Maximizing Bitcoin Gains with ETF Data

Since the intro of Bitcoin Exchange Traded Funds (ETFs) in early 2024, Bitcoin has actually reached brand-new all-time highs, with several months of double-digit gains. However, as remarkable as this efficiency is, there’s a method to considerably exceed Bitcoin’s returns by making use of ETF data to assist your trading choices.

Bitcoin ETFs and Their Influence

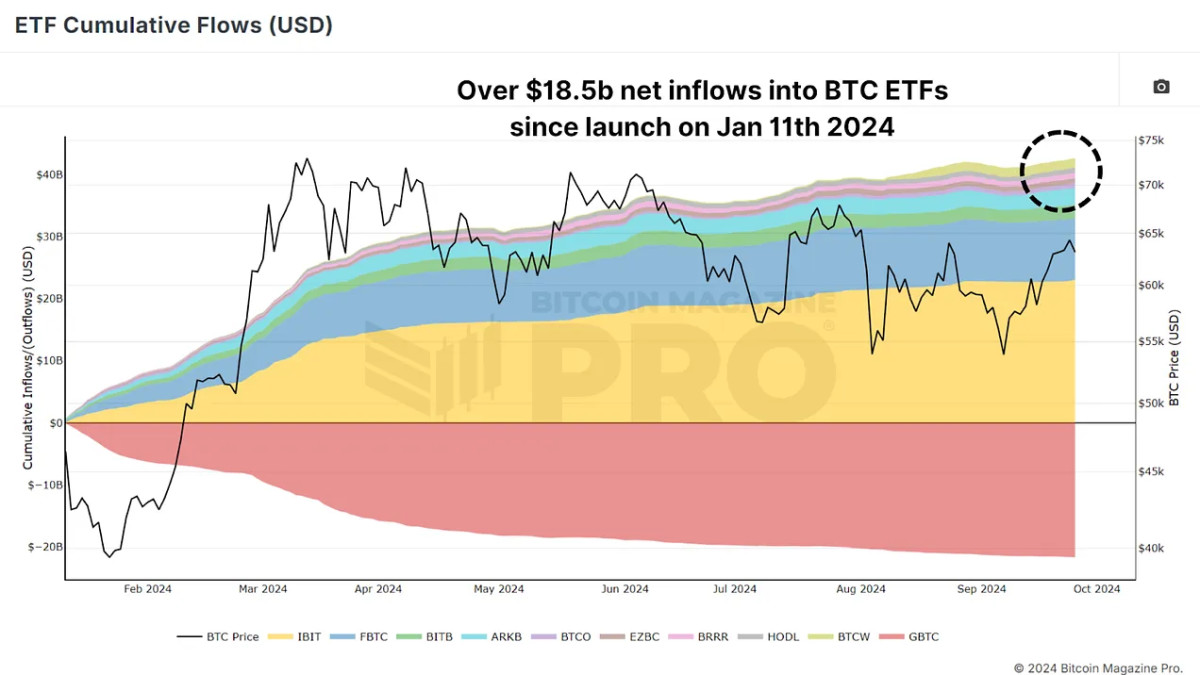

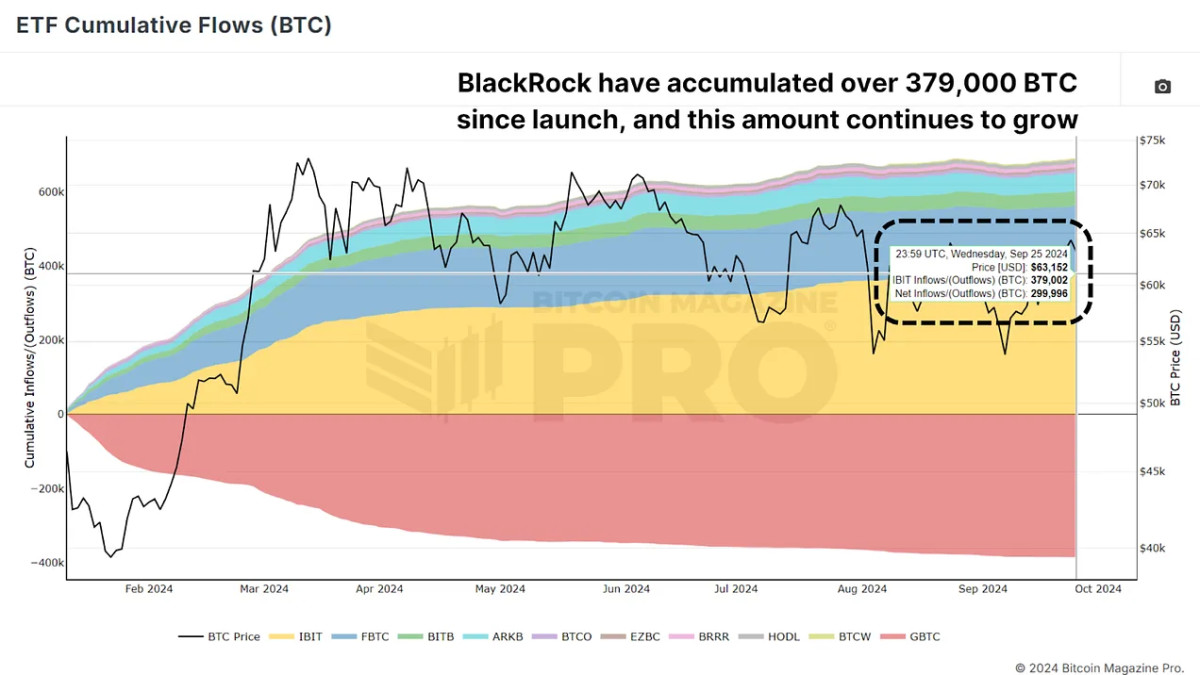

Bitcoin ETFs, introduced in January 2024, have actually rapidly generated big quantities of Bitcoin. These ETFs, tracked by numerous funds, enable institutional and retail financiers to get direct exposure to Bitcoin without straight owning it. These ETFs have actually built up billions of USD worth of BTC, and tracking this cumulative circulation is vital for keeping an eye on institutional activity in Bitcoin markets, assisting us evaluate whether institutional gamers are purchasing or offering.

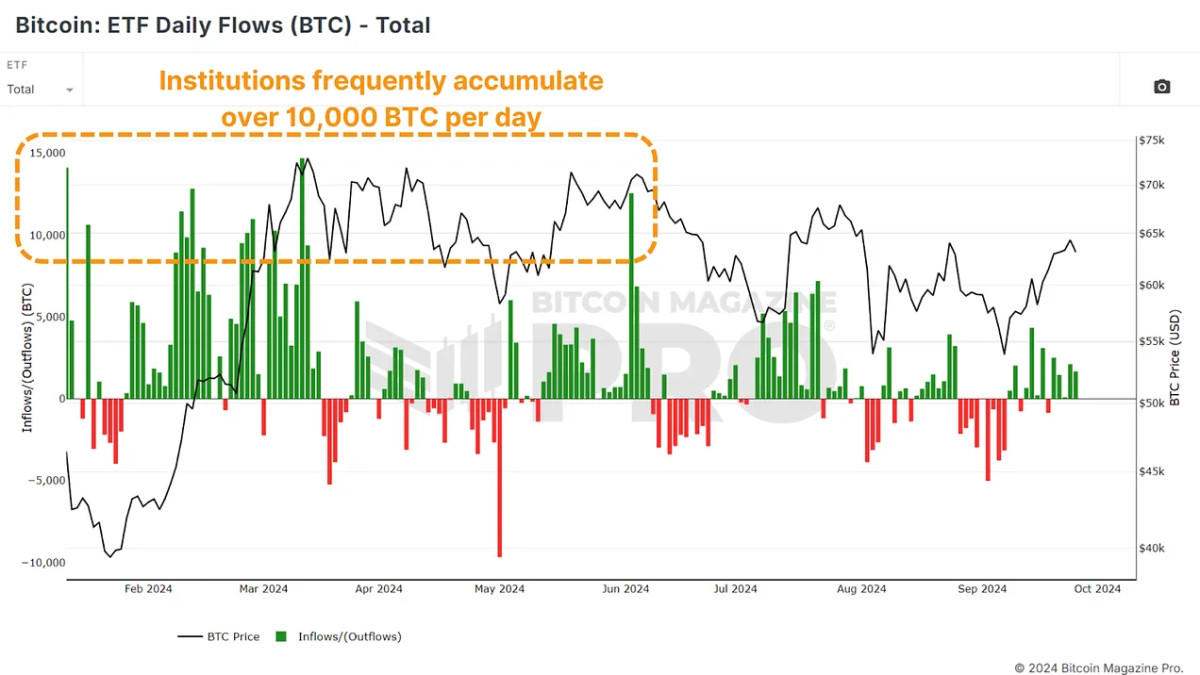

ETF everyday inflows denominated in BTC suggest that massive financiers are collecting Bitcoin, while everyday outflows recommend they are leaving positions throughout that trading duration. For those wanting to exceed Bitcoin’s currently strong 2024 efficiency, this ETF data uses a tactical entry and exit point for Bitcoin trades.

A Simple Strategy Based on ETF Data

The technique is fairly uncomplicated: purchase Bitcoin when ETF inflows are favorable (green bars) and offer when outflows take place (red bars). Surprisingly, this approach permits you to exceed even throughout Bitcoin’s bullish durations.

This technique, while basic, has actually regularly surpassed the wider Bitcoin market by catching cost momentum at the ideal minutes and preventing prospective declines by following institutional patterns.

The Power of Compounding

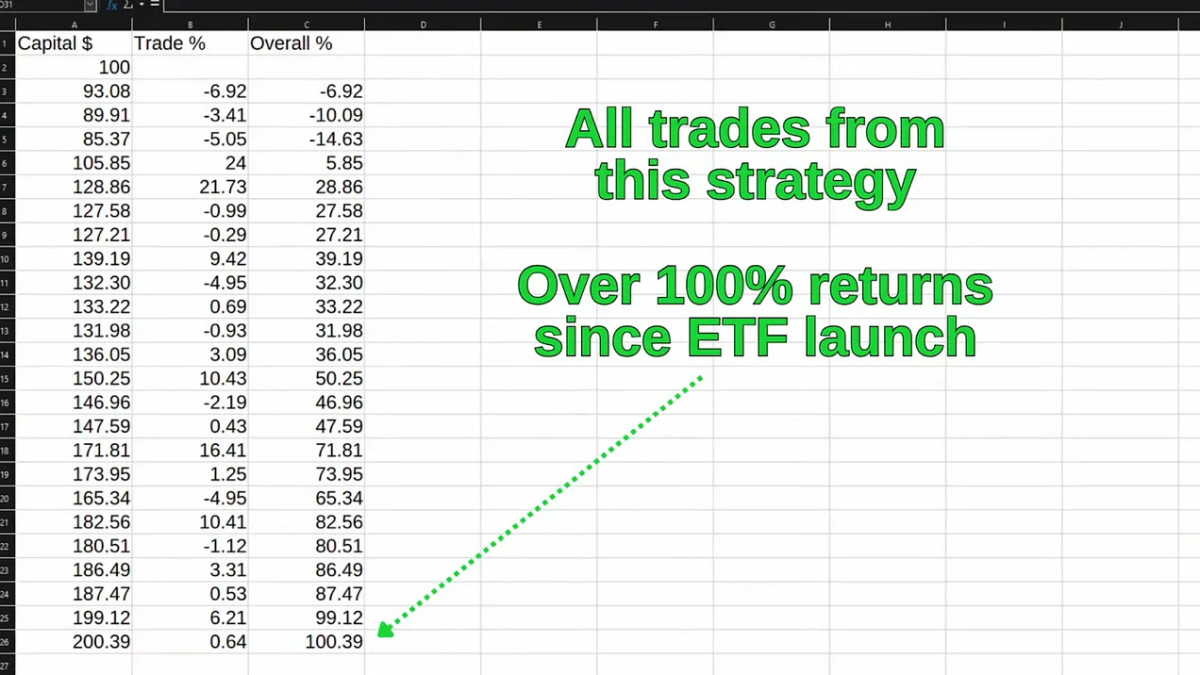

The genuine trick to this technique depends on intensifying. Compounding gains gradually considerably improves your returns, even throughout durations of combination or small volatility. Imagine beginning with $100 in capital. If your very first trade yields a 10% return, you now have $110. On the next trade, another 10% gain on $110 brings your overall to $121. Compounding these gains gradually, even modest wins, build up into substantial earnings. Losses are unavoidable, however intensifying wins far surpass the periodic dip.

Since the launch of the Bitcoin ETFs, this technique has actually offered over 100% returns throughout a duration in which simply holding BTC has actually returned approximately 37%, or perhaps compared to purchasing Bitcoin on the ETF launch day and selling at the precise all-time high, which would have returned roughly 59%.

Can Further Upside Be Expected?

Recently, we’ve started to see a continual pattern of favorable ETF inflows, recommending that organizations are as soon as again greatly collecting Bitcoin. Since September 19th, every day has actually seen favorable inflows, which, as we can see, have actually typically preceded cost rallies. BlackRock and their IBIT ETF alone have actually built up over 379,000 BTC because beginning.

Conclusion

Market conditions can alter, and there will undoubtedly be durations of volatility. However, the constant historic connection in between ETF inflows and Bitcoin cost increases makes this an important tool for those wanting to optimize their Bitcoin gains. If you’re trying to find a low-effort, set-it-and-forget-it technique, buy-and-hold might still appropriate. However, if you wish to attempt and actively increase your returns by leveraging institutional data, tracking Bitcoin ETF inflows and outflows might be a game-changer.

For a more thorough check out this subject, take a look at a current YouTube video here: Using ETF Data to Outperform Bitcoin [Must Watch]

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.