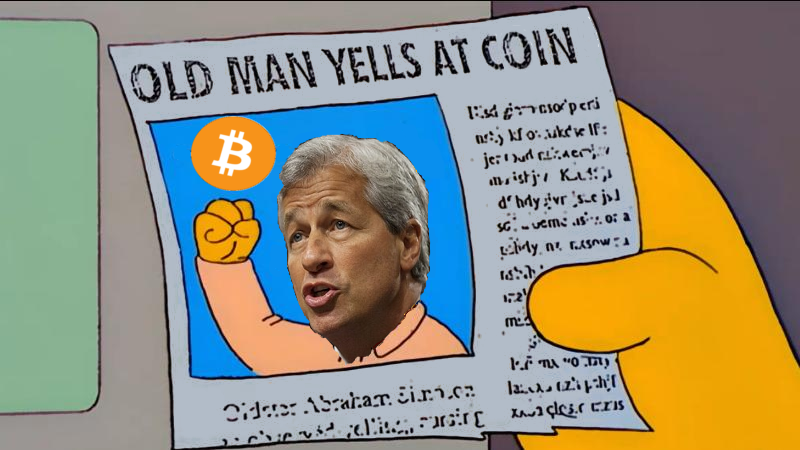

Perhaps cryptocurrency’s largest institutional nemesis is JP Morgan Chase. Led by the ever-belligerent Jamie Dimon, it and he have taken quite a few alternatives to sandbag bitcoin and its spawn. Theories about why have lengthy circled, however now there seems to be proof the legacy financial institution is threatened by decentralized currency in digital kind, in line with an inside annual report.

JP Morgan Chase One Chastised Bitcoiners

In partial fulfilment of its fiduciary responsibility, JP Morgan Chase filed an Annual Report for 2017, Form 10-Ok: Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. It’s an exhaustive doc principally of curiosity to shareholders. This 12 months, nevertheless, it contained uncommon perception into the institutional mindset of the United States’ largest financial institution.

Under the rubric Competition, deep within the report, the financial institution worries aloud: “The financial services industry is highly competitive, and JPMorgan Chase’s results of operations will suffer if it is not a strong and effective competitor. JPMorgan Chase operates in a highly competitive environment, and expects that competition in the U.S. and global financial services industry will continue to be intense.”

Where competitors appeared least seemingly, in line with CEO Jamie Dimon, was within the space of cryptos akin to bitcoin. Famously, Mr. Dimon chastised those that held or traded bitcoin as “stupid.” Indeed, the very idea, he maintained, was a “fraud.” He’d additional assault his personal workers who may dare dabble as risking their very job in consequence. Though he’d later come off a few of these remarks a tad, strolling them again and virtually apologizing, the reality of the matter may be extra in step with taking a web page from the Niccolò Machiavelli playbook: ridicule your opponent in an effort to reduce his reputation, realizing full properly that foe may sooner or later eat your lunch.

The Annual Report seems to make clear the difficulty. It does checklist the standard suspects of different banks and establishments as opponents, warning ominously how “JPMorgan Chase cannot provide assurance that the significant competition in the financial services industry will not materially and adversely affect its future results of operations.” This appears, at the very least partly, because of the reality “New competitors have emerged.”

Disrupted by Technologies

After fast traces concerning the progress of e-commerce, the Report lastly comes out with it. “These advances have also allowed financial institutions and other companies to provide electronic and internet-based financial solutions, including electronic securities trading, payment processing and online automated algorithmic-based investment advice. Furthermore, both financial institutions and their non-banking competitors face the risk that payment processing and other services could be disrupted by technologies, such as cryptocurrencies, that require no intermediation. New technologies have required and could require JPMorgan Chase to spend more to modify or adapt its products to attract and retain clients and customers or to match products and services offered by its competitors, including technology companies.”

And “intermediation” is Wall Street speak for banks. Cryptocurrencies can have the eventual influence of placing “downward pressure on prices and fees for JPMorgan Chase’s products and services or may cause JPMorgan Chase to lose market share,” the financial institution revealed.

What all this virtually means for the quick and long-term concerning the financial institution and crypto is anybody’s guess, however the next appears to present a reasonably massive trace: “Increased competition also may require JPMorgan Chase to make additional capital investments in its businesses, or to extend more of its capital on behalf of its clients in order to remain competitive.” In different phrases, earlier than it may beat crypto, it simply might need to hitch crypto.

What do you consider JP Morgan’s newest admittals? Let us know within the comments part below.

Not updated on the information? Listen to This Week in Bitcoin, a podcast up to date every Friday.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.