From an odd footnote understood to just the more tech-savvy in a far more insular web, Bitcoin has actually changed into a crucial gamer in today’s financial landscape.

However, while we’re all acutely knowledgeable about BTC’s impact on financial markets (a basically long-term component of the news cycle), we frequently forget to take an action back and take a look at how this brand-new frontier impacts genuine modification and genuine individuals.

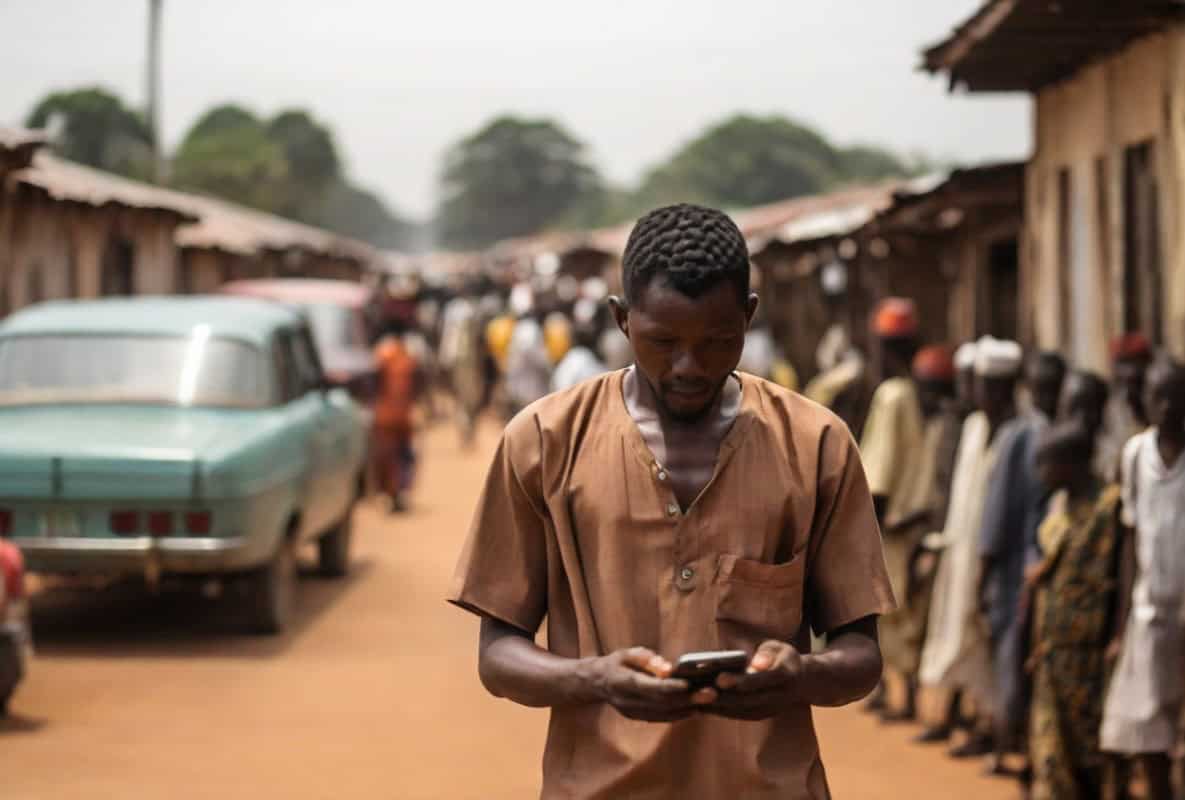

For those traditionally marginalized by standard banking due to barriers like bad credit or absence of ease of access, BTC has actually become an essential financial tool. Its impact is most extensive in establishing nations, where access to banking still postures an obstacle for numerous.

Here, Bitcoin acts as more than a currency or a financial investment; it’s a method to participate in vital financial activities, such as sending out and getting cash, that would otherwise run out reach.

Forget, a minimum of for a minute, the speculative capacity in regards to financial gain—the real worth of Bitcoin depends on its prospective to level the financial playing field, using access to financial tools that were formerly unique to those with more recognized financial backgrounds.

Amid its ever-changing worth, the sustaining guarantee of Bitcoin is its contribution to financial inclusivity, making it a beacon of expect more fair access to financial services worldwide.

Historical context of Bitcoin and financial inclusivity

Bitcoin was substantiated of the financial chaos of the late 2000s, with its developer(s) intending to create a decentralized currency that could bypass standard banking systems and assist society at big traverse a repeat of the 2008 financial crisis.

This vision was not simply technical however deeply ideological, looking for to empower people with financial autonomy.

At its core, Bitcoin assured to make financial services available to anybody with web gain access to, despite their standing with standard financial organizations.

This guarantee has actually seen concrete awareness in nations like Nigeria, where standard banking services run out grab numerous. In Nigeria, Bitcoin has actually ended up being more than a speculative possession—for example, with the nation’s substantial diaspora, Bitcoin assists in remittances, making it possible for Nigerians living abroad to send out cash home more effectively and at lower expenses compared to standard banking services.

In Argentina, Bitcoin has actually become an important financial tool in the middle of the nation’s continuous financial difficulties, consisting of high inflation rates and currency decline. For Argentinians, Bitcoin uses a more steady shop of worth compared to the nationwide currency, the Argentine peso, which has actually struggled with substantial devaluation throughout the years.

A comparable pattern can be seen in Ghana, where the yearly inflation rate is forecasted to land in the 13% to 17% variety in 2024.

In Venezuela, a nation facing political instability and recessions, Bitcoin has actually discovered a unique function beyond simply a method of maintaining wealth versus run-away inflation. Here, Bitcoin is being used to support microfinance efforts and charitable contributions, straight affecting the lives of those in requirement. Organizations and platforms leveraging cryptocurrency can bypass standard financial systems, which are frequently unattainable or undependable for the nation’s impoverished populations, to supply direct financial help.

Moreover, for business owners and small company owners the world over, it uses a method to participate in global deals without the requirement for checking account or the danger of currency decline. It’s both a hedge versus crisis and a vessel of flexibility versus authoritarian routines, however the decentralization schtick isn’t

The increase of Bitcoin ETFs and institutional interest

By enabling financiers to acquire direct exposure to Bitcoin’s cost motions without the intricacies of straight purchasing, saving, and handling the digital currency, BTC ETFs use a familiar, regulated opportunity for institutional financiers to go into the Bitcoin area.

Previously, the unpredictable and uncontrolled nature of Bitcoin prevented numerous institutional financiers. However, with the development of ETFs and other regulated financial investment items, these entities can now take part in the cryptocurrency market, bringing with them significant capital inflows and increased authenticity and stability to Bitcoin and the more comprehensive crypto market, which will just increase with additional adoption.

This institutional venture into Bitcoin has a double impact.

On one hand, it presents a level of stability and liquidity formerly hidden, possibly making Bitcoin a more appealing possession for both retail and institutional financiers.

On the other, it represents a shift from Bitcoin’s initial principles of decentralization and democratization of financing.

Another indicate think about is that institutional interest isn’t restricted to personal, for-profit business—with nations like El Salvador, which just recently took custody of its nationwide Bitcoin treasury showcasing that, gradually however undoubtedly, the basic mindset of federal governments towards cryptocurrencies is also altering with the times.

Potential effects of institutionalization on ease of access

On the one hand, these advancements can boost Bitcoin’s appeal by adding to market stability and minimizing volatility—an essential issue that has actually prevented a more comprehensive market from welcoming cryptocurrencies.

The entry of institutional financiers can also boost liquidity in the Bitcoin market, possibly making it a more dependable possession for people and companies worldwide.

However, the other side of institutionalization is the prospective boost in barriers to entry for marginalized groups.

The really essence of Bitcoin’s attract these groups is its ease of access: the capability to take part in the financial system with absolutely nothing more than a smart device and a web connection. As regulative structures end up being more strict and the marketplace more institutionalized, the procedures for obtaining and utilizing Bitcoin could end up being more intricate.

Requirements such as extensive identity confirmation and compliance with financial guidelines, while essential for scams avoidance and financial security, could accidentally sideline those without official recognition or those residing in areas with less regulative clearness.

Moreover, the shift towards institutionalization may result in a concentration of wealth and power within the Bitcoin environment, similar to standard financial systems.

This concentration could weaken the decentralized principles of Bitcoin, making it less about empowering the private and more about serving institutional interests.

The obstacle depends on discovering a balance: leveraging institutional interest to bring stability and authenticity to Bitcoin while guaranteeing that its advanced guarantee of financial inclusivity stays undamaged.

Financial addition and cryptocurrency adoption

Sub-Saharan Africa, with its mix of restricted banking facilities and high mobile penetration, has actually become a fertile ground for cryptocurrency adoption. The area, marked by its smaller sized general market size in regards to standard financial metrics, reveals a substantially high level of grassroots cryptocurrency use.

Nigeria, for instance, not just ranks 2nd on the Global Crypto Adoption Index however also leads Sub-Saharan Africa in raw deal volume, along with the world in P2P exchange trade volume ranking. Other nations like Kenya, Ghana, and South Africa also function plainly on the index, highlighting the extensive approval of cryptocurrencies as feasible financial instruments

The adoption is driven mostly by useful needs instead of speculative interests, with cryptocurrencies functioning as a hedge versus inflation and currency decline.

In Ghana, where inflation rose to its greatest level in twenty years at the tail end of 2022, and in other countries like Nigeria, Kenya, and South Africa dealing with comparable financial difficulties, cryptocurrencies have actually ended up being an appealing ways of maintaining wealth. The shift towards digital currencies, especially Bitcoin, and more just recently, stablecoins, shows a more comprehensive look for financial stability and flexibility

Peer-to-peer deals, specifically popular in Sub-Saharan Africa, represent a substantial part of crypto deals, highlighting the area’s distinct position in the worldwide crypto landscape. This high rate of P2P deals is credited to the daily usage of crypto for retail payments, remittances, and business deals.

The choice for crypto over standard banking and financial services is not simply a matter of benefit however a need in areas where regional currencies are declining, as seen in nations like Nigeria and Kenya

Through bypassing standard financial barriers, cryptocurrencies use broadened financing alternatives to underserved markets, exhibited by efforts like Empowa and Pezesha in Mozambique and Kenya that make use of blockchain to help with property advancement and link MSMEs with worldwide lending institutions.

Balancing institutional interest and financial inclusivity

As Bitcoin continues to browse the waters in between grassroots empowerment and institutional adoption, its future landscape provides a dichotomy.

On one side, increased institutional interest brings stability and reliability, possibly making Bitcoin a more feasible and relied on financial possession worldwide.

On the other, this shift could challenge the really inclusivity that has actually been a foundation of Bitcoin’s appeal, especially among minority groups and in areas with restricted access to standard banking services.

To guarantee that Bitcoin stays a tool for empowerment, a well balanced technique is essential. One prospective path is the advancement of regulative structures that motivate inclusivity.

Regulations could be developed to secure customers without suppressing development or access to cryptocurrencies. Additionally, the ongoing assistance and promo of peer-to-peer platforms can empower people by helping with direct deals without the requirement for standard financial intermediaries.

Conclusion

As Bitcoin progresses in the middle of increasing institutional interest, its fundamental function as a representative of financial inclusivity deals with both difficulties and chances. Ensuring that Bitcoin continues to serve marginalized neighborhoods needs a fragile balance, mixing the stability brought by institutional participation with its prospective as an equalizing force.

One thing is particular—the future of Bitcoin hinges in big part on keeping its essence as a lifeline for financial empowerment around the world.

This is a visitor post by Kiara Taylor. Opinions revealed are totally their own and do not always show those of BTC Inc or Bitcoin Magazine.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.