South Korea’s Financial Supervisory Service has said that it gained’t regulate the digital token markets due to cryptocurrencies not comprising a legally acknowledged monetary instrument. In central financial institution information, Zimbabwe’s central financial institution has said that bitcoin will not be authorized, and Singapore’s central financial institution has launched the second public session for its newly proposed funds laws. Here’s a regulator round-up.

Also Read: President of Belarus Expected to Sign Decree to Legalize Cryptocurrencies

South Korea’s Financial Regulator Does Not Plan on Regulating Cryptocurrencies

The Governor of South Korea’s Financial Supervisory Service (FSS), Mr. Choe Hueng-sik, has indicated that the FSS doesn’t contemplate bitcoin and different digital tokens to comprise reputable currency, and as such, is not going to regulate the cryptocurrency markets.

The Governor of South Korea’s Financial Supervisory Service (FSS), Mr. Choe Hueng-sik, has indicated that the FSS doesn’t contemplate bitcoin and different digital tokens to comprise reputable currency, and as such, is not going to regulate the cryptocurrency markets.

The governor likened the FSS’s stance to its regulatory place concerning casinos, stating “It is identical with the truth that we don’t regulate or supervise casinos. Though there may very well be issues on extreme playing, that doesn’t present grounds for the FSS to management on line casino practices.”

The governor indicated that the FSS’s place would change provided that cryptocurrencies had been to turn out to be a legitimately acknowledged currency, stating “Though we’re monitoring the apply of cryptocurrency buying and selling, we don’t have plans proper now to immediately supervise exchanges. Supervision will come solely after the authorized recognition of digital tokens as a reputable currency.”

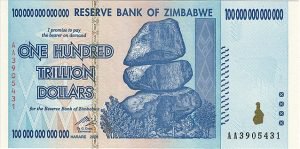

Reserve Bank of Zimbabwe States Bitcoin “Is Not Actually Legal”

Norman Mataruka, the Reserve Bank of Zimbabwe’s (RBZ) director and registrar of banking establishments, has advised reporters that bitcoin will not be authorized. Mr. Mataruka said:

Norman Mataruka, the Reserve Bank of Zimbabwe’s (RBZ) director and registrar of banking establishments, has advised reporters that bitcoin will not be authorized. Mr. Mataruka said:

“In terms of the bitcoin, as far as we are concerned, it is not actually legal. In Southern Africa, what we have done as regulators, we have said that we will not allow this in our markets… Research is currently being undertaken to ascertain the challenges and risks associated with these particular products and until we have actually established and come up with a legal and regulatory framework for them, it will not be allowed.”

The announcement comes shortly after the resignation of Robert Mugabe, following a coup that ousted Zimbabwe’s former chief of 37 years. In current months, growing protection has been given to the inflated value of bitcoin within the African nation, with excessive demand for the cryptocurrency being pushed by Zimbabwe’s prevailing currency disaster.

Although Mr. Mataruka failed to make clear if he meant that the possession and use of bitcoin was unlawful, or just that bitcoin doesn’t comprise a legally acknowledged currency within the state of Zimbabwe, it’s unlikely that the RBZ can spare the assets required to try to uphold prohibitive cryptocurrency laws given Zimbabwe’s present political turmoil.

Singapore’s Central Bank Seeks To “Streamline” Payment Regulations to Include Cryptocurrencies

The Monetary Authority of Singapore (MAS), has launched its second public session concerning a newly proposed regulatory framework, the “Payment Services Bill”. The invoice seeks to “streamline the regulation of payment services under a single legislation,” and “expand the scope of regulated payment activities to include virtual currency services and other innovations, and calibrate regulation according to the risks posed by these activities.” The MAS said:

The Monetary Authority of Singapore (MAS), has launched its second public session concerning a newly proposed regulatory framework, the “Payment Services Bill”. The invoice seeks to “streamline the regulation of payment services under a single legislation,” and “expand the scope of regulated payment activities to include virtual currency services and other innovations, and calibrate regulation according to the risks posed by these activities.” The MAS said:

“When the new Bill is enacted, payment firms will only need to hold one license under a single regulatory framework to conduct any or all of the specified payment activities. Only payment activities that face customers or merchants, process funds or acquire transactions, and pose relevant regulatory concerns will need to be licensed. The new framework will expand the scope of regulation to include domestic money transfers… merchant acquisition… and the purchase and sale of virtual currencies… To help ensure that the expanded scope of regulation is not onerous, the Bill will differentiate regulatory requirements according to the risks that specific payment activities pose rather than apply a uniform set of regulations on all payment service providers… The Bill will empower MAS to regulate payment services for money-laundering and terrorism financing risks.”

Mr. Ravi Menon, the managing director of the MAS, said: “We want to put in place a forward-looking regulatory regime to encourage wider adoption of secure e-payment solutions.” The public session will run from 21 November 2017 to eight January 2018.

Do you suppose that Zimbabwe has the assets to implement a cryptocurrency ban? What are your ideas on Singapore’s public session, or the FSS’ announcement that it gained’t regulate cryptocurrencies at the moment? Tell us what you suppose within the comments part below!

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.