ETF inflows and institutional purchases continue to climb, yet lots of investors are puzzled by the soft Bitcoin price action. With billions streaming into BTC, why aren’t we seeing the price blow up to brand-new highs? The truth is more nuanced than it initially appears.

Bitcoin ETF Inflows

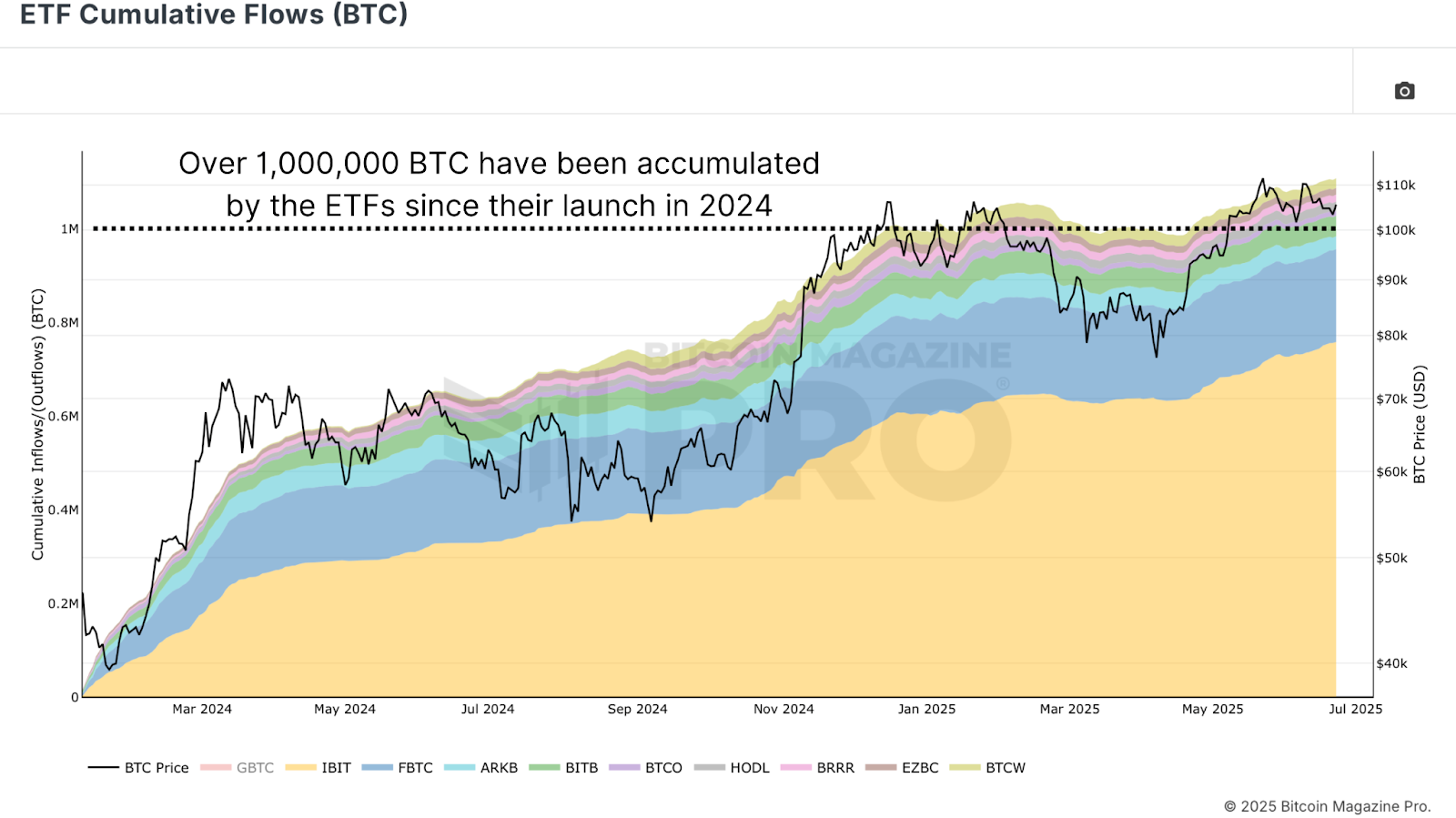

Looking at the ETF cumulative inflows chart (leaving out GBTC outflows), it’s clear that need from institutional players has actually been robust. Since the latest pullback in late March, net ETF inflows have actually climbed up from approximately 527,000 BTC to over 630,000 BTC, a boost of around 100,000 BTC in under 3 months. These are significant numbers, yet the Bitcoin price has mostly generally wandered sideways considering that the start of 2025.

It’s crucial to keep in mind that not all ETF streams represent “institutional” buying in the purest sense. Many ETF purchases come from customer allowances, for instance, household workplaces or high-net-worth people utilizing platforms like BlackRock. Still, these circulations matter, and the constant build-up is a positive chauffeur for long-lasting supply and need dynamics.

Bitcoin Treasury Buying

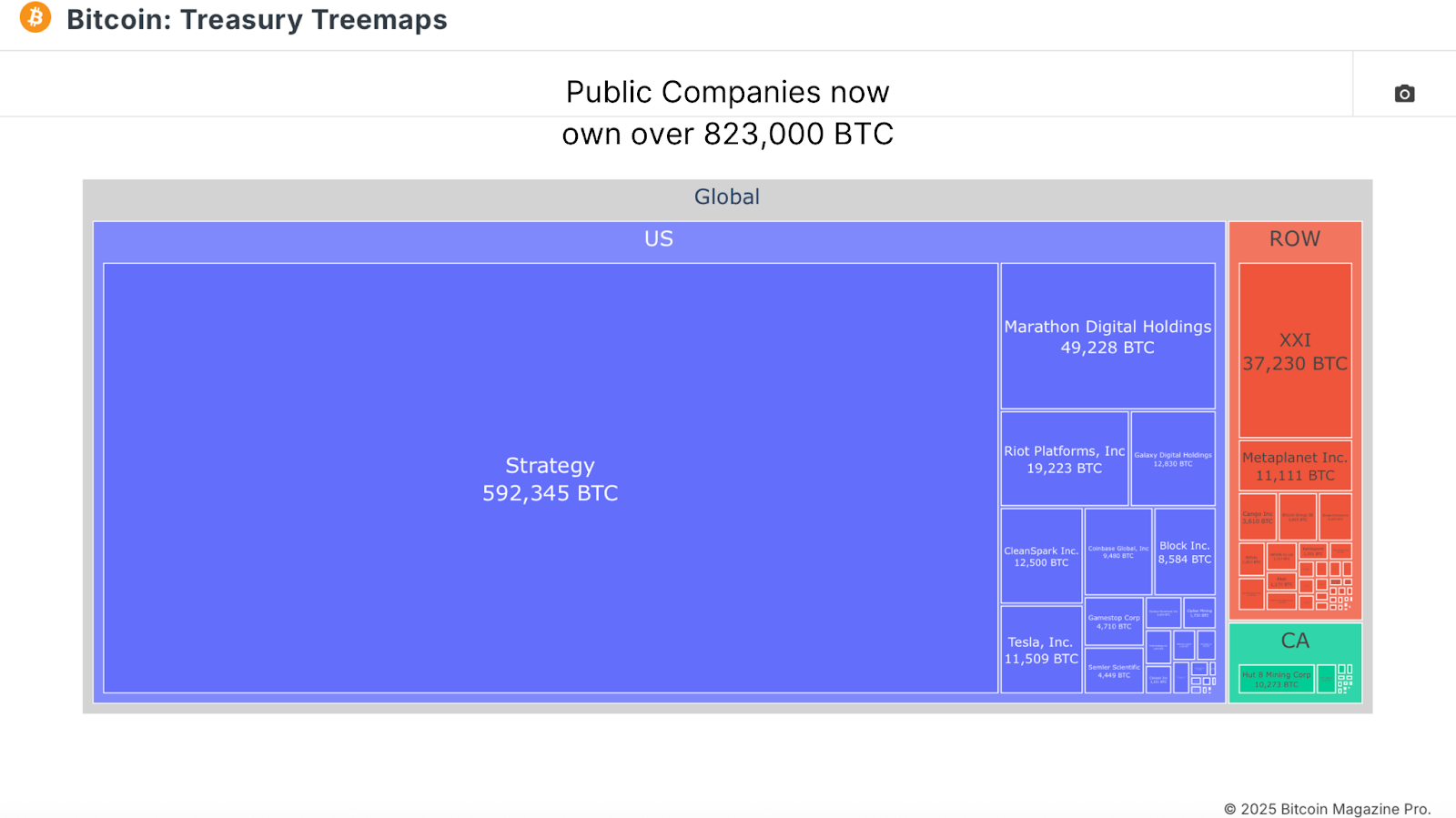

Complementing ETF inflows, business treasury buying has also been strong, with (Micro)Strategy leading the charge. MSTR alone have actually seen their holdings have leapt from approximately 528,000 BTC to over 592,000 BTC in this year alone. Across all treasury business tracked, overall holdings now go beyond 823,000 BTC, representing an impressive $86 billion in worth.

Despite this, lots of market individuals feel underwhelmed by price action compared to prior cycles. But we need to contextualize expectations: the BTC market cap is now in the multi-trillion-dollar variety. The large scale of capital needed to drive rapid relocations today overshadows previous cycles. Comparing this cycle to the 10x returns of earlier periods isn’t reasonable. In reality, BTC has more than doubled from $40K at the time of ETF launch to current levels above $110K, a still huge accomplishment for a developing property class.

Bitcoin Supply Overhang

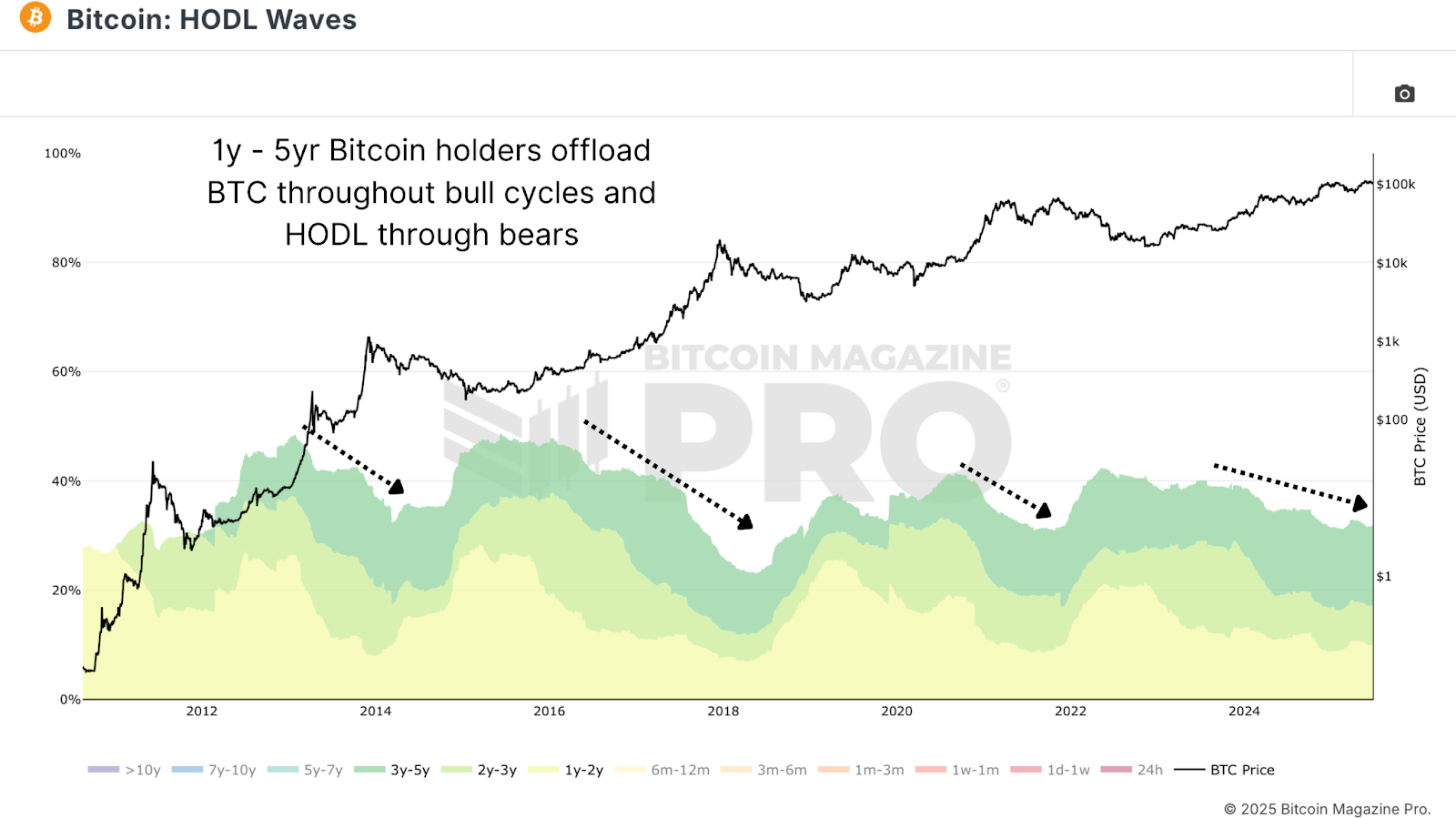

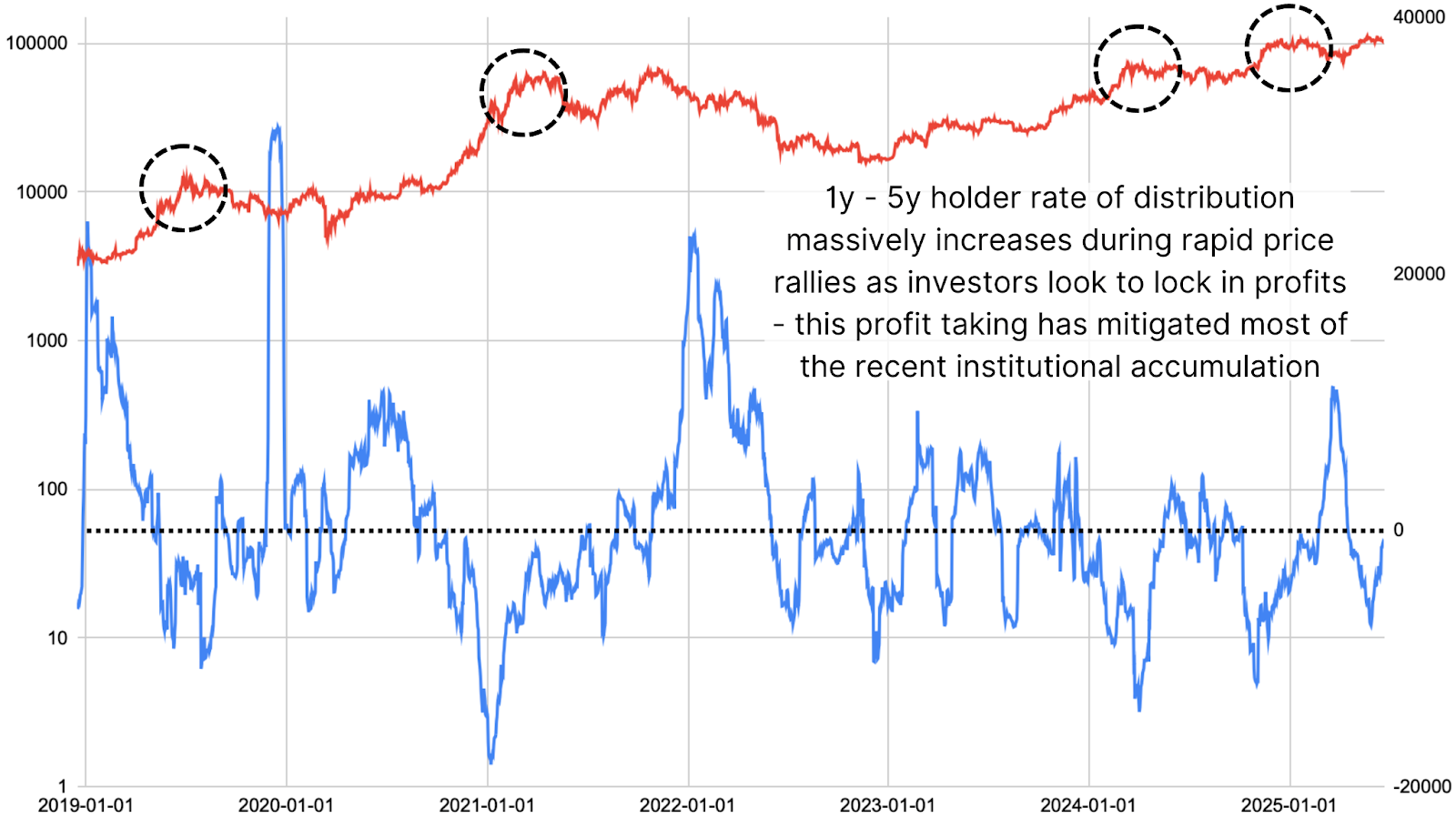

To comprehend why Bitcoin rates haven’t risen even even more, we need to analyze offering habits. By examining HODL Waves information for 1-5 year bands, we can measure long-lasting holder revenue-taking. Over the past 3 months, more than 240,000 BTC from these older bands has actually been dispersed to the market, almost a quarter-million BTC in web outflows.

This selling has actually mostly reversed institutional build-up. Given that everyday miner issuance still includes another ~450 BTC to the market, we see why price has actually had a hard time to break greater: the market is in a state of supply-demand stability.

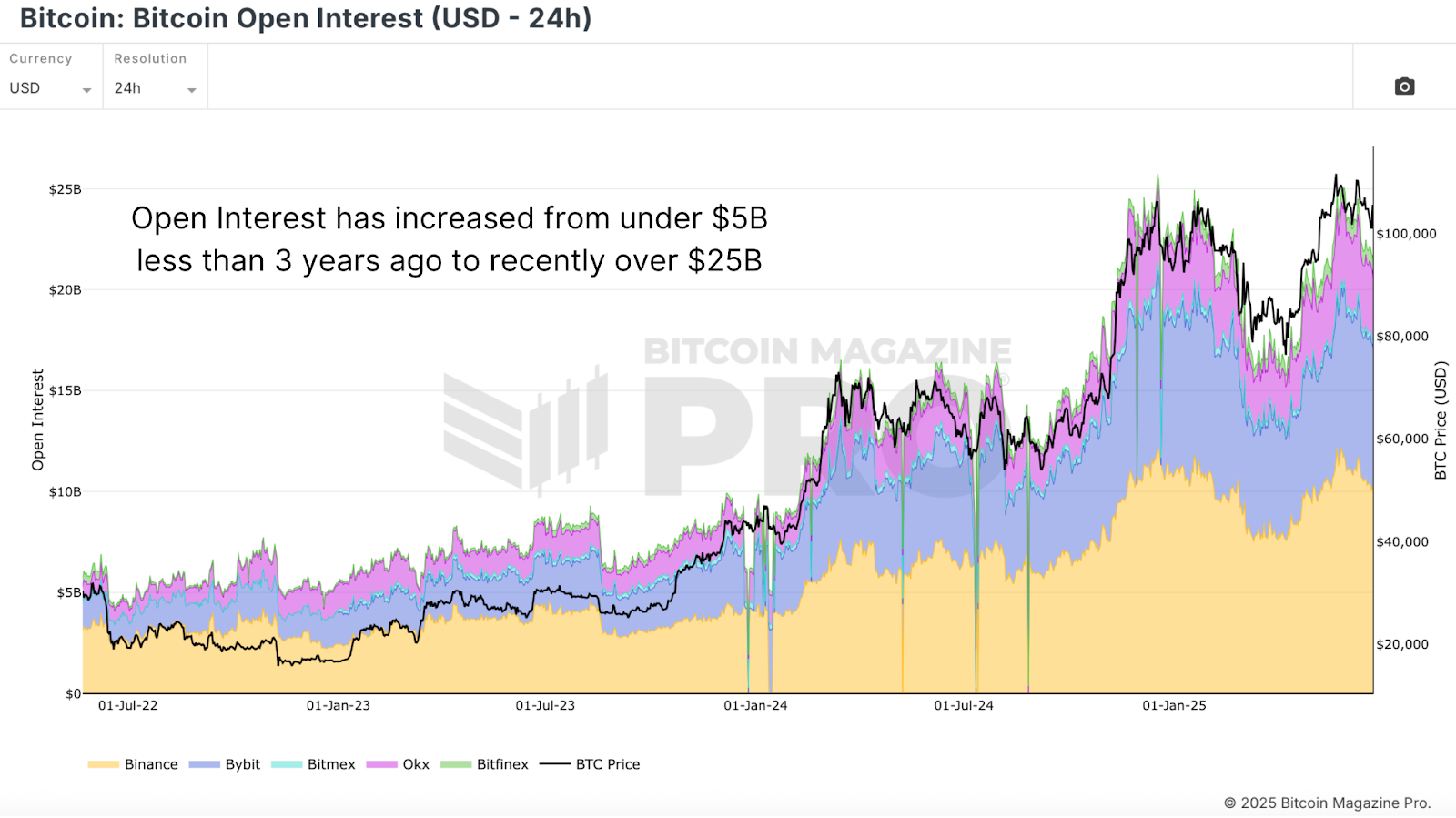

Meanwhile, open interest on BTC derivatives markets has actually blown up. From under $5B less than 3 years back to over $25B today. Many brand-new individuals choose are choosing to trade “paper BTC” on derivatives rather than buying area BTC, which minimizes the positive impact on price of increased market individuals.

Bitcoin Bullish Shifts

There is nevertheless now factor for optimism. Long-term holder selling is now decreasing, with current web outflows falling below 1,000 BTC each day, a significant decrease from previous regular monthly averages just weeks back. If institutional inflows remain constant and retail need begins to awaken, even at levels seen previously this cycle rather than severe previous peaks, we might quickly see another effective leg greater. Past circumstances reveal that when retail streams rise from these levels, BTC can double in price within months.

Conclusion

ETF inflows and treasury purchases are putting billions of dollars into Bitcoin, however the soft Bitcoin price response makes ideal sense when seen through the lens of supply and need. Heavy revenue-taking by long-lasting holders and growing derivatives speculation have actually stabilized out the inflows.

As long-lasting selling subsides and institutional buying continues, the phase is being set for the next bullish impulse. Whether we see the blissful retail mania of previous cycles stays to be seen, however even modest retail inflows integrated with present institutional need might drive rates greatly greater faster rather than later on.

Loved this deep dive into bitcoin price dynamics? Subscribe to Bitcoin Magazine Pro on YouTube for more specialist market insights and analysis!

Loved this deep dive into bitcoin price dynamics? Subscribe to Bitcoin Magazine Pro on YouTube for more specialist market insights and analysis!

Click Here To Subscribe To YouTube Channel

For more deep-dive research study, technical signs, real-time market signals, and gain access to to a growing neighborhood of experts, go to BitcoinMagazinePro.com.

This post If Institutions Are Buying Why Isn’t The Bitcoin Price Going Up? initially appeared on Bitcoin Magazine and is composed by Matt Crosby.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.