Introduction

One of Bitcoin’s indisputable and regularly promoted strengths is its decentralization. It’s typically declared that the Bitcoin network provides levels of decentralization, ease of access, and circulation unequaled by any other cryptocurrency. But simply how decentralized is Bitcoin in truth? And how do we set about determining its decentralization? Before diving into these concerns, it’s vital to clarify the principles of centralization and decentralization, as they are typically muddled.

To offer a clear meaning, the centralization/decentralization dynamic can be comprehended as the degree of concentration/diffusion of authority amongst the individuals in a system. Here, “authority” refers to the power to affect the working and guidelines of the system, whether for harmful or benign functions. With this in mind, determining the degree of centralization in a system includes measuring the minimum variety of entities, individuals, needed to modify its performance or guidelines. The lower this number, the higher the degree of centralization. In a critical 2017 paper on the topic, Balaji S. Srinivasan and Leland Lee presented an informative metric for this function: the Nakamoto coefficient.

Derived from the Lorenz curve utilized in computing the Gini coefficient, the Nakamoto coefficient recognizes the minimum variety of individuals essential to compromise or manage the system. For circumstances, in the widely known circumstance of Bitcoin’s hashrate, if we presume that 5 mining swimming pools jointly have 50%+1 of the overall hashrate, then this number would be 5. This implies that an easy bulk of 50% of the hashrate would be appropriate to perform a double costs operation on the blockchain. However, the crucial limit might differ for other variables.

Different elements of centralization

Now, let’s attend to the core problem recognized by the authors of the paper: recognizing subsystems crucial to the performance of the system. When it comes to Bitcoin, focusing entirely on the concentration of hashrate (i.e., miners) stops working to record the complete spectrum of centralization/decentralization within the network and neglects the capacity for a 50%+1 attack.

Balaji S. Srinivasan and Leland Lee, in their post, propose 5 extra quantifiable subsystems of the Bitcoin Network: customer platform, code designers, nodes, custodial/exchanges, and ownership.

According to Balaji S. Srinivasan, the 6 measurements of centralization within the Bitcoin network are as follows:

• Client centralization

• Ownership centralization

• Node centralization

• Developers centralization

• Custodial/exchanges centralization

• Hashrate centralization

In addition, we may think about including one last measurement:

- Hardware Centralization

While this list is detailed, what’s doing not have is a qualitative evaluation of these measurements. Which amongst them are genuinely critical for Bitcoin’s network performance, and which are not?

For circumstances, one might argue that the customer or ownership variables aren’t as vital in determining Bitcoin’s decentralization.

In the very first case, Bitcoin Core stands as the de facto basic customer today. However, it deserves keeping in mind that this is an open-source software application authored by Satoshi Nakamoto himself. As long as it stays open-source, actively kept, and kept track of, its supremacy does not always correspond to vulnerability. It’s crucial to acknowledge the difference in between Bitcoin Core’s hegemony instead of a monopoly, as in theory, other functional customers exist—such as Bitcoin Knots, BTCD, Libbitcoin, BitcoinJ, Bitcoin Unlimited, Gocoin—that can support the Bitcoin procedure. Yet, in practice, really couple of network nodes make use of these options, preferring Nakamoto’s initial application. In this regard, in 2010, Satoshi Nakamoto himself stated: “I don’t believe a second, compatible implementation of Bitcoin will ever be a good idea.” Damage qualitative evaluation from 1 to 5: 2

As for the 2nd measurement noted above – the circulation of Bitcoin ownership – this unquestionably has substantial socio-economic ramifications however it does not straight impact Bitcoin’s facilities. Since Bitcoin depends on a proof-of-work algorithm, the power that Bitcoin owners have more than nodes and procedure operation is basically nil. The centralization of sat ownership might just end up being bothersome if currency concentration reaches such severe levels that weaken the network impact, affecting useful usage as a cash and shop of worth. Fortunately, as polarized as Bitcoin wealth might be, we are far from this point and according to numerous analyses, as Bitcoin adoption increases, the concentration of sats slowly reduces. Damage qualitative evaluation from 1 to 5: 3

Conversely, subsystems like nodes and coding are critical for attaining real network decentralization, being possibly the most crucial points within the Bitcoin system. The danger of node takeover and subsequent tough forks or collaborated harmful actions on the procedure positions substantial and enduring dangers to network trust. However, the likelihood of such incidents is currently low and have actually continuously reduced gradually, offered the growing variety of active or rapidly activatable nodes (around 16 thousand and 53 thousand respectively, according to the current recognized information) and their circulation throughout various areas, entities, and legal jurisdictions. Damage qualitative evaluation from 1 to 5: 5

In the latter case, the concentration of Bitcoin Core code designers – the so-called Core designers and maintainers – stays really high and perhaps increasing from a particular viewpoint: there are fairly couple of developers actively associated with composing and keeping the customer in spite of it being a crucial function for the whole technological facilities of the Bitcoin network. As these days, usually, in between 40 and 60 designers contribute to this job monthly with dedicates according to GitHub information. They choose willingly and separately when and how to contribute to the advancement of Bitcoin Core software application on GitHub. In practice, for many years, there has actually been a rather high turnover within this neighborhood of designers: it consists of both historic designers going back to the early variations of Bitcoin Core and numerous newbies who have actually signed up with more just recently. Many historic figures have actually left for many years, while others have actually re-aggregated later on, some run regularly and frequently, others in a restricted and erratic way. Within this group, which does not have a formalized hierarchy (and how could it, being Bitcoin an open-source job?), there are even less crucial designers, those who pull the strings of the neighborhood’s work. According to GitHub information, from its starts, 30% of the recognized dedicates to the Bitcoin Core master repository were made by just 2 designers, and in specific, practically 25% (significance 7347 out of an overall of 29,822 found dedicates) by Wladimir van der Laan alone, the previous Bitcoin’s Lead Maintainer. After his departure in 2022, there has actually not been a single organizer of deal with the Bitcoin Core code, however his massive contribution stays undeniable. As these days, directing the deal with Bitcoin Core advancement is a limiting management comprised of a couple of senior designers consisting of Gennady Stepanov, Michael Ford, Ava Chow, and Gloria Zhao, each concentrating on supervising a particular element of the customer.”

One might wonder if such a small and decentralized group of developers/maintainers contributing to the code today might be the Achilles’ heel among Bitcoin’s various subsystems, making the entire structure vulnerable to attack. A huge, complex, and highly valuable (not only economically) infrastructure like today’s Bitcoin network relies on the often part-time and mostly unpaid work of a few passionate supporters and maintainers. On the one hand, it’s true that individual nodes have the final say on the adoption of each new update/version of the Bitcoin Core client through the consensus mechanism. On the other hand, one might question how many nodes actually analyze the new code for vulnerabilities, harmful changes, or bugs before installing it.

What would happen if, hypothetically, gradual infiltrations of saboteurs occurred within the limited circle of Key Core developers and Maintainers, with the aim of first gaining trust and influence in the community and then hacking the new versions of the code? They could, for example, hide virtual time bombs within them (in the form of bugs or zero-day vulnerabilities). It’s a Machiavellian and complex hypothesis to execute, but not impossible, especially if we consider a gradual, covert operation conducted by entities with significant financial, human, and technological resources at their disposal and with a strong motivation to disrupt the network, such as the intelligence service of a powerful state. What would be the consequences of such an operation on Bitcoin if it were successful? Probably quite serious, if not existential. It could unleash chaos among nodes that unwittingly implemented the corrupted update, leading to forced hard forks with effects on the stability, integrity, and trust in the Bitcoin network. What a technological brute force attack couldn’t accomplish, social engineering aimed at dismantling consensus could. It’s difficult to estimate the probability of success of such an attack on the Bitcoin Core code, but the small number of individuals overseeing its development and maintenance, and the relative lack of interest from the wider user community in their valuable work (and, last but not least, their remuneration), make this subsystem particularly vulnerable to a well-conceived attack. Damage qualitative assessment from 1 to 5: 4

When considering the realm of custodial and exchange services, the trend toward greater or lesser centralization isn’t entirely clear-cut. While their numbers have soared since the early days of Bitcoin (think MtGOX), the lion’s share of trading volumes against fiat currencies today remains concentrated among a select few major players (Binance, Bybit, Coinbase, OKX, Kraken, Bitfinex, etc.). Specifically, as of today, three major entities hold more than 55% of the Bitcoin held in custody by third parties, while just Binance rules the volume of fiat-BTC transactions with 30% of total public exchanges. The risks stemming from excessive centralization in this specific subsystem aren’t so much tied to the security of the Bitcoin network itself, but rather to its convertibility with fiat currencies and the security of those delegating custody (i.e., all those Bitcoin users entrusting their sats and hence their “physical” ownership).

In the very first circumstance, increased centralization (a decrease in the variety of exchanges) would render the system more susceptible to collaborated legal or cyberattacks targeted at interfering with and possibly severing the link in between fiat currencies and Bitcoin. This follows the reasoning that less doors produce simpler locking. In the 2nd circumstance, under an oligopolistic routine, those going with custodial options rather of self-custody would deal with increased counterparty danger. This would arise from the reduced bargaining power of users towards custodial equivalents, who might then enforce more challenging financial conditions and more overbearing provisions (for instance, relating to gain access to to custodied bitcoins) than they might in a competitive environment.

Moreover, with just a few big operators efficient in managing substantial bitcoin amounts on behalf of their customers, the danger of abuses (such as non-consensual fractional reserve practices), hacking (the richer the target, the more attractive), and political-regulatory disturbance (consisting of collusion with public authorities, extreme policy, and bureaucratization) would be substantially greater compared to a more fragmented and competitive custodial system.

At the back of this counterparty danger spectrum lies the possibility of a 6102 attack: the massive seizure of bitcoins hung on exchanges and custodial wallets within a particular jurisdiction by legal action. While this would not straight affect the performance of the Bitcoin network, it would likely weaken rely on Bitcoin as a safe ways of payment and shop of worth amongst the public, consequently threatening its success as a totally free permissionless currency. Damage qualitative evaluation from 1 to 5: 3

We will not stay much on the hashrate/mining subsystem as both the problem of its decentralization and the possibility of 51% attacks have actually been evaluated and dissected numerous times without a doubt more reliable sources. We just remember here the most typical attack situations: double costs attack, selective deal censorship, and empty block attack. The repercussions of such attacks might be terrible and need to not be undervalued, however there is a large literature describing the restrictions of this kind of attack and the countermeasures that might be embraced by the node agreement to prevent it or a minimum of efficiently combat it. However, all in all, it stays among the most fragile and susceptible subsystems, if just due to its degree of centralization. In reality, 2 mining swimming pools – Foundry U.S.A. and Antpool – presently manage more than 50% of the hash rate. Damage qualitative evaluation from 1 to 5: 4

Finally, turning to the hardware measurement (initially missing in the work of Balaji S. Srinivasan and Leland), we require to evaluate the diversity of mining devices in regards to makers, designs, and their particular market shares of Bitcoin’s hashrate. It’s indisputable that nowadays the variety of hardware makers for mining (ASICs) has actually substantially increased compared to the past. Major business in the sector consist of Bitmain, Whatsminer, Canaan, Zhejiang Ebang Communication, Halong Mining, Helium, Bitfury, Bee Computing, and HIVE Blockchain. However, the overall hashrate of miners is presently controlled by a couple of ASIC designs and even less makers. According to current quotes by Coinmetrics, over 70% of the worldwide hashrate is produced by ASICs from a single leading business, Bitmain. Additionally, consisting of simply 3 other makers (Whatsminer, Canaan, and Ebang) represent practically all of the computational power utilized by the Bitcoin network. Moreover, the frustrating bulk of the hashrate is produced by just 7 ASIC designs from these previously mentioned business: Antminer S19xp, Antminer S19jpro, Antminer S19, Canaan 1246, Antminer S17, MicroBT m20s, and MicroBT m32.

The dangers of such centralization of hardware in regards to designs and makers are many. With really couple of big makers, mainly now situated in China, they might quickly be forced by federal governments and legislators of the jurisdictions they’re subject to, to stop production in their centers, turn over batches of made hardware, or covertly infiltrate backdoor hardware and trojans into their ASIC designs. The repercussions would instantly affect the mining subsystem, triggering instability and possibly a collapse in the network’s hashrate, leading to substantial financial losses for miners utilizing damaged ASICs or those not able to get brand-new ones. A substantially lower and extended hashrate would lower the security of the whole network, as it would increase the opportunities of a 51% attack, maybe exactly by the star who started the hardware attack. Here, we see how an attack on one badly decentralized subsystem can practically deteriorate another and therefore assault it in a harmful domino effect with unsafe repercussions for the stability of the Bitcoin network. Damage qualitative evaluation from 1 to 5: 3

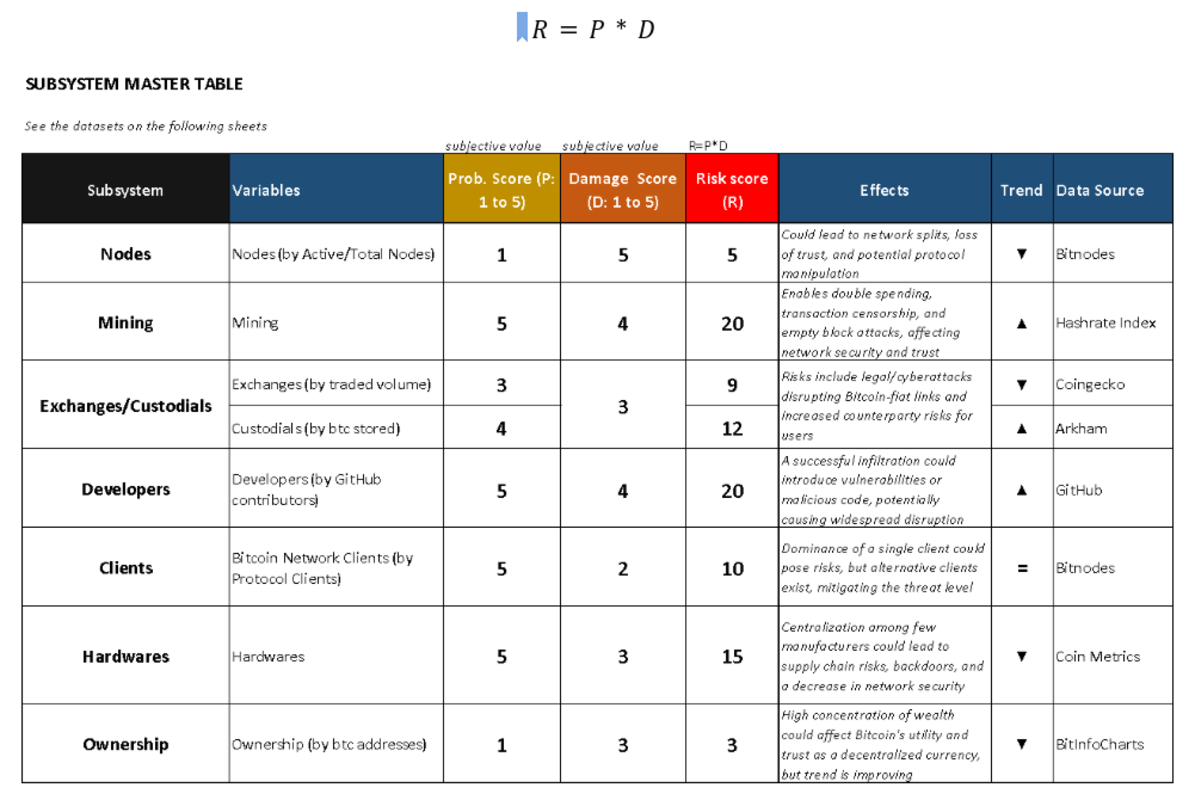

Given this non-exhaustive introduction of the numerous subsystems of Bitcoin and their vulnerabilities, we can venture to manufacture the 6 measurements into a single table. This table would determine the danger of centralization as a matrix in between likelihood (P) and damage occurrence (D, i.e.: the importance of impacts on the network), showing the characteristics towards increasing or reducing centralization.

A likelihood rating (P) is appointed on a scale from 1 to 5 based upon an inverted and non-linear function of the variety of entities needed to reach a provided crucial centralization limit. In other words, the higher the variety of existing entities needed to reach a particular limit, the lower the likelihood rating. The previously mentioned limit is a portion (often subjectively specified) of the overall projected variety of entities taking part in a provided subsystem, beyond which the system ends up being seriously susceptible to compromise. In some cases, this limit is unbiased, as when it comes to the mining measurement, while in others it is more approximate, such as when it comes to designers or the customer; nevertheless, in basic, it might be comprehended as the tipping point of centralization.

A damage variable (D) is also appointed a rating from 1 to 5. This is associated in relation to the unfavorable repercussions gotten out of an attack on the particular subsystem on the security, stability, and performance of the Bitcoin network as a whole.

This latter rating is clearly subjective and unquestionably might be subject to criticism and subsequent modifications by more extensive analyses.

Finally, the particular danger rating, which sums up the danger of centralization of each subsystem, is gotten from the item of these 2 ratings.

Geographical and Economic Decentralization

Other variations of the decentralization/centralization dichotomy can be recognized, which crossed the 7 types simply highlighted: geographical (jurisdictions) and financial (financial entities). Geographical decentralization attends to the concern: where are the nodes, wallets, exchanges/custodians, and miners physically and lawfully situated? Economic decentralization, on the other hand, worries the financial ownership of these entities: for instance, who owns the mining swimming pools? Or who manages the exchanges? The geographical and financial elements might appear overlapping in the beginning look, however in truth, they are not. For circumstances, there might be a Bitcoin environment where there are numerous independent miners, however all situated within the very same jurisdiction and therefore subject to the very same political-legal danger. Here, economic/ownership centralization would be low, while geographical centralization would be really high. Conversely, there might be numerous miner factories spread around the world however managed by the very same financial entity and for that reason efficiently thought about as a single point of failure. The very same argument might similarly use to nodes, hardware or bitcoin ownership. In a world controlled by states and big corporations, disregarding these aspects can be deadly. The simple variety of individuals in a Bitcoin subsystem informs us little about decentralization if they are mainly focused in a single jurisdiction or topic to the very same financial control. Therefore, both the qualitative geographical specification and the financial specification need to be incorporated into any effort to step the degree of decentralization of the Bitcoin network.

What modifications with ETFs?

The current introduction of Bitcoin ETFs in the United States market might have a substantial influence on the decentralization of the network, especially worrying the Custodial/Exchanges subsystem. While purchasing an ETF substantially streamlines gain access to to bitcoin efficiency compared to other fiduciary options, this alternative doubles (if not triples) the counterparty dangers for financiers. Those who “invest in bitcoin” through an ETF do not really have or own the properties; they are subject to both the counterparty danger of the ETF supervisor and that of the Custodial/Depository to which the ETF depends on (if the supervisor does not choose a not likely self-custody), in addition to the danger of the intermediary/broker through which they get the instrument. In practice, the expression “Not your keys, Not your coins” minimizes to an easy “Not Your Coins, goodbye” particularly when it comes to an hypothetical 6102 attack used on ETFs.

On a macro level, the very same arguments produced custodial/exchange entities use to passive funds on Bitcoin: the more they are used by institutional and retail financiers as a type of “investment in bitcoin,” the more bitcoin is soaked up into their masses. Consequently, their coercive power over users and legal (i.e., financial) power over other subsystems of the Bitcoin Network boost. If a particular Bitcoin ETF were to get a considerable (if not dominant) market share of distributing bitcoin gradually and methodically utilize its earnings to fund designers of the Bitcoin Core customer, it might affect their actions, guide customer applications, and therefore the advancement instructions of the whole network towards its desires. This would be a case where the centralization of one measurement (that of custodians through ETFs) leads to the centralization of a far more crucial measurement: that of designers gone over previously.

Conclusions

Upon analyzing numerous measurements of decentralization within the Bitcoin network, 2 crucial subsystems come to the leading edge due to their substantial importance and existing restricted decentralization: the mining/hashrate subsystem and the coding/developers subsystem. While conversations around the previous have actually been continuous considering that the beginning of the Bitcoin job, with disputes on many 51% attacks and their options, the latter has actually mainly been ignored or undervalued by experts. Despite the traditionally truthful and transparent habits of core designers, whose intents have actually regularly targeted at the authentic success of the innovation, this does not ensure the very same conduct in the future.

The mathematical shortage of Bitcoin Core designers, combined with the out of proportion code contributions from a choose couple of people compared to the overall individuals, positions dangers of seepage, hacking, and social adjustment that cannot be minimized. The inadequate variety of designers to guarantee an attack-proof level of decentralization may come from their restricted acknowledgment and monetary benefits within the Bitcoin user base and the larger worldwide programs neighborhood.

Whereas miners have a monetary reward predetermined by the procedure itself to take part constructively and consistently in the network, the very same cannot be stated for customer developers who do not have fixed, unbiased, or proportional compensation for the amount and quality of their work. Those amongst them who have not enriched themselves with Bitcoin in the network’s early days and/or do not act out of generous selflessness, have to depend on grants, scholarships, and contributions from third-party humanitarian entities to sustain themselves. The primary aids to Bitcoin Core designers presently originate from numerous companies and business in the Bitcoin Economy such as OpenSats, Spiral, Square Crypto, Chaincode, MIT DCI, Blockstream, Gemini, Coinbase, BitMEX, Hardcore Fund, and so on. Their contribution is vital, however their kindness is not always neutral or indifferent. It’s not a bad thing in itself, however what would take place if other less good-hearted donors, who likely have intents and interests not lined up with the success of Bitcoin, were to take their location?

This raises issues about possible disturbance from less benign donors, which might jeopardize the security and stability of the whole Bitcoin network. The restricted numbers, advertisement hoc cooperations, and unpredictable financial rewards make the function of core designers unappealing to most developers, rendering them susceptible to corruptive or manipulative actions.

To address these obstacles and incentivize the self-reliance, involvement, and retention of core designers, we describe a couple of concepts here.

At one extreme, we might have committed micro-crowdfunding platforms that solely offer restricted, non-refundable contributions from donors to prevent imbalances and excessive impacts from a couple of people. At the other end, a multilateral arrangement – optional however technically binding for signatories – amongst the huge gamers in the Bitcoin environment (miners, ETFs, exchanges, and so on.) in which they devote, verifiably by all, to contribute a predefined share of their profits to Bitcoin Core designers, therefore subjecting themselves to a type of voluntary self-taxation.

In both cases, technical application of reward systems might make use of DAOs, clever agreements, and layer-2 options to manage requirements for dispensation and anonymize payment circulations to designers.

Naturally, the 2 concepts pointed out are not equally special or definitive. Even less need to they be enforced from above. We consider them easy grassroots concepts to start a major argument on the requirement to worth the crucial function of Bitcoin developers without weakening their autonomy. An argument that, in our modest viewpoint, need to be urgently resumed amongst all those who think in the worth of this innovative innovation.

This is a visitor post by Michele Uberti. Opinions revealed are totally their own and do not always show those of BTC Inc or Bitcoin Magazine.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.