This article highlights findings from CoinDesk Research’s new ‘Spotlight Study’ on blockchain token gross sales (or ICOs).

Based on a survey of 400+ blockchain entrepreneurs, traders and builders, the report highlights key findings in what analysts consider is likely one of the trade’s most fun – however opaque – markets and purposes.

For extra of our reviews, please go to CoinDesk Research.

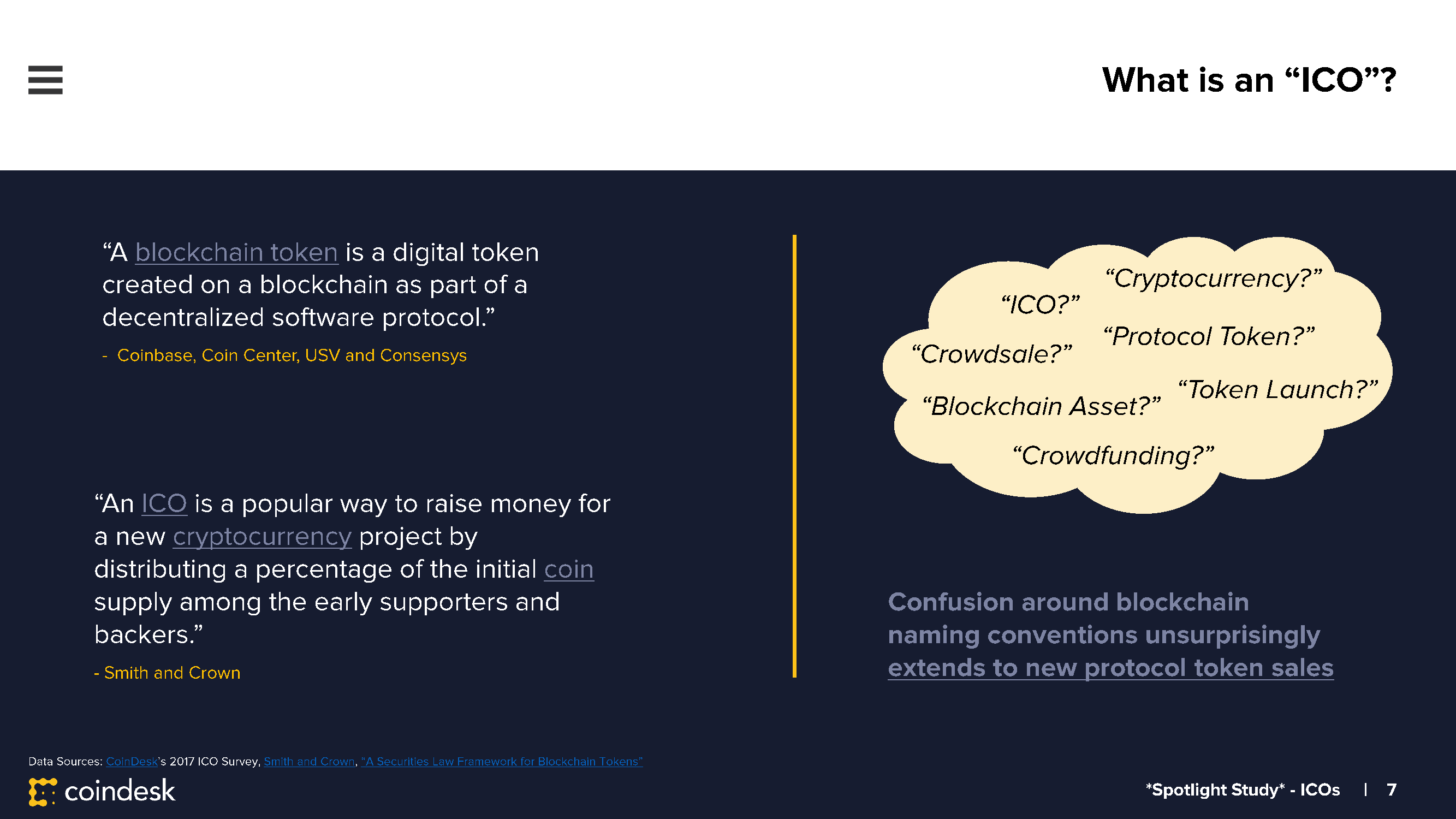

CoinDesk Research is proud to disclose the outcomes of its first ‘Spotlight Study’ of 2017: a free, in-depth take a look at the present state of blockchain token gross sales, a fundraising and product distribution course of usually colloquially known as an ‘preliminary coin providing’ (ICO).

Based on a survey of 400-plus blockchain entrepreneurs, traders and fans, the report highlights key findings in what analysts consider is likely one of the trade’s most fun – however opaque – areas of innovation and progress.

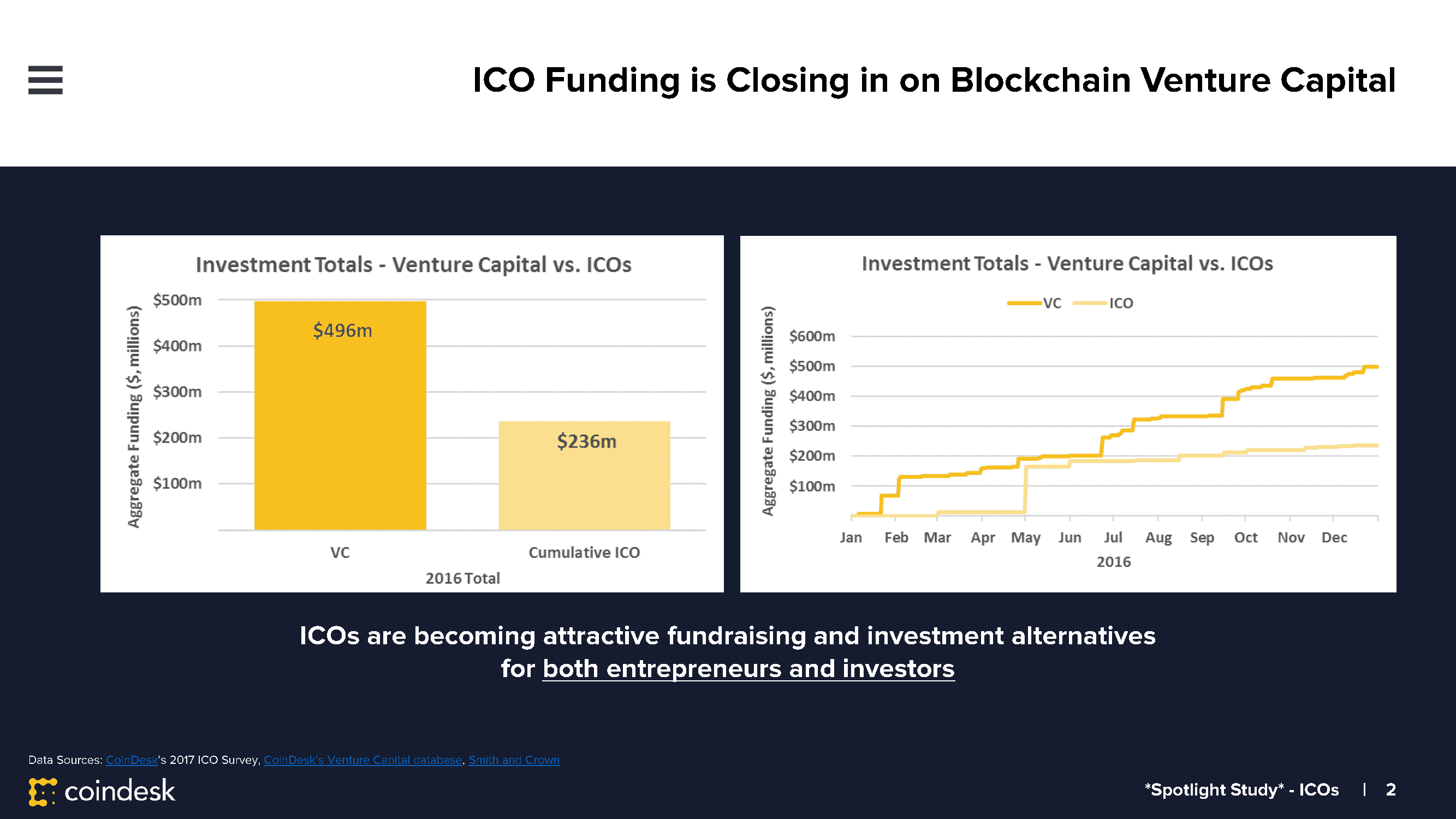

Most notably, maybe, the recognition of ICOs continued to realize traction in 2016 as complete funds diverted to such tasks approached half (48%) of the trade’s complete enterprise capital funding.

While a big portion of this capital was invested in a single, failed mission, The DAO, we consider the determine nonetheless hints on the potential of this rising – and admittedly opaque – sector of the trade.

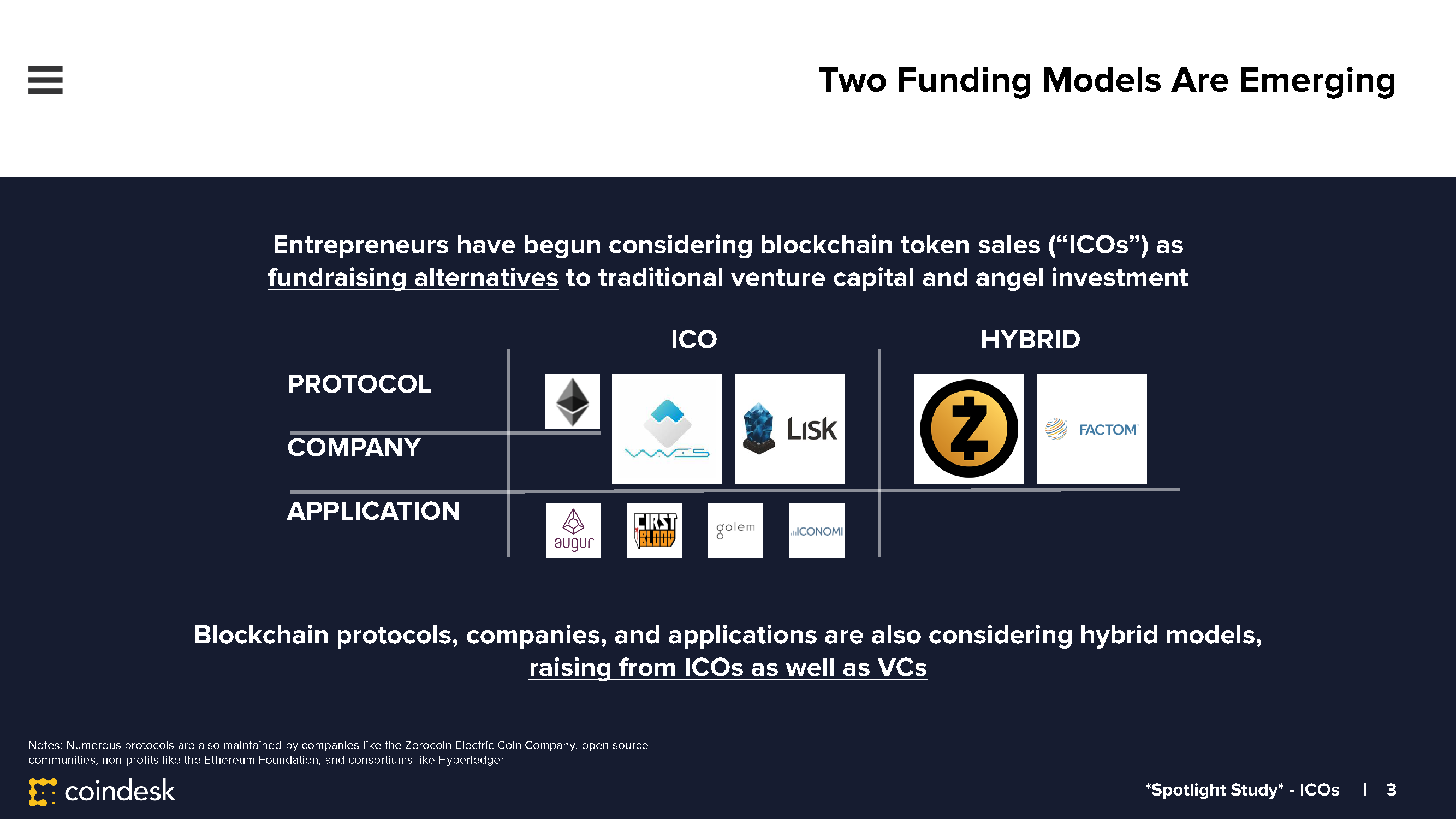

The outcomes additionally revealed the beginning of an evolution in the kind of funding coming to market, with firms and protocols like Factom exploring elevating funding from each conventional enterprise traders and the retail public.

Funds like Polychain Capital have additionally emerged to speculate institutional capital into tokens that had been not too long ago comprised nearly solely by retail traders, and now even enterprise companies themselves, similar to Blockchain Capital, are reportedly contemplating issuing and promoting their very own blockchain tokens.

Two sides of the coin

In the examine, CoinDesk Research tapped into its massive community of accelerators, enterprise capital companies, unbiased entrepreneurs, cryptocurrency fans and traders to get an thought of total market sentiment, in addition to the distinction between the ‘entrepreneurial’ and ‘investor’ views on the ICO phenomenon.

Our ‘entrepreneurial’ phase was comprised of largely (86%) these working at startups with lower than 10 workers or $1m raised or in the financial institution, whereas a overwhelming majority (89%) of our ‘investor’ phase had vital expertise investing in bitcoin and inspecting ICOs for his or her private portfolios.

Entrepreneur outcomes had been analyzed to get a perspective of how startups are taking a look at token gross sales for potential fundraising choices, whereas ‘investor’ outcomes had been analyzed to get a perspective on the opposite aspect of the market – the precise purchasers of recent blockchain tokens.

This group included retail traders and institutional capital, and all the explanations they might be investing in an ICO – whether or not to work together and use a new blockchain protocol or software, or purely in an try to revenue from token worth appreciation.

Despite the potential attract of fundraising for, or investing in, rising blockchain tasks with token gross sales, each the trade and the ICO development are nonetheless very a lot in their infancy, and entrepreneurs and traders present a mix of warning and curiosity when contemplating naming conventions, token buildings and authorized frameworks, because the outcomes of our survey point out.

Initiatives are additionally creating to assist inform and information these contemplating token sale launches, and the ideas behind printed ‘core principals’ have began to form the minds of these getting concerned.

ICO curiosity

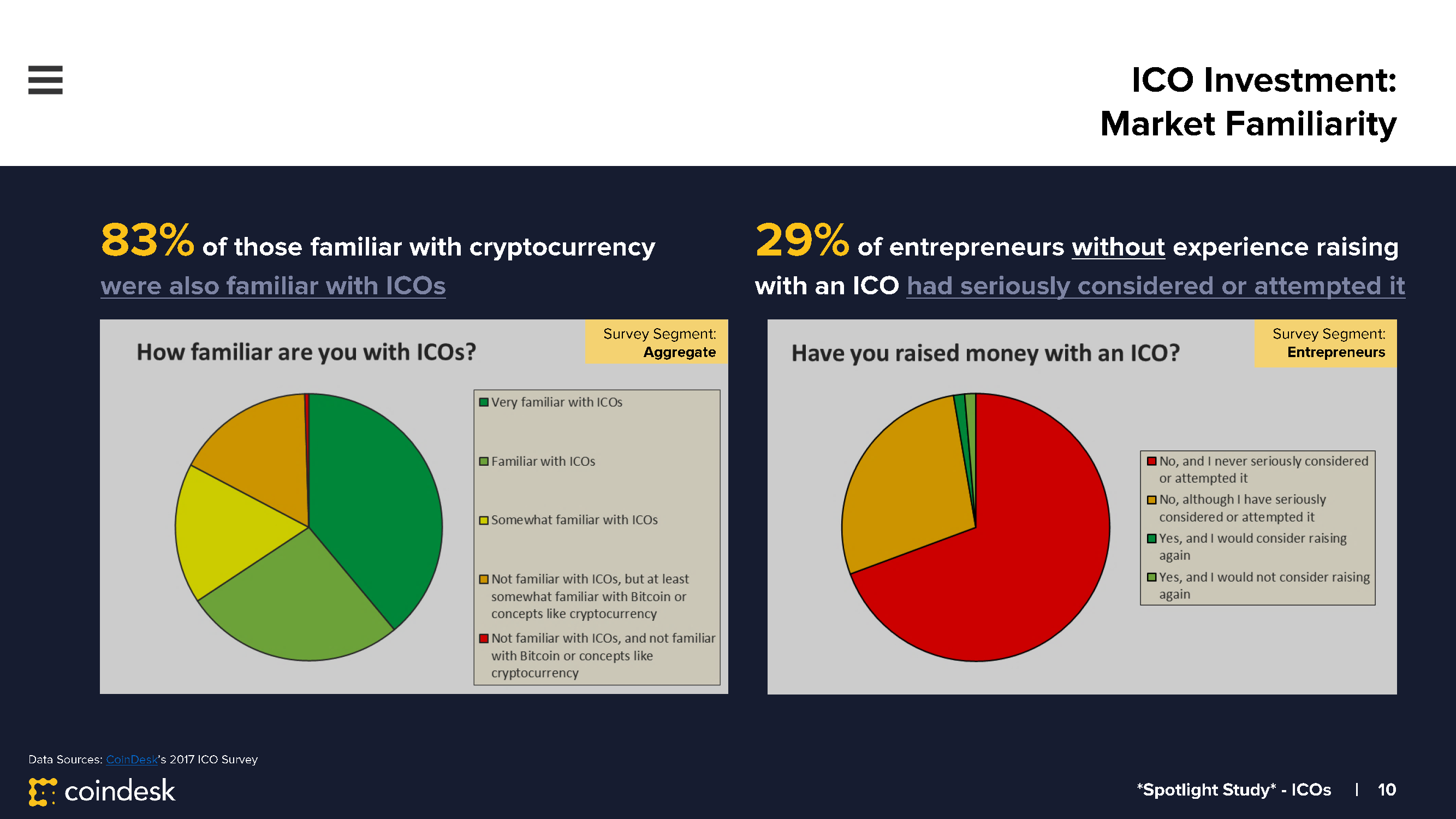

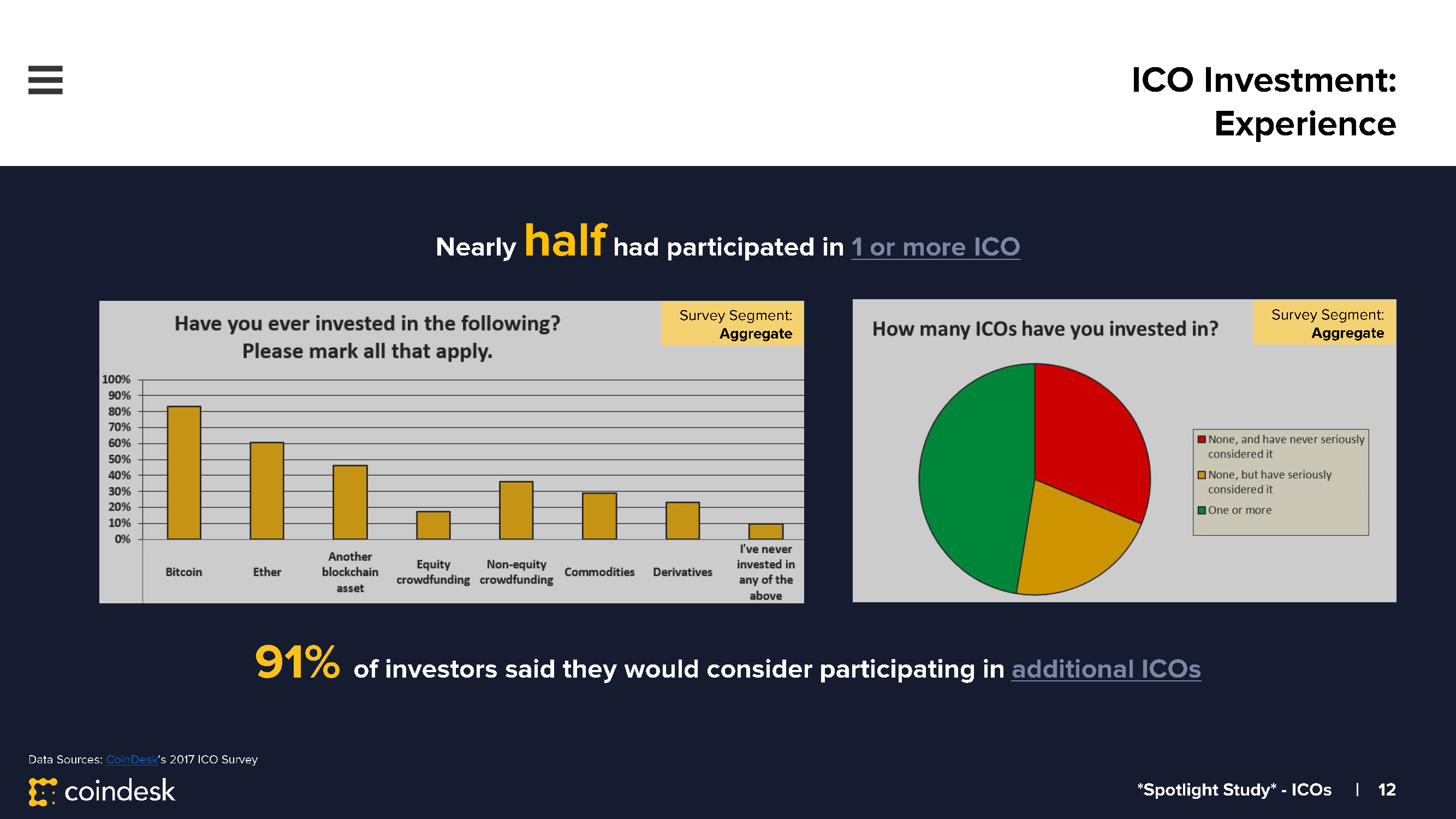

Conducted in January 2017, the CoinDesk Research survey discovered that a big majority (83%) of surveyed individuals accustomed to cryptocurrency had been additionally accustomed to ICOs, and practically half (47%) had participated in a token sale.

Perhaps most notably, nearly a 3rd (29%) of entrepreneurs with out ICO fundraising expertise had critically thought of elevating with a token sale, and practically all (91%) of traders who had participated in an ICO stated they might contemplate taking part in future blockchain token launches.

Also noteworthy was that survey respondents had considerably higher expertise investing in blockchain belongings like bitcoin and ether than extra conventional options like commodities (for instance, gold or silver) or crowdfunding (for instance, startups on AngelList).

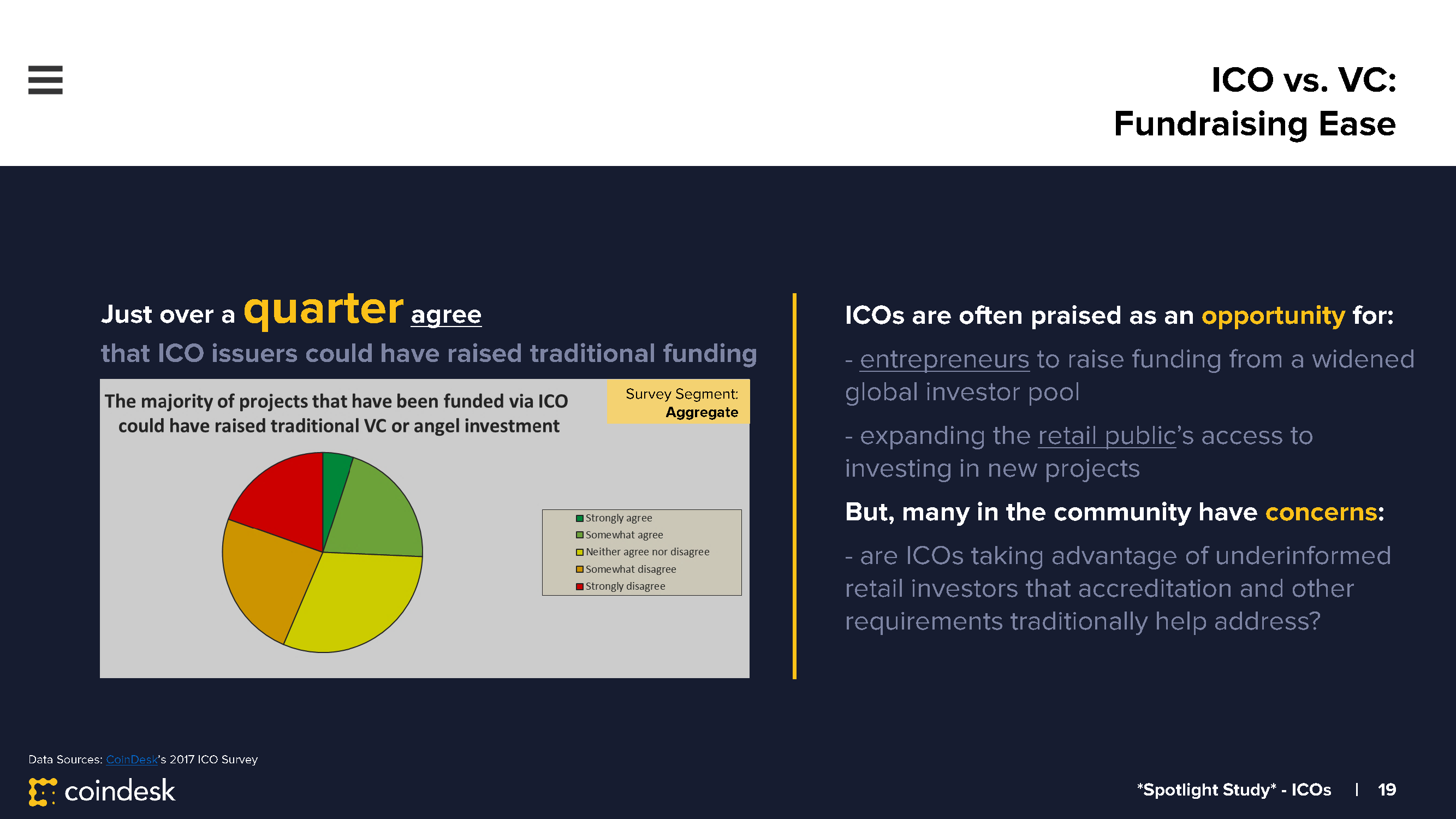

In complete, solely a couple of quarter (26%) consider ICO issuers may have efficiently raised conventional enterprise capital or angel funding funding as a substitute for their token gross sales, whereas practically half (44%) didn’t assume conventional fundraising efforts would have labored.

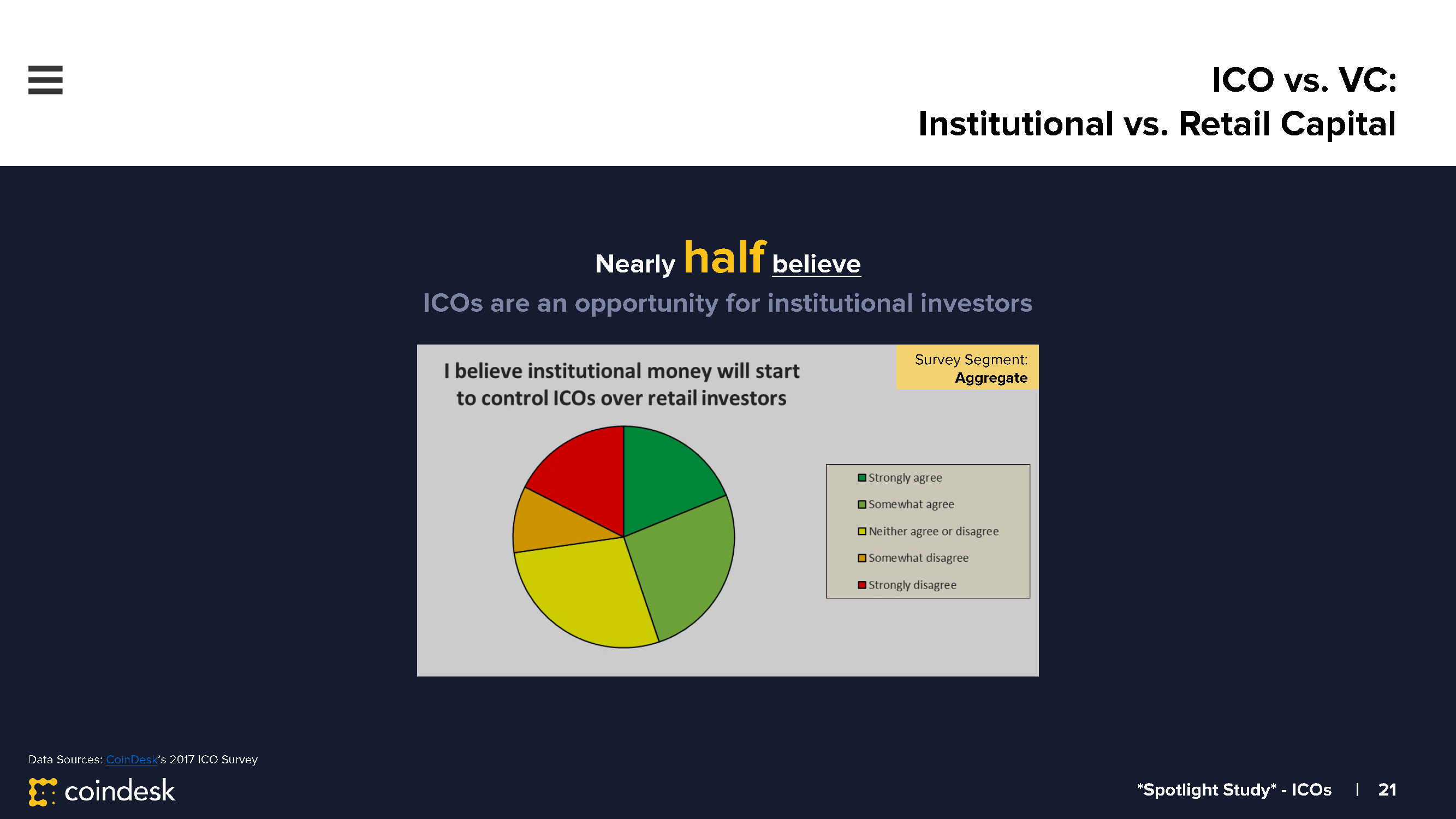

The survey additional revealed that respondents consider institutional capital will quickly start to regulate ICOs over retail traders, maybe suggesting the standard of token gross sales and the blockchain tasks they help is seen to be growing, inflicting extra conventional traders to start to take be aware.

Nearly half of all respondents (45%) assume token gross sales have gotten a chance for institutional traders, whereas solely simply over 1 / 4 (27%) thought retail traders would proceed to dominate token sale allocations.

These weren’t the one findings from the intensive survey, nonetheless.

For extra findings and takeaways on ICOs and the complete blockchain ecosystem, together with an expanded deep dive into enterprise blockchain tasks, look out for our full 2017 State of Blockchain analysis report set to go reside subsequent week!

For our earlier quarterly and annual reviews, please go to CoinDesk Research.

Image by way of Alex Sunnarborg for CoinDesk

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.