In this CoinDesk 2016 in Review particular function, CoinDesk contributor Frederick Reese offers an summary of traits in the digital currency and digital asset markets.

2016 has been an thrilling yr for cryptocurrencies.

With a lot of the main open-source currencies displaying progress this yr and with some anticipated to see important growth in 2017, 2016 displays a lack of religion in conventional cash methods in gentle of the worldwide populism pattern and a rising confidence in the underlying applied sciences in play for crypto transactions.

As the yr involves an finish, CoinDesk took a second to have a look at the best-performing cryptocurrencies by market capitalization for the yr and the elements that affected the markets all year long.

For the sake of this evaluation, we’re taking a look at a evaluate interval of December 27, 2015 to December 26, 2016.

Bitcoin

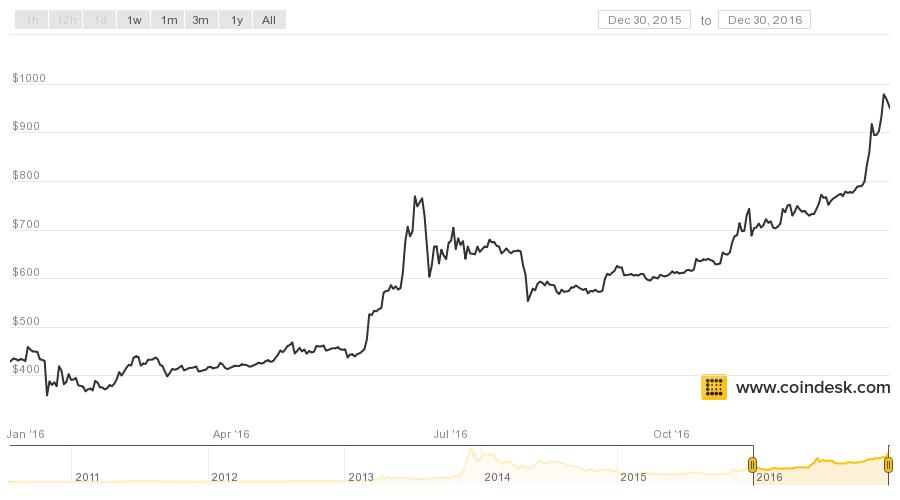

Market Capitalization (Beginning of Year): $6,161,215,794

Market Capitalization (End of Year): $14,590,356,108

Price (Beginning of Year): $411.99

Price (End of Year): $908.17

Price (Annual High): $909.94

In 2016, bitcoin remained the king of cryptocurrencies.

The world’s oldest blockchain-based asset proved to be a “little engine that would,” booming dependably in occasions of macroeconomic uncertainty.

While bitcoin failed to achieve a brand new all-time excessive, the digital currency nonetheless rebounded from a low of underneath $400 to attain an nearly three-year excessive of $982.87 on 29th December.

As of the writing of this text, the value was nonetheless on the higher finish of the yr’s vary, exceeding $950 per bitcoin.

Though shallow markets may be an element, bitcoin costs and buying and selling quantity have been supported by a rare set of world circumstances (not less than, in keeping with analysts and buyers).

These included the devaluation of the Chinese yuan, the UK’s determination to go away the EU, and the unpredictability of a Donald Trump presidency.

Yet, regardless of this, bitcoin remained in the center of the pack by metrics reminiscent of year-to-date valuation change and towards the underside in phrases change in market capitalization by share.

However, bitcoin’s massive valuation arguably makes its constructive progress extra important to the worldwide funding neighborhood.

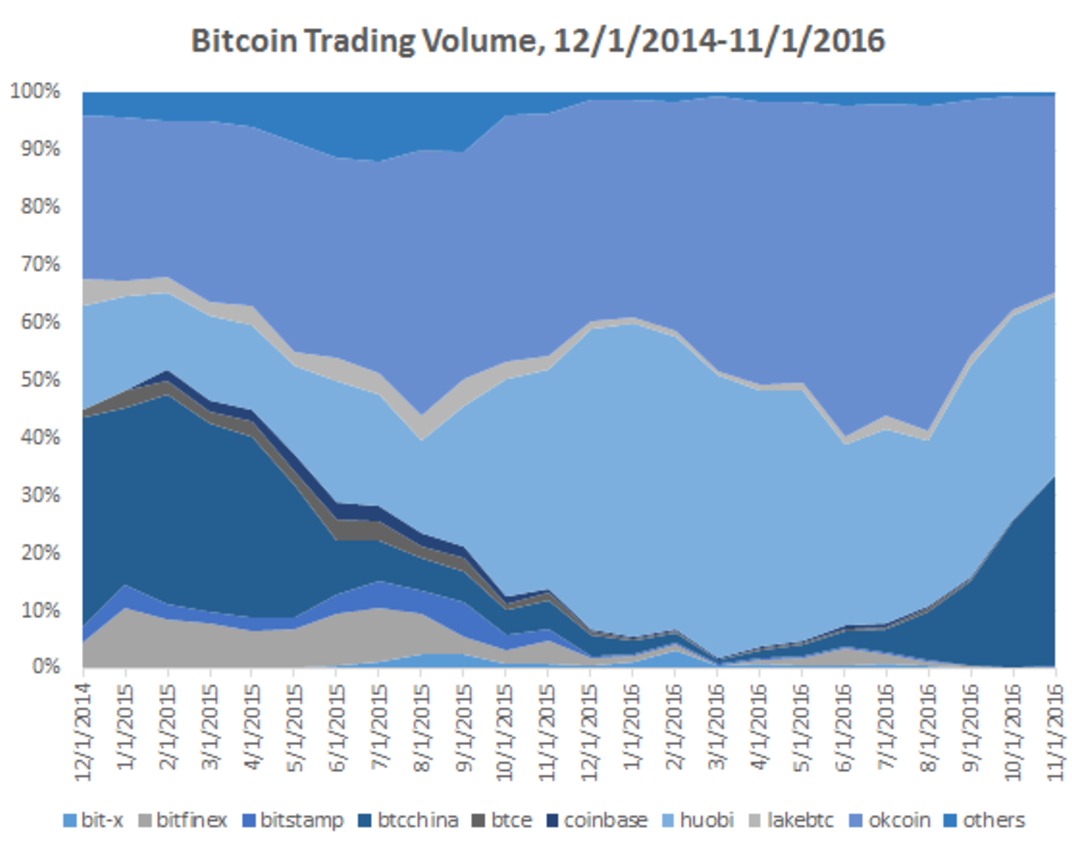

Still, a lot of the buying and selling exercise stays centered in Asia, as Chinese buying and selling quantity continued to exceeded US buying and selling quantity by important multitudes.

As seen above, among the largest Chinese miners and exchanges – OKCoin, Huobi, BTCC, Bitfinex and LakeBTC – dominated international bitcoin buying and selling this yr.

The drop in the yuan would be the motive for all this exercise, nonetheless, with reports of the Chinese authorities exploring methods to resolve the plain bypassing of its capital controls, the native scene might ultimately turn out to be extra subdued.

Ethereum

Market Capitalization (Beginning of Year): $80,339,474

Market Capitalization (End of Year): $638,zero41,577

Price (Beginning of Year): $2.83

Price (End of Year): $7.31

Price (Annual High): $19.59

2016 noticed ether – the cryptocurrency that powers the ethereum community – turn out to be one of many world’s best-performing currencies, regardless of a well-publicized hack.

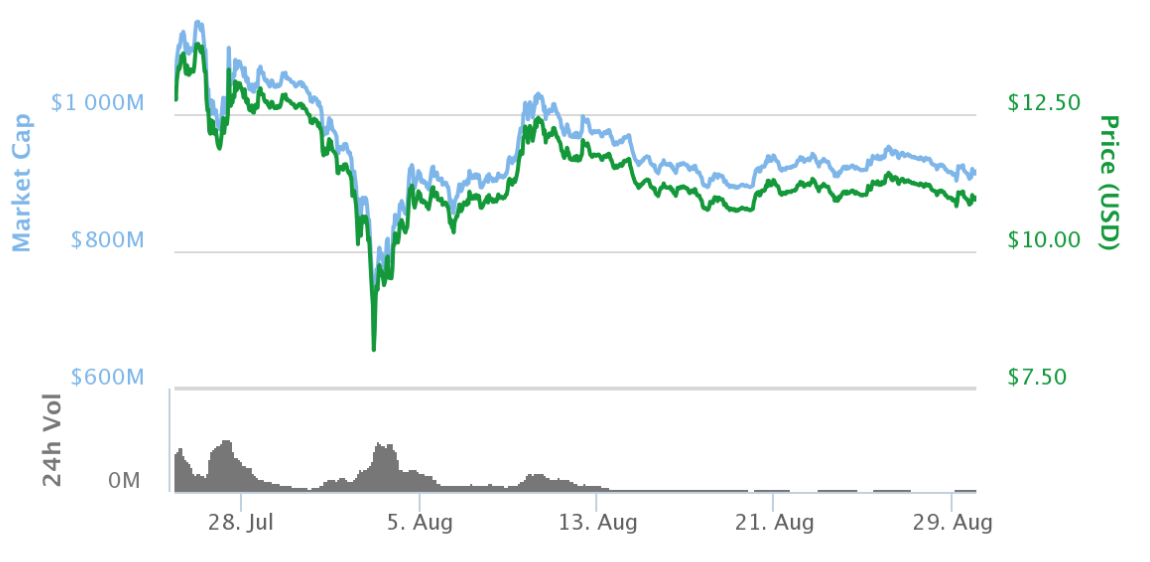

With a greater than 2,000% enhance over the primary six months of the yr and a virtually 300% enhance for the calendar yr, the pioneering blockchain for decentralized functions suffered from excessive volatility, maybe as a result of its relative newcomer standing.

The most vital elements in the instability of the ether value have been the DAO hack, the next collapse of the autonomous group, and the creation of ethereum basic. These actions, occuring in June and July, noticed an erosion of almost 50% of the altcoin’s price in lower than two days.

It’s necessary to grasp what have an effect on the creation of ethereum basic had on ethereum (see above picture).

While valuation recovered to a sure diploma, the successive forking of the blockchain led to a gentle decline in costs.

However, as ethereum is at present being seen as the popular community for attainable FinTech permissioned distributed ledgers, enterprise software program and Internet of Things functions, 2017 might present a capitalization enhance for ether.

Ripple

Market Capitalization (Beginning of Year): $206,189,522

Market Capitalization (End of Year): $231,713,026

Price (Beginning of Year): $zero.006168

Price (End of Year): $zero.006310

Price (Annual High): $zero.009358

To start with, it is necessary to acknowledge the clear the excellence between an open blockchain asset reminiscent of bitcoin, and one which operates on a permissioned ledger overseen by a personal firm, like Ripple’s XRP token.

Yet, seeing the place this upstart lies on the cryptocurrency map helps to grasp what occurred in different markets this yr.

Serving as an middleman for instantaneously changing one currency to a different, there are not any retailers that settle for XRP.

Despite this – and perhaps due to the potential XRP has for regulated cross-border commerce – Ripple did present important potential for progress and at present has the second highest market capitalization amongst publicly traded cryptocurrencies.

Despite this, XRP ended this yr near its opening value, although it did see some noteworthy volatility alongside the best way.

The largest spike got here in September following investments from main monetary companies reminiscent of Standard Chartered and Siam Capital.

Litecoin

Market Capitalization (Beginning of Year): $149,142,004

Market Capitalization (End of Year): $212,469,870

Price (Beginning of Year): $three.41

Price (End of Year): $four.34

Price (Annual High): $5.55

One of the oldest of the bitcoin alternate options, litecoin confirmed one of many extra steady valuation curves for 2016. Closing greater than $2 above its beginning value for the yr, litecoin confirmed gradual however regular progress in worth.

This was disturbed, nonetheless, by two occasions.

In June, litecoin noticed its upward spike – which was fueled by the restoration in valuation from the altcoin’s 2015 reward halving and by the decreasing of mining issue – develop considerably in response to the Brexit vote.

This, as with bitcoin and a lot of the world’s fiat currencies, led to the strengthening of the US greenback’s worth towards the litecoin and induced a big value drop.

Then, in August, VC-backed startup Coinbase added litecoin to GDAX for greenback buying and selling, which trigger a short lived spike in pricing.

Monero

Market Capitalization (Beginning of Year): $four,707,521

Market Capitalization (End of Year): $133,545,372

Price (Beginning of Year): $zero.448294

Price (End of Year): $10.38

Price (Annual High): $13.50

As far as market capitalization progress as a share goes, monero is way and away alone in the pack.

With a monetization that went from $four.7m at the start of our commentary interval to a excessive of almost $168m, monero made skeptics of this non-bitcoin by-product eat their phrases and rethink their portfolios.

The main motive for monero’s speedy valuation enhance was its adoption as a most well-liked currency by the DarkNet market AlphaBay.

While this brings up the ghosts of bitcoin’s use in darkish markets, the publicity served to assist mainstream the previously obscure altcoin.

“Alphabay Market is now implementing monero,” reads a press release on Reddit. “Following the demand from the neighborhood, and contemplating the security measures of monero, we determined so as to add it to our market.”

This was adopted by the currency’s adoption by Oasis Market, one other DarkNet market, and by in depth protection by Vice, ZDNet and others.

However, as monero pricing is topic to the identical hype market that impacts different cryptocurrencies, the value spike collapsed in the post-summer settle down, solely to ratchet up once more following information of Donald Trump’s election win.

Ethereum Classic

Market Capitalization (Beginning of Year): $47,874,732

Market Capitalization (End of Year): $90,639,072

Price (At Creation): $zero.58

Price (End of Year): $1.05

Price (Annual High): $three.30

If XMR represented the very best % of annual progress for 2016, basic ether represents the very best share of value loss for the yr.

The results of a tough fork to refund the out-of-pocket token holders of The DAO after the 18th June hack, ethereum basic (ETC) shaped as a result of a break up in the ethereum neighborhood in which some felt that “code is legislation”, the blockchain is immutable and that any try and appropriate a “permitted” motion defies the aim and worth of the blockchain.

The controversial break up created a excessive quantity of enthusiasm amongst some merchants, which noticed basic ether’s costs climb effectively above $2 and 24-hour commerce quantity to over $133m at its highest.

The 24-hour commerce quantity on the finish of our commentary interval is lower than $750,000, with a low of about $205,000 on 20th November, as per CoinMarketCap.

The notion of a double blockchain has at all times been a troubling and one thing bitcoin has desperately sought to keep away from, as having two competing, equivalent blockchain might presumably erode confidence in one or each. It would appear that that is precisely what occurred with ethereum basic – as ethereum rose, ethereum basic sank.

However, there may be some gentle on the finish of this tunnel: basic has made as a lot as a 37% comeback in December, as a result of aggressive buying and selling by the Chinese altcoin neighborhood. With a spike in hashrate, it’s doubtless that this uptick could also be a part of a long-term pattern.

Dash

Market Capitalization (Beginning of Year): $16,081.586

Market Capitalization (End of Year): $70,675,107

Price (Beginning of Year): $2.64

Price (End of Year): $9.67

Price (Annual High): $14.42

In 2015, darkcoin determined to finish its affiliation with shadow companies and the DarkNet by altering its title to Dash.

“Recently it grew to become obvious that our branding was getting in the best way of our mission, so we began investigating rebranding,” stated Dash lead developer Evan Duffield to IBTimes on the time. “We consider Dash, which stands for digital money, is a superb illustration of what we need to turn out to be.”

“That’s the way that Bitcoin started and it eventually moved away from that and more into legitimate areas, so I’m guessing that [Dash] will go the same route.”

This rebranding appeared to work. Dash ended its yr with pricing almost thrice, and a market capitalization near 4 occasions, the place they began the yr.

Powered by its Darksend system, transactions are nearly untraceable on the Dash community, making Dash and its Masternodes’ batch-processing of transactions a most well-liked alternative for anonymity-seekers.

It’s necessary to notice, nonetheless, that Dash nonetheless has its fair proportion of vocal detractors, so the decision continues to be out on its potential.

Conclusion

As we enter 2017, the long run for the cryptocurrency market is wanting vibrant.

While some digital currencies, like bitcoin, might hit new highs, and others, like ethereum and ethereum basic, will battle for place, the digital currency/digital asset market will proceed to progress and show its price as one of many top-performing commodities obtainable right this moment.

At the identical time, improvements in blockchain interactions, FinTech integration and anonymity-assurance will make cryptocurrencies in 2017 nearer to the best imagined by Satoshi Nakamoto and the early pioneers of the know-how.

Correction: An earlier model of this text incorrectly said the date darkcoin rebranding as Dash.

Markets visualization by way of Shutterstock

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.