In the early phases of trade, when saving money people are just gradually awakening to understanding of the financial gains that can be stemmed from exploitation of existing exchange chances, their attention is, in keeping with the simpleness of all cultural starts, directed just to the most apparent of these chances.

In thinking about the products he will obtain in trade, each male measures just of their use-value to himself. Hence the exchange deals that are in fact carried out are limited naturally to scenarios in which saving money people have products in their ownership that have a smaller sized usage worth to them than products in the ownership of other saving money people who value the exact same products in reverse style. A has a sword that has a smaller sized usage worth to him than B’s till, while to B the exact same plough has a smaller sized usage worth than A’s sword—at the start of human trade, all exchange deals in fact carried out are limited to cases of this sort.

It is easy to see that the number of exchanges in fact carried out should be really directly restricted under these conditions. How seldom does it occur that a great in the ownership of a single person has a smaller sized usage worth to him than another great owned by another individual who values these products in specifically the opposite method at the exact same time! And even when this relationship exists, just how much rarer still should scenarios remain in which the 2 individuals in fact fulfill each other! A has a fishing web that he wish to exchange for an amount of hemp. For him to be in a position in fact to perform this exchange, it is not just essential that there be another saving money person, B, who wants to offer an amount of hemp representing the desires of A for the fishing web, however also that the 2 saving money people, with these particular desires, fulfill each other. Suppose that Farmer C has a horse that he wish to exchange for a number of farming carries out and clothing. How not likely it is that he will discover another individual who requires his horse and is, at the exact same time, both ready and in a position to offer him all the carries out and clothing he desires to have in exchange.

This trouble would have been overwhelming, and would have seriously impeded development in the department of labor, and above all in the production of products for future sale, if there had actually not been, in the very nature of things, an escape. But there were components in their circumstance that all over led males undoubtedly, without the requirement for an unique arrangement or perhaps federal government obsession, to a state of affairs in which this trouble was totally gotten rid of.

The direct arrangement of their requirements is the supreme function of all the financial ventures of males. The last end of their exchange operations is for that reason to exchange their products for such products as have use-value to them. The venture to achieve this last end has actually been similarly particular of all phases of culture and is totally appropriate financially. But saving money people, would certainly be acting uneconomically if, in all circumstances in which this last end cannot be reached instantly and straight, they were to abandon approaching it completely.

Assume that a smith of the Homeric age has actually made 2 fits of copper armor and wishes to exchange them for copper, fuel, and food. He goes to market and uses his items for these products. He would doubtless be really delighted if he were to experience individuals there who want to acquire his armor and who, at the exact same time, have for sale all the raw products and foods that he requires. But it should certainly be thought about an especially delighted mishap if, amongst the little number of individuals who at any time desire to acquire a great so challenging to offer as his armor, he needs to discover any who are providing specifically the products that he requires. He would, for that reason, make the marketing of his products either completely difficult, or possible just with the expense of a lot of time, if he were to act so uneconomically regarding want to take in exchange for his products just products that have usage worth to himself and not also other products which, although they would have commodity-character to him, however have higher marketability than his own product. Possession of these products would substantially facilitate his look for individuals who have simply the products he requires.

In the times of which I am speaking, livestock were, as we will see below, the most salable of all products. Even if the armorer is currently adequately supplied with livestock for his direct requirements, he would be acting really uneconomically if he did not offer his armor for a number of extra livestock. By so doing, he is of course not exchanging his products for intake products (in the narrow sense in which this term is opposed to “products”) however just for products that also have commodity-character to him. But for his less salable products he is acquiring others of higher marketability. Possession of these more salable products plainly increases his opportunities of finding individuals on the marketplace who will provide to offer him the products that he requires. If our armorer properly acknowledges his private interest, for that reason, he will be led naturally, without obsession or any unique arrangement, to offer his armor for a matching number of livestock. With the more salable products gotten in this method, he will go to individuals at the marketplace who are providing copper, fuel, and food for sale, in order to attain his supreme goal, the acquisition by trade of the intake products that he requires. But now he can continue to this end far more rapidly, more financially, and with a considerably improved likelihood of success.

As each saving money private ends up being progressively more mindful of his financial interest, he is led by this interest, with no arrangement, without legal obsession, and even without regard to the general public interest, to offer his products in exchange for other, more salable, products, even if he does not require them for any instant intake function. With financial development, for that reason, we can all over observe the phenomenon of a particular number of products, particularly those that are most quickly salable at a provided time and location, ending up being, under the effective impact of custom-made, appropriate to everybody in trade, and hence capable of being given up exchange for any other product. These products were called “Geld” by our forefathers, a term stemmed from “gelten” which indicates to compensate or pay. Hence the term “Geld” in our language designates the ways of payment as such.

The excellent value of custom-made in the origin of money can be seen instantly by thinking about the procedure, explained above, by which particular products ended up being money. The exchange of less quickly salable products for products of higher marketability remains in the financial interest of everyeconomizing person. But the real efficiency of exchange operations of this kind presupposes an understanding of their interest on the part of saving money people. For they should want to accept in exchange for their products, since of its higher marketability, a great that is maybe itself rather worthless to them.

This understanding will never ever be obtained by all members of an individuals at the exact same time. On the contrary, just a little number of saving money people will in the beginning acknowledge the benefit accumulating to them from the approval of other, more salable, products in exchange for their own whenever a direct exchange of their products for the products they want to take in is difficult or extremely unpredictable. This benefit is independent of a basic recognition of any one product as money. For an exchange of this sort will constantly, under any situations whatsoever, bring a saving money private substantially nearer to his last end, the acquisition of the products he wants to take in.

Since there is no much better method which males can end up being informed about their financial interests than by observation of the financial success of those who utilize the appropriate ways of accomplishing their ends, it appears that absolutely nothing preferred the increase of money even the long-practiced, and financially rewarding, approval of incomparably salable products in exchange for all others by the most critical and most capable saving money people. In by doing this, custom-made and practice contributed in no little degree to transforming the products that were most salable at a provided time into products that became accepted, not simply by numerous, however by all saving money people in exchange for their own products.

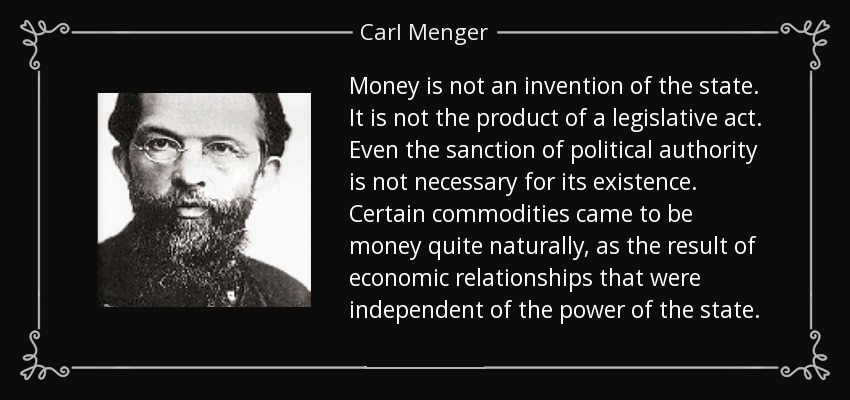

Within the borders of a state, the legal order generally has an impact on the money-character of products which, though little, cannot be rejected. The origin of money (as unique from coin, which is just one range of money) is, as we have actually seen, totally natural and hence shows legal impact just in the rarest circumstances. Money is not a development of the state. It is not the item of a legal act. Even the sanction of political authority is not essential for its presence. Certain products became money rather naturally, as the outcome of financial relationships that were independent of the power of the state.

What do you think of Carl Menger’s Origin of Money essay? Let us understand in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.