It has been a busy week for Singapore because it pertains to cryptocurrency. The city-state is about open the primary fiat-crypto change in Southeast Asia, whereas the monetary regulator has vowed to assist crypto corporations arrange native financial institution accounts, in keeping with media experiences.

Strong Response to

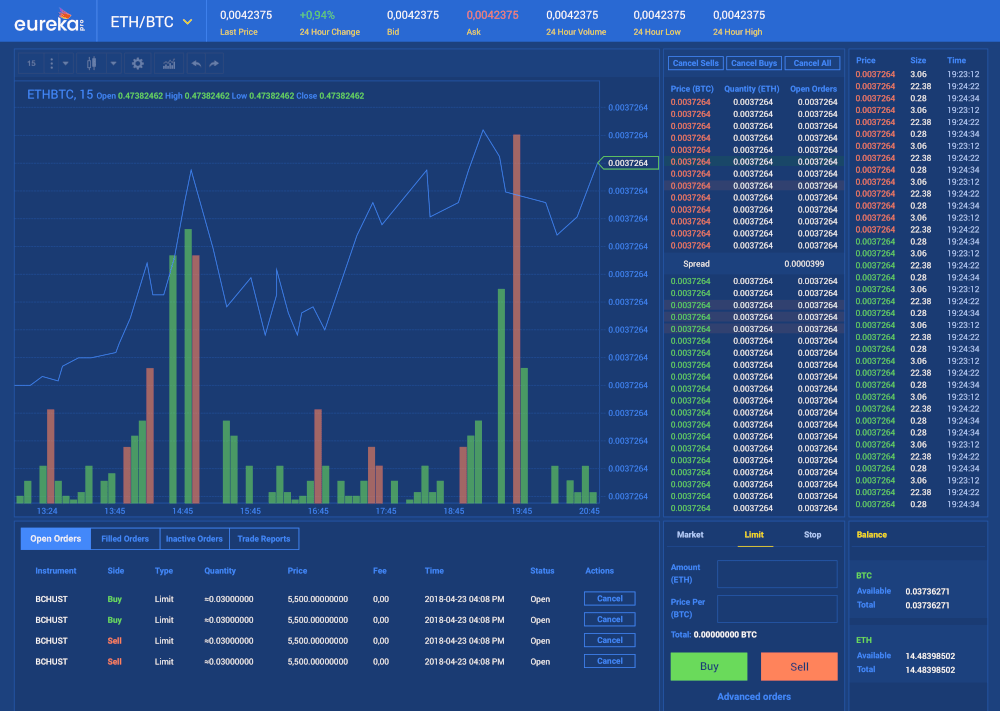

Eurekapro’s Beta Launch

More than 8,000 individuals signed up for the open public beta launch of Eurekapro’s new fiat-crypto change, Finews.asia has reported. “A Singapore-based exchange will allow for easy fiat-to-crypto trading and aims to make digital currency more easily accessible to businesses and consumers,” the information web site mentioned.

Eurekapro presents its personal native token, EKT, and claims it gives essentially the most intensive fiat-to-crypto assist in Asia. With its new Singapore change, the corporate — which was beforehand referred to as Overswitch and primarily based out of Sweden — will permit customers to conduct transactions with a lot of regional fiat currencies, together with the Singapore greenback, Malaysian ringgit and Indonesian rupiah.

MAS Cautiously Embraces Crypto

The Monetary Authority of Singapore (MAS) will begin serving to crypto companies to arrange native financial institution accounts, Bloomberg has reported, citing MAS Managing Director Ravi Menon. Although Asia is house to a rising center class that’s eager to experiment with cryptocurrencies, Singapore is seeking to distinction its embrace of crypto in opposition to that of different international locations throughout the continent. For instance, MAS doesn’t plan to require licenses for crypto exchanges, because the Japanese authorities do.

Japan has emerged because the gold commonplace for crypto in Asia, and actually all over the world, because it has largely taken a live-and-let-live strategy. But in Singapore, MAS plans to put totally different crypto companies into classes. “Utility tokens,” the primary of those classes, refers to using blockchain know-how to facilitate funds for issues similar to computing services. Menon mentioned that hardly any regulation will probably be required for such actions.

The second distinction that MAS will draw for the crypto trade pertains to digital tokens that resemble securities. Such cryptocurrencies will fall underneath the oversight of Singapore’s Securities and Futures Act. In actuality, Menon acknowledged that there haven’t been many native preliminary coin choices that could possibly be categorized underneath this class so far. But those who do will probably be topic to the related laws. MAS has even mentioned that it’s going to not think about many such examples to be viable enterprise fashions. “Most of them are careful to steer clear of that line,” Menon mentioned.

Lack of Regulatory Clarity

While the Singapore authorities have overtly tried to encourage the expansion of monetary know-how companies, crypto corporations have discovered {that a} lack of regulatory readability has so far held again their growth. Part of the issue is that crypto companies have struggled to get native financial institution accounts; in some circumstances, the banks have ended up closing accounts that such corporations have managed to open.

Yet Menon acknowledged that the crypto enterprise is totally different from the fintech area in some ways, noting that the reluctance of native banks to become involved is comprehensible, because of the arguably “opaque” practices of some crypto corporations. He mentioned that the regulator’s main concern includes discouraging cash laundering and defending the pursuits of customers. But he also famous that there are in the end limits to the regulatory attain of the MAS.

Do you consider Singapore will finally accommodate crypto companies to the identical diploma as Japan? Let us know within the comments below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.