Following 3 successive days of losses shedding $50 billion off the cryptoconomy, digital currency markets lost another $44 billion in a matter of hours on March 12. Not just did ‘Black Thursday’ wreck conventional markets, however gold and bitcoin felt the impact too. Amidst the sell-off, the whistleblower Edward Snowden stated that he “seemed like buying bitcoin” as he thinks the rate drop was conjured up by “panic” instead of basics.

Whistleblower Edward Snowden ‘Felt Like Buying Bitcoin’ on Black Thursday Calling the Sell-Off ‘Too Panicky’

The cryptoconomy was punched straight in the gut on March 12, as BTC rates moved from $7,648 per coin to a low of $3,870 on Thursday afternoon. The drop was the most significant in 2020 and the least expensive dip BTC markets have actually seen given that March 2019. Crypto rates have actually rebounded a hair given that the market thrashing on Thursday and BTC is presently hovering in between $5,300-5,600 per coin. During the course of ‘Black Thursday,’ numerous financiers who entered into crypto early stated that even they were shaken by the speedy failure.

“Doesn’t matter that I’ve been around bitcoin for a very long time, which my bullish case is still undamaged – seeing this ruthless 1-day relocation provides me stress and anxiety. Sitting tight can be the hardest thing,” Tuur Demeester tweeted on Thursday. “I’ve been doing this a while, given that 2014 expertly and prior to that personally,” said Alistair Milne. “Let me simply state that this is right up there with the most OMG, adrenalin-pumping minutes I’ve ever experienced in Bitcoin/crypto. Sincerely hope everybody is OKAY.”

Meanwhile, as the rate of BTC and most other digital possessions dropped like a falling knife, the infamous whistleblower Edward Snowden stated that it was the very first time in a while he seemed like acquiring bitcoin. Snowden’s Thursday night tweet stated:

This is the very first time in a while I’ve seemed like buying bitcoin. That drop was excessive panic and insufficient factor.

It’s not the very first time Snowden has actually spoken about cryptocurrencies, as he’s discussed bitcoin in the past on different events. In September 2019, the U.S. Department of Justice (DoJ) revealed a claim versus Snowden and chose to take all the follows his book sales. A couple of hours after the DoJ suit went viral on the web, Snowden tweeted: “In conclusion, this is excellent for bitcoin.”

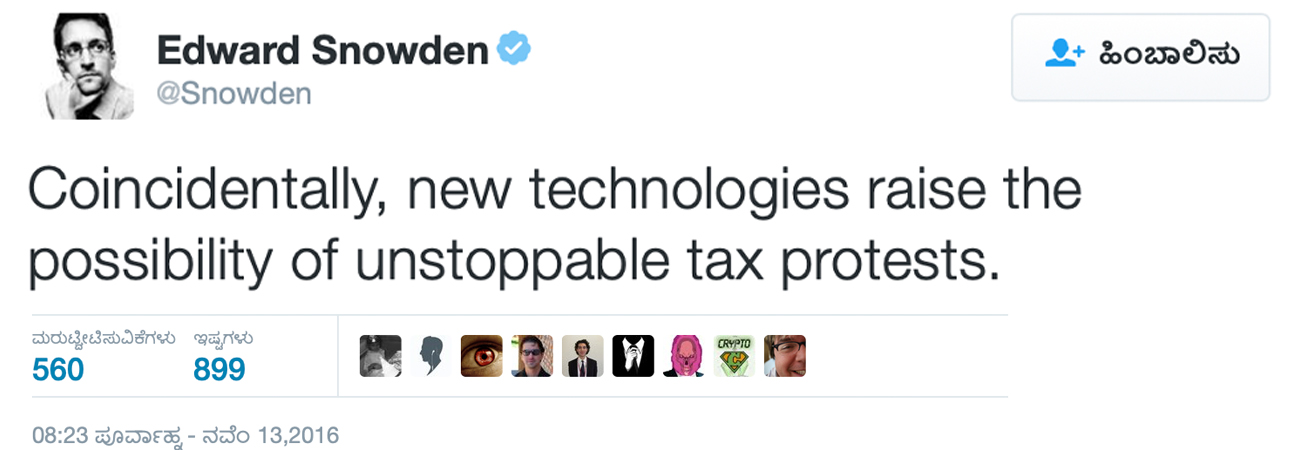

Snowden also did an interview with the American Civil Liberties Union in 2018 where called the innovation the “initially totally free cash” system in the world. “Bitcoin might not yet actually be personal cash, however it is the very first ‘totally free’ cash,” Snowden mentioned throughout the conversation. In 2016, the whistleblower also as soon as stated that “brand-new innovations raise the possibility of unstoppable tax demonstrations.”

‘A Serious Monetary Alternative’

Snowden’s newest bitcoin tweet was invited by the crypto neighborhood and the tweet has actually been retweeted 2.6K times and has more than 12,000 likes at the time of publication. “In times of systemic interruptions Bitcoin need to be viewed as a major financial option,” Bisq’s Manfred Karrer said in action to Snowden’s tweet. “Printing cash like hell will have now an ethical validation in contrast to occasions prior to like the bank bailout 2009, therefore causing an overall overshoot and a severe tension test.”

A variety of crypto lovers shared the very same belief on Thursday, despite the fact that lots of people were liquidated and lost a considerable amount of their portfolio’s worth. “I’m buying. This is why bitcoin was developed,” tweeted Digital Currency Group creator Barry Silbert on Thursday. Francis Pouliot the creator of Bull Bitcoin stated that he discovered a lot more buying than typical throughout the market thrashing. Pouliot composed:

If it’s any alleviation, Bull Bitcoin is having its busiest day of the year. Inbox and brand-new sign-ups blowing up. Had to cancel my strategies to strike the beach. People are most absolutely FOMO buying the bitcoin dip at the OTC level. Twice more deals from purchasers than sellers.

Bitcoin Proponents and Crypto Traders Debate the Elusive Price ‘Bottom’

Snowden’s tweet has actually consoled traders and crypto supporters who now think the bitcoin bottom remains in. “Just earned money in bitcoin at the outright bottom,” one bitcoiner tweeted. “In all severity, if this isn’t the bottom then we’re in for an awful couple of months/year,” a trader composed after the dust settled. “Bitcoin is sculpting short-term bottom near $4K after an enormous 50% decrease,” tweeted Cryptoveins.

“Bitcoin is down more than 50% and broke numerous essential assistances such as $5,000 versus the U.S. dollar. BTC rate appears to be forming a short-term bottom near $4,000 and it might recuperate,” the expert included.

I question the low remains in. Maybe a pause/bounce for now prior to the next drop lower to 3100. I’m on sidelines for now #btc

— TraderSZ (@trader1sz) March 13, 2020

Meanwhile, regardless of Snowden’s tweet and other ‘bottom’ feeders like Barry Silbert, a couple of doubters wear’t think the outright bottom remains in. “No method it’s in,” crypto supporter Savage BTC explained. “Now that we understand bitcoin is associated to every monetary possession in the world, the very first concern should be, is the market bottoms in? Which is extremely not likely considering we sanctuary’t seen any earning for business post [coronavirus].” The popular cryptocurrency trader Peter Brandt who called the BTC top in 2017 appears to have a bearish outlook too.

“If I analyze the chart without predisposition, I would state sub $1,000,” Brandt tweeted.

What do you think of Snowden tweeting that ‘Black Thursday’ was the very first time in a while he seemed like buying bitcoin? What do you think of the argument about whether the BTC bottom remains in? Do you believe the bottom remains in? Let us understand what you think of this topic in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.