Originally released on Unchained.com.

Unchained is the main United States Collaborative Custody partner of Bitcoin Magazine and an important sponsor of associated material released through Bitcoin Magazine. For more details on services used, custody items, and the relationship in between Unchained and Bitcoin Magazine, please visit our site.

As a bitcoin miner, you have a lot to handle, from looking for economical electrical energy, to building centers, to obtaining rigs and developing a well-informed group that can keep them hashing. In talking with mining business throughout the years, we understand that bitcoin custody is typically an afterthought.

Here we’ll explain the procedure of protecting your mined bitcoin in self-custody while handling a bitcoin treasury, CapEx, OpEx, OpSec, LP circulations, taxes, and more. Given the ever-present dangers of hacks and suspended withdrawals, our objective is to discuss the advantages and compromises of numerous techniques to bitcoin self-custody—despite the size of your operation.

Bitcoin self-custody factors to consider for miners

There are special obstacles miners confront with self-custody in contrast to other kinds of bitcoin holders:

- Miners get a high frequency of inbound deposits from mining swimming pool payments, which can increase deal expenses due to UTXO bloat (more on this below).

- Some part of mined bitcoin need to be offered to cover overhead.

Other obstacles are comparable to that of other organizations that hold bitcoin:

- Businesses might not have the internal know-how required to established self-custody firmly while lessening intricacy.

- Businesses normally have several operators and desire dispersed control over bitcoin funds.

- Businesses desire to lessen counterparty danger while removing the dangers of malware, user mistake, storage media decay, phishing, physical attacks, and other security dangers.

In all cases, holding the personal secrets to your company’s bitcoin ought to be focused on. As we’ll discuss next, multisig can improve the security of your bitcoin despite your company’s size. While the information of your setup might differ, multisig assists to address a number of the above issues while permitting your bitcoin to touch exchanges just when needed (e.g., for OpEx/CapEx).

Why miners require multisig

Better security than singlesig

Singlesignature (singlesig) wallets—managed by a single crucial protected by a Trezor or Ledger hardware wallet, for circumstances—enhance security, minimize counterparty danger, and get rid of exchanges as a single point of failure. With singlesig, nevertheless, your bitcoin is endangered if a hardware wallet or seed expression is lost or jeopardized. Just one or the other, in the incorrect hands, might lead to irreversible loss of funds.

Multisignature wallets, on the other hand, allow you to shop bitcoin in a wallet managed by several secrets. They increase your security by guaranteeing more than among those secrets, kept in various areas, are needed to sign a deal. If established properly, multisig can remove all single points of failure. For a miner, this indicates getting rid of the danger of a single rogue worker moving funds, and producing redundancy so that the loss of a single hardware wallet or seed expression cannot lead to a vital loss of funds.

Eliminates exchange custody danger

Exchanges can be a hassle-free location to send out newly-mined bitcoin. They enable you to quickly exchange bitcoin for your regional fiat currency before sending out funds to a connected savings account, and they even look after things like UTXO management. In bitcoin, nevertheless, there is constantly a rate to pay for benefit. The dangers and possible drawbacks of utilizing an exchange for crucial storage are many—the reality that they can cut you off at any time and the possibility of hacks and insolvency are just the start.

Flexibility to accomplish a perfect balance of security and intricacy

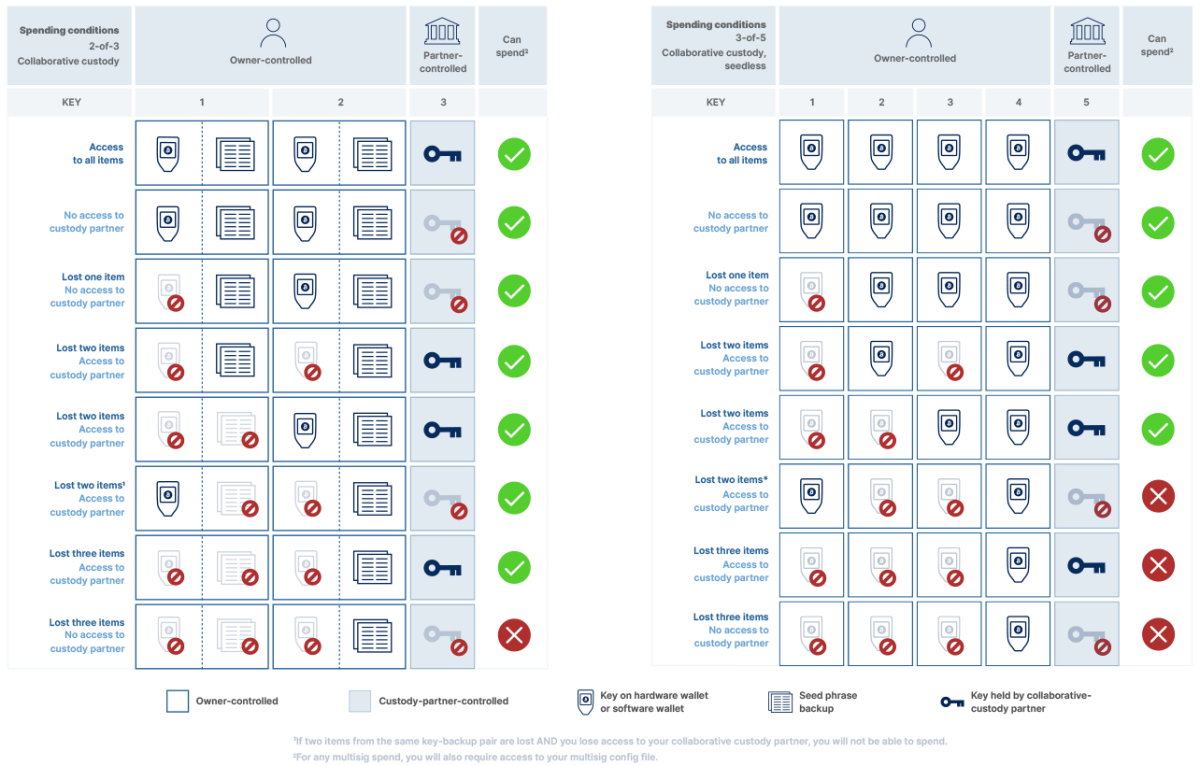

A 2-of-3 multisig quorum has 3 overall secrets where 2 are needed to invest, which keeps your bitcoin safe even if one secret is jeopardized. Many mining companies discover that 2-of-3 multisig is the ideal setup for their business treasury due to the fact that no single person can jeopardize the whole treasury, while sending LP payments and month-to-month expenditures is still kept simple (just 2 signatures needed).

Higher-quorum multisig (e.g., 3-of-5, with 5 overall secrets and 3 needed to invest) includes more secrets and generally more people to the formula. This can technically enhance the security of your bitcoin wallet in many cases—however also considerably increases intricacy. We composed an extensive short article describing why this holds true, however for the functions of this short article, you simply require to understand the sweet area for most people, companies, and mining operations tends to be 2-of-3.

The advantages of collective custody

When utilizing multisig for your mining business’s treasury, you may also advantage by consisting of an organization (like Unchained) to hold among 3 secrets for your multisig setup.

In addition to the improved security that multisig offers, collective custody can also aid with:

- Reduces the variety of physical products (hardware wallets and seed expressions) you require to safe.

- Active tracking over suspicious activity like unapproved deal signatures or account logins

- A partner that can assist your group recuperate the wallet in case where among your secrets has actually been lost or jeopardized.

Wallet management

Managing mining swimming pool payments

Every miner requires to make choices on security, deal expense, and counterparty danger when choosing which kind of wallets to usage for their freshly mined bitcoin.

Below are 4 example workflows that might assist you identify which design is the very best for your mining operation.

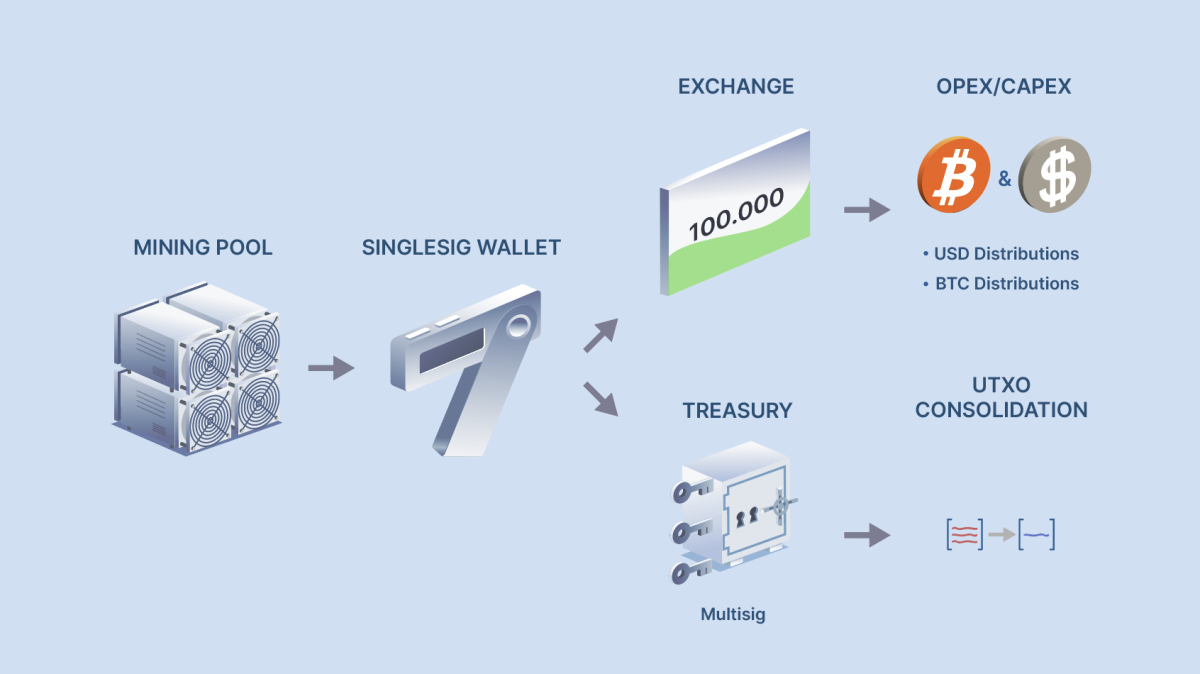

Workflow #1: Mining swimming pool payments sent out to a singlesig wallet

In this popular workflow for smaller sized mining operations, you get mining swimming pool payments straight to a singlesig wallet managed by a single operator. Funds that require to be offered can then be sent out to an exchange, while funds to be kept long-lasting are sent out to a multisig wallet.

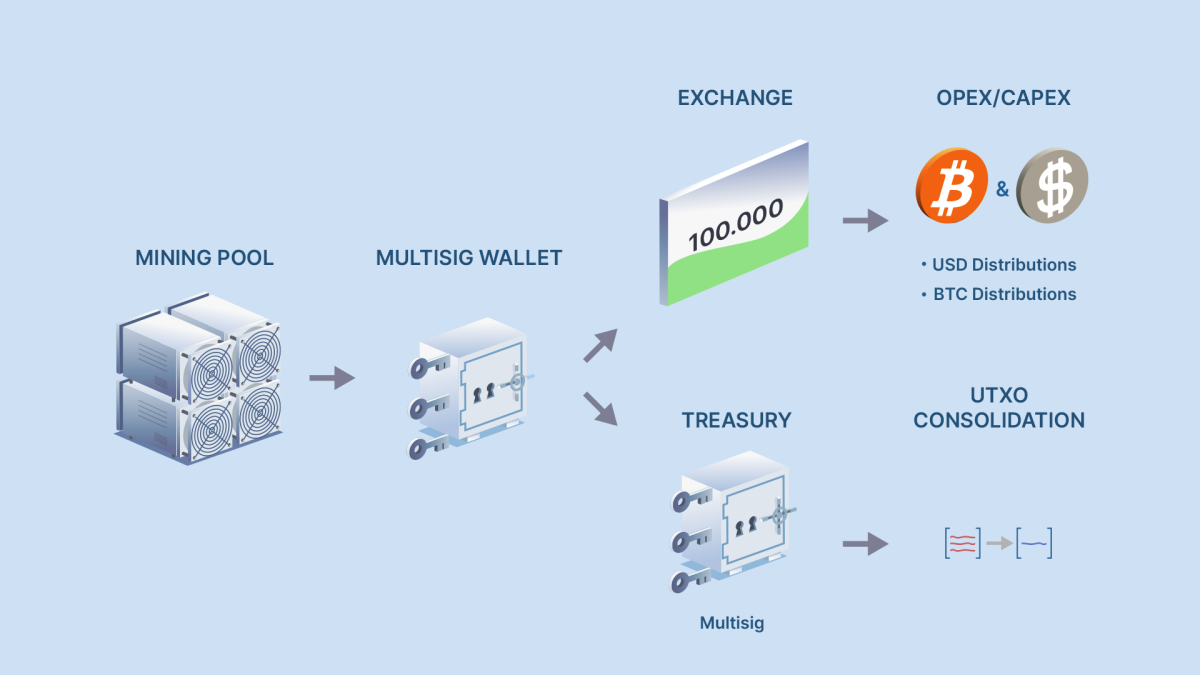

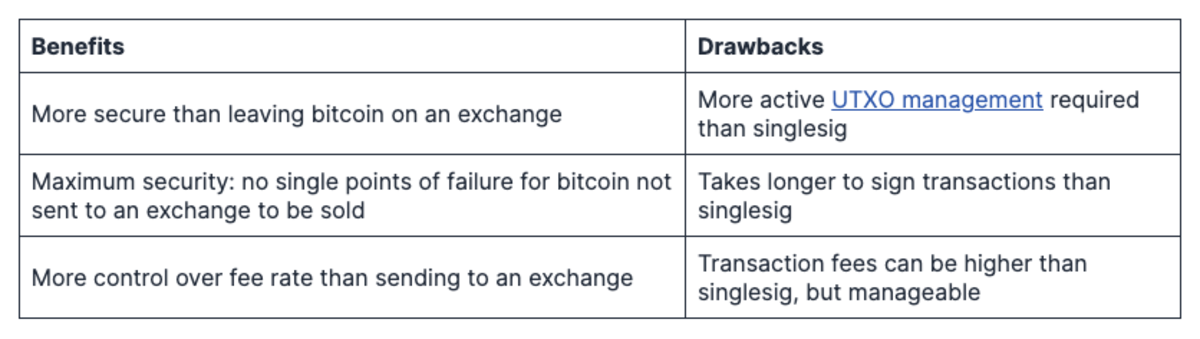

Workflow #2: Mining swimming pool payments sent out to a multisig wallet

This workflow is the very same as the workflow explained above, other than that mining swimming pool payments are sent out to a multisig wallet rather of singlesig. A 2nd multisig wallet is needed for the business treasury.

Sending bitcoin payments direct to multisig takes full advantage of security throughout the workflow, however needs 2 individuals to authorize each deal to the exchange and treasury. As such, it is much better fit for bigger mining operations.

“With multisig you’re paying higher fees to remove counterparty risk.” – Griffin Haby, Mountain Lion Mining

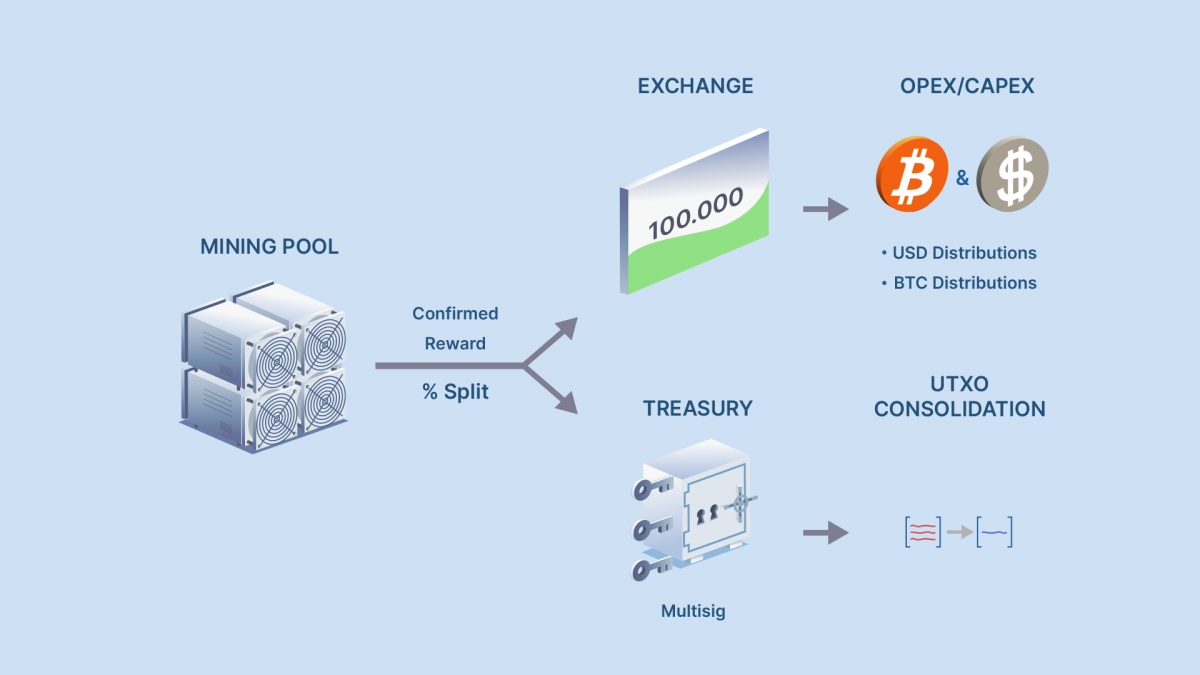

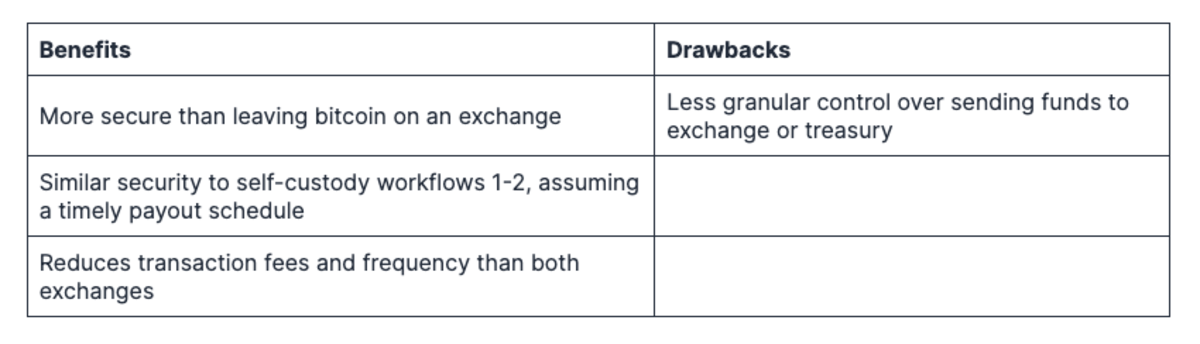

Workflow #3: Split payments from the mining swimming pool

Some mining swimming pools enable miners to divided payments in between 2 or more accounts. In this workflow, we reveal automating the payment procedure to send out a set portion straight to freezer, and the rest to an exchange to sell to cover overhead.

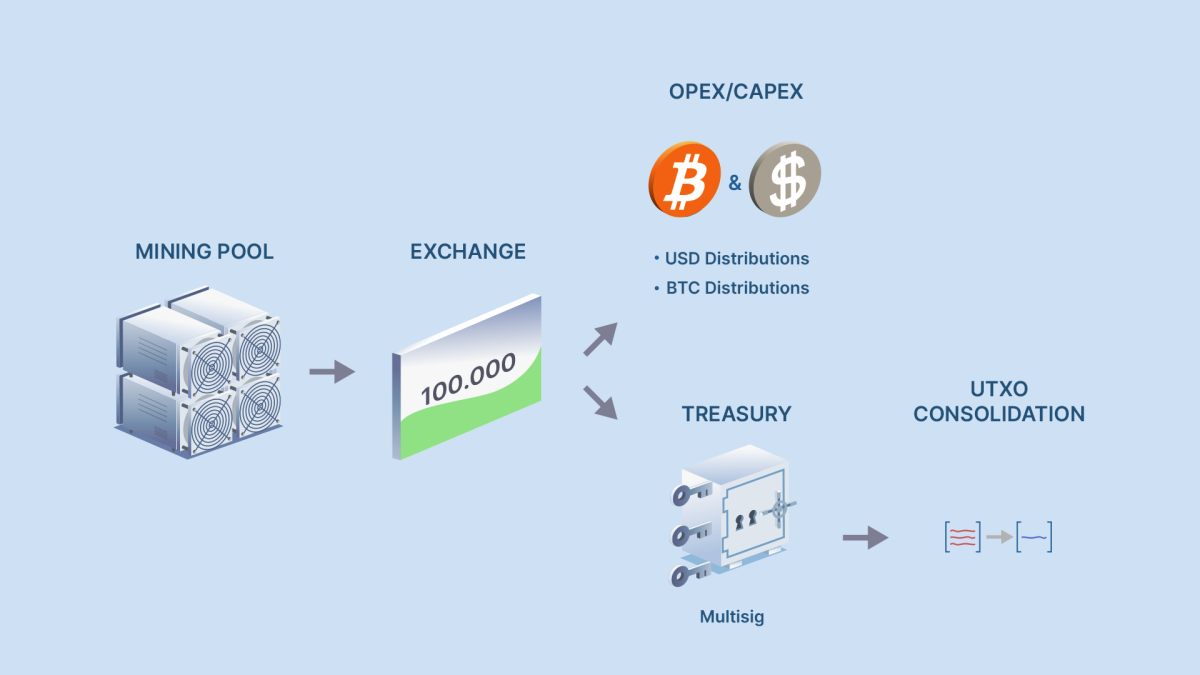

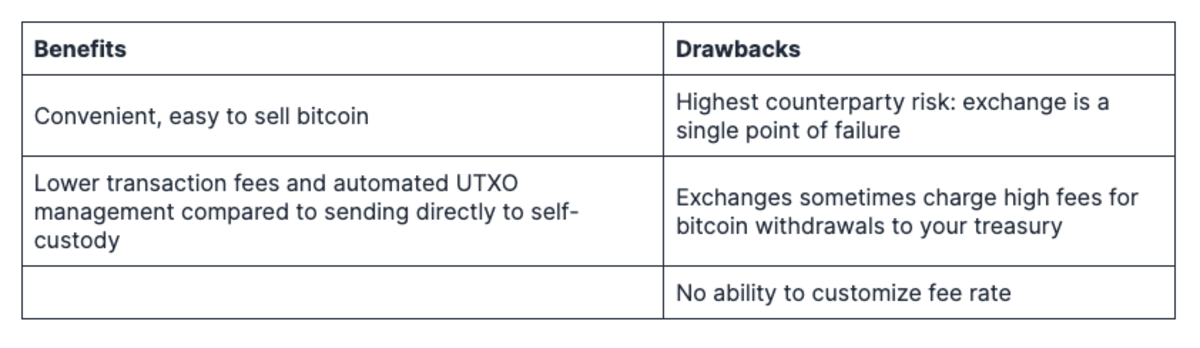

Workflow #4: Mining swimming pool payments sent out to an exchange

In this workflow, bitcoin is mined straight to an exchange. This is much more hassle-free for the functions of UTXO and charge management functions, and permits instant liquidation of funds, however leaves bitcoin in the most susceptible state for the longest quantity of time, with high counterparty danger.

Maintaining several fund containers

Even within the above top-level techniques to bitcoin security, you might desire to even more different wallets for different functions, like circulations, business expenses, or business treasury. Keeping these containers of bitcoin cryptographically separated from each other will make it far simpler to monitor your operation from a tax and accounting viewpoint—and a lot easier to make sure those long-lasting satoshis aren’t being utilized for overhead!

Managing deal costs

Miners are generally more worried with gathering deal costs from other users. However, when handling your bitcoin mining wallets, the costs you pay when sending out bitcoin—whether to an exchange, freezer, or investors/partners—ought to also be thought about.

As we explained in a previous short article, bitcoin deal costs depend upon how crowded the bitcoin network is at any provided time and just how much information is being processed in a deal. One of the crucial elements behind the information size of a deal is the variety of UTXOs included. Our short article on the issue of a lot of UTXOs is a great guide on UTXO combinations, payment limits, and how bitcoin deal costs are computed.

As a miner, there are 4 primary methods you can minimize your deal expenses:

1. Increase payment limits from mining swimming pools

If you utilize a mining swimming pool, and take a high frequency of payments, it’s going to lead to a great deal of little UTXOs in your location wallet, which might be pricey to invest when the time comes.

To alleviate this, you can increase your swimming pool payment limit to minimize the variety of deposits being made to your wallet (and for that reason minimize the wallet’s UTXO count). This approach is specifically beneficial for future charge mitigation if you are pointing your payments straight to a multisig wallet (which needs more information to make a deal than a singlesig wallet).

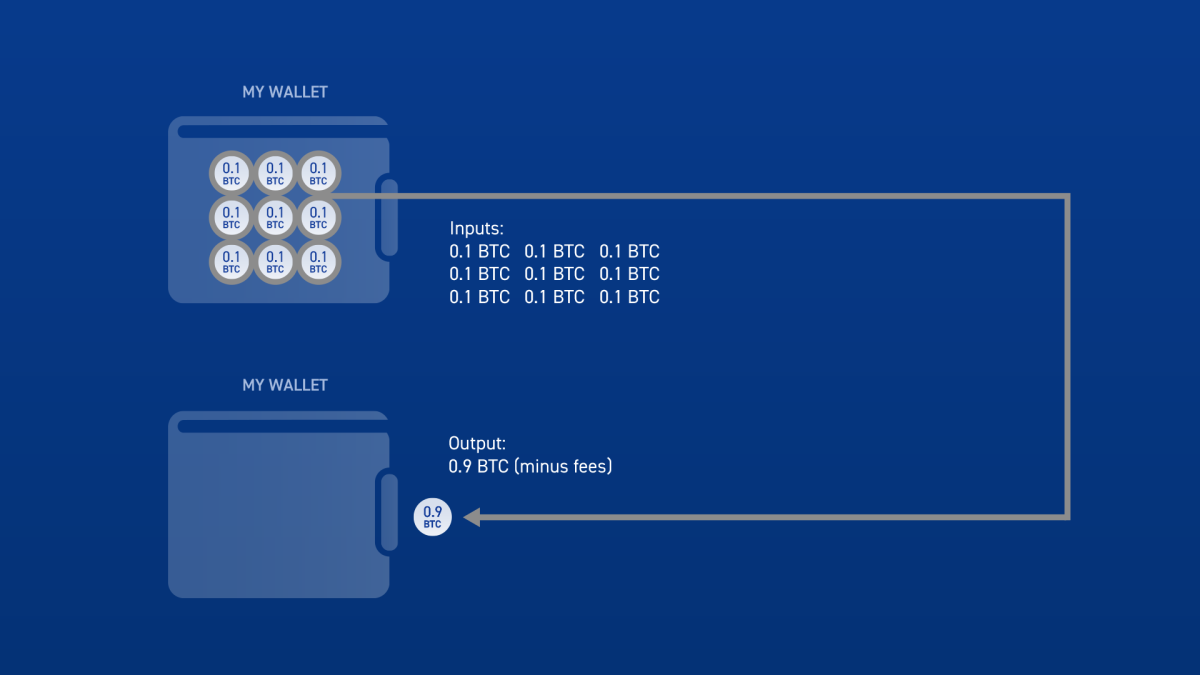

2. Manually combine your UTXOs

You can even more minimize the variety of UTXOs in your wallet by occasionally combining. This is a fairly basic procedure; you simply require to author a deal consisting of the UTXOs you want to combine, and send them back to yourself. You can find out more in our short article covering methods to handle a lot of UTXOs.

3. Set a low charge…and wait

Block area is restricted by style—the greater the need for area (increased amount of deals), the greater costs will be. If you don’t require a deal to be processed instantly, think about setting a lower charge rate than advised at the time of sending out. This makes the deal take longer to procedure, however can assist you prevent paying extreme costs throughout durations of high need.

At any provided time, there is a minimum charge rate the mempool wants to accept. Typically, this remains in between one to 3 sats/vbyte. Current costs can quickly be seen on a lot of obstruct explorers, such as mempool.space.

4. Batched costs

Miners who require to send out several payments at the very same time can minimize deal costs by sending them at one time utilizing a deal approach called batching. This approach of combining several payments can be carried out with lots of popular bitcoin wallets (such as Bitcoin Core, Electrum, or BlueWallet) and can be handy for LP circulations or any other time you require to make several deals simultaneously.

Key management

Identify your keyholders

When your business chooses to hold the secrets to its bitcoin you will require to identify who at the business will physically hold the secrets.

The objective is to disperse control over secrets and seeds equally. This provides nobody individual the capability to indication a deal or relocation bitcoin by themselves. What this appears like for your company will depend upon your particular situations, such as the variety of principals, the variety of secrets, and whether the wallet is for long-lasting storage or merely dispersing control over invests.

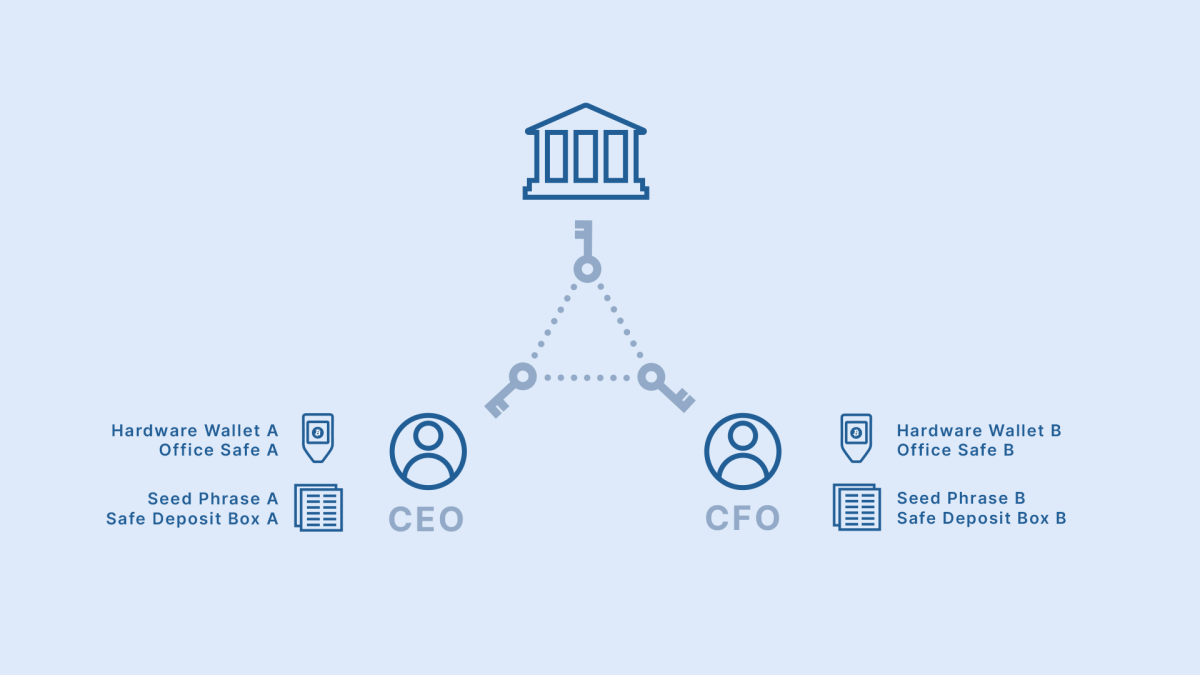

In the above example where you’ve chosen to utilize 2-of-3 multisig for your mining operation’s bitcoin treasury (we’d generally suggest this), you may choose the business’s CEO and CFO to hold a crucial each, and a collective custody partner to hold the 3rd secret.

Properly protect your hardware wallets and seed expressions

There are generally 2 different physical products to safeguard for each of your business’s bitcoin secrets: a hardware wallet and a seed expression. An important component of executing a safe multisig design is the geographical circulation of hardware wallets and seed expressions so that no single physical place is a point of failure for your bitcoin.

Seed expressions deserve specific attention due to the fact that they are a physical and unencrypted copy of your bitcoin personal secrets. You ought to constantly maintain seed expression backups of your secrets to minimize the dependence on often picky hardware wallets.

The place of the hardware wallets and seed expressions ought to just be understood to people who will be anticipated to offer deal signatures to relocation bitcoin. Keep in mind: When keeping and protecting these products, you might desire to make sure that no bachelor at your company has actually seen or understands the place of the needed hardware wallets or seed expressions to invest—so that no bachelor can jeopardize your bitcoin treasury.

Ongoing crucial upkeep

Key health

After you’ve appropriately kept your hardware wallets and seed expressions, there are a couple of finest practices you ought to observe to keep the gadget and information on the gadget in correct working order:

- Keep the firmware up to date: This ought to be done approximately 2 to 3 times a year to guarantee your hardware wallets have the very best security, latest performance, and will work to indication deals when you require to.

- Perform crucial checks: At routine periods, examine that your hardware wallets are practical and examine the physical security of your seed expressions. We suggest this ought to be done approximately 4 times a year.

Changing crucial holders

When a crucial holder leaves your mining operation, you ought to constantly change their secret as quickly as possible. Don’t merely turn over the old secret to a brand-new crucial holder—that would be a a possible security hole. Even if the initial crucial holder can be relied on and left in excellent standing, changing the crucial lowers the danger that unapproved signatures will be carried out or tried in the future.

Key replacements

To change a secret, you will require the brand-new crucial holder to produce a brand-new secret, (if utilizing multisig) develop a brand-new multisig wallet with the brand-new quorum, and after that (thoroughly) send out all the business’s bitcoin to the brand-new wallet.

If you’re utilizing collective custody with Unchained Capital, our platform can securely guide you through the crucial replacement procedure. If you’re not utilizing a collective partner, we’d suggest having somebody technical on hand to aid with the procedure.

- For Unchained Capital customers requiring aid with crucial replacements, connect to your devoted account supervisor or customer services.

- If you are not sure whether you require to carry out a crucial replacement, or if you would like to discover how crucial replacements for multisig work technically, you can refer to this short article.

Other factors to consider

Bitcoin mining and taxes

Bitcoin miners are accountable for understanding and following regional and federal tax guidelines. Taxes and accounting as they relate to bitcoin mining are beyond the scope of this guide, however they matter factors to consider and you ought to talk to an accounting professional or tax expert to find out more.

For US-based miners, Unchained’s Head of Legal Jeff Vandrew briefly discussed the subject of mining and taxes in his piece covering what you require to learn about bitcoin mining, IRAs, and taxes:

If a taxpayer gets bitcoin through mining, they need to acknowledge earnings in the quantity of the reasonable market price in U.S. dollar regards to the bitcoin gotten on the date of invoice. That acknowledged earnings is subject to earnings tax at regular earnings tax rates. On top of earnings tax, the taxpayer might also be subject to self-employment tax.

Selling bitcoin

If you do require to transform bitcoin to your regional currency to pay costs, taxes, or cover overhead, you might desire to speed up the procedure by establishing an exchange account and connecting an active savings account. Some exchanges can take days or weeks to authorize brand-new accounts, so strategy appropriately, specifically if you are up versus a due date like paying a billing, payroll, or taxes.

Unchained Capital can assist assist in the purchase or sale of bitcoin straight to or from a multisig vault, within specific limitations, for business and people in the U.S. that live in a state where our trading desk is active.

Collateralizing your bitcoin

Securing your bitcoin with a collective custody partner like Unchained Capital indicates you can quickly utilize that bitcoin to gain access to liquidity to reinvest in your mining operations—without ever offering your bitcoin. For more in-depth details on bitcoin collateralized financing, go to unchained.com/loans.

Let Unchained Capital be your guide

Whether it be the complicated job of handling costs, recommendations on how to structure your bitcoin custody workflow, or gain access to to a trading desk to buy and sell bitcoin, we’re here to assistance. Our multisig vaults for organization provide your company total control over your bitcoin while supplying a relied on partner to guide you and your group through setup and to aid with crucial replacements and wallet healing if and when needed.

Originally released on Unchained.com.

Unchained is the main United States Collaborative Custody partner of Bitcoin Magazine and an important sponsor of associated material released through Bitcoin Magazine. For more details on services used, custody items, and the relationship in between Unchained and Bitcoin Magazine, please visit our site.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.