The following is a heuristic evaluation of GBTC outflows and isn’t supposed to be strictly mathematical, however as an alternative to function a instrument to assist folks perceive the present state of GBTC promoting from a excessive stage, and to estimate the dimensions of future outflows that will happen.

Number Go Down

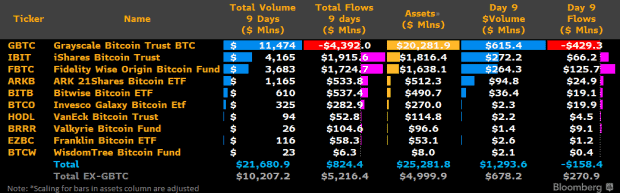

January 25, 2024 – Since Wall Street got here to Bitcoin beneath the auspices of Spot ETF approval, the market has been met with relentless promoting from the most important pool of bitcoin on the planet: the Grayscale Bitcoin Trust (GBTC) which held greater than 630,000 bitcoin at its peak. After conversion from a closed-end fund to a Spot ETF, GBTC’s treasury (3% of all 21 million bitcoin) has bled greater than $4 billion throughout the first 9 days of ETF buying and selling, whereas different ETF contributors have seen inflows of roughly $5.2 billion over that very same interval. The outcome – $824 million in internet inflows – is considerably stunning given the sharply unfavorable value motion because the SEC lent its stamp of approval.

In making an attempt to forecast the near-term value influence of Spot Bitcoin ETFs, we should first perceive for how lengthy and to what magnitude GBTC outflows will proceed. Below is a assessment of the causes of GBTC outflows, who the sellers are, their estimated relative stockpiles, and the way lengthy we will anticipate the outflows to take. Ultimately these projected outflows, regardless of being undoubtedly giant, are counterintuitively extraordinarily bullish for bitcoin within the medium-term regardless of the draw back volatility that we’ve got all skilled (and maybe most didn’t anticipate) post ETF-approval.

The GBTC Hangover: Paying For It

First, some housekeeping on GBTC. It is now plainly clear simply how essential of a catalyst the GBTC arbitrage commerce was in fomenting the 2020-2021 Bitcoin bull run. The GBTC premium was the rocket gasoline driving the market increased, permitting market contributors (3AC, Babel, Celsius, Blockfi, Voyager and many others.) to accumulate shares at internet asset worth, all of the whereas marking their ebook worth as much as embrace the premium. Essentially, the premium drove demand for creation of GBTC shares, which in flip drove bidding for spot bitcoin. It was mainly danger free…

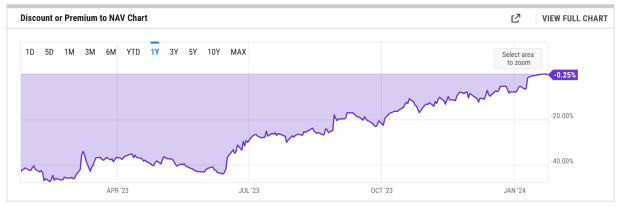

While the premium took the market increased throughout the 2020+ bull run and billions of {dollars} poured in to seize the GBTC premium, the story rapidly turned bitter. As the GBTC golden goose ran dry and the Trust started buying and selling below NAV in February 2021, a daisy chain of liquidations ensued. The GBTC low cost basically took the stability sheet of all the business down with it.

Sparked by the implosion of Terra Luna in May 2022, cascading liquidations of GBTC shares by events like 3AC and Babel (the so-called “crypto contagion”) ensued, pushing the GBTC low cost down even additional. Since then, GBTC has been an albatross across the neck of bitcoin, and continues to be, because the chapter estates of these frolicked to dry on the GBTC “risk free” commerce are nonetheless liquidating their GBTC shares to today. Of the aforementioned victims of the “risk free” commerce and its collateral injury, the FTX property (the most important of these events) lastly liquidated 20,000 BTC throughout the primary 8 days of Spot Bitcoin ETF buying and selling with the intention to pay again its collectors.

It is also essential to notice the position of the steep GBTC low cost relative to NAV and its influence on spot bitcoin demand. The low cost incentivized traders to go lengthy GBTC and quick BTC, amassing a BTC-denominated return as GBTC crept again up towards NAV. This dynamic additional siphoned spot bitcoin demand away – a poisonous mixture that has additional plagued the market till the GBTC low cost just lately returned to near-neutral post ETF approval.

With all that stated, there are appreciable portions of chapter estates that also maintain GBTC and can proceed to liquidate from the stockpile of 600,000 BTC that Grayscale owned (512,000 BTC as of January 26, 2024). The following is an try to spotlight totally different segments of GBTC shareholders, and to then interpret what extra outflows we might even see in accordance with the monetary technique for every section.

Optimal Strategy For Different Segments Of GBTC Owners

Simply put, the query is: of the ~600,000 Bitcoin that have been within the belief, what number of of them are prone to exit GBTC in complete? Subsequently, of these outflows, what number of are going to rotate again right into a Bitcoin product, or Bitcoin itself, thus largely negating the promoting stress? This is the place it will get difficult, and figuring out who owns GBTC shares, and what their incentives are, is essential.

The two key elements driving GBTC outflows are as follows: price construction (1.5% annual price) and idiosyncratic promoting relying on every shareholder’s distinctive monetary circumstance (value foundation, tax incentives, chapter and many others.).

Bankruptcy Estates

Estimated Ownership: 15% (89.5m shares | 77,000 BTC)

As of January 22, 2024 the FTX property has liquidated its whole GBTC holdings of 22m shares (~20,000 BTC). Other bankrupt events, together with GBTC sister firm Genesis Global (36m shares / ~32,000 BTC) and a further (not publicly recognized) entity holds roughly 31m shares (~28,000 BTC).

To reiterate: chapter estates held roughly 15.5% of GBTC shares (90m shares / ~80,000 BTC), and certain most or all of those shares will probably be offered as quickly as legally attainable with the intention to repay the collectors of those estates. The FTX property has already offered 22 million shares (~20,000 BTC), whereas it’s not clear if Genesis and the opposite social gathering have offered their stake. Taking all of this collectively, it’s doubtless that a good portion of chapter gross sales have already been digested by the market aided in no small half by FTX ripping off the bandaid on January 22, 2024.

One wrinkle so as to add to the chapter gross sales: these will doubtless not be easy or drawn out, however extra lump-sum as within the case of FTX. Conversely, different forms of shareholders will doubtless exit their positions in a extra drawn-out method relatively than liquidating their holdings in a single fell swoop. Once authorized hangups are taken care of, it is extremely doubtless that 100% of chapter property shares will probably be offered.

Retail Brokerage & Retirement Accounts

Estimated Ownership: 50% (286.5m shares | 255,000 BTC)

Next up, retail brokerage account shareholders. GBTC, as one of many first passive merchandise obtainable for retail traders when it launched in 2013, has a large retail contingency. In my estimation, retail traders maintain roughly 50% of GBTC shares (286m shares / ~255,000 bitcoin). This is the trickiest tranche of shares to venture when it comes to their optimum path ahead as a result of their choice to promote or not will rely upon the worth of bitcoin, which then dictates the tax standing for every share buy.

For instance, if the worth of bitcoin rises, a higher proportion of retail shares will probably be in-profit, which means in the event that they rotate out of GBTC, they’ll incur a taxable occasion within the type of capital beneficial properties, thus they’ll doubtless keep put. However, the inverse is true as nicely. If the worth of bitcoin continues to fall, extra GBTC traders is not going to incur a taxable occasion, and thus will probably be incentivized to exit. This potential suggestions loop marginally will increase the pool of sellers that may exit with no tax penalty. Given GBTC’s distinctive availability to these early to bitcoin (subsequently doubtless in revenue), it’s doubtless that the majority retail traders will keep put. To put a quantity on it, it’s possible that 25% retail brokerage accounts will promote, however that is topic to alter relying upon bitcoin value motion (as famous above).

Next up we’ve got retail traders with a tax exempt standing who allotted through IRAs (retirement accounts). These shareholders are extraordinarily delicate to the price construction and might promote with no taxable occasion given their IRA standing. With GBTC’ egregious 1.5% annual price (six instances that of GBTC’s opponents), it’s all however sure a good portion of this section will exit GBTC in favor of different spot ETFs. It is probably going that ~75% of those shareholders will exit, whereas many will stay as a result of apathy or misunderstanding of GBTC’s price construction in relation to different merchandise (or they merely worth the liquidity that GBTC affords in relation to different ETF merchandise).

On the intense facet for spot bitcoin demand from retirement accounts, these GBTC outflows will doubtless be met with inflows into different Spot ETF merchandise, as they’ll doubtless simply rotate relatively than exiting bitcoin into money.

Institutional Shareholders

Estimated Ownership: 35% (200,000,000 shares | 180,000 BTC)

And lastly, we’ve got the establishments, which account for about 180,000 bitcoin. These gamers embrace FirTree and Saba Capital, in addition to hedge funds that wished to arbitrage the GBTC low cost and spot bitcoin value discrepancy. This was finished by going lengthy GBTC and quick bitcoin with the intention to have internet impartial bitcoin positioning and seize GBTC’s return to NAV.

As a caveat, this tranche of shareholders is opaque and arduous to forecast, and also acts as a bellwether for bitcoin demand from TradFi. For these with GBTC publicity purely for the aforementioned arbitrage commerce, we will assume they won’t return to buy bitcoin via some other mechanism. We estimate traders of this sort to make up 25% of all GBTC shares (143m shares / ~130,000 BTC). This is certainly not sure, however it will motive that higher than 50% of TradFi will exit to money with out returning to a bitcoin product or bodily bitcoin.

For Bitcoin-native funds and Bitcoin whales (~5% of complete shares), it’s doubtless that their offered GBTC shares will probably be recycled into bitcoin, leading to a net-flat influence on bitcoin value. For crypto-native traders (~5% of complete shares), they’ll doubtless exit GBTC into money and different crypto property (not bitcoin). Combined, these two cohorts (57m shares / ~50,000 BTC) may have a internet impartial to barely unfavorable influence on bitcoin value given their relative rotations to money and bitcoin.

Total GBTC Outflows & Net Bitcoin Impact

To be clear, there’s a considerable amount of uncertainty in these projections, however the next is a ballpark estimate of the general redemption panorama given the dynamics talked about between chapter estates, retail brokerage accounts, retirement accounts, and institutional traders.

Projected Outflows Breakdown:

- 250,000 to 350,000 BTC complete projected GBTC outflows

- 100,000 to 150,000 BTC anticipated to go away the belief and be transformed into money

- 150,000 to 200,000 BTC in GBTC outflows rotating into different trusts or merchandise

- 250,000 to 350,000 bitcoin will stay in GBTC

- 100,000 to 150,000 net-BTC promoting stress

TOTAL Expected GBTC-Related Outflows Resulting In Net-BTC Selling Pressure: 100,000 to 150,000 BTC

As of January 26, 2024 roughly 115,000 bitcoin have left GBTC. Given Alameda’s recorded sale (20,000 bitcoin), we estimate that of the opposite ~95,000 bitcoin, half have rotated into money, and half have rotated into bitcoin or different bitcoin merchandise. This implies net-neutral market influence from GBTC outflows.

Estimated Outflows Yet To Occur:

- Bankruptcy Estates: 55,000

- Retail Brokerage Accounts: 65,000 – 75,000 BTC

- Retirement Accounts: 10,000 – 12,250 BTC

- Institutional Investors: 35,000 – 40,000 BTC

TOTAL Estimated Outflows To Come: ~135,000 – 230,000 BTC

Note: as stated beforehand, these estimates are the results of a heuristic evaluation and shouldn’t be interpreted as monetary recommendation and easily goal to tell the reader of what the general outflow panorama might appear like. Additionally, these estimates are pursuant to market situations.

Gradually, Then Suddenly: A Farewell To Bears

In abstract, we estimate that the market has already stomached roughly 30-45% of all projected GBTC outflows (115,000 BTC of 250,000-300,000 BTC projected complete outflows) and that the remaining 55-70% of anticipated outflows will comply with briefly order over the following 20-30 buying and selling days. All in, 150,000 – 200,000 BTC in internet promoting stress might outcome from GBTC gross sales provided that the numerous proportion of GBTC outflows will both rotate into different Spot ETF merchandise, or into chilly storage bitcoin.

We are via the brunt of the ache from Barry Silbert’s GBTC gauntlet and that’s motive to have fun. The market will probably be significantly better off on the opposite facet: GBTC may have lastly relinquished its stranglehold over bitcoin markets, and with out the specter of the low cost or future firesales hanging over the market, bitcoin will probably be a lot much less encumbered when it does come up. While it would take time to digest the remainder of the GBTC outflows, and there’ll doubtless be an extended tail of individuals exiting their place (talked about beforehand), bitcoin may have loads of room to run when the Spot ETFs settle right into a groove.

Oh, and did I point out the halving is coming? But that’s a narrative for one more time.

Bitcoin Magazine is wholly owned by BTC Inc., which operates UTXO Management, a regulated capital allocator centered on the digital property business. UTXO invests in a wide range of Bitcoin companies, and maintains vital holdings in digital property.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.