Bitcoin and a a great deal of cryptocurrencies experienced a sharp crash after touching brand-new rate highs this year. On June 26, the rate of bitcoin core (BTC) dropped from $13,850 to under $11,900 in less than an hour. BTC worths versus the USD continued to spiral on Thursday, dropping to $10,350 prior to recuperating a little. With more than $72 billion slashed off the assessment of the whole cryptoconomy, lots of traders question what the future has in shop for digital property markets.

Also Read: Iranians Defy Warning and Share Pictures of Bitcoin Mining in Mosque

Crypto Prices Moved Too Much and Too Fast

At the time of publication, the marketplace capitalization of all 2,000+ coins is around $315 billion. Over the last 2 days, BTC shed more than $2,500 after rallying from $5,000 in May to $13,850 at the end of June. Currently, BTC is trading for around $10,500-10,700. The question lots of are asking is whether the rally was a fast flash in the pan or the marketplace is legally experiencing a bull run. After the huge drop, Genesis Global Trading CEO Michael Moro informed journalism that he thinks the fast snapback was because of excessive utilize. “The existence of utilize worsens the relocations in both instructions and impacts the speed drastically,” Moro mentioned. “Of course bitcoin has a history of doing this (both up and downward), however it’s hard to call the magnitude of the relocation healthy.”

“Even the most positive crypto bulls would inform you that a 50%+ relocation in a week is excessive too quickly,” he included.

Marketwatch factor Mark Hulbert thinks that the chances are extremely “above 80% — that bitcoin will crash in coming months.” Hulbert based his projection on Andrei Shleifer, Robin Greenwood, and Yang You’s research study called “Bubbles for Fama.” Hulbert described on Thursday that the Harvard scientists found that when a cost rally surpasses particular limits, the chances of a crash grow considerably. “Bitcoin’s current rate action more than certifies — It has actually increased more than 440% over the previous 2 years — It is up more than 270% simply considering that the start of this year,” Hulbert kept in mind. “The S&P 500 over the previous 2 years is up ‘just’ 20%.”

Hyper Volatile and Facebook Coin’s Possible Push

Of course, not everybody is so depressing about the rate, and Fundstrat Global Advisors cofounder Thomas Lee is generally positive, however still cautioned that “Bitcoin is a hypervolatile property.” On the intense side, Lee said: “This is terrific for volatility and other devoted traders.” One of Lee’s colleagues Robert Sluymer, technical strategist at Fundstrat Global Advisors, composed his viewpoint in a research study note and mentioned:

A 20%-30% pullback would not be unexpected and extremely constant with Bitcoin’s current bull-market pullbacks.

Some speculators believe that the spike came from the current Facebook coin statement and the results of the news beginning to lose its shine. Craig Erlam, senior market expert at Oanda, informed the media that the most recent rally “seems connected to the launch of Facebook’s Libra coin and the promotion it has actually gotten.”

“Whether individuals see this as legitimizing cryptocurrencies — being connected to Facebook — or the size of the rally has actually brought in individuals looking for fast earnings, like back in 2017, isn’t crucial however it’s plainly assisted it discover its groove once again,” Erlam observed in his analysis.

Staircase Up, Elevator Down

Alistair Milne, a primary financial investment officer of the Altana Digital Currency Fund, believed that the rate of BTC increased so quick it was bound to drop. “[The correction] was unavoidable — you just wear’t increase this rapidly and sustain it permanently, followed by combination — This is not 2017’s boom and bust, we sanctuary’t seen brand-new retail financiers coming in as we did [then],” Milne described.

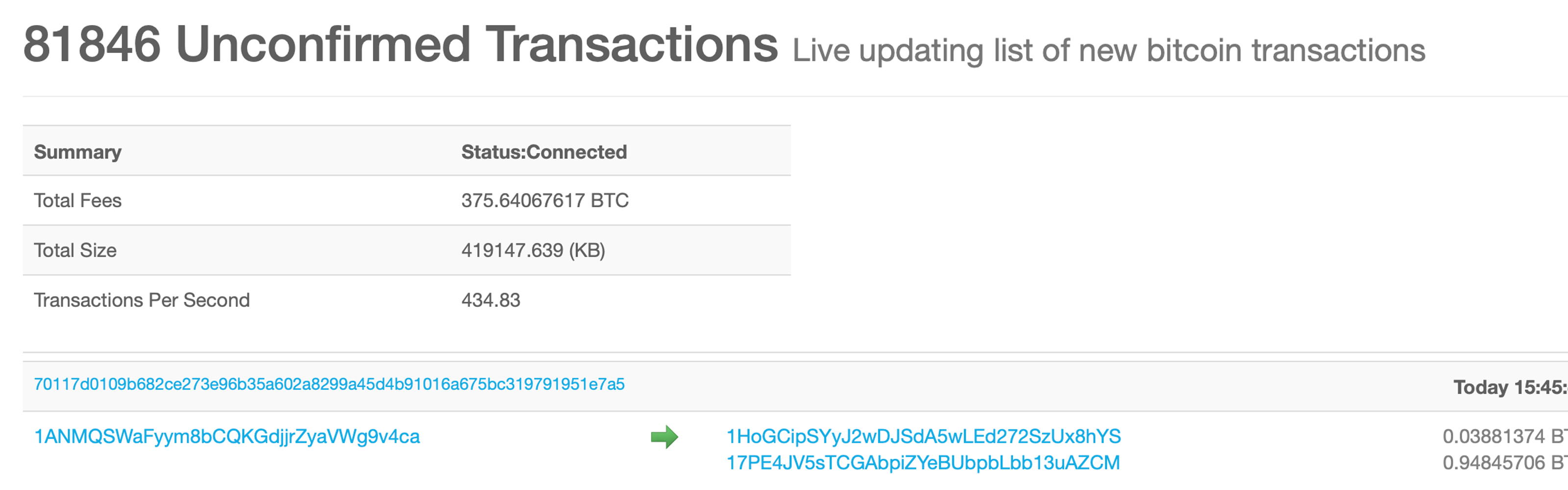

Many traders doubt what will occur next in crypto-land. Former Fortress Investment hedge fund supervisor Michael Novogratz informed Bloomberg on Thursday that he offered the day in the past and wanted he had actually offered more. The news outlet exposed that Novogratz is “exasperated” by BTC’s swings in worth. To observers, it’s anybody’s think what these insane crypto markets will do next. On a side note, the BTC mempool has actually been greatly supported over the last 72 hours. At press time there are 82,000 deals waiting to validate and it’s rather most likely much of those come from exchange traffic.

Where do you see the rate of BTC and the cryptoconomy going from here? Let us understand what you believe in the comments below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.