When it concerns saving your bitcoin, multisignature—or multisig for brief—is commonly acknowledged as one of the most safe and secure techniques. It can get rid of threats related to exchanges and custodians, and concurrently deals with the most typical problems with self-custody. In this short article, we’re going to stroll through why you must hold your own bitcoin secrets, what requirement singlesignature self-custody appears like, and how multisig is an enhancement for long-lasting freezer.

Why Should I Self-custody?

Interest in bitcoin normally starts with acknowledging it as an alternative financial tool that solutions a few of the clear threats of traditional cash, such as inflation, censorship, and confiscation. As inspiration grows for moving wealth into bitcoin, individuals are instantly confronted with the choice of how to securely keep it.

The very first piece of guidance you may hear is to prevent custodial options. The factor for this is easy: custodians of fiat currencies like the U.S. dollar (banks, brokerages, and so on) can provide specific assurances that custodians of bitcoin cannot. For example, federal government programs like the FDIC and SIPC offer insurance coverage for when a custodian loses customer deposits, and this responsibility can constantly be satisfied. Bitcoin has a rigorous supply limitation—21 million coins—and brand-new systems can never ever be arbitrarily released to change coins that are lost by a reckless or destructive custodian.

Avoiding a custodian indicates taking self-custody. In the world of bitcoin, custody is figured out by who manages the personal secrets, since the personal secrets are the tools needed to invest bitcoin. If you have actually acquired bitcoin on an exchange and haven’t withdrawn it to your own custody managed by your own secrets, then the bitcoin stays managed by the exchange’s secrets, and all you have is an IOU, instead of real bitcoin. As the popular stating goes, “not your keys, not your bitcoin.”

Holding your own secrets just implies securing deceptive details, since that’s what a personal secret is: arbitrarily produced information that must be kept personal, and cannot reasonably be thought by anybody else. Generating a personal secret is simple, and can be done on a laptop computer or a phone app, however it is more suitable to utilize a hardware wallet so that you can have self-confidence your secret was never ever exposed to the web. Check out a few of our other short articles to get more information about the factors to utilize hardware wallets, and a few of the very best gadget designs.

It is totally regular to feel worried about holding your own bitcoin secrets. People typically lose details such as passwords, or physical products such as sunglasses and cars and truck secrets. If you are fretted that you may lose your bitcoin secrets and for that reason also lose access to your funds, that is a legitimate issue! However, multisig can assist you rest simple understanding that you have backup strategies on the occasion that you slip up and lose some details.

First, what is singlesig?

To comprehend multisig, it’s important to initially comprehend the predecessor technique of bitcoin storage: singlesig.

A singlesig wallet is the easiest and most utilized type of self-custody bitcoin wallet. It includes simply one master personal secret, which can produce addresses for getting bitcoin. If bitcoin is sent out to among those addresses, the quantity will be counted towards the wallet balance, and it can just be eliminated from the wallet after approval from somebody who has the personal secret.

The personal crucial holder can show approval for a withdrawal by utilizing the personal secret to cryptographically sign the deal. You can envision this like a physical signature being used to a file that defines the deal information, in a verifiably distinct manner in which can’t be created. This is done within your software application wallet, or for bitcoin in freezer, within a hardware wallet. Then the signed deal can be transmitted to the bitcoin network, where it will just be acknowledged as legitimate if the appropriate signature was used.

Singlesig wallets have the advantage of being easy to establish, along with offering relatively fast and simple access to withdrawing funds. Singlesig deal costs can also expense less than multisig.

However, a significant disadvantage to singlesig is that it constantly includes a single point of failure. Specifically, there are 2 glaring problems:

- Vulnerability to theft: If your personal secret is exposed to another person, that individual might have what they require to take your bitcoin.

- Vulnerability to loss: If you lose your personal crucial details (due to neglect or a natural catastrophe), you can lose the capability to invest your bitcoin, implying you efficiently no longer own it.

Various systems have actually been produced in an effort to reduce these issues. Introducing tools such as BIP 39 passphrases or Seed XOR into a singlesig setup can assist deal with the very first concern, however they feature the compromise of worsening the 2nd concern. Another tool called Shamir’s Secret Sharing can produce an enhancement on both ends, however a single point of failure will still exist when it comes time to sign a deal.

As an outcome, many individuals turn to multisig as the gold requirement for eliminating single points of failure.

How is multisig various?

While bitcoin protected by singlesig needs one signature from one particular personal secret to invest funds, this is simply the start of what bitcoin enables. A multisignature bitcoin wallet, as the name recommends, is an approach of protecting bitcoin that can need signatures from numerous personal type in order to invest the bitcoin. A subset of those secrets are required to approve investing any bitcoin that has actually been gotten into that plan.

This structure is widely referred to as an m-of-n quorum. The “m” represents the variety of personal secrets that are needed to sign for a withdrawal to end up being legitimate, while the “n” represents the variety of personal secrets that exist which can produce among the needed signatures.

For example, a 2-of-2 quorum suggests that there are 2 various personal secrets included, and signatures from both secrets are needed to withdraw bitcoin that was gotten into that plan. This concept may be familiar to you if you have actually ever utilized a safe-deposit box at a bank. Typically, these boxes need 2 secrets to be opened, among which is held by you, and the other is held by the bank. There are also ancient examples of similar approaches.

Alternatively, you might produce a 1-of-2 quorum, where just one out of the 2 secrets included is required to authorize an invest. Or you might produce a quorum that includes more than 2 secrets, such as a 2-of-3. This would imply that 3 secrets exist in the setup and any mix of 2 of them can approve costs bitcoin.

Multisig quorums are personalized to fulfill the requirements of the user, so it can be encompassed nearly any quorum you might envision—5-of-6, 2-of-9 or other intricate setups. However, some quorums are considerably more popular than others. 2-of-3 and 3-of-5 are without a doubt the most commonly utilized plans for protecting bitcoin in freezer, for factors that we’ll cover below.

The most typical bitcoin quorums: 2-of-3 and 3-of-5. Both strike a balance in between intricacy and security.

Why utilize multisig?

Switching from singlesig to multisig methods presenting more secrets, and for that reason extra intricacy. Is it worth it? Let’s have a look at a few of the benefits and drawbacks.

Upgraded security

Earlier we went over a few of the most significant issues that included utilizing singlesig. These consisted of single points of failure, such as your personal secret being exposed, lost, or ruined. How can multisig assist?

With specific multisig quorums, redundancy is contributed to guarantee that there’s nobody thing that, if it breaks or quits working, will trigger you to lose your cash. You can rest simple understanding that if among your personal secrets is exposed to somebody, they will not have all the pieces required to take your bitcoin. Additionally, if among your secrets is lost or ruined, you can still recuperate your bitcoin by utilizing the staying type in your belongings to move funds into a brand-new wallet where you as soon as again have all the pieces.

However, not all multisig quorums provide these securities. A “1-of-n” quorum (such as 1-of-2 or 1-of-5) does not offer sufficient resistance to theft, since if any among the secrets is exposed to somebody, that individual might have what they require to take bitcoin from you (they still require the associated multisig file). On the other hand, an “n-of-n” quorum (such as 2-of-2 or 5-of-5) would suggest that if any among the numerous secrets are lost or ruined, you will no longer have the ability to invest your bitcoin.

Setups that suit between these 2 extremes are the sweet area for resolving both classifications of single points of failure: loss and theft. The least intricate plan that pleases both objectives is 2-of-3, which is also the most popular multisig quorum for protecting bitcoin in freezer, and the just one we utilize at Unchained. A 3-of-5 quorum is a relatively popular plan too, however it presents more intricacy than required for a lot of scenarios. While 3-of-5 can offer additional redundancy, this point can be duplicated to promote for 4-of-7, and after that 5-of-9, etc to infinity.

If you wish to get the most out of the securities provided by a multisig plan, you must keep all of your various type in geographically separated places, so that no 2 secrets can be lost or exposed at the exact same time. The less complex your multisig setup is, the much easier it will be to produce an efficient system for keeping your secrets safe and secure and apart. You can read more about the compromises in between 2-of-3 and 3-of-5 in our much deeper dive on the subject.

Additional applications

Besides using brand-new custody choices for people, multisig can unlock for serving the requirements of groups of individuals. By developing a structure where various individuals hold various secrets within the multisig quorum, some appealing possibilities appear. Let’s briefly cover a couple examples.

Treasury management

If a service, federal government or other company wants to hold bitcoin smartly, multisig is all however needed. Not just since of the increased security, however also to guarantee that individuals within the company have the proper level of power to invest funds on behalf of the group.

Suppose a committee or legal council includes 9 individuals, and this group will be accountable for handling a bitcoin treasury. If each member of the group protects a personal secret, they can tailor their structure so that a specific limit of members should approve a treasury withdrawal. Spending funds might need a little part of the group (3-of-9), or a bulk (5-of-9), or perhaps a supermajority (6-of-9).

Special members of a group like this might also have extra power to invest funds, if they hold extra secrets within the selected quorum.

Trust-reduced security

Many bitcoin holders wish to work out the acquiring power of their bitcoin without offering it, which might lead to capital gains taxes along with losing out on future boosts in worth.

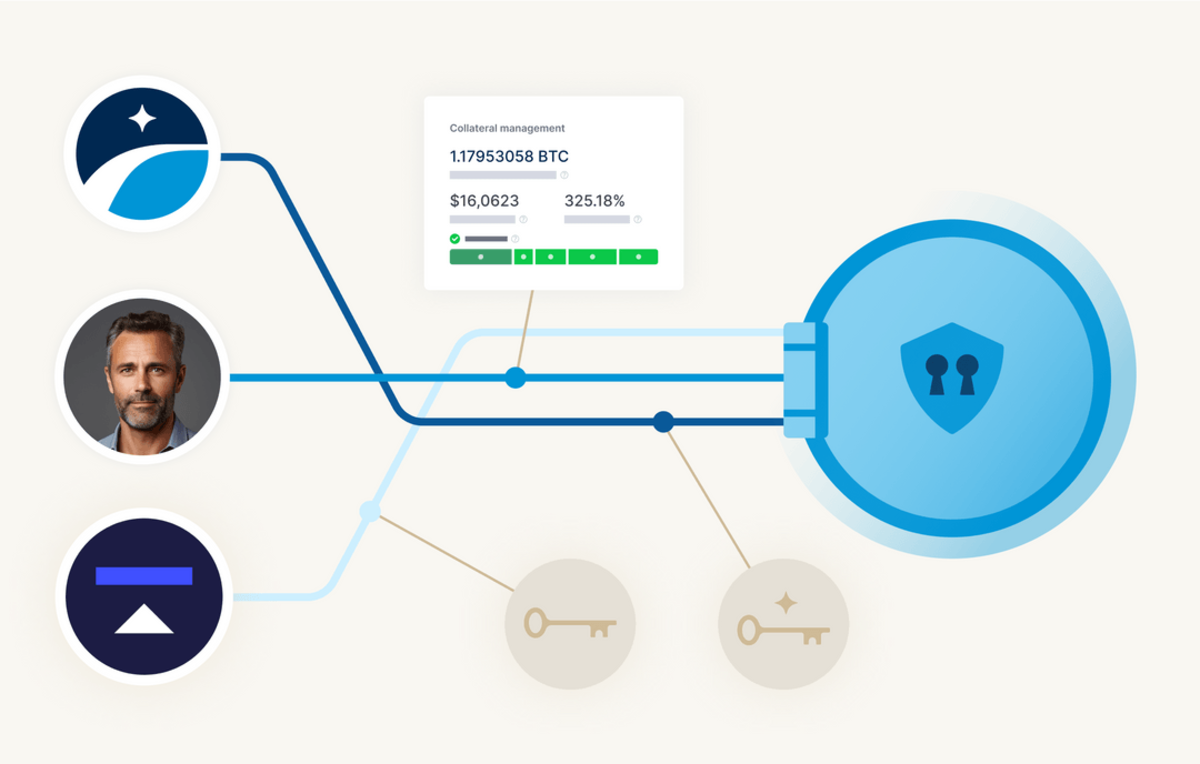

A popular service to this predicament is a bitcoin-backed loan, normally developed with a 2-of-3 multisig quorum. A bitcoin holder can obtain money from a lending institution after transferring their bitcoin into the multisig wallet, where the debtor keeps one secret, the loan provider holds one secret, a 3rd party arbitrator holds one secret, and 2 secrets are needed to withdraw bitcoin from the wallet.

Once the loan is paid back, the debtor and loan provider can utilize their secrets to approve returning the bitcoin to the debtor’s complete control. If the loan is not paid back, the bitcoin can be moved to the loan provider’s complete control. If there is a conflict, or either individual is noncooperative, the arbitrator can evaluate the scenario and help the warranted celebration.

With this design, taking funds would need to include collusion in between 2 crucial holders, ruining the track records of both entities. This structure is described as “trust-minimized,” a considerable enhancement over putting total rely on a single custodian. It also makes sure that the bitcoin is not being rehypothecated and stays readily available to be moved into the complete custody of the rightful owner at any time.

Bitcoin-backed loans are a service provided by Unchained, and you can learn more about specifics here.

Trade-offs with multisig

As kept in mind earlier, there are a number of compromises when utilizing multisig compared to singlesig.

First is the apparent boost in intricacy that features including more secrets into the custody plan. With more secrets, there are more products to track, and each product will preferably be kept in different places. This will make it more troublesome to withdraw bitcoin out of the wallet, which benefits avoiding unapproved gain access to, however can trigger inconvenience when you yourself require to move funds.

Another drawback is increased deal costs. If you get bitcoin into a multisig wallet, when you later on go to invest that bitcoin, it will normally cost you more than if it remained in a singlesig wallet. This specifics depend upon numerous other elements, however typically you will be paying more in costs the more intricate your quorum is. In other words, singlesig will be less expensive than 2-of-3, and 2-of-3 will be less expensive than 3-of-5.

On the brilliant side, bitcoin’s taproot upgrade in 2021 made it possible for multisig deals to be identical from singlesig on the blockchain. This indicates that they would cost the exact same, and there would be no additional cost problem for multisig quorums! However, at the time of composing, this innovation has yet to be commonly embraced.

A popular method to use the defense advantages of multisig while decreasing its downsides is to hold some bitcoin within both custody plans. For example, you might keep the huge bulk of your bitcoin in a freezer multisig wallet for the function of long-lasting cost savings, and concurrently keep a much smaller sized quantity of bitcoin in a singlesig hot wallet on your phone. That method, you might rest easily understanding the bulk of your bitcoin wealth has optimal defense, while at the exact same time you can quickly send out and get smaller sized quantities in an easier way.

How to utilize multisig

Most individuals who established multisig for the very first time are amazed at how simple and easy the procedure is, specifically if they are currently acquainted with utilizing singlesig. That stated, there are still a number of techniques worth comparing before you dive in.

DO IT YOURSELF (do it yourself)

Free and open source programs exist to assist you establish a multisig wallet all by yourself. Examples of such programs consist of Caravan, Sparrow Wallet, Electrum, and Specter. There are video tutorials on YouTube if you would like some help finding out how to utilize these programs.

Since most bitcoin wallet innovation is developed to be interoperable, if you utilize among these programs to establish your multisig wallet, you must also have the ability to pack that exact same wallet into among the other programs (as long as you have your wallet setup file conserved). This supplies some comfort that if something fails with software application you’re utilizing, your bitcoin is still safe and available.

Creating a do it yourself multisig wallet can be a fulfilling academic experience, and it can also be an especially personal technique of readying up. However, if you face any technical problems down the roadway, it might be a headache to discover somebody trustworthy who can assist you out. Similarly, if something awful takes place to you, your liked ones might be charged with determining the intricacies of your multisig plan in order to acquire your bitcoin, which they may discover rather difficult.

Collaborative custody

While relying on a single custodian with your bitcoin has actually been revealed to be unsafe, collective custody multisig is various. When done correctly, you can keep control over the secrets to your bitcoin while having actually the included advantage of specialists who can help you with technical concerns or inheritance.

For example, with an Unchained vault, a 2-of-3 multisig wallet is built where you hold 2 of the secrets and Unchained holds just one secret. This implies that Unchained can never ever move your funds out of the vault without your authorization, since we can just offer one signature while 2 signatures are needed for any and all withdrawals.

On the other hand, considering that you hold 2 of the secrets, you can offer the 2 signatures required for a withdrawal without ever depending on Unchained’s crucial! What’s more, finalizing and relaying a deal is a permissionless activity, so as long as you are keeping your secrets safe and available, no one can ever avoid you from moving your bitcoin somewhere else. Similar to a do it yourself multisig wallet, you might constantly pack an Unchained vault into another software application (utilizing the wallet setup file) so you aren’t required to depend on our site or company.

A collective custody vault can be precisely called a kind of self custody, since you are the only one who has complete power to invest the bitcoin in your vault. At the exact same time, Unchained’s secret can pertain to the rescue if you lose among your secrets, or it can be utilized to assist enhance the procedure of giving your bitcoin in accordance with our Inheritance Protocol.

Using collective custody is not completely personal, since your collective partner will have employee with clearance to see your wallet balance while they are helping you with technical concerns. However, it is very important to keep in mind that Unchained takes customer personal privacy exceptionally seriously, and it is difficult for Unchained to invest your funds or limit your access to your funds.

If you have an interest in establishing an Unchained vault, we welcome you to learn more about our Concierge Onboarding plan. You will have as much time as you require with among our specialists personally directing you through every action, and ensuring all of your concerns are responded to.

Originally released on Unchained.com.

Unchained Capital is the main United States Collaborative Custody partner of Bitcoin Magazine and an important sponsor of associated material released through Bitcoin Magazine. For more details on services provided, custody items, and the relationship in between Unchained and Bitcoin Magazine, please go to our site.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.