“The institutions are coming.”

Anyone who’s remained in the Bitcoin area for any considerable time period has actually heard some popular figure within the area utter this expression.

In August 2020, when MicroStrategy, an American-based company software application business, revealed it would be acquiring bitcoin to include it to its treasury, lots of believed that was the start of the institutional stampede.

But it wasn’t.

Sure, Tesla purchased some bitcoin the list below year, just to dispose 75% of it not long after.

And so from 2020 through 2023, MicroStrategy was an abnormality. During these years, the business — led by Bitcoin permabull Michael Saylor — stayed the only significant corporation on Earth to transform a significant part of its treasury into bitcoin.

Saylor’s vision to get MicroStrategy on a bitcoin requirement hasn’t fluctuated, however.

Instead, he has actually doubled down and continued to guide MicroStrategy as it has actually put more bitcoin on its balance sheet. He’s also hosted a conference — MicroStrategy World: Bitcoin for Corporations — every year beginning the year after his business made its very first bitcoin purchase as a method to reveal other business how to replicate MicroStrategy.

This year’s edition of the conference — hung on May 1 and 2 in Las Vegas, NV — marked the start of a new era, according to Saylor, an era in which the time has actually come for institutions to follow MicroStrategy’s lead.

The Age of Bitcoin For Institutions and Corporations Has Begun

In Saylor’s keynote discussion on the 2nd day of the conference entitled “There Is No Second Best”, he called 2020-2023 the “crazy years” in the Bitcoin area.

He described that these years belonged to a duration of “crypto chaos,” a duration from which bitcoin became the dominant and most relied on crypto property.

What follows the insane years, Saylor stated, are the years in which institutions and corporations welcome Bitcoin, and he informed Bitcoin Magazine in an X Spaces on April 30, the day before the conference started, that he thinks this new era started in January 2024, when 11 area Bitcoin ETFs released in the United States.

Let’s not simply take Saylor’s word that a new day has actually dawned, though. Let’s consider what Hunter Horsley, CEO of Bitwise, among the 11 banks that released an area Bitcoin ETF in the United States, needed to state about institutional interest in bitcoin.

“The bitcoin ETFs have really brought bitcoin into the realm of possibility for a lot of traditional financial institutions,” Horsley stated on a panel throughout the 2nd day of the conference.

“A lot of traditional and reputable firms have started engaging with bitcoin in a way they never have before, but so few of them are saying anything about it. If you just scroll through your LinkedIn or you read press releases, you would think that nothing has changed versus last year, but, for now, most — or many — are preferring not to have it be public,” he included.

SIMPLY IN: $3.5 billion Bitwise CEO states "A lot of traditional and reputable firms have started engaging with #Bitcoin in a way they never have before, but so few are saying anything about it."

"Banks are reaching out to us" 👀 pic.twitter.com/h0jjhrzZQ6

— Bitcoin Magazine (@BitcoinMagazine) May 2, 2024

Alexander Leishman, CEO and CTO, of Bitcoin exchange River, also explained in his discussion that while purchasing bitcoin has actually typically been a retail investor-driven phenomenon, a growing number of companies are starting to dip their toes into the bitcoin waters, too.

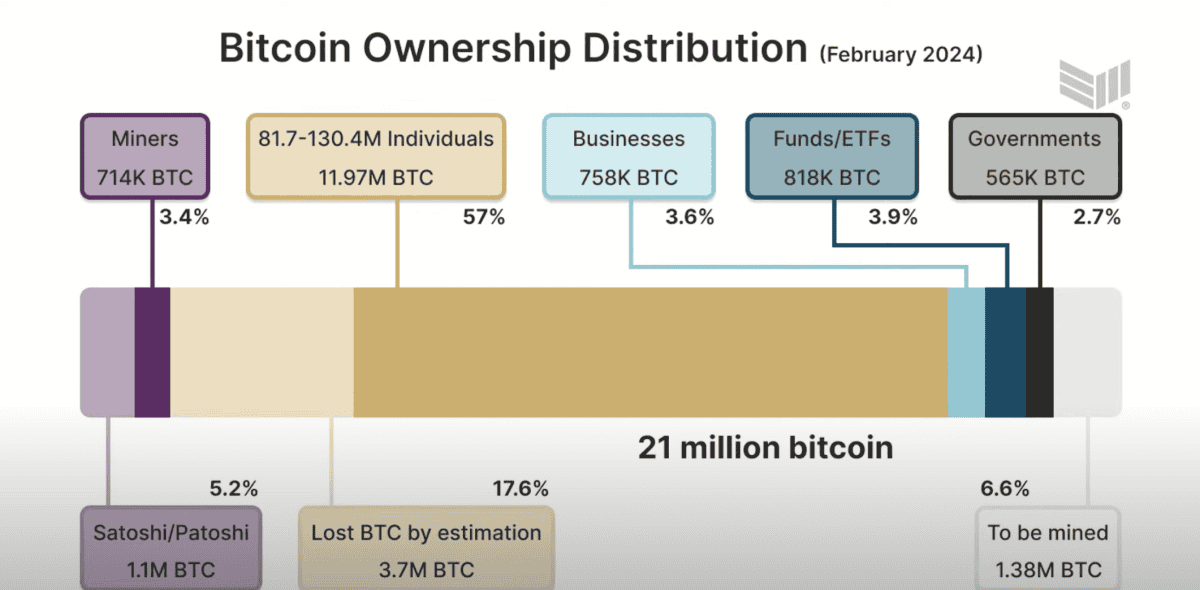

In among his slides, Leishman explained that the portions of companies and funds/ETFs that hold bitcoin might not look like a lot, however they’re larger than they’ve remained in previous years.

“We have businesses, funds and ETFs and governments, these large institutions, these blue and black bars. These bars have gone from virtually nothing to where they are today, but they’re continuing to grow,” Leishman stated.

“Retail is not really driving the recent rally in the bitcoin price. Consumer interest in bitcoin is nowhere near its all-time highs. So, what is driving this price increase? We think that one big factor is institutions,” he included.

According to David Marcus, CEO of Lightspark, in the future, institutions won’t simply be seeking to hold bitcoin on their balance sheet or provide it to their consumers, however they’ll begin utilizing it for payments.

Lightspark Is Using Lightning To Link Businesses Globally

To conclude the very first day of the conference, Saylor took a seat for a fireside chat with Marcus, previous executive at PayPal and previous lead for Facebook’s deserted cryptocurrency job Libra, to talk about how the Lightning Network will link companies throughout the world.

Lightspark made headings the day before the conference started, as it revealed Coinbase would be utilizing Lightspark to incorporate Lightning for its United States users.

According to Marcus, Coinbase was simply the very first of lots of business that would quickly be utilizing the power of Lightning.

“In a world where you’ll have hundreds of millions if not billions of people that have an address for money that can be settled in real time in the currency that they’re choosing, you can imagine all kinds of new applications [for businesses],” stated Marcus about business utilizing Lightning to not just send out sats, however digitized variations of fiat currencies, too.

"The time is now to enable fast cheap, realtime movement of Bitcoin and other assets [on Lightning]."

-David Marcus, CEO, LightSpark @lightspark#BitcoinforCorporations— MicroStrategy (@MicroStrategy) May 1, 2024

“Streaming money to endpoints is one of them. New forms of payments for merchants that would reach new audiences or new client bases that they couldn’t reach [previously]. The ability to create brand new business models to enable people to actually contribute to anything that you’re building from anywhere around the world,” he included.

“It will have an impact on the world that is going to be as important as the internet itself was in its own time for communications.”

Marcus also discussed how business are more international in nature than specific Bitcoin users and will considerably take advantage of moving worth all over the world in genuine time through Lightning.

It was challenging not to be bullish on Bitcoin and Lightning after listening to Marcus and Saylor reverse.

It was also challenging not to be bullish on Bitcoin not simply as a shop of worth and a legal tender, however as a platform for trust after Cezary Raczko, Executive Vice President of Engineering at MicroStrategy, exposed its prepare for MicroStrategy Orange, a decentralized identity (DID) platform developed on the Bitcoin blockchain.

MicroStrategy Orange

MicroStrategy Orange is a business platform that empowers companies to use DID applications, developed straight on the base layer of Bitcoin.

It’s the very first technological development including Bitcoin that MicroStrategy has actually belonged of.

“The platform consists of three fundamental pieces,” stated Raczko. “At the heart of it, is a service cloud hosted that allows you to issue those identifiers to your users in your organization. It also allows you to deploy applications that run on MicroStrategy Orange. The Orange SDK allows you to integrate the applications into your own services. And the Orange apps are going to be prepackaged solutions that address specific digital identity challenges.”

This news came as an enjoyable surprise to lots of at the conference, as it showed that MicroStrategy wishes to continue to blaze a trail with Bitcoin adoption — beyond its shop of worth usage case — as we enter this new era of companies and institutions embracing Bitcoin.

Normalizing Bitcoin For Corporations

Conversations both on and off the conference phase focused on Bitcoin developing from a taboo entity, to something that’s ending up being more regular, making it harder to disregard for business and institutions.

In discussions I had with Bitcoin market leaders like Becca Rubenfeld, COO of AnchorWatch; Sam Abbassi, creator and CEO of Hoseki; and Nathan McCauley, co-founder and CEO of Anchorage Digital, I found out that business and institutions that as soon as composed Bitcoin off as being bit more than a rip-off or trend, are now starting to ask about how they can embrace it.

“It’s exciting to be at a stage of adoption where access to bitcoin is being expanded to businesses and their clients,” Rubenfeld informed Bitcoin Magazine. “This event is particularly oriented to that, which allows conversation to be focused on the benefits and challenges unique to that new set of Bitcoin owners.”

While it’s spent some time for corporations to come around to Bitcoin, it’s clear that we’re at the beginning of an era in which they’re starting to see the worth in it.

Even if business and institutions aren’t always prepared to embrace a bitcoin basic the manner in which MicroStrategy has, it does appear that more want to have some direct exposure to bitcoin the property or start utilizing Lightning for payments or apps that use the Bitcoin blockchain.

For this, we have Michael Saylor and the group at MicroStrategy to thank.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.