Money is among the essential however least comprehended manmade tools around. For more than 5,000 years human beings have actually utilized a tool of exchange called money to help with trade. During this timespan, the advancement of money has actually developed into a system of info, a social agreement, and a ranking system.

Also Read: Internal Revenue Service Agents Propose Draconian Tactics to Investigate Bitcoin Users

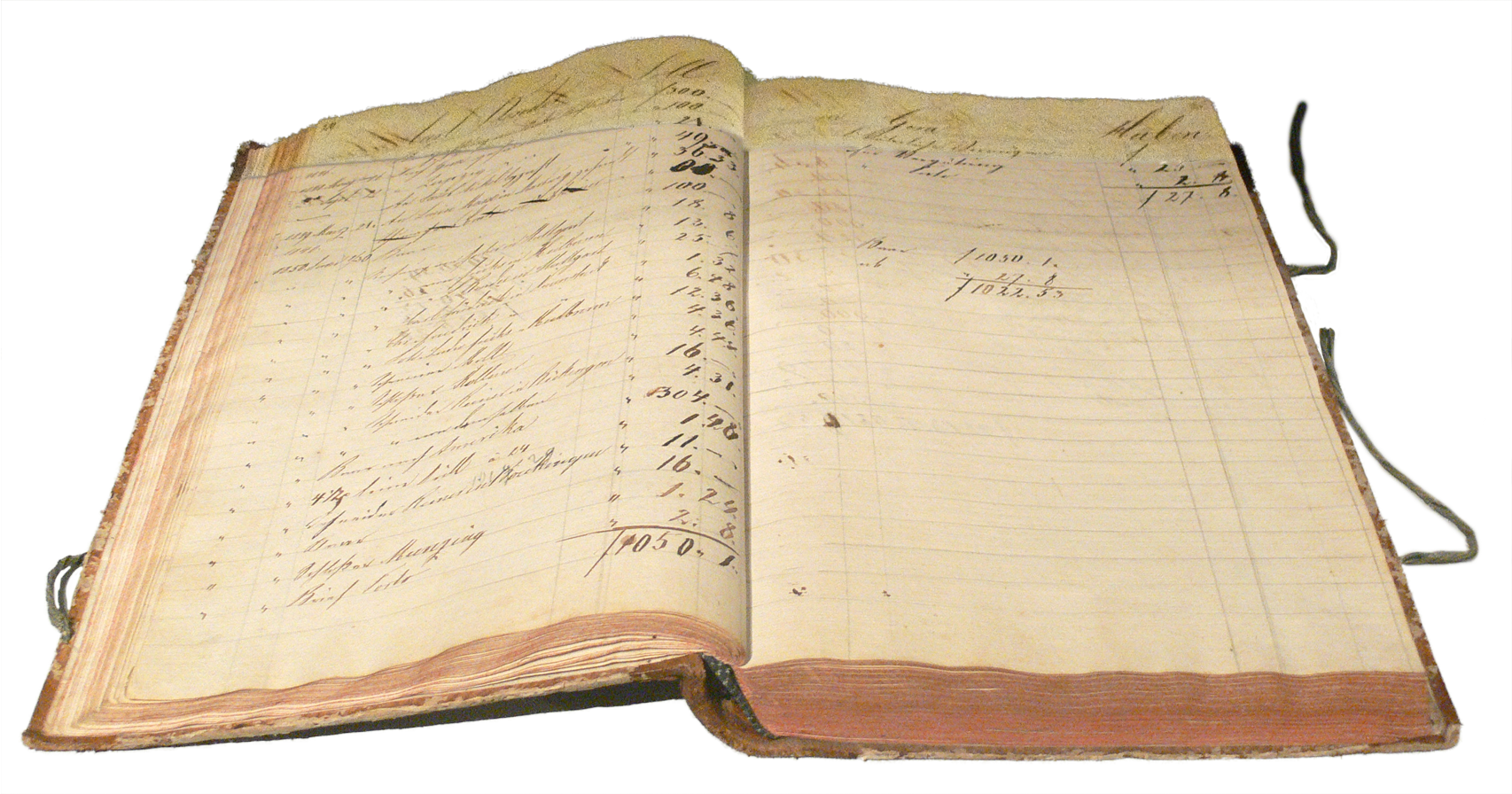

Introducing the General Ledger

The advancement of money has a remarkable history and the birth of the Bitcoin network changed society’s principle of the topic into something completely brand-new. In its easiest type, money is merely info, in some cases paired with physical products, that is traded for items discovered or produced by human beings. One of the earliest variations of money comes from ancient Mesopotamia (3,200 BC) when individuals utilized tablets to represent specific kinds of items like grain, meal, and malt. The factor people established an accounting system is due to the fact that physical products might get too troublesome to reveal wealth to others for credit. For circumstances, if you had 6 months’ worth of grain in storage, it’s much easier to reveal somebody from a remote town a journal of the items instead of transferring the grain itself. The very first journal entry systems created by the Mesopotamians were called pictographic tablets.

Double Entry Bookkeeping, Fractional Reserve Banking, and Promissory Notes

The Mesopotamians were the initially to present the principle of a “basic journal,” which summed up a specific or group’s monetary info in a log. Thousands of years later on, the basic journal changed into a various system called double-entry accounting. The brand-new technique assisted help with loaning in between merchants and the Jewish lenders in Old Cairo. Most individuals acknowledge the double-entry journal system started in 1340 ADVERTISEMENT which is referred to as the Messari. While individuals still utilized physical products like coins, the double-entry accounting (DEBORAH) system typically served as the foundation for all the systems of money utilized by the neighborhood of people. Rather than a basic basic record, a DEBORAH procedure needed investors to record a matching and opposite entry into 2 different classifications called debit and credit. The extremely structures of the world’s banking system stem from the rankings of capital and financial obligation. Just like silver and gold coins, the DEBORAH system ended up being an implicit contract that members of society observed to more cooperation and trade. The journal system and the most popular physical currencies and products at the time formed a social agreement we call money and society still utilizes the very same system today.

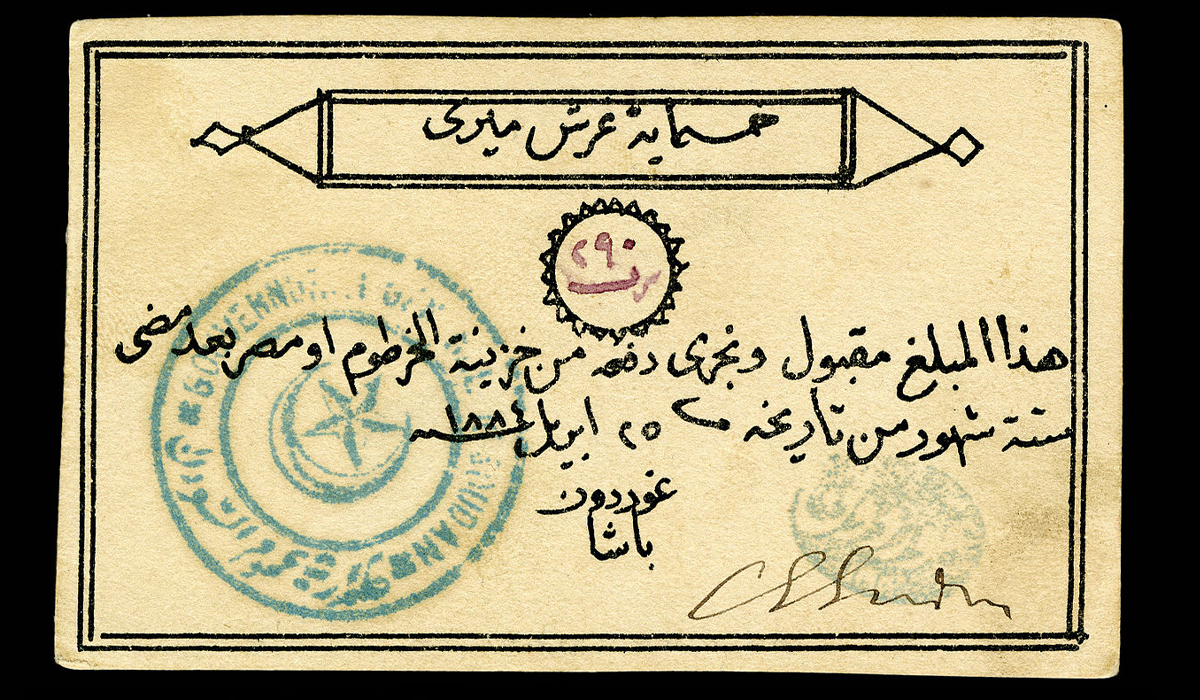

After the DEBORAH system was created, lenders found out how to control the books. For circumstances, the 3rd parties who were delegated with the world’s money ledgers found out plans like fractional reserve banking. If a guy visited his regional lender and transferred a couple of shillings of gold, the lender would take the funds to secure and shop and offer the guy a billing or a promissory note. The note discussed that the guy had actually transferred a variety of shillings, he was the rightful owner by having the note, and he might redeem it for his shillings. From here human beings found out it was way much easier to trade the promissory notes in contrast to trading the heavy and typically troublesome gold. So throughout the middle ages days, individuals started to trade the notes and human beings experienced the birth of fiat. At the very same time, they saw the development of fractional reserve banking due to the fact that the lenders understood that they might release more promissory notes than the gold shillings they had actually kept in reserves, due to the fact that nobody would even understand. The people did learn later on, when the local economy struggled with quick inflation and the rate of items started to increase due to the fact that there were more notes than gold reserves.

Central Banks and Governments Produced Credit-Based Social Classes and the 1%

News.Bitscoins.net’s current research study report “Money and Democracy: Why You Never Get to Vote on the Most Important Part of Society” detailed how the main banking system was started by stock traders utilizing Sweden’s Riksbank and in England when the very first reserve banks were created. Moreover, in the U.S. the Wall Street magnates from the House of Morgan generated the Federal Reserve. The reserve banks connected ledger entries as a money system to the state however in a personal way, acting as if they were politically independent. However, the reserve banks utilized the force of the state and created a monopoly on minting legal tender. In the mid-1800s the world’s 2nd reserve bank, the Bank of England (BoE), was the initially to release promissory notes that might be redeemed for gold bullion. The Federal Reserve also had a comparable journal system where provided banknotes might be exchanged for gold. Meanwhile, the federal governments required individuals to pay taxes in the legal tender (main banknotes) and throughout the late 1900s, a lot of reserve banks eliminated the gold support from provided banknotes. You can no longer redeem promissory notes for gold and you cannot pay taxes with bullion either, which successfully solidified the fiat system into an abnormal monopoly.

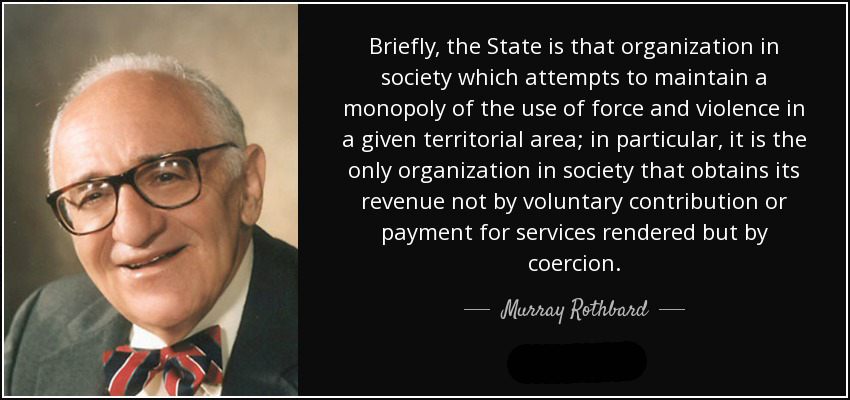

The world’s individuals never ever had any state when the reserve banks took control of and they do not have a vote when it concerns the world’s financial system. Over time the reserve banks and other banks under their control cushioned a system of fascism, corporatism, and crony-capitalism. Global people of the 21st century now have a group of individuals called the 1%, which describes the variety of individuals within the world’s population who manage the world’s financial resources. 1% of the most affluent individuals manage a fantastic bulk of the world’s capital, products, land, suggests of production, and political impact. The world’s individuals (the 99%), through the usage of force and browbeating, are threatened and needed to accept federal government fiat money as a social agreement. Governments and the reserve banks that produce promissory notes utilize this money to handle the economy and rearrange wealth.

Because the fiat system is manipulated and the reserve bank’s monopoly is asserted by state violence, the system has actually created a ranking system of social classes that include the 1%, the abundant, middle class, and the bad. All of these social classes are ranked within the world’s financial system of production. (The topic of human classes is a questionable subject, it needs to be kept in mind.) The social class ranking system is more manipulated by reserve banks when they release credit to people based upon their monetary performance history. A rich person is most likely to get a larger loan in contrast to a individual who has little to no capital. For some odd factor, human beings driven by the desire to repair the big wealth variation have actually just made it even worse by choosing federal government authorities and empowering them to handle the world’s financial system. The Leviathans’ power in tandem with the reserve bank’s financial management of the worldwide economy has actually ended up being practically invincible.

Bitcoin: The First Real-World Example of Triple-Entry Accounting

When Satoshi Nakamoto launched Bitcoin into the world, he dispersed a extremely ingenious type of money that used Professor Yuji Ijiri’s triple-entry accounting system presented in 1999. The procedure includes the fundamentals of double entry-bookkeeping, however consists of safe and proven cryptography. Instead of the debit and credit entries, the underlying properties are kept in one location that’s proven by the 2 celebrations exchanging. With the case of Bitcoin, the system is a totally transparent journal. In 2005, the well recognized cryptographer Ian Grigg developed a robust term paper around the principle of a triple-entry accounting system. But it wasn’t till January 2009 that the very first working example of triple-entry accounting was born with Bitcoin. For the very first time in history, people and companies had access to a cash that was not managed by one person or a group of individuals, not provided by a federal government or reserve bank, and had absolutely no business support whatsoever. Moreover, due to the development of triple-entry accounting and a transparent blockchain, anybody can validate the journal, unlike reserve banks printing funds behind closed doors.

Bitcoin has actually altered the landscape of money due to the fact that it provides ‘the individuals,’ or 99%, the possibility to rearrange the world’s wealth in a fairer method. Unlike the reserve banks, it is not personal and the procedure can be investigated 24-7. Bitcoin depends on a social agreement that we as individuals all concur upon, that includes: no confiscations, censorship resistance, digital deficiency, and all of these guidelines can be confirmed by the public at any time. Bitcoin’s potential customers of survival, and hence that of the triple entry-bookkeeping it includes, continue to reinforce with each passing year in what’s referred to as the Lindy result. It’s as much as us as a society to produce trustworthy money that can be traded for items and labor, however also stay important for day-to-day usage as a cash. With Bitcoin, Satoshi offered us a brand-new kind of system that is totally voluntary to utilize and which might one day modification the method the masses utilize and comprehend money.

What do you consider the method which main lenders and political leaders manipulated the world’s financial journal systems? Let us understand what you consider this topic in the comments area below.

Image credits: Shutterstock, Wikipedia, Occupy.com, and Pixabay.

Verify and track bitcoin money deals on our BCH Block Explorer, the finest of its kind throughout the world. Also, stay up to date with your holdings, BCH, and other coins, on our market charts at Markets.Bitscoins.web, another initial and totally free service from Bitscoins.web.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.