Bitfinex’s banking points seem like affecting the broader bitcoin change markets.

As fiat withdrawal issues at the world’s largest US greenback bitcoin change continued right now, the unfold between bitcoin costs noticed on Bitfinex and different worldwide exchanges surged, rising to greater than $90, or roughly 7%, in some circumstances.

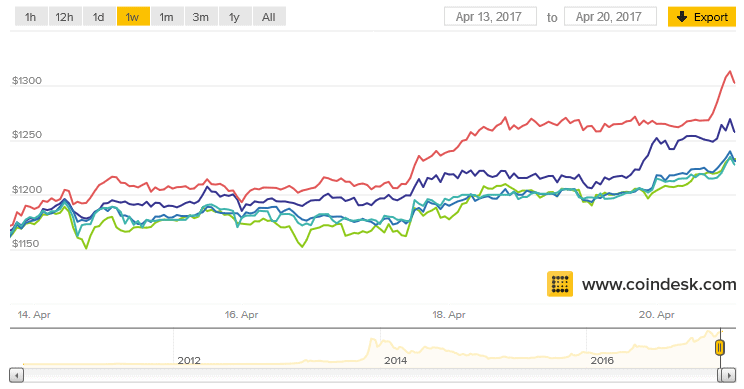

At roughly 17:15 UTC, for instance, bitcoin traded at $1,325 on Bitfinex, roughly $92 (or 7% greater) than the value of $1,233 noticed on itBit, in accordance with knowledge from the CoinDesk Bitcoin Price Index (BPI).

The unfold was comparable on Bitstamp and CoinBase’s GDAX change – the place the digital currency traded at an $85 unfold at that point. The distinction was smaller when noticed on OKCoin, although OKCoin has additionally reported banking points in recent days.

These figures had been sharply greater than the beginning of the session, when bitcoin was buying and selling at $1,265 on Bitfinex, roughly $50 greater than the value on each itBit and GDAX, in accordance with knowledge from the CoinDesk BPI.

At press time, these worth gaps continued to be outsized with a $60 unfold noticed between Bitstamp and GDAX and Bitfinex.

Wire switch difficulties

The improvement follows Bitfinex’s announcement today that it’s unable to ship wire transfers abroad as a consequence of challenges with its correspondent banks. At first, Bitfinex claimed it was informed by these monetary establishments that the change lacked the flexibility to course of transfers involving Hong Kong and Swiss francs.

While the change stated it was capable of make some transfers involving these fiat currencies, the monetary establishments later knowledgeable Bitfinex it could now not be capable to make transfers utilizing these currencies.

These difficulties come days after Bitfinex introduced on 13th April that its USD withdrawals had been suffering delays. On 17th April, it additional stated its Taiwan-based banking suppliers had been refusing incoming wire transfers.

At the time, the change emphasised that it was engaged on “alternative solutions” that may enable its prospects to make deposits and withdrawals utilizing fiat currencies.

Uncertain context

Still, whereas this has stoked worries a couple of Mt Gox-style insolvency, the change vehemently denied these allegations right now.

It’s price noting, too, that Bitfinex has a historical past of bouncing again from points as nicely, because it not too long ago completed paying again customers for a $65m hack skilled early final August.

While it stays to be seen how the state of affairs will unfold, with BTC-e and OKCoin becoming a member of Bitfinex in saying banking points, the developments have sparked some fears of wider crackdowns on exchanges.

BTC-e representatives advised CoinDesk its difficulty needed to do with a third-party cost service, Mayzus, one it reported occurs a number of instances a 12 months.

As such, it is doable the uptick in points is merely reflective of the robust atmosphere bitcoin companies have always faced when searching for to safe banking partnerships.

Suspension bridge image through Shutterstock

Source link

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.