Cryptocurrency costs are making some headway right this moment after affected by a bearish onslaught final week. Since our final markets replace the digital asset financial system has gained $26 billion during the last 5 days. The worth of bitcoin money (BCH) touched a excessive of $1,160 earlier right this moment however now hovers round $1,140 per BCH. Bitcoin core (BTC) values reached $7,790 per BTC however subsequently dropped to a mean of $7,713 at 7am EDT.

Also Read: Devere Group Adds Bitcoin Cash and EOS to Crypto Exchange App

Cryptocurrency Markets See a Short Term Push Upwards

The query over the previous few months is — How lengthy will the cryptocurrency bear run final? A number of weeks in the past issues have been trending upwards displaying indicators of a reversal after digital property misplaced appreciable worth after touching all-time highs. Today cryptocurrency markets are displaying some deep consolidation as merchants have been shifting positions in hopes of one other bull run this 12 months. However ever since BTC touched a excessive of $19,600 digital currency bears have been storming the markets and shorting them to revenue from the downturn.

Bitcoin Cash Market Action

On Sunday, June 3, 2018 bitcoin money markets are commanding an general valuation of $19.5Bn and the decentralized currency has gained 10 p.c over the previous 24-hours. Seven day good points for BCH present the digital asset has jumped upwards 13.9 p.c in worth. BCH buying quantity has also elevated and rests at $753Mn over the previous 24-hours. The high 5 exchanges swapping probably the most bitcoin money right this moment embody Okex, Huobi, Bitfinex, Lbank, and Binance. One BCH is roughly 0.1465 BTC and bitcoin core is probably the most traded pair with BCH right this moment. BTC captures 40.Eight p.c of BCH trades adopted by tether (USDT 28.9%), USD (17.7%), KRW (8.9%), and the EUR (1.3%).

BCH/USD Technical Indicators

Looking on the 4-hour BCH/USD chart on Bitfinex exhibits bulls are tiring out a contact from this morning’s upward thrust. Before the spike, the market appeared to kind a deep consolidated diagonal formation as Bollinger Bands have been extraordinarily tight. BCH patrons are presently going through resistance and the 2 Simple Moving Averages (SMA) point out the trail to resistance could also be in the direction of the upside. The short-term 100 SMA is above the 200 SMA trendline however not by a lot. After this morning’s rise, the MACd nonetheless exhibits room for enchancment and the Relative Strength Index (RSI) factors to (71) overbought situations. Order books present BCH bulls must press previous $1,185 to search out smoother seas whereas on the bottom there are foundations between the present vantage level and $925.

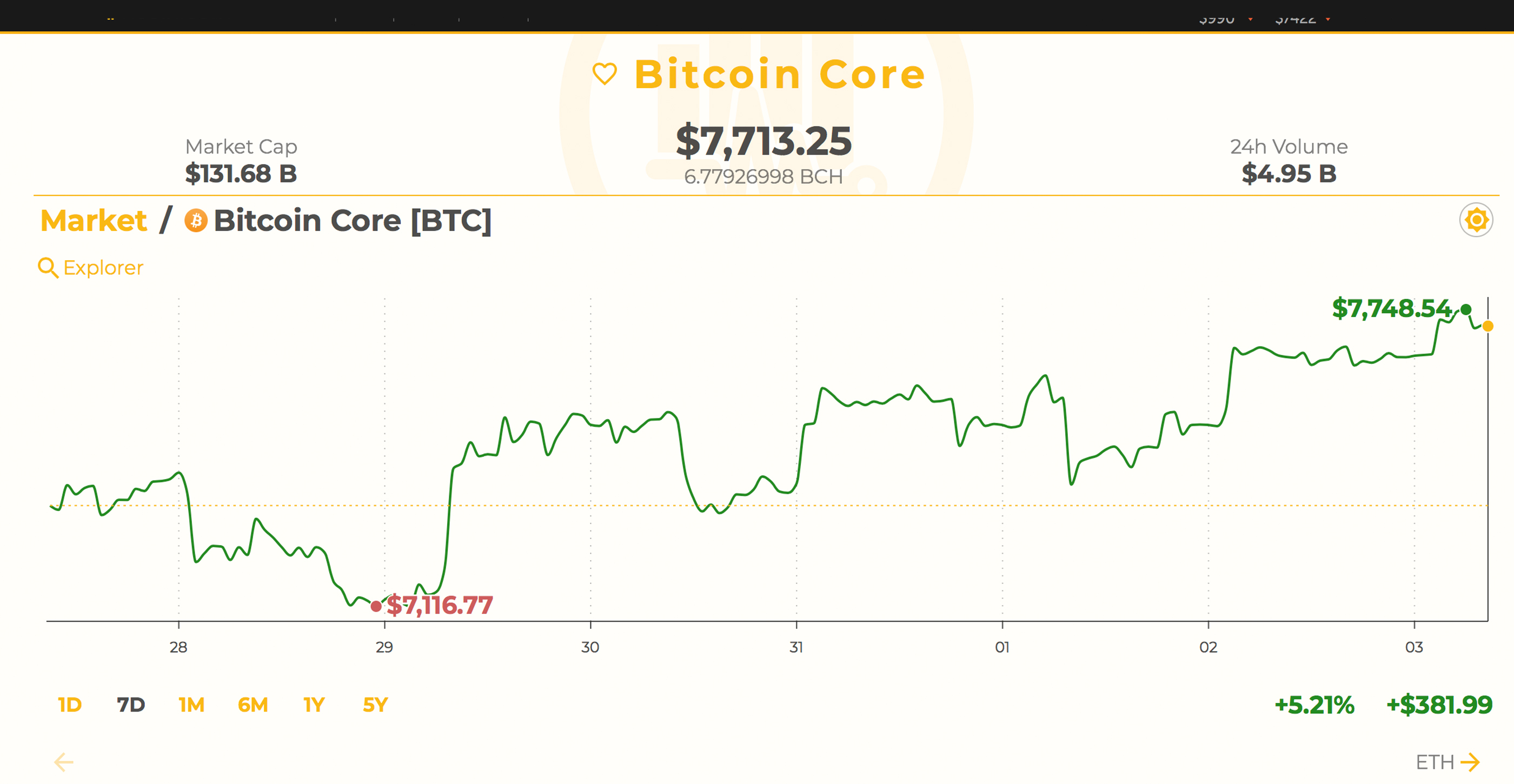

Bitcoin Core Market Action

Bitcoin Core’s (BTC) upwards motion is slowing down proper now after touching a excessive of near $7,800 earlier this morning. The worth of BTC is up 0.88 p.c during the last 24 hours and 5.2 p.c during the last seven days. Trading quantity has elevated solely a bit bit since our final markets replace as BTC merchants this Sunday are swapping $4.95Bn in commerce quantity. The high exchanges buying and selling probably the most of this motion are Binance, Okex, Bitfinex, Huobi, and BTCC. The Japanese yen right this moment is the forerunning pair traded with BTC capturing 55 p.c of trades. Tether (USDT 18.6%) follows the yen, after which the USD (16.3%), KRW (3.3%), and the RUB (2.3%). The Russian Ruble has kind of silently sneaked into the highest 5 currency pairs place with BTC. Furthermore on the peer-to-peer alternate Shapeshift.io the highest commerce right this moment is ETH for BTC.

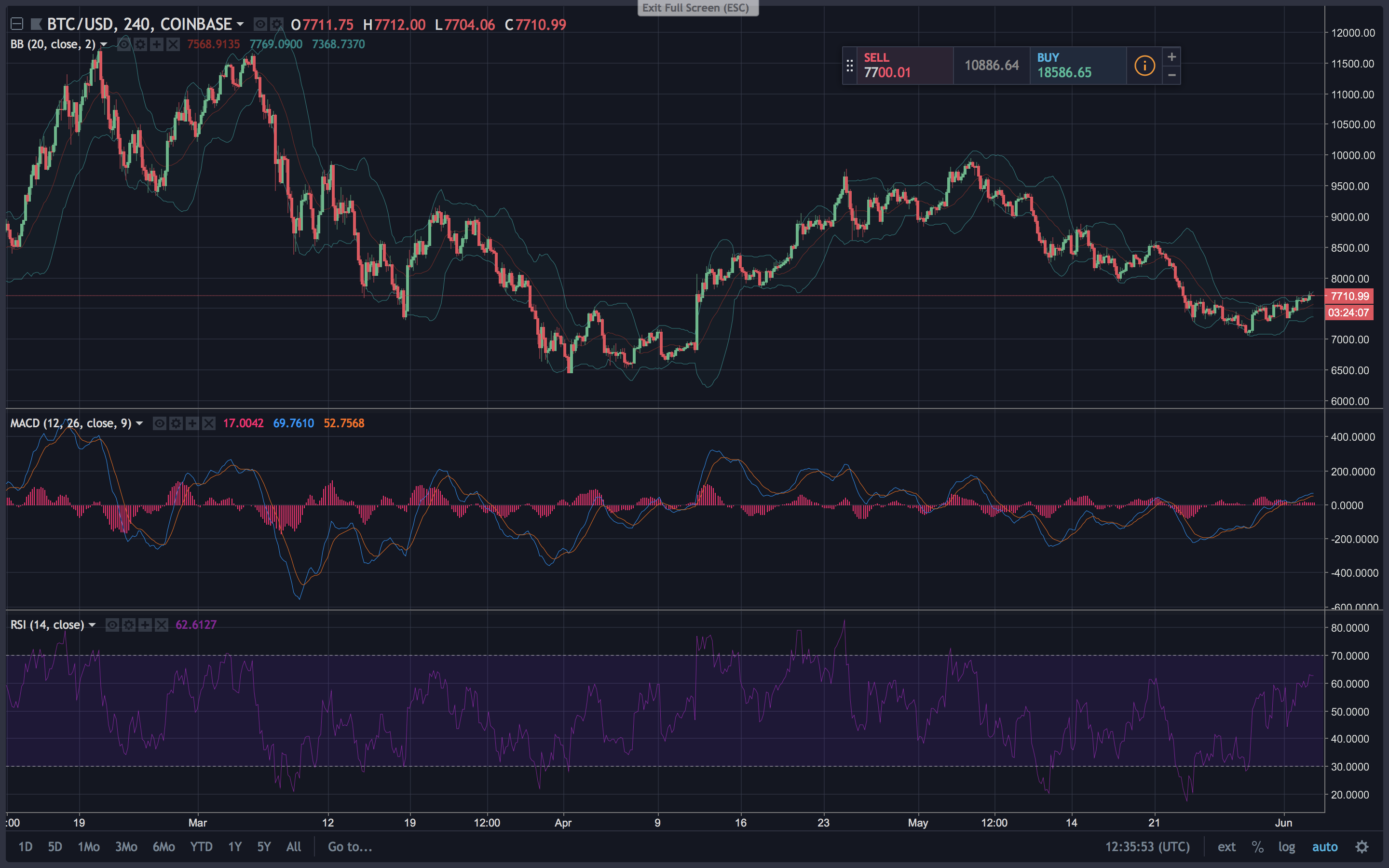

BTC/USD Technical Indicators

Looking on the similar 4-hour timeline for BTC/USD on Coinbase and Bitstamp present bulls are feeling exhausted after that final push. The cryptocurrency is holding simply above the $7,700 area and resistance is piling up throughout alternate order books. The two SMA trendlines for BTC present comparable motion because the quick time period 100 SMA is simply above the long-term 200 SMA. With this mentioned we might even see some extra northbound motion if bulls can handle to press by means of present resistance. MACd is meandering downwards indicating bears are attacking and RSI ranges are round 56, displaying situations might go both approach after the final spike. Order books usually are not too dangerous wanting on the upside as bulls must muster up energy to get previous $7,900-8,100 to be able to method far safer and fewer bearish situations. Looking down we will see that bears might be stopped at $7,200 and there are significantly sized partitions by means of $6,600 as nicely.

The Top Digital Assets Today

Cryptocurrency markets basically all through the highest positions are seeing good points right this moment. The second highest market capitalization commanded by ethereum (ETH) has seen a 4.6 p.c improve this Sunday. The worth of ethereum has gained 7.Three p.c this week in complete and the worth per ETH right this moment is $619. Ripple (XRP) values are up 2.7 p.c as one XRP is averaging round $0.66 cents per token. The token EOS which simply launched its mainnet is up 5.7 p.c this Sunday and 19 p.c this week. One EOS is priced at $14.84 per token on the time of publication.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.