Since the Bitcoin Cash (BCH) fork occurred just lately, it’s a superb time to debate the distinction between custodial and noncustodial cryptocurrency services. Newcomers to the digital asset economic system usually get confused once they hear a few blockchain break up and could marvel how they need to deal with the result. Individuals ought to observe that the most effective answer relies upon enormously on how they like to retailer their cryptocurrencies – in a custodial or noncustodial pockets.

Third Party and Sovereign Control Over Private Keys

If you might have simply joined the cryptocurrency area, you may discover some components of the ecosystem complicated. One of an important classes to be taught is the easiest way to maintain your belongings protected and safe as a result of nobody likes to lose cash. In the early days, round eight years in the past, there have been only a few service suppliers providing wallets and exchanges. But now there are a whole lot of wallets and exchanges providing a storage answer for cryptocurrencies. What some digital currency newcomers could not perceive is that there’s a huge distinction between custodial and noncustodial services. The current Bitcoin Cash fork is an effective instance of why folks ought to perceive the variations between each methods.

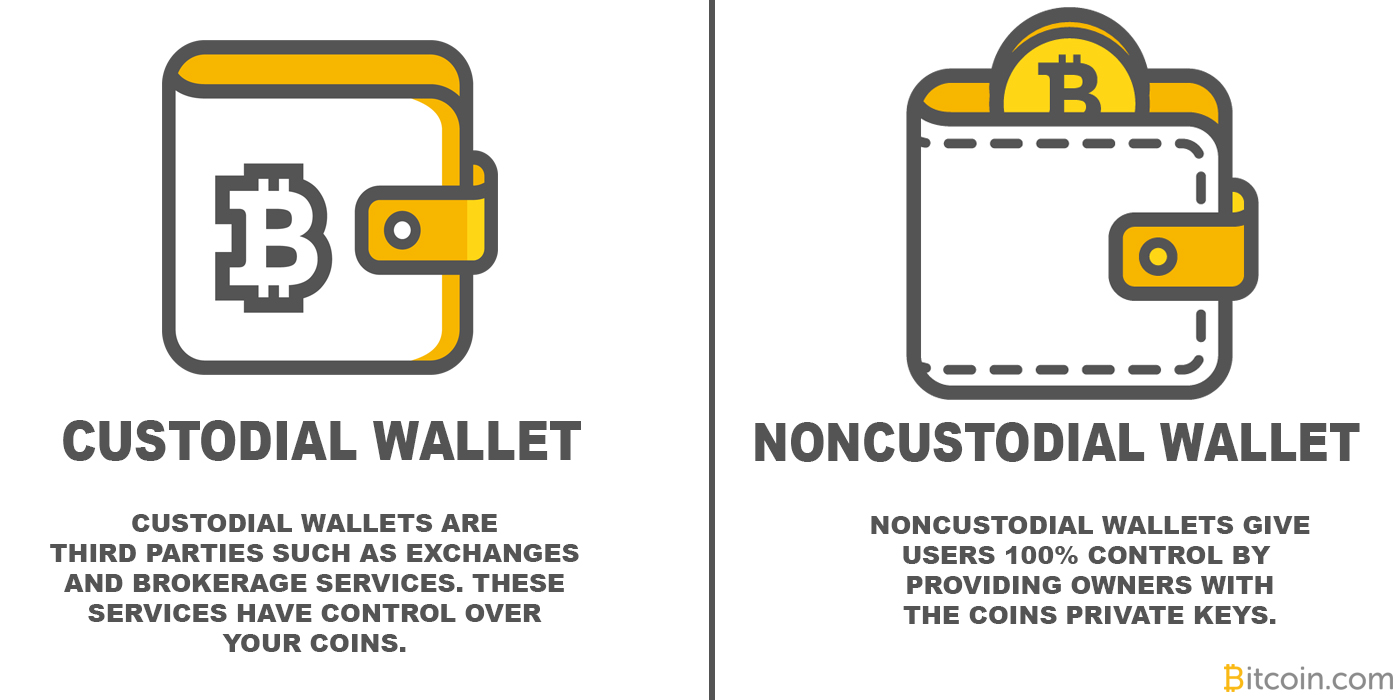

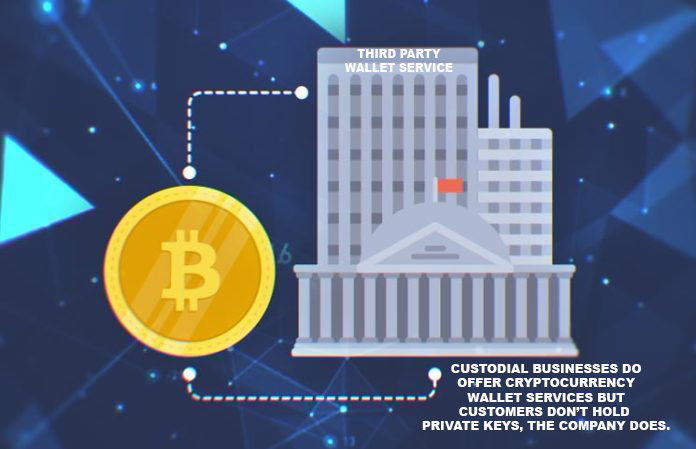

Custodial Wallet Services

Custodial cryptocurrency services embody most exchanges, brokerage services, and platforms that assist you to purchase, promote, and retailer digital belongings. A custodial enterprise is mainly a 3rd get together that gives to guard your belongings inside their system. People who retailer digital belongings with a 3rd get together want to grasp that they don’t seem to be 100% answerable for their cryptocurrencies. Coinbase is a good instance of an trade and brokerage service that also permits folks to retailer digital belongings inside their pockets system. When you obtain the Coinbase utility that permits purchases and gross sales, you’ll observe that it’s described as “the world’s most popular cryptocurrency wallet.” Therefore it’s protected to imagine some customers might imagine the applying is a noncustodial pockets, however that isn’t the case.

For instance, with the final onerous fork, Coinbase and a mess of different third-party services paused clients from sending and receiving BCH to their wallets. Noncustodial wallets have been 100% operational earlier than, throughout, and after the onerous fork, as a result of these sorts of wallets are usually not managed by a 3rd get together. In one other occasion, Coinbase defined to their clients that BCH wallets had been just lately enabled and that sooner or later they’ll disperse BSV funds. In essence, which means that in the event you saved BCH on Coinbase earlier than the fork you should await them to permit you entry to the BSV tokens that have been as soon as tethered to your BCH.

So the third get together services which have re-enabled BCH transactions have break up the cash saved there already, enabling you to transact as soon as once more with BCH with out worrying a few replay assault or sending two sorts of cash.

However, probably the most necessary slogans inside the cryptocurrency neighborhood is “If you don’t possess your non-public keys you don’t personal bitcoin.” And that is true for any cryptocurrency held on an trade or custodial pockets, as that third-party service is answerable for your cash to a big diploma. Examples of custodial services embody Kraken, Coinex, Bitstamp, Poloniex, Bittrex, Bitfinex, Binance, and the myriad of different buying and selling and brokerage service platforms that also provide storage.

Noncustodial Wallet Services That Give the User 100% Control

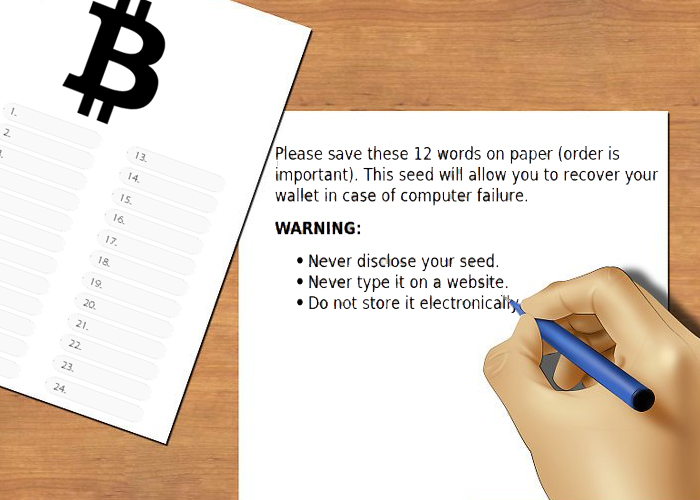

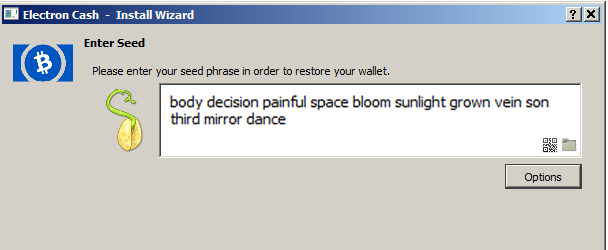

Noncustodial pockets services are platforms that permit customers to own their non-public keys. The utility will both provide you with a file or have you ever write down a mnemonic phrase that may encompass 12-24 random phrases. A platform that gives customers with the power to retailer a cryptocurrency’s non-public keys provides the consumer 100% management over the funds. If you possess your non-public keys, you wholly personal bitcoin or any of the opposite 2,000+ cryptocurrencies in existence.

So shifting again to the BCH onerous fork instance, in the event you held pre-fork bitcoin money in a noncustodial pockets, it will have allowed you to have full possession over your BCH and BSV. Noncustodial wallets embody the Bitscoins.internet consumer, BRD, Blockchain, BTC.com, Electron Cash, Copay, Jaxx, Coinomi, Edge, and many extra as a result of these platforms give customers the power to retailer their very own non-public keys.

Individuals utilizing a majority of these user-controlled wallets had the power to separate their BCH and BSV proper after the break up occurred. Because people retailer their funds in a pockets they’ve sovereign management over, they’re 100% answerable for the security and safety of the keys. Noncustodial pockets homeowners also want to separate their BCH on their very own, until the pockets software program gives a local splitting answer inside the consumer. This implies that if a consumer sends some BCH with out splitting their BSV first in a noncustodial pockets, they face shedding the BSV after sending the transaction. Having full possession of your cryptocurrency non-public keys via a noncustodial pockets means you’re accountable for each motion, together with splitting cash.

Research and Get to Know the Storage Solution You Choose

There are a number of functions and platforms that provide cryptocurrency storage in wallets, however you should watch out which one you select. It is essential to grasp the distinction between custodial (third-party management) and noncustodial (sovereign management) storage options. The distinction may be big on the subject of trade hacks, blockchain splits, and different unknowns that happen inside the cryptocurrency ecosystem. The neatest thing to do is analysis the service or utility you utilize to retailer your cryptocurrency and carry out due diligence. Find out whether or not or not the applying you utilize is a custodial or noncustodial answer and resolve for your self if the service is protected and safe sufficient to carry your valuable digital belongings.

Do you perceive the distinction between custodial and noncustodial cryptocurrency services? Let us know what you concentrate on this topic within the comments part below.

Now reside, Satoshi Pulse. A complete, real-time itemizing of the cryptocurrency market. View costs, charts, transaction volumes, and extra for the highest 500 cryptocurrencies buying and selling at present.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.