitcoin, however they’ve also been understood to shock previously-held presumptions in a huge method. We’re currently seeing a couple of examples of these market modifications; simply to call one, the bigger miners have actually been updating their devices to guarantee maximally effective hardware. This has actually caused a fire sale of out-of-date devices from these business, with lots of countless mining rigs discovering their method to aiming miners in Africa and Latin America. The low-cost hydroelectricity from Ethiopia has actually currently been drawing in global capital to end up being a new mining center, and a big part of these rigs are going there for cents on the dollar.

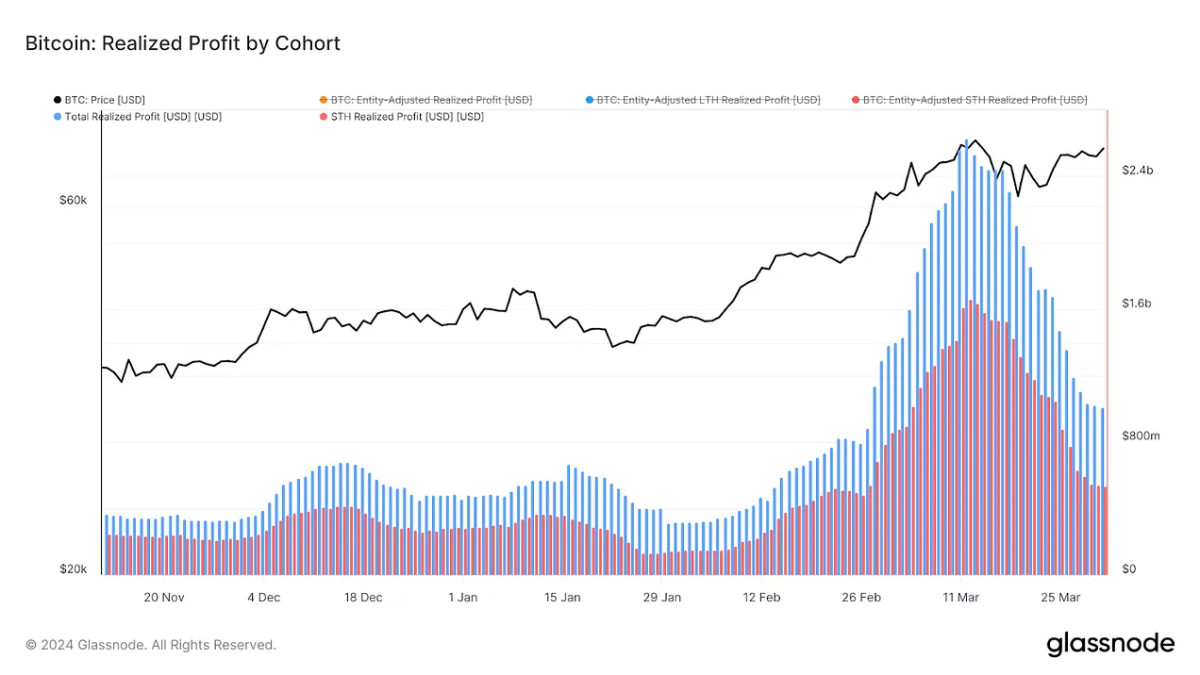

In other words, miners are anticipating to see less output in the instant future, however this has actually nonetheless incentivized the development of new mining business around the world and net development for the market. This is simply one illustration of the sorts of unanticipated chances that will take the digital property area by storm, and it’s up to Bitcoiners to take on them. For miners as an entire, chances are definitely abundant. March 2024 saw the greatest ever regular monthly earnings for the cumulative mining market, simply topping $2 billion. This is especially notable due to the fact that less than half of this income has actually originated from deal charges, a far cry from the scenario in December where deal charges exceeded mining benefits.

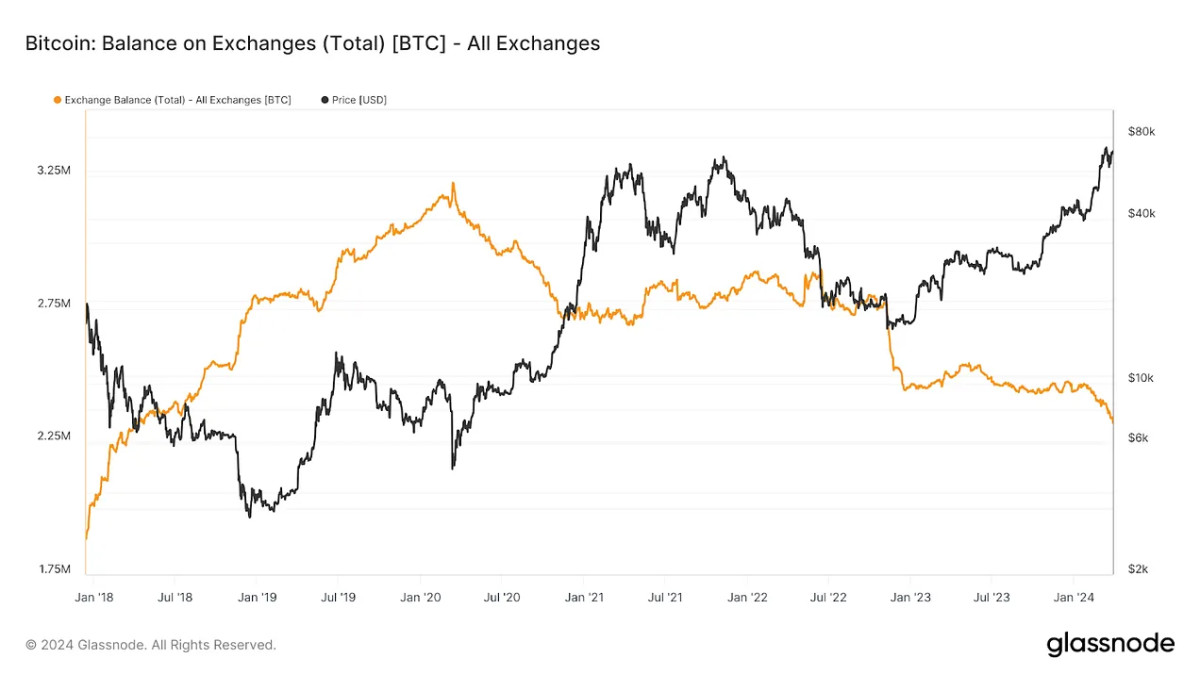

In December, the cost of Bitcoin was far lower, and the blockchain was pestered with blockage. Not just did this blockage reduce the need for purchasing Bitcoin, however it also raised the need for miners to process the blockchain. Simply dealing with deals on already-mined Bitcoin comprised a bigger share of profits than mining and offering new ones, and this business ended up being a lifeline for lots of smaller sized companies. Now, nevertheless, it looks like the cash is streaming all around. Bitcoin ETFs are demolishing Bitcoin at severe rates—more than 6x the real output of miners. The gold mine has actually even brought equity capital interest directly back into focus, more increasing the craze. In the very first 3 months of 2024, significant exchanges jointly saw their reserves of Bitcoin stop by almost $10 billion, exposing the tremendous need for newly-mined coins. With market conditions like this, it’s no surprise that miner profits have actually struck an all-time record.

However, although this duration of extreme sales has actually definitely developed a chance for the miners, there are also dangers related to the halving. These business remain in a mad dash to protect as much income as possible pre-halving, and the race is so desperate for one basic factor: trendlines might offer motivating information, however there’s no real warranty that Bitcoin’s cost will climb up appropriately after its supply is lowered. Halving buzz and the runaway success of ETFs have actually brought Bitcoin’s cost to its greatest levels, however this record has actually been followed by volatility. Bitcoin has actually hovered around its terrific benchmark since passing it without continuing to rally in an overblown spike. If Bitcoin’s cost continues to act in unanticipated methods, it will ultimately ruin smaller sized companies and promote market combination.

Additionally, an especially intriguing advancement has actually emerged in the secondary Bitcoin markets. Since the rapacious need of ETF companies and other banks has actually totally exceeded supply, some long-lasting holders (LTHs) have actually been awakening to worries of a generalized liquidity crisis. Whales formerly content to hold Bitcoin for several years at a time have actually altered their habits, obviously choosing that now is the time to lastly understand huge profits. March 2024 has actually seen long-lasting holders start offering their possessions at unmatched rates, generating an out of proportion quantity of earnings in relation to other Bitcoin sellers. Obviously, a resource like this cannot last permanently, however it’s an essential tip to a few of the miners: even if you’re having difficulty making ends fulfill post-halving, it doesn’t indicate the market is. Adapt, or the area will discover new methods to leave you behind.

Nevertheless, miners huge and little have actually not handled the difficulty of the halving resting. These runaway profits have actually allowed services to buy a variety of preparation strategies, in some cases even considerably shocking their service designs. For example, the American company Arkon Energy has actually formerly run more as a facilities business, seeing itself as a company for a customer base of independent miners. As it revealed a significant purchase of modern mining devices on April second, it signed up with an industry-wide pattern of getting ready for the halving with maximally effective devices. Rather than providing this devices to its previous clients, nevertheless, Arkon has actually specified its intent to pivot and just mine Bitcoin themselves. This basic shift represents a remarkable modification in their general service design, and they prepare to follow through by “aiming to make Arkon one of the most efficient miners in the world”.

Leading miner Hut 8, on the other hand, has actually started an organization design pivot of its own, however in a somewhat various instructions. A Q1 revenues employ late March saw CEO Asher Genoot acknowledge that 70% of the business’s income originated from property mining, however that strategies were anticipated to alter rather as the halving approaches. Hut 8 is still concentrating on updating its hardware and making use of energy resources at new websites, like lots of other mining business, however it’s also purchasing a new instructions. This new instructions is not in a various property, as its mining operations are concentrated on Bitcoin, however rather in establishing high-performance computing and AI operations. Genoot declared that these new operations were “sub-scale today… But we are excited about that business because we see it as a foundation to be able to grow.” He added that “You’ll see us continuing to be creative in how we maximize the value of every machine,” worrying the requirement to keep an excited and disciplined mindset towards the existing mining operations.

These are simply a number of the various new strategies that miners are requiring to expect the halving. Companies have actually been getting ready for months now, and there is still time to make extra new strategies. At the time of composing, the halving remains in less than 3 weeks, and the countdown to this occasion exposes the positive and celebratory mindset of Bitcoiners all over. No matter what takes place when the long-awaited day lastly gets here, a couple of constants appear really dependable. There will be a tremendous need for the world’s leading digital property, and the Bitscoins.netmunity will have the exact same ingenious spirit as constantly. Whether Bitcoin leaps right now or acts unexpectedly, it’s specific that somebody will end up a huge winner. For us Bitcoiners, that indicates there’s plenty to anticipate.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.