Second generation blockchains existed as being quicker, more affordable, and more scalable than Bitcoin. Third generation chains (generally anything that followed Ethereum) guaranteed even higher optimizations. In the occasion, these networks have actually faced the exact same problems as Bitcoin, with competitors for limited resources leading to installing expenses and blockage. To deal with these issues, a range of scaling options has actually been proffered – a few of which might also advantage UTXO blockchains such as BCH and BTC.

The Great Scaling Debate

At the yearly Ethereum designers’ conference in Osaka recently, the majority of the talks had to do with scaling. So was a great piece of the casual talk in between delegates, a lot of whom have serious issues about Ethereum’s capability to fulfill growing network need. Eth 2.0, the much-vaunted upgrade that will include a shift from PoW to PoS, is still years away, with numerous Devcon participants yielding that it might never ever take place. This deadlock has actually triggered competing smart contract chains such as Qtum to position themselves as more scalable options.

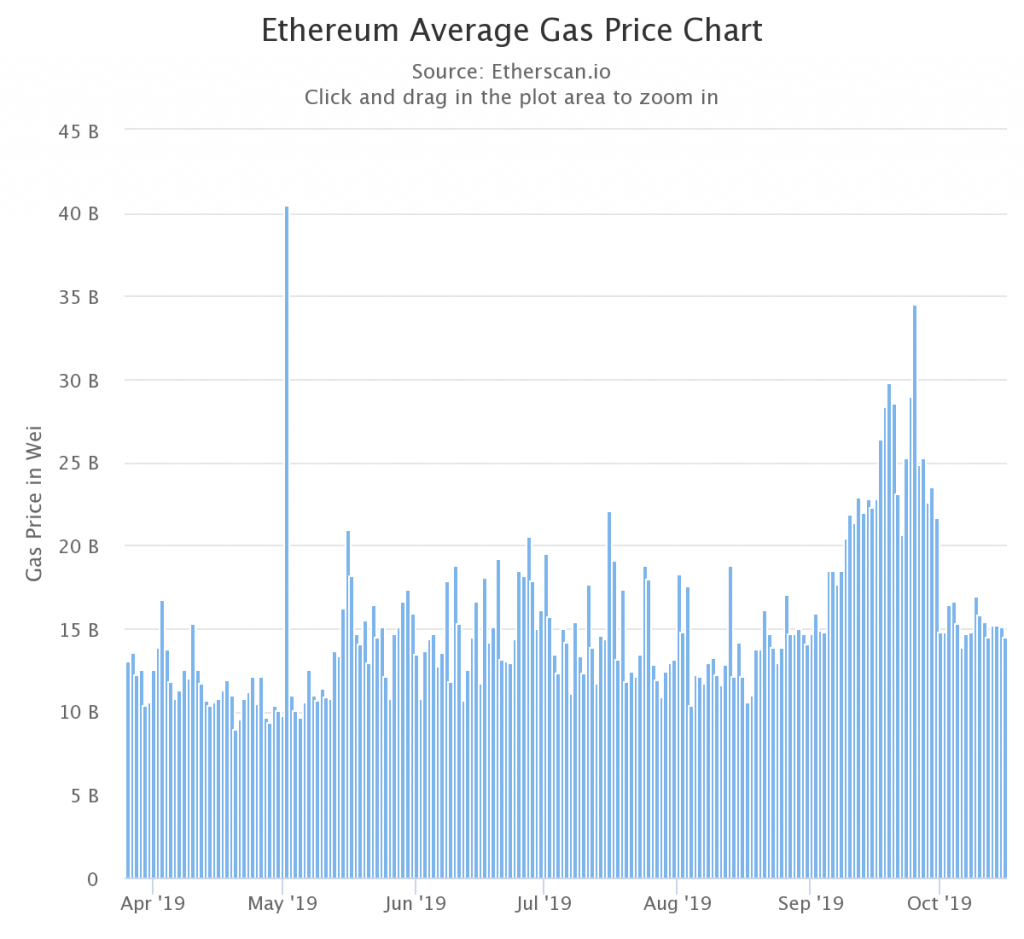

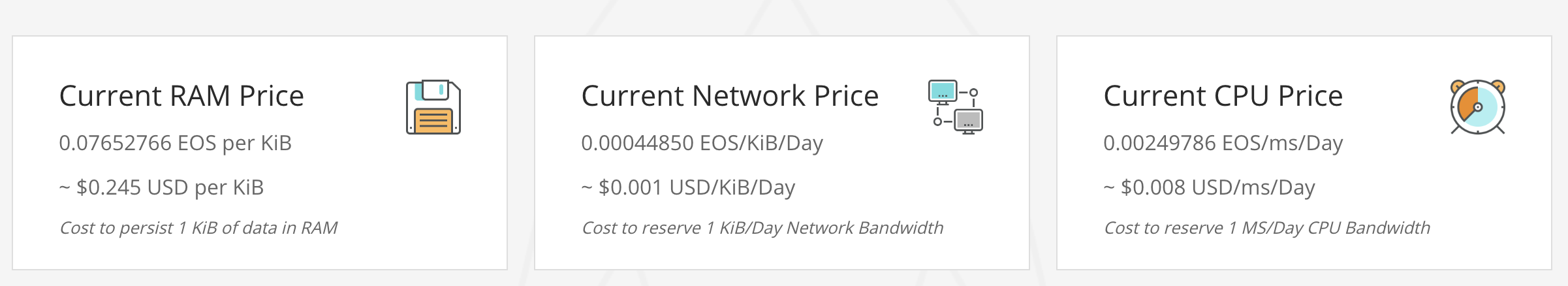

Over on EOS, there are comparable issues accumulating. Unlike Ethereum, EOS isn’t truly gunning for the decentralized financing crown, however it does share something in typical: growing need for limited resources. On Ethereum, those resources manifest as block area which rises gas rates. On EOS, it takes the type of computational resources: RAM (virtual storage) and CPU, which is the quantity of time a block manufacturer will designate to deals from a specific account.

Rising and unpredictable computational expenses on EOS have actually required designers to look for scaling options of their own. The architecture of blockchains such as Bitcoin, EOS, and Ethereum varies significantly, however this much applies: onchain resources are restricted and there is a free market contending for area. Just as your automobile moves more gradually and is less fuel effective throughout heavy traffic, at peak times on crypto networks, your deal is most likely to be slower and more pricey. Fixing this issue requires some out the blocks believing.

Virtual CPU and Offchain Transactions

For EOS, scaling redemption has actually come thanks to Liquidapps, whose vRAM item has actually now been matched by a vCPU equivalent. This technique includes taking these valuable resources off-chain to a different network of nodes that carry out the calculation at low expense, prior to transmitting the confirmation to the EOS primary chain. Although presently being provisioned on EOS, the exact same innovation can be used to Ethereum, or perhaps to Bitcoin Cash, for designers looking for to produce decentralized applications that need gain access to to inexpensive storage.

For Ethereum, the scaling option provided as the likeliest to prosper is Plasma, which can manage numerous deals per 2nd, and now supports smart agreements. As co-founder Jinglan Wang puts it, defi jobs stating they put on’t requirement Ethereum scaling options today resembles a New Yorker stating they put on’t require a Metrocard in heavy traffic. Plasma is a layer 2 option, whose BTC analogue is Lightning Network.

Dapp Developers Must Choose Wisely

Developers considering the very best network on which to launch decentralized applications have some hard options.

Ethereum has a big environment of users, devs, and business, however it’s running near capability, and network costs have actually been increasing for months. Scaling options such as Matic can assist.

EOS supplies totally free deals at the point of gain access to, making it more consumer-friendly, however popular dapps run the risk of landing their designers with increasing computational expenses. Secondary options such as vRAM can reduce this nevertheless.

Qtum has actually simply undergone its very first tough fork, including a brand-new EVM that’s improved its smart contract abilities, while maintaining the UTXO design initially originated on Bitcoin. It’s generally Ethereum without the scaling issues, albeit with a smaller sized environment at this moment in time.

Horizontal vs Vertical Scaling

Taking deals offchain, be it to a sidechain or layer 2, is not without compromises. Generally speaking, there is a decrease in decentralization and in deal finality. The designers of these options tension that a micropayment doesn’t require the exact same level of security and trustlessness as a $1 billion BTC deal. Gaming and betting dapps, for example, are great to utilize an item like Liquidapps’ vRAM for offchain storage, or Plasma for affordable deals.

To return to the traffic example, side road can be utilized to skirt the traffic snarling up the highway, however they’re not developed to assistance 16-wheelers. Blockchain scaling options can for that reason be more properly referred to as scaling choices: options that will appropriate for some jobs, and undesirable to others.

Vertical scaling is the procedure of increasing throughput by increasing block or node capability. It’s the technique taken by Bitcoin Cash, for example. The option to Bitcoin obstructs ending up being complete, its advocates argue, is merely to include a couple more lanes to the highway. It’s an easy technique, however one that has actually shown extremely reliable up until now. Horizontal scaling requires taking as much of the load off the primary chain as possible, pressing it out to 3rd party options that include extensibility.

Despite the countless dollars and 10s of countless hours put into blockchain scaling, the reality is, we still put on’t understand which options will dominate. Bigger obstructs; more sidechains; developing the stack; establishing horizontally. Through experimentation, discourse and dispute, a course will be discovered to make blockchains prepared for the mass adoption that all crypto supporters view as unavoidable. In the here and now, however, the designers of so-called next-generation blockchains are finding out a lesson that bitcoiners discovered long earlier: onchain, there’s no such thing as limitless scalability.

Which blockchain scaling options do you think have the very best opportunity of success? Let us understand in the comments area below.

Did you understand you can validate any unofficial Bitcoin deal with our Bitcoin Block Explorer tool? Simply total a Bitcoin address search to see it on the blockchain. Plus, go to our Bitcoin Charts to see what’s taking place in the market.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.